Bank Indonesia Policy Review: Rate Pause As BI Steadies IDR

In line with our view Bank Indonesia kept its policy rate steady at 5.75% in its February 18-19 meeting after last month’s surprise cut. The weakening rupiah and external uncertainties reman critical factors influencing the rate decision. The central bank is likely to assess the impact of its January move before considering another cut. A cut is likely in Q3 2025.

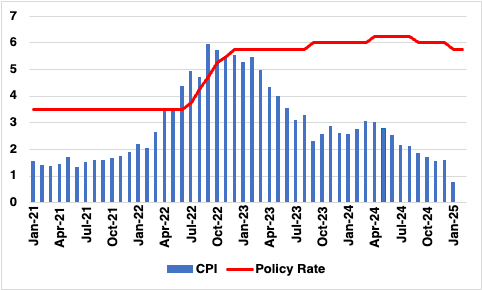

Figure 1: Bank Indonesia Main Policy Rate and Inflation (%)

Source: Continuum Economics

In its latest monetary policy committee (MPC) meeting, Bank Indonesia (BI) opted to maintain its benchmark 7-day reverse repurchase rate at 5.75%, a decision that aligned with our expectations. This decision underscores BI's cautious approach amid a global economic environment fraught with uncertainty, especially as President Trump's erratic trade policy measures continue to threaten stability.

Bank Indonesia's (BI) latest decision comes amid a backdrop of modest inflation and a relatively stable rupiah, despite ongoing global economic uncertainties. This move reflects a cautious yet flexible approach to monetary policy, aimed at balancing the need for economic stability with the potential to support growth as conditions evolve. The central bank's decision was heavily influenced by the current inflation rate, which stood at a low 0.8% year-on-year in January, influenced in part by a temporary reduction in electricity tariffs. This low inflation environment affords BI the flexibility to potentially ease monetary policy later this year, should economic conditions warrant such action.

Moreover, global economic conditions, marked by volatility and uncertainty, especially in key economies such as the United States and China, play a significant role in shaping BI’s policy stance. These conditions pose risks through potential impacts on capital flows and exchange rates, requiring a cautious approach to rate adjustments. Governor Perry Warjiyo indicated that while the current focus remains on managing inflation and maintaining currency stability, there is openness to easing monetary policy in the future. This suggests a shift could occur if the inflation remains controlled and economic indicators suggest a need to stimulate growth. The rupiah has remained relatively stable since the January rate cut, holding near its pre-cut levels and close to the multi-year lows seen in mid-2024.

Warjiyo’s remarks also underscored an ongoing commitment to monitor economic and inflationary trends closely, suggesting that any decision to adjust rates will be data-driven. The mention of potential rate cuts later in the year aligns with our forecast. We anticipate another rate cut of 25bps in Q3.