U.S. Outlook: Fed Easing to Prevent Recession, but May Also Keep Inflation Above Target

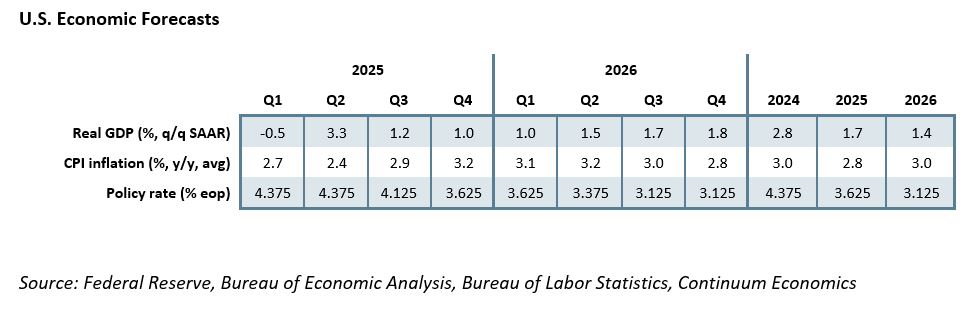

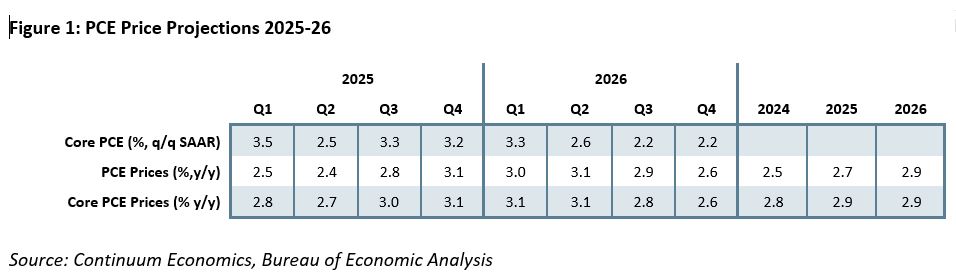

• GDP growth, supported in particular by business investment, was resilient in Q2, but growth in employment is now minimal and that will weigh on consumer spending, particularly with tariff-supported inflation set to restrain real wage growth. Recession is a risk if we see a vicious circle of weakening consumption and employment, but with the Fed having scope to ease a soft landing remains more likely. We expect GDP growth of 1.7% in 2025 and 1.4% in 2026 with quarterly annualized rates bottoming at 1.0% in Q4 of 2025 and Q1 of 2026. Growth is likely to gradually improve through 2026, but remain below 2.0% on an annualized basis. We expect core PCE prices to average 2.9% in both 2025 and 2026, with tariffs to lift annualized growth above 3.0% in Q3 and Q4 of 2025 and Q1 of 2026. While inflationary pressures will subsequently moderate, we do not expect a return to the 2.0% Fed target in a less globalized world. We expect core PCE prices to rise by 2.2% annualized in the second half of 2026 with yr/yr growth ending 2026 at 2.6% in Q4.

• The FOMC has resumed easing given the loss of labor market momentum but still faces the dilemma of balancing upside inflation risks with downside risks to employment. The pace of future easing will be data-dependent but under a soft landing scenario we expect two more easings in 2025, and two in 2026, in Q2 and Q3 with a pause in Q1 on inflation concerns. That would see the Fed Funds target range ending 2026 at 3.0-3.25%, which is probably a little lower than would be appropriate if the Fed is unable to return inflation to the 2.0% target.

• Forecast changes: Our 2025 GDP forecast has been revised up to 1.7% from 1.4% but only because Q2 was stronger than we expected in June. Our forecasts for subsequent quarters have been revised marginally lower, though our 2026 forecast is unrevised at 1.4%. Tariffs have so far provided less of a lift to inflation than we expected but we believe pass through will eventually be seen. Our 2025 CPI forecast has been revised down to 2.8% from 3.0% but 2026 has been revised up to 3.0% from 2.9%. For core PCE prices our 2025 forecast is unrevised at 2.9% but we now expect 2026 to rise by 2.9% rather than 2.7%. We expect core PCE prices to end 2026 at 2.6% yr/yr, compared to our 2.2% forecast made in June. In June we expected the Fed to ease only once in 2025, by 25bps in December. We now expect easings in October and December to follow September’s move. We now expect two easings in 2026 rather than three, in Q2 and Q3 rather than Q2, Q3 and Q4. We expect the Fed Funds target to end 2026 at 3.0-3.25% rather than 3.25-3.5%.

Economy resilient, but labor market slowdown will restrain consumers

The U.S. economy has slowed, and with employment growth now minimal looks set to slow further. However it does not appear to be on the cusp of recession. A strong 3.3% annualized rise in Q2 GDP needs to be seen alongside a 0.5% decline in Q1, leaving an average of 1.4%, but final sales to private domestic buyers increased by 1.9% in each quarter, suggesting a near potential underlying pace outside tariff-induced volatility in net exports and cuts in government. Business investment has been strong, particularly intellectual property which has been lifted by the spread of artificial intelligence. Consumer spending has lagged behind real disposable income, which grew by 2.5% in Q1 and 3.0% in Q2, albeit supported by some one-time factors. Historical revisions to GDP data due on September 25 do however need to be watched.

Employment growth through March 2025 has been revised down by 911k, suggesting trend had already fallen below 100k per month by then, and appears to be slowing further with August’s three month average only 29k. However, slowing labor force growth means that the unemployment rate is edging only marginally higher, with the August 2025 rate of 4.3% only marginally above 4.2% seen 12 months before. Initial claims, while having increased recently, remain consistent with limited layoffs. Still, minimal employment growth will restrain consumer spending, particularly if tariffs boost inflation to contain real wage growth. We expect growth in consumer spending to fall to 0.5% annualized in Q4 2025 and Q1 2026, underperforming GDP which we expect to rise by 1.0% in each of those quarters. Fed easing is likely to help growth pick up into the second half of 2026, but a return to 2.0% will be difficult to achieve with limited increases expected in the labor force. We expect GDP to rise by 1.7% in 2025 and 1.4% in 2026 by calendar year, with the Q4/Q4 gains being 1.2% in 2025 and 1.5% in 2026.

Tariffs to continue a gradual pass through to inflation

Tariff rates are a little higher than we anticipated in June, though retaliation on US exporters has been mostly modest. The tariff impact on inflation so far has been modest, but visible in goods inflation. Uncertainty remains high with the Supreme Court set to consider an appeals court ruling against Trump’s reciprocal and fentanyl tariffs. While Trump’s claim that trade deficits represented an emergency is a dubious one, we expect the Supreme Court will rule in favor of these tariffs, though we would not rule out the possibility of them seeking some middle ground. If the Supreme Court does rule against these tariffs, Trump has legal means that he could pursue to impose other tariffs, and deals made with various trading partners are likely to stick. Still, one reason tariffs have not been fully passed on to consumers yet is likely to be uncertainty over their eventual magnitude. Continued uncertainty is likely to keep the feed through from tariffs to inflation gradual, though ultimately a substantial pass through will be difficult to avoid.

We expect annualized growth in core PCE prices above 3.0% in Q3 and Q4 of 2025 and Q1 of 2026. Some slowing is likely after that but we expect the rate to remain above 2.0% even in the second half of 2026, and with the economy likely to be regaining momentum by then the rate may settle slightly above the Fed’s 2.0% target. This will be the consequence of a less globalized world and tighter immigration controls restricting growth in the labor force. We expect yr/yr growth in core PCE prