U.S. February Employment - Detail mostly on weak side of trend

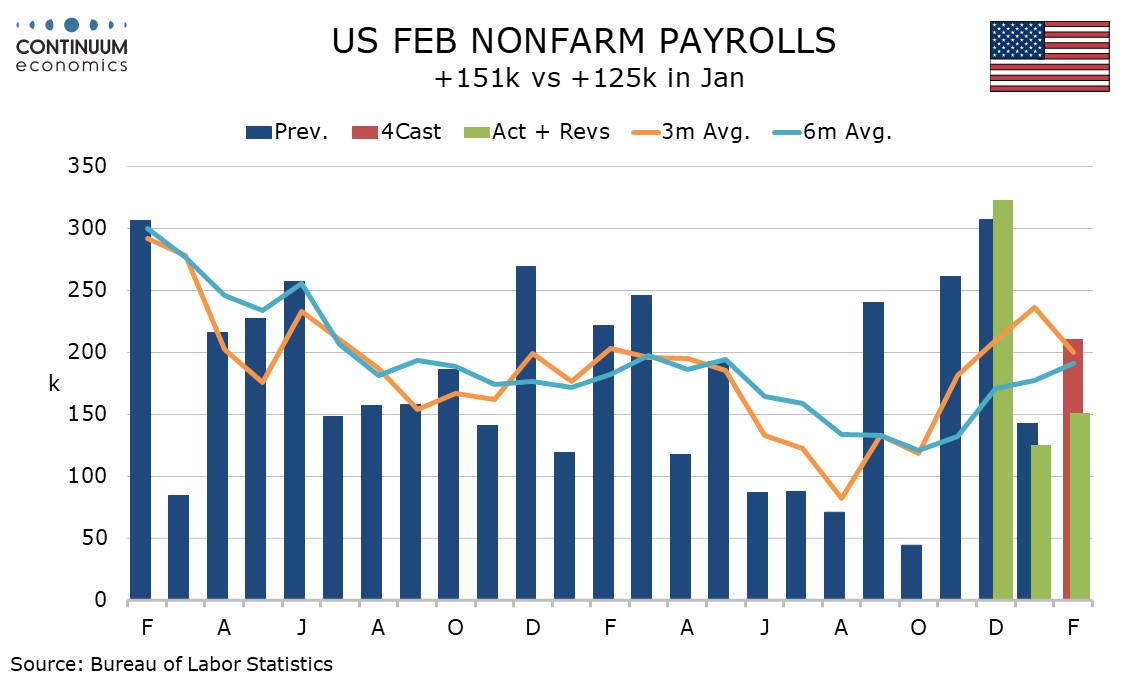

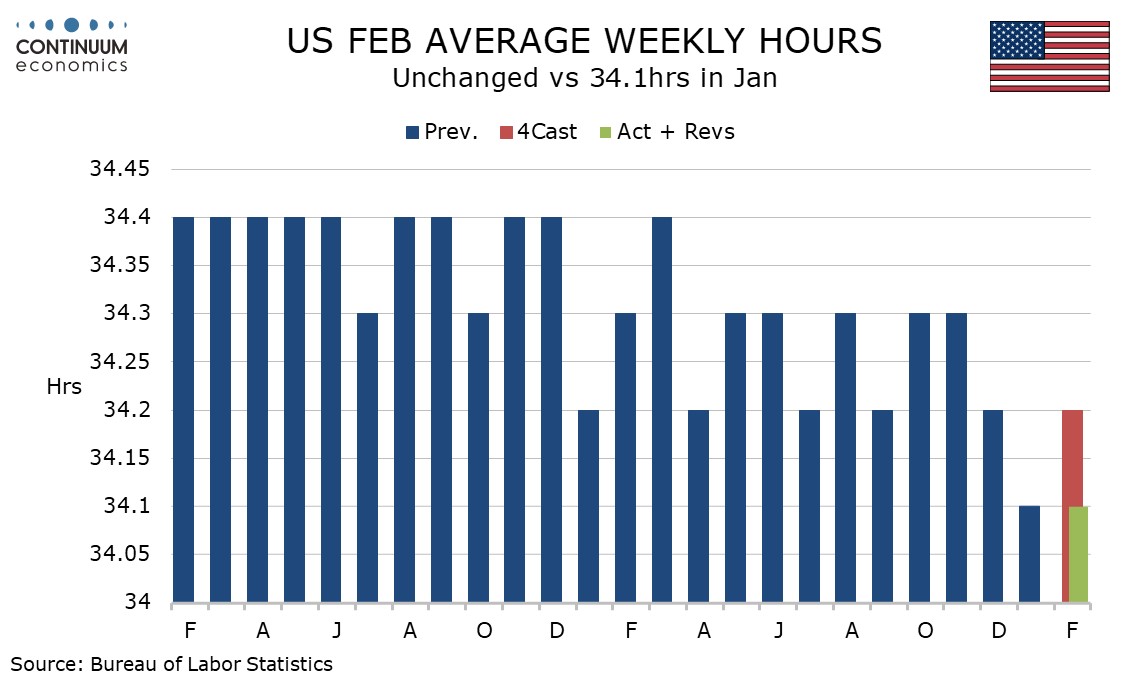

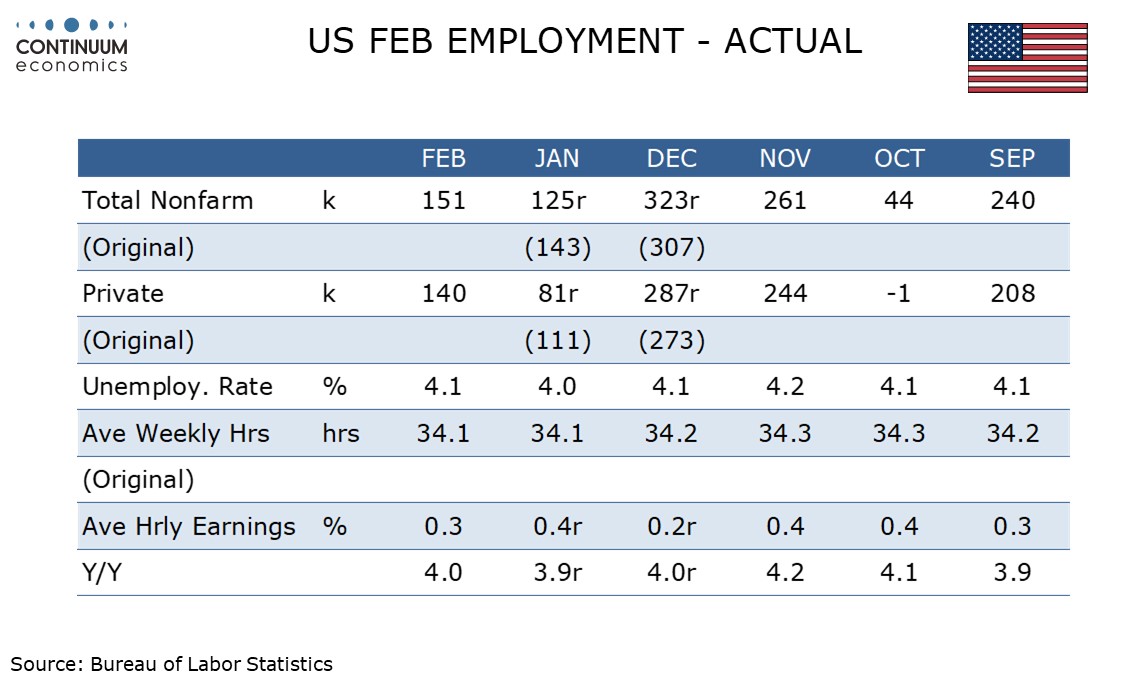

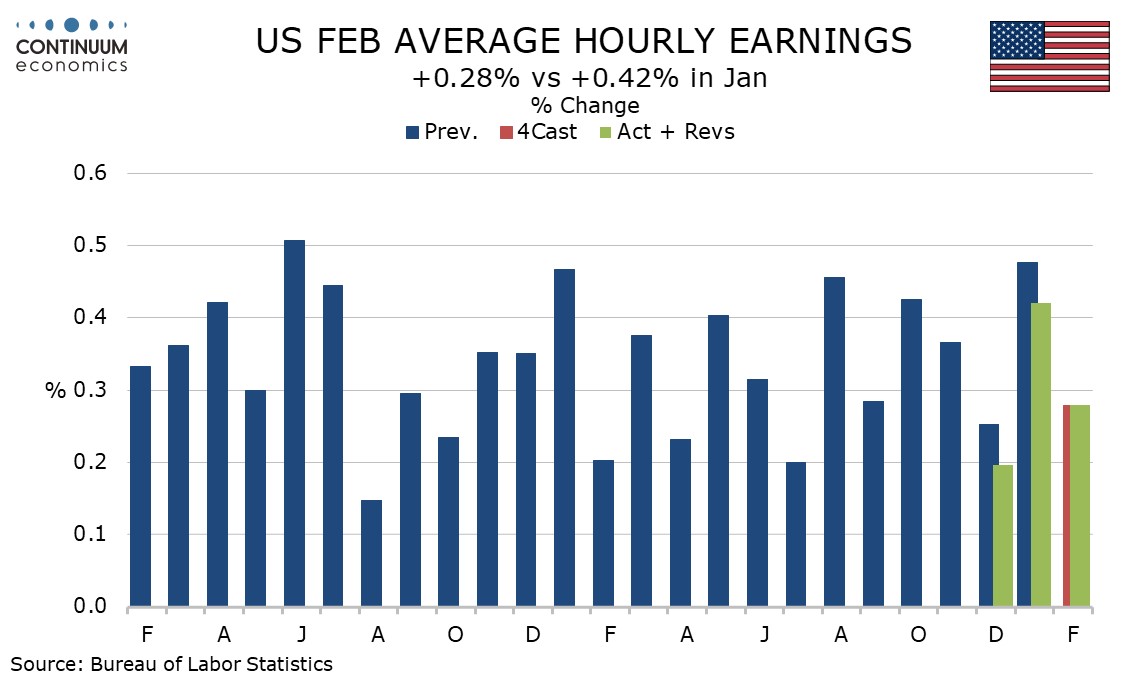

February’s non-farm payroll with a 131k increase in not far from consensus with near neutral back revisions, but does suggest momentum is slowing in Q1, though probably in part on weather. Other detail is on the soft side, with average hourly earnings up 0.3% with net negative revisions, and the workweek remaining weak at January’s 34.1 hours.

January was revised down to 125k from 143k but December revised up to 323k from 307k. January was generally seen as weather-depressed. Weather was less of an