Mexico CPI Preview: Easing Inflation to Back March Cut

INEGI will release February's CPI data, with an expected growth of only 0.1%. Despite this, the Y/Y index is forecasted to fall to 4.4% from January's 4.8%. Notably, Non-Core food CPI contracted by 3.9% in February, showing a reversal from January's rise. We anticipate a 0.3% increase in Core CPI, aligning with historical averages. The February CPI data is likely to support a 25bps cut from Banxico, although monetary policy will remain contractionary throughout 2024.

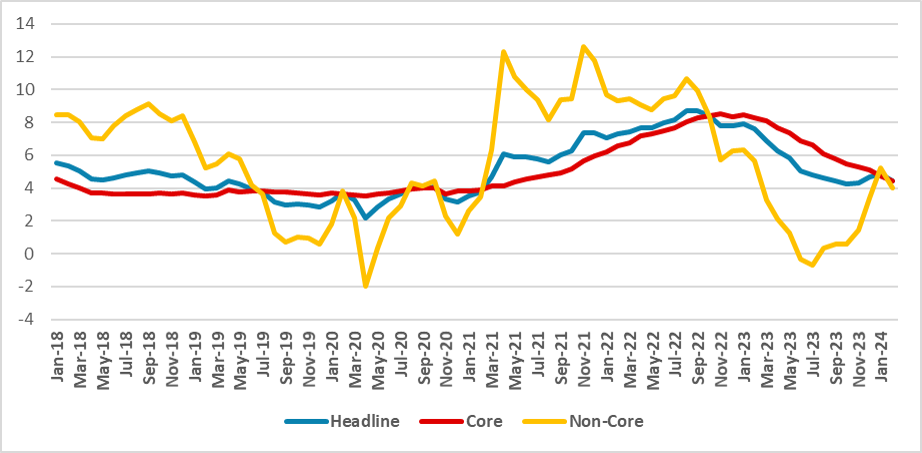

Figure 1: Mexico CPI (Y/Y, %)

Source: INEGI and Continuum Economics

The Mexico National Statistics Institute (INEGI) will reveal the CPI data for February. We expect the CPI data to grow only 0.1%. We forecast the CPI data to have grown 0.1% (m/m), and therefore, the Y/Y index will fall to 4.4% from 4.8% in January. The good news in February is the disinflation in the Non-Core food CPI. The bi-weekly CPI points out that food CPI has contracted by 3.9% in the first two weeks of February, reversing the strong rise seen in January.

The Core CPI is behaving mostly according to an economy in the process of disinflation. We forecast this group to have risen by around 0.3% in February, which is mostly in line with its historical average. Even in January, when the CPI rose by 0.9% (here), the Core CPI behavior was already benevolent, and most of the rise was in the non-core index, which indeed is more volatile than the core one. We expect both services and goods to continue to rise at a rate around 0.3%-0.4% m/m. Even if Banxico starts to cut, the effects of these cuts will only be felt between 6-12 months later, meaning the strong contractionary monetary policy will continue to feed through in the next months.

Moving forward, we believe that the February CPI will boost Banxico's confidence to cut rates in their next meeting (scheduled for Mar. 21). The discussion will now be what magnitude they will choose for the first cut. All Banxico communications have been in favor of a cautious cut. The Mexican labor market continues to be strong, and the looser fiscal policy to be applied during this year will likely generate inflationary pressures for a large part of the year. Additionally, expectations are not fully aligned with the 3.0% target.

We believe that given the current inflationary outlook, Banxico's majority will be in favor of a 25bps cut, and it is very likely that this decision will be split. The key is that monetary policy will need to be kept tight during the whole of 2024, and cutting too strongly means achieving neutral rates too soon, which in a situation where inflationary risks continue to exist is not an ideal one.