South Africa Inflation Moderately Surged to 3.6% y/y in December

Bottom Line: Statistics South Africa (Stats SA) announced on January 21 that annual inflation edged up moderately to 3.6% y/y in December from 3.5% the previous month due to higher housing and utilities; and insurance and financial services prices. The change in the consumer price index (CPI) between November and December was 0.2% and inflation stayed within the South African Reserve Bank’s (SARB) 1 percentage point tolerance band of new 3% target supported by suspended power cuts (loadshedding), stronger Rand (ZAR), and decrease in inflation expectations.

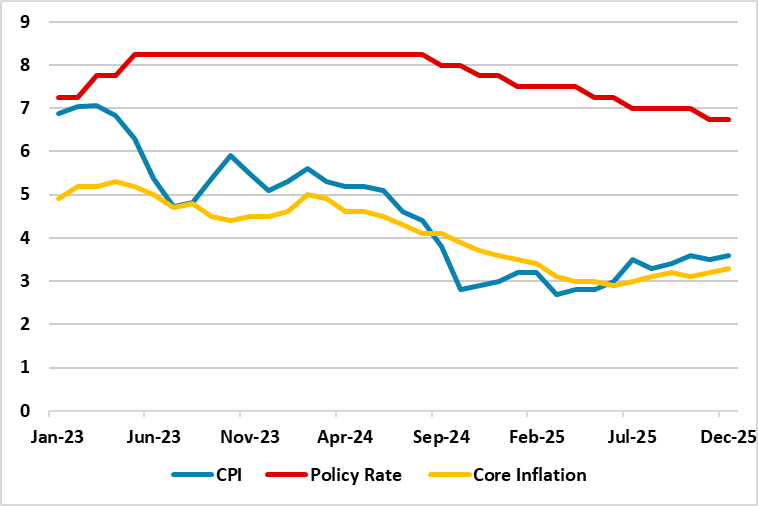

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – December 2025

Source: Continuum Economics

After hitting 3.5% in November, annual inflation edged up to 3.6% y/y in December due to higher housing and utilities; and insurance and financial services prices. According to StatsSA announcement on January 21, fuel prices rose by 0.6% in the final year to December. Stats SA also conducted its quarterly survey of housing rents in December, with actual rentals increasing by 0.8% in Q4 2025 compared to Q3 demonstrating the annual change for actual rentals was 3.7%, with townhouses rising by 4.6%, flats by 4.2% and houses by 3.3%.

2025’s last inflation print showed that annual core inflation slightly edged up to 3.3% in December from 3.2% in November. MoM prices surged by 0.2% December from the previous month. The average inflation rate for 2025 was 3.2%, marking the lowest rate in 21 years (since 2004) when it was 1.4%.

On the power cuts front, South Africa’s national electricity utility company Eskom announced on January 2 that South Africa has now experienced 231 consecutive days without an interrupted supply, with only 26 hours of loadshedding recorded in April and May. Despite few load shedding in H2 2025, some energy analysts think blackouts are still a threat and further power disruptions are likely while continued investment build out of energy infrastructure remain the key.

This is still a significant development for South African economy as the suspension helped businesses and households to relieve facing increasing costs from using alternative sources such as diesel backup generators, contributing at lower inflation figures. December inflation outlook has also been supported by a stronger ZAR, which hovered around 16.6-17.1 against the USD.

Additionally, there has been a recent fall in the inflation expectations as well. The Bureau for Economic Research’s (BER) latest survey for the SARB in December showed that in Q4 2025 (the first survey after the inflation target changed to 3%), the two- and five-year inflation expectations on average, fell to a record low of 3.7% (from 4.2% before). Next-year expectations were also down by a significant margin (0.4% pts) to 3.8%. Household inflation expectations resumed its downward trend, after a brief pause in Q3; one-year expectations were observed at 5.3% (5.5% previously).

Speaking about the inflation trajectory, SARB governor Kganyago told Reuters in Davos that “We expect that inflation this year would average 3.6% … if you break that inflation across the categories … all of them have got a three handle which then says that we are on course even for 2026 to meet our new inflation target.”

Despite inflation staying within the SARB’s 1 percentage point tolerance band of new 3% target, we think possible increase in utility costs and stubborn food prices could pressurize prices in 2026. The usual increase in sin taxes in the budget and hikes in wages and salaries will likely ignite CPI in Q1 2026. We foresee average inflation will hit 3.8% and 3.5% in 2026 and 2027, respectively, supported moderately by long lagged impacts of previous tightening, and a relatively stable ZAR.