issue in February but still unseasonably cold. The fact that the workweek did not pick up from January suggest weather may have continued to be a restraining factor.

Goods producing employment picked up by 34k after a 7k January decline. Construction’s 19k gain hints weather was less of a restraint, while a 10k rise in manufacturing came largely in autos which fell in December.

Private services rose by 106k, with the majority of that in a 63k gain in health care and social assistance. Negatives were seen from retail at -6k, temporary help at -12k, often seen as a leading indicator, and surprisingly leisure and hospitality at -16k. This sector is sensitive to weather but failed to see the improvement of construction.

A rise of 11k in government is below recent trend. Federal fell 10k as the first DOGE cuts arrived (there will be many more) but state rose by 1k and state and local by 20k.

Average hourly earnings rose by 0.28% before rounding. January was revised to 0.42% from 0.48% and December to 0.20% from 0.25%. Yr/yr growth of 4.0% was lower than expected with January revised to 3.9% from 4.1%.

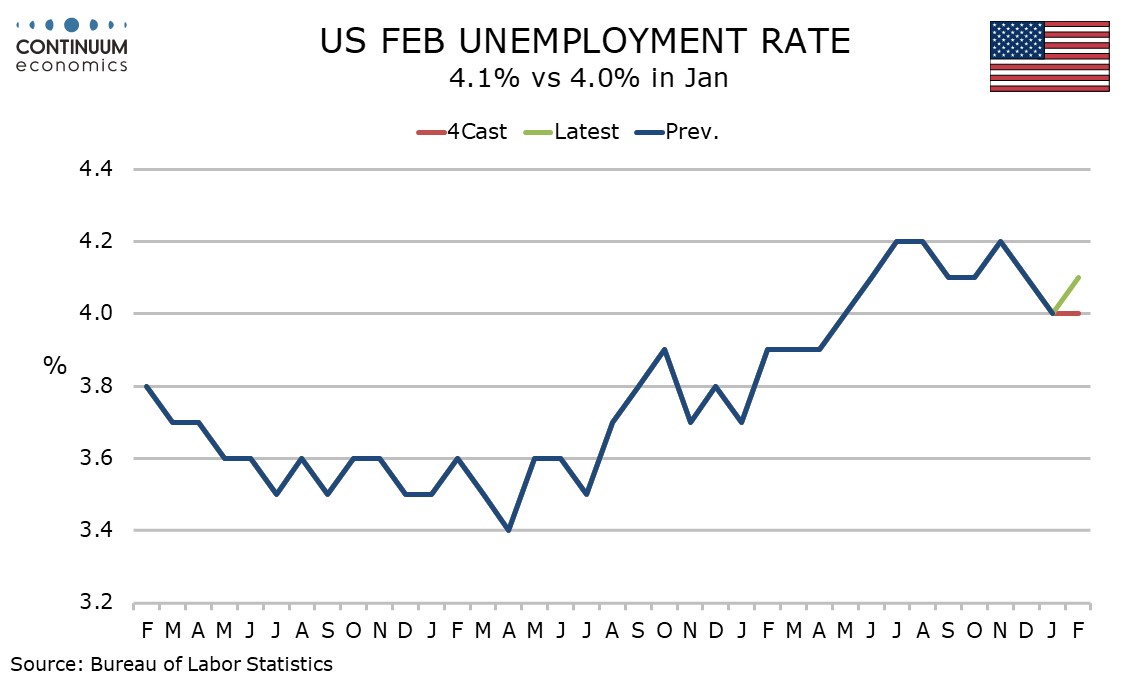

The household survey shows employment plunging by 588k with the labor force falling by 385k, sharply underperforming the payroll but still delivering a rise in unemployment to 4.1% from 4.0%. This may reflect a shift in immigration attitudes but the series is volatile and conclusions should be tentative at tis point.