U.S. November CPI - A little higher than the Fed would like, but a cautious December easing still expected

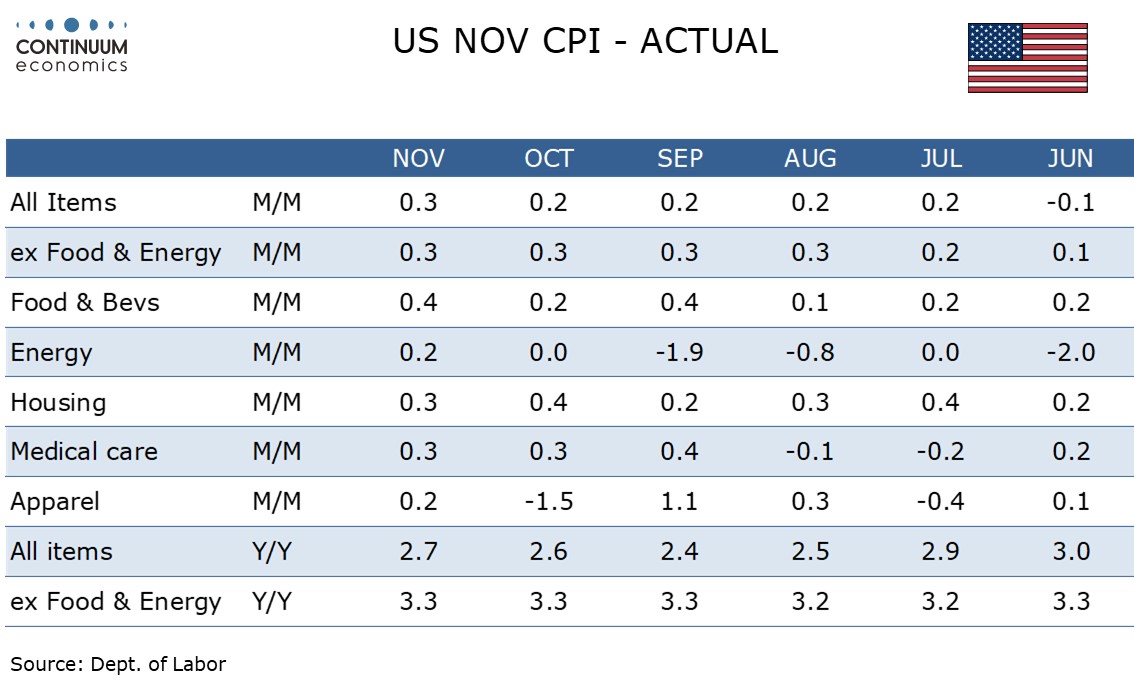

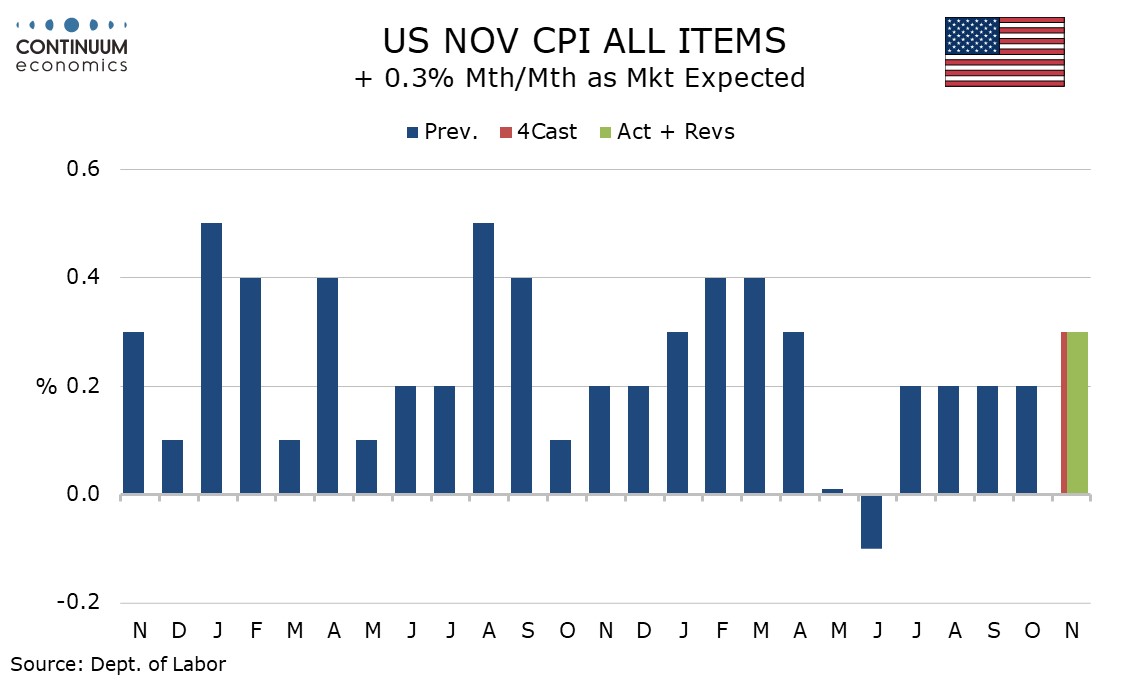

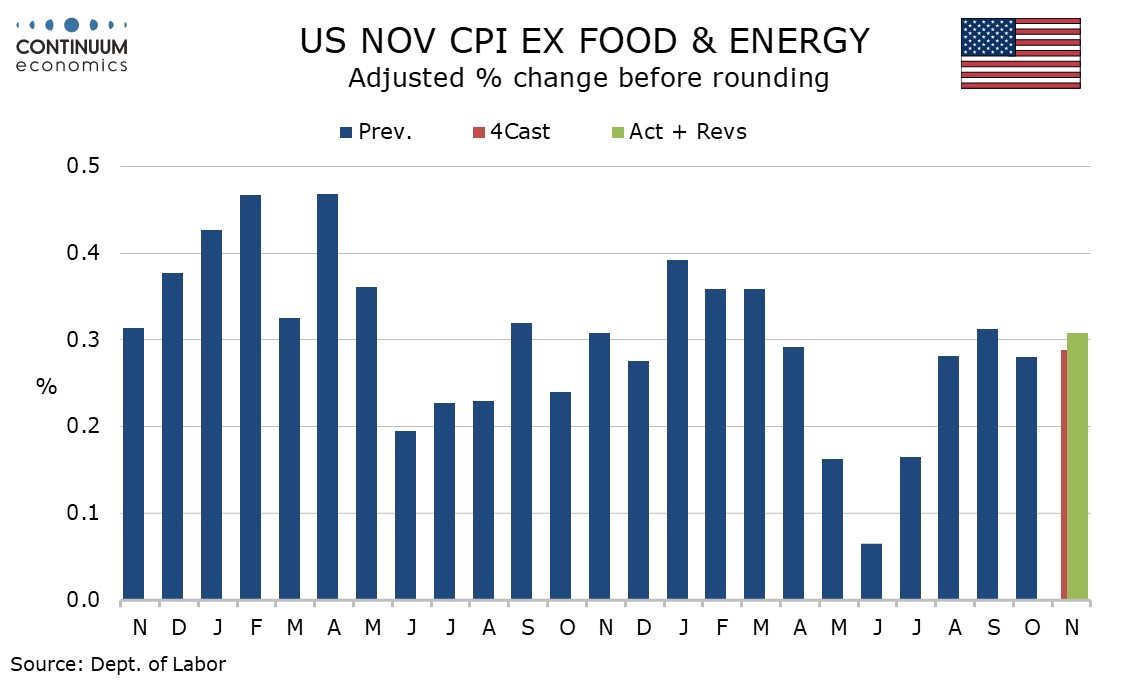

November CPI is in line with expectations at +0.3% both overall and ex food and energy, with both up by 0.31% before rounding. Core CPI with four straight 0.3% gains is still a little high for comfort but the data is probably subdued enough to allow the FOMC to deliver a 25bps easing next week, though they may hint at a slower pace of easing in early 2025.

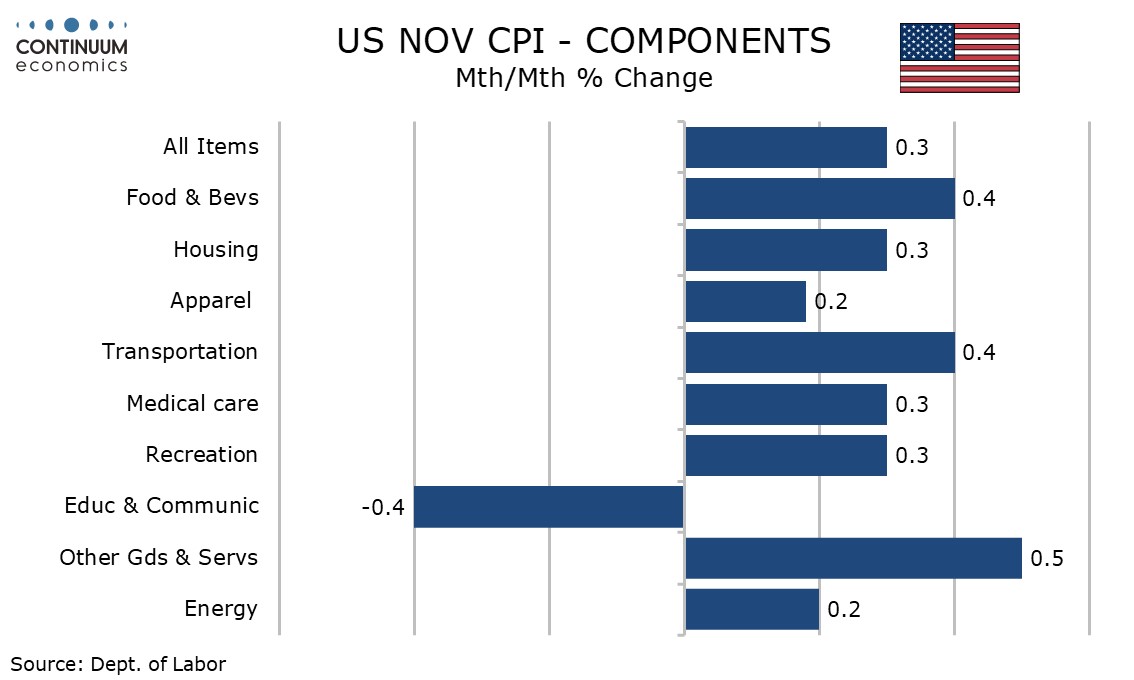

Gasoline prices rose by 0.6% but energy overall rose by only 0.2%. Food was above trend at 0.4%.

The detail is unusual in that commodities ex food and energy matched the usually stronger services ex energy, both rising by 0.3%. Commodities were supported by strength in autos, with used autos seeing a second straight strong month with a rise of 2.0% and new vehicles also accelerating with a rise of 0.6%. Apparel followed a 1.5% October decline with a modest rise of 0.2%.

This is a second straight 0.3% gain in services less energy and signals some recent loss of momentum. Transportation services, a recent source of strength both in air fares and auto services, were unchanged, restrained by a fall in auto rentals. Air fares were up a modest 0.4%. Shelter rose by 0.3% with owners’ equivalent rent up by only 0.2%, its slowest since early 2021. Loss of momentum here will be welcome to the Fed. Shelter did however see support from a 3.7% rise in the volatile lodging away from home sector.

Yr/yr growth edged up to 2.7% from 2.6% overall, a second straight acceleration but still below the core rate which saw a third straight month at 3.3%, There has been little change here for six months, with June also at 3.3% while July and August came in at 3.2%. Yr/yr core CPI is likely to slip in Q1 as three straight 0.4% gains drop out, though another strong Q1 in 2025 would be of concern to the FOMC.