UK: Weak Growth – Don’t Blame It All on the Budget!

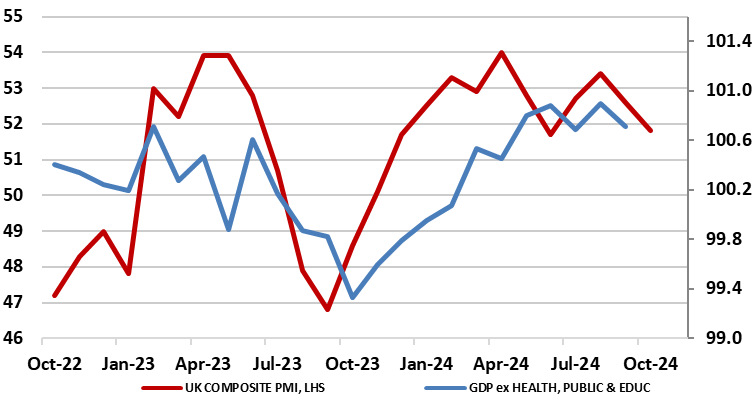

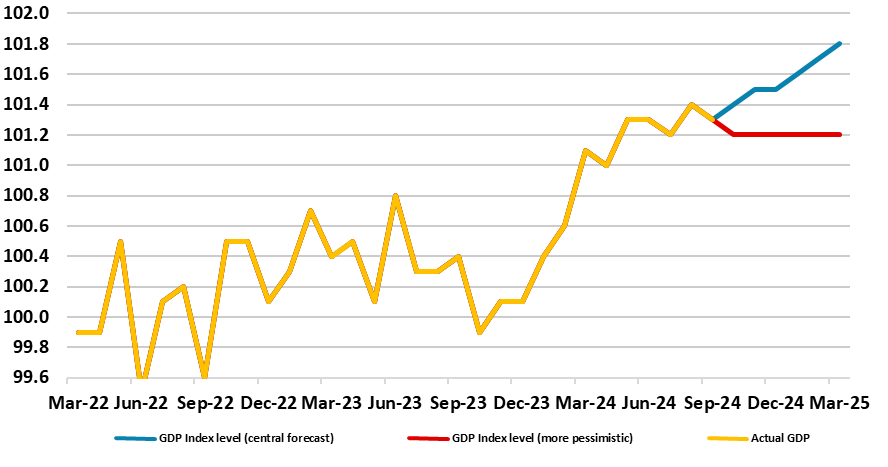

To suggest that the disappointing Q3 GDP data is largely down to apprehension about the Budget presented at the end of October is incomplete at best and misplaced at worst. After all, monthly GDP data suggest that the economy has not grown since May and by only 0.2% since March. These numbers are hardly consistent with there having been any momentum at all through the period, let alone momentum that has recently been lost. Indeed, business survey (Figure 1) and payroll data also suggest little, if not actually fading, momentum chiming with a GDP backdrop which actually contacted in the last 3-4 months outside of the public sector. Budget worries may have played a role, but, if so, they may weigh on activity further, meaning that GDP growth this quarter may be hard pressed to match the anaemic Q3 reading, especially given the adverse base effect created by the unexpected September m/m drop. Indeed, there are clear risks to our central GDP outlook into 2025, with the more pessimistic outlook (Figure 2) actually a mere continuation of the recent trend.

Figure 1: Surveys Corroborate Weak(er) Real Activity

Source: ONS, Markit

That added momentum may be forthcoming as fiscal stimulus bites into next year, but will merely offset the continued downside risks, which recent data suggest may actually be materializing. As a result, we now expect an additional 25 bp BoE cut next ear, this envisaging a fall to 3.25% by end-2025, even given a probable less friendly Fed backdrop!

Not Just GDP That is Weak!

A whole range of data, now including that for the Q3, very much questions the UK’s economy’s apparent solidity, if not strength, as apparently seen in sizeable q/q gains in the first two quarters of the year of 0.7% and 0.5% respectively. Indeed, GDP growth has been positive in only two of the last six months of data and worth a cumulative 0.2%, and where even that much more modest momentum looks to have ebbed given that September GDP fell 0.1% m/m, soft enough to have limited Q3 GDP growth to a 0.1% q/q rise, half the pace the BoE recently pared back its estimate too but in line with our thinking. Output weakness has been widespread, but most notable in manufacturing, thereby chiming with business survey data which has also pointed to a softer service sector backdrop. The GDP data also are more in line with the increasing weakness in payroll growth, particularly for the private sector, and it is notable that without the impulse from the public (mainly heath) sector the economy has actually contracted over the last 3-4 months. As a result, the monthly real economy data may become an increasingly important factor in shaping BoE policy ahead – why?

Figure 2: Downside Risk – Continuation of Recent Past?

Source: ONS, CE

Re-evaluating the Budget?

Many analysts Have attributed the poor Q3 GDP outcome to apprehension about the Budget. Admittedly, when taking power in early July, the government did preside over a gloomy assessment of economic and particularly fiscal matters, albeit partly a political ruse so as to place any blame for problems ahead on the previous administration. The apprehension may have been made worse by the fact that in order to have credible fiscal arithmetic, the Budget itself could not be presented until Oct 30, thereby possibly accentuating uncertainty and, in turn, apprehension. Despite a clear focus on hefty tax rises of some 1% of GDP, the Budget also saw a sizeable surge in government spending mean this it was one of the largest fiscal loosenings in recent decades, the result being growth upgrades from the likes of the BoE, to a degree that the latter now sees GDP rising by 0.4-0.5% q/q per quarter through 2025. But given the lack of recent momentum - which we attribute to BoE tightening still biting, alongside weak global growth - we think this is too optimistic, especially as the Budget itself (for all its fiscal giveaways), does seem to have hurt both business and consumer sentiment. Indeed, a just-released consumer survey was very candid in this regard, stressing ‘November is seeing households grow somewhat gloomier again, failing to build on the underlying improvement seen in the months leading up to the General Election. Consumer confidence has fallen back since spiking higher in July amid the election buzz, as ongoing pressure on household finances has resulted in squeezed spending, higher debt and lower savings’.

The fiscal boost is coming, but the question is whether it will merely offset the lack of momentum already evident in the likes of payrolls and instead where tax hikes act to make sentiment ever more fragile. Against this backdrop, while we adhere to out below consensus 1% GDP picture for 2025, we note clear risks to that central GDP outlook that may be both increasing and even materialising. Notably, our more pessimistic outlook (Figure 2) is actually a mere continuation of the recent trend!