U.S. September CPI - Core not led by housing this time, Hurricanes starting to lift Initial Claims

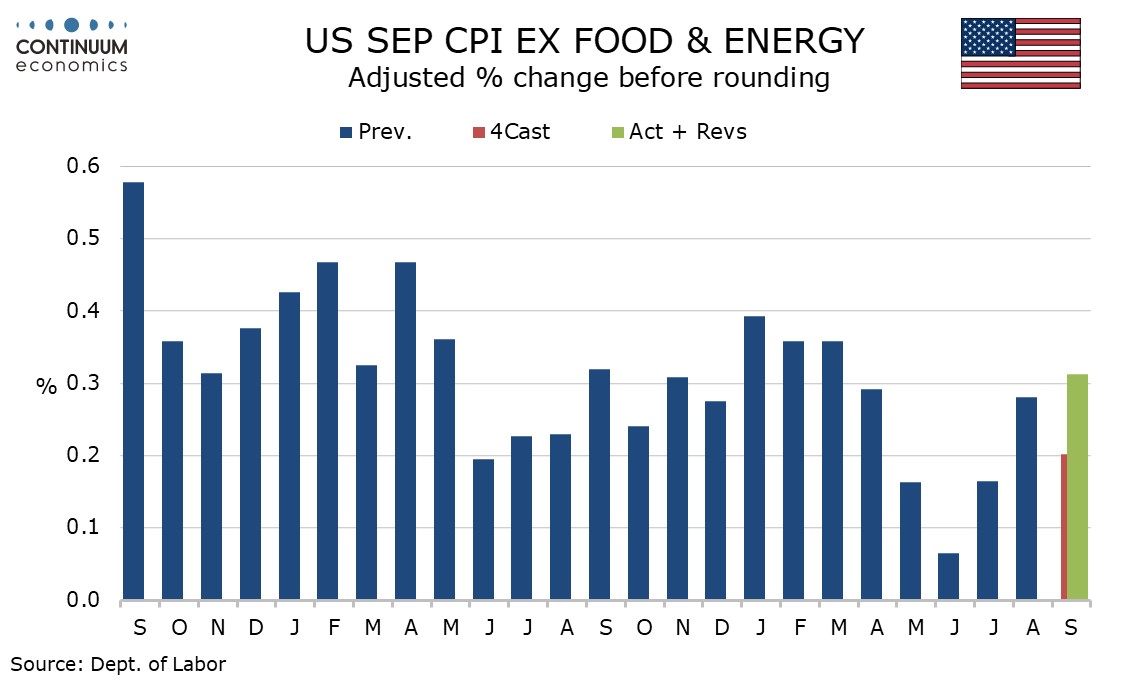

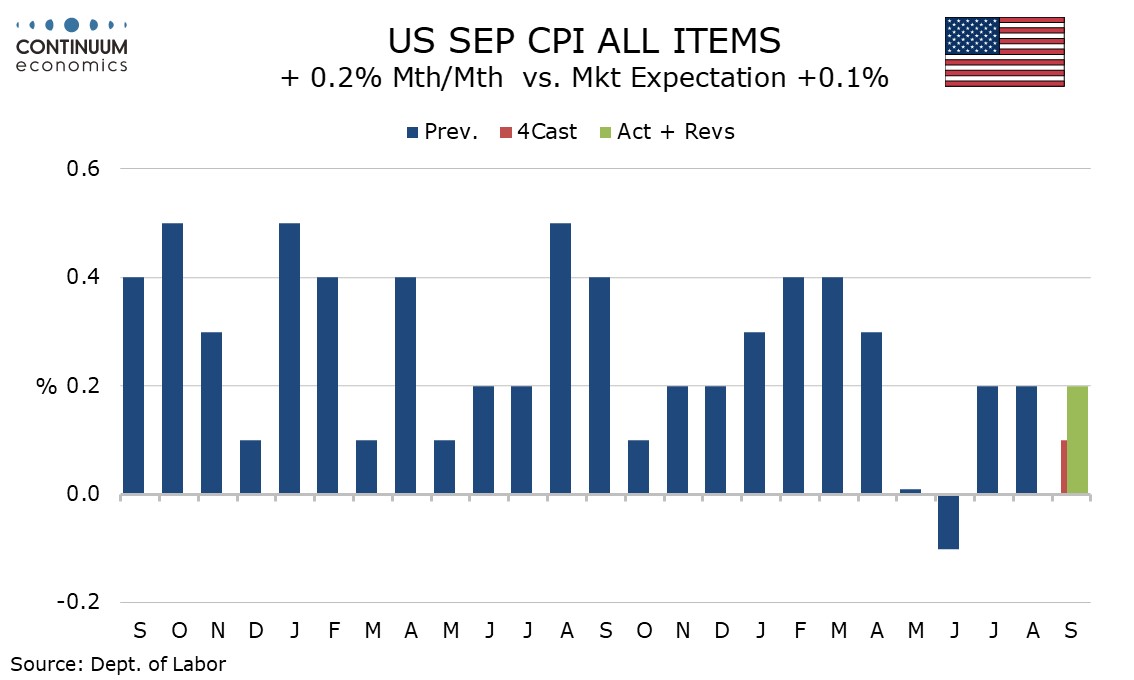

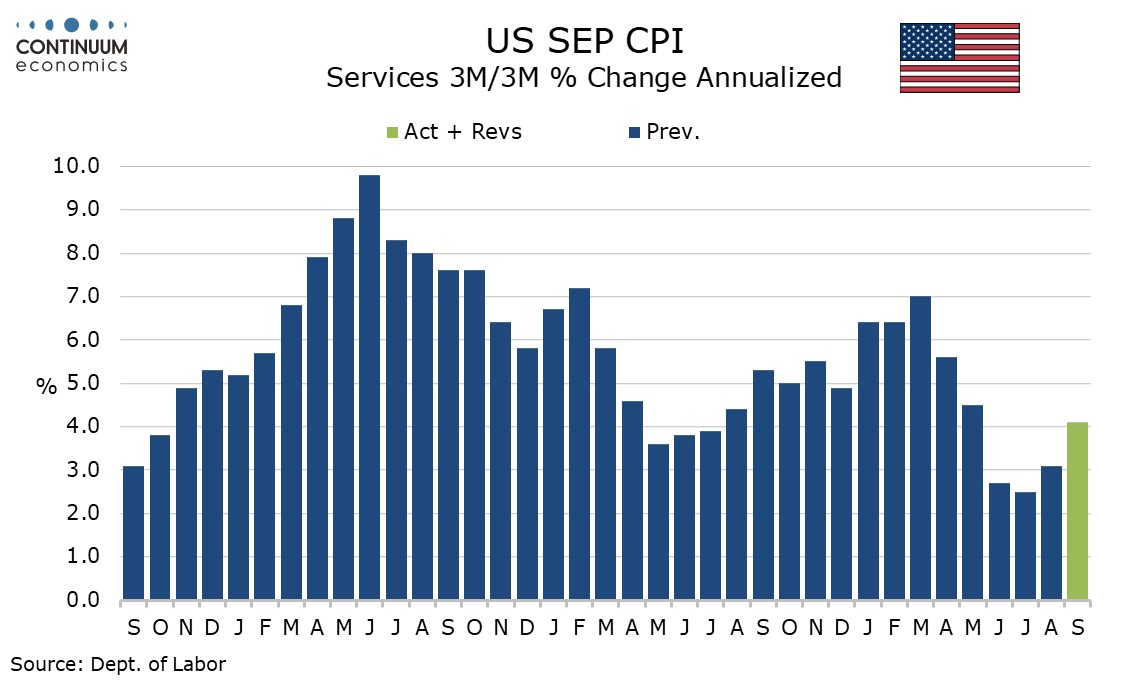

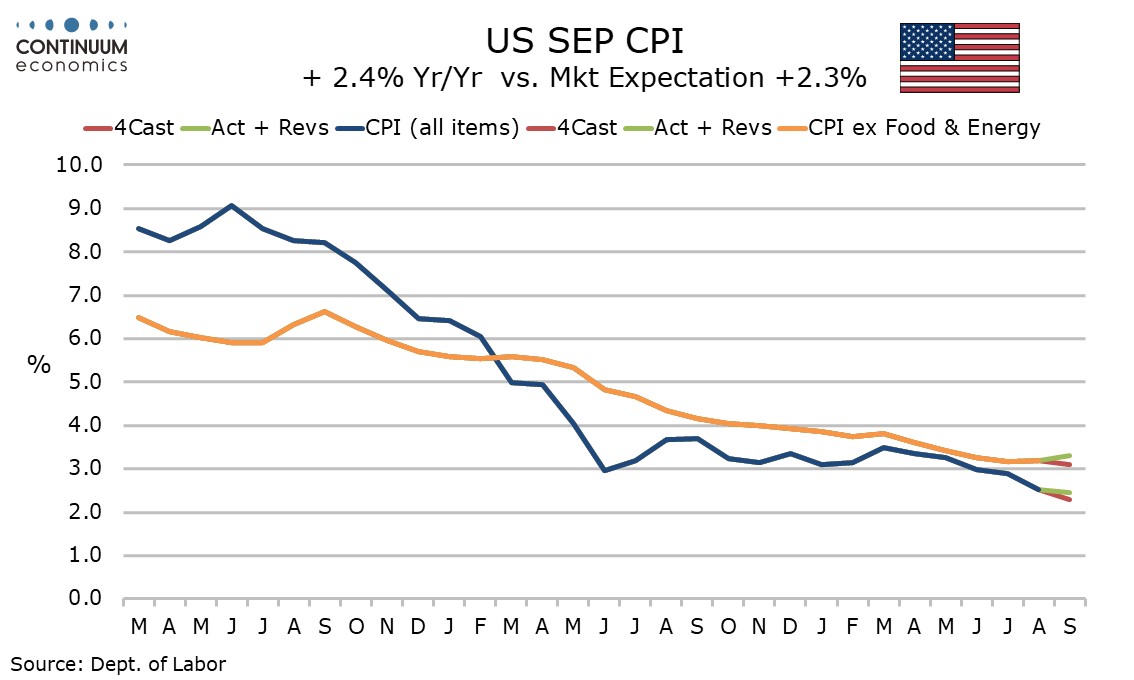

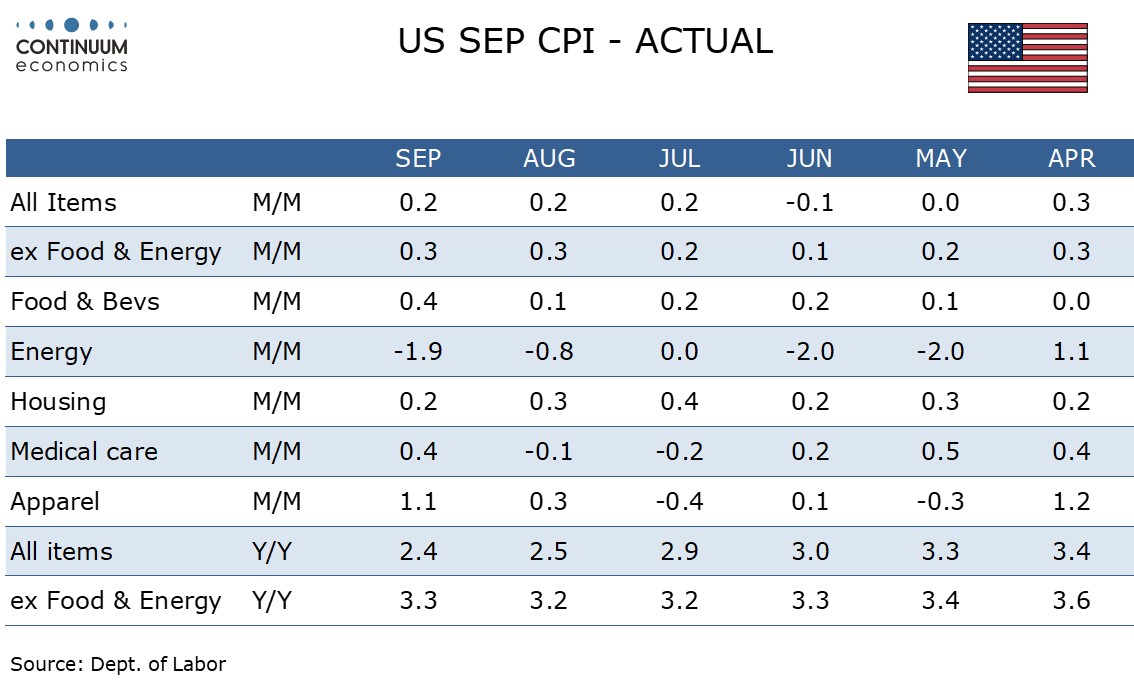

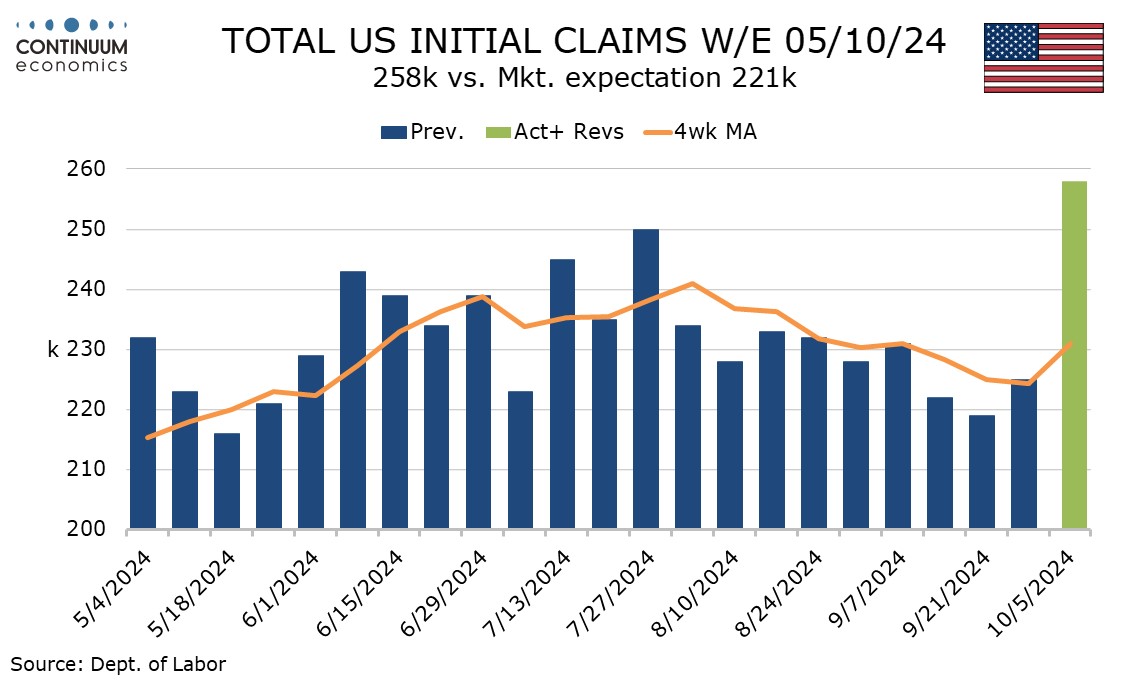

September CPI is on the high side of expectations, up 0.2% overall and 0.3% ex food and energy, with the gains before rounding being 0.18% and 0.31% respectively. While the core rate looks similar to August’s, the details are different with strength not led by housing this time. A spike in initial claims to 258k from 225k looks at least in part a response to Hurricane Helene. Hurricane Milton may provide an even bigger boost in coming weeks.

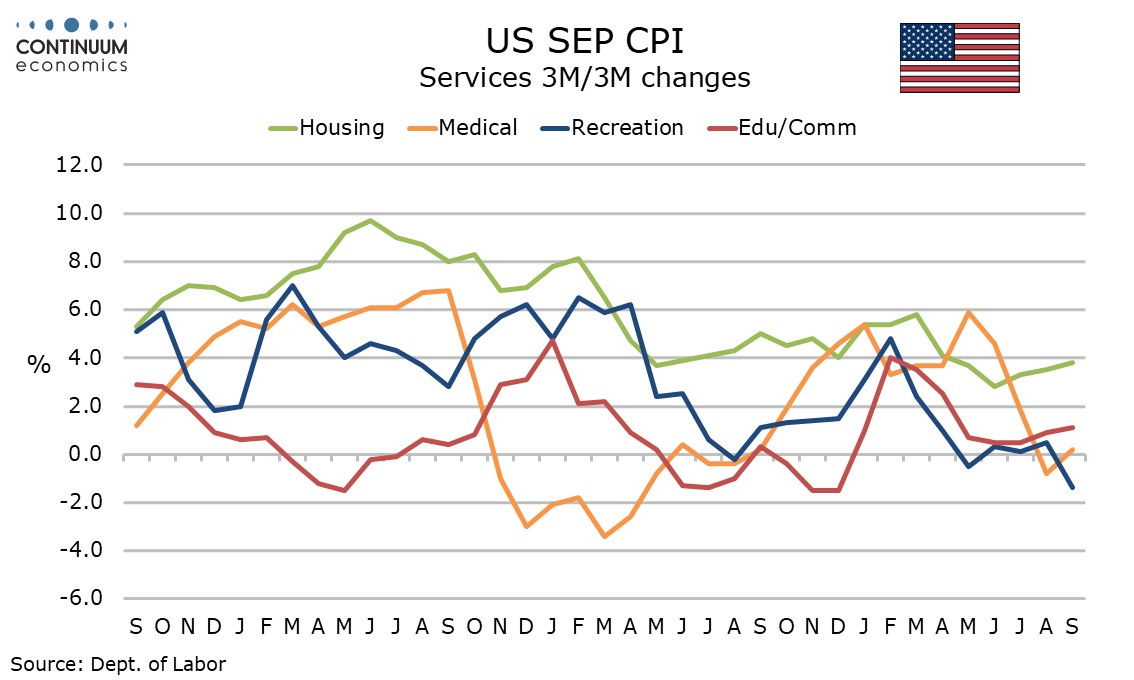

In August’s CPI shelter rose by 0.5% but in September shelter rose by only 0.2%. Despite this core CPI rose by 0.3% in both months. The core CPI rise led by shelter was followed by a much softer 0.1% rise in August’s core PCE price index. September’s 0.3% core CPI may well be matched by core PCE prices.

It is notable that in 2023 September was the only month in the second half of the year to see core PCE prices rise by more than 0.2% before rounding, in fact rising by 0.32%.

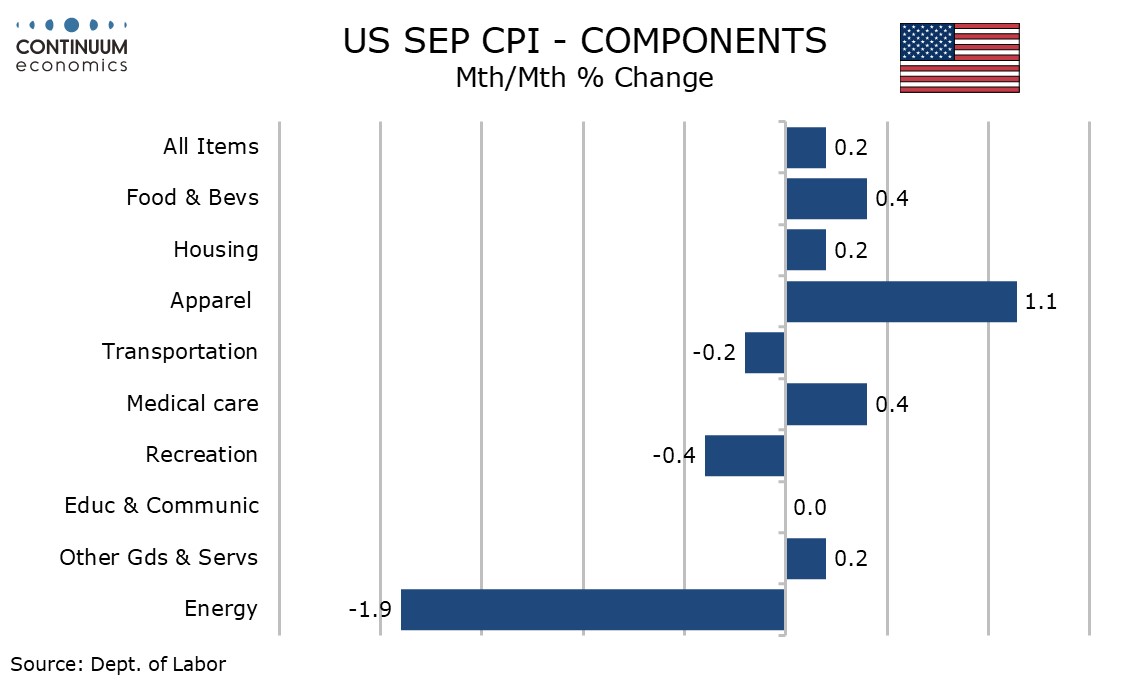

Details of September’s shelter breakdown showed owners’ equivalent rent below trend at 0.3% after an above trend 0.5% in August, while lodging away from home with a 1.9% decline reversed a 1.8% August increase.

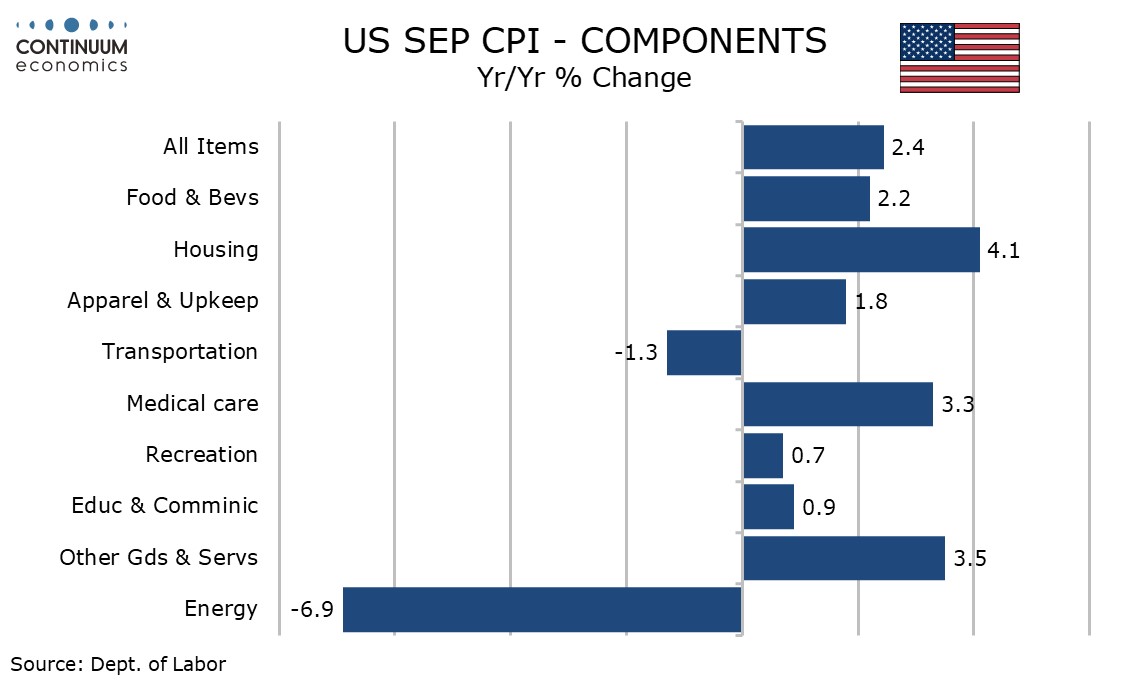

Elsewhere there were several components that accelerated in September. Commodities ex food and energy unusually increased by 0.2% with apparel firm at 1.1% and used autos above trend with a rise of 0.3%.

Medical care services saw a strong rise of 0.7% to follow two straight declines. Airline fares with a 3.2% rise were firm for a second straight month while stronger gains in auto services saw transportation services up by 1.4% after a 0.9% rise in August. Recreation services however were weak at -0.5%

Energy prices fell by 1.9% led by a 4.0% fall in gasoline, but the situation in the Middle East poses upside risks for October. Food was above trend with a 0.4% increase.

This slightly disappointing CPI looks a little more broadly based than that of August, though the fact core PCE prices were above trend in September 2023 suggests the strength may not be repeated in Q4.

Yr/yr CPI slipped to 2.4%, its lowest since February 2021, from 2.5% in August, but the core rate nudged up to 3.3% from 3.2%, and remains too high.

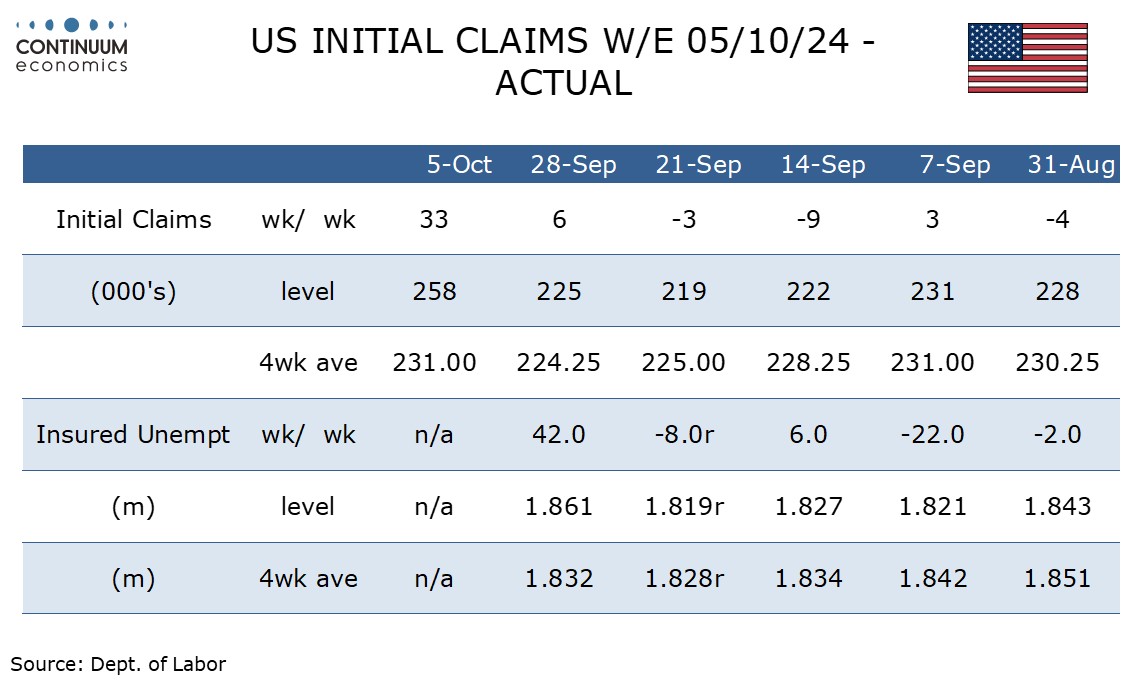

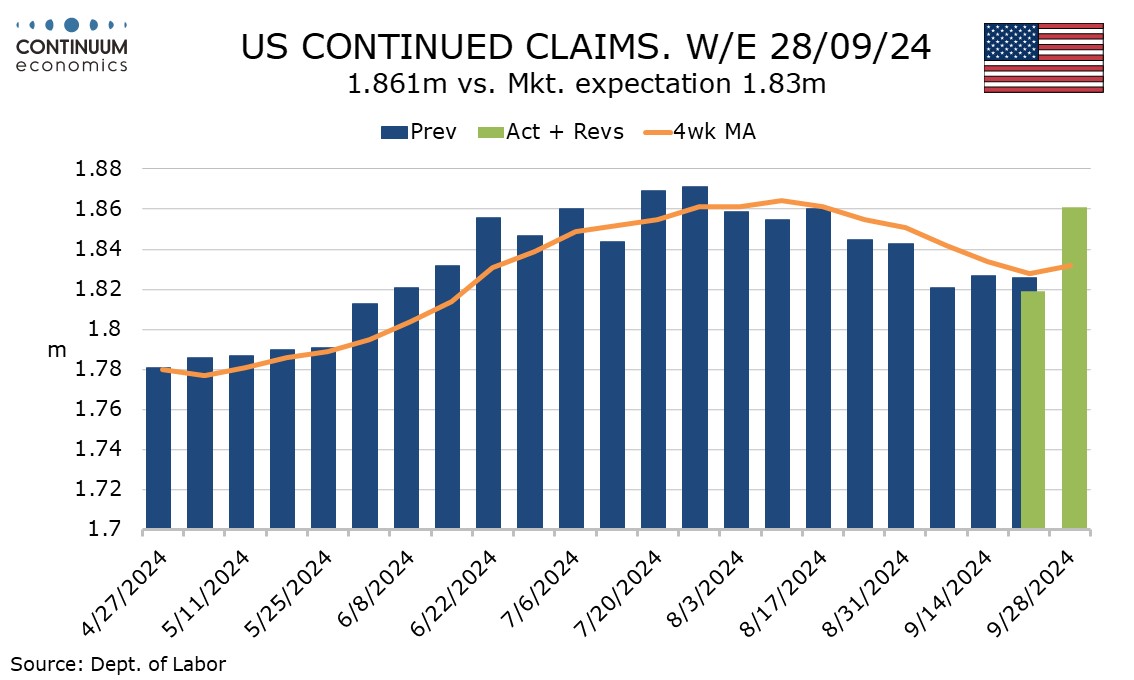

Weekly initial claims at 258k are the highest since August 2023 while continued claims at 1.861k from 1.819k are also above expectations, and the highest since July 27 of this year. Continued claims cover the week before initial claims so are likely to rise by more next week.

The rise in clams was led by Michigan (9.5k) and North Carolina (8.5k). The latter looks like a response to Hurricane Helene as do more modest gains in Florida, Kentucky and Tennessee (totaling 7.6k). It is clear that a significant part of the gain is due to Hurricane Helene, while data for the next week and probably beyond is likely to get an even larger boost from Hurricane Milton.

The survey week for October’s non-farm payroll comes next week so Hurricane Milton is likely to have a significant impact on that, even if the impact of Hurricane Helene fades quickly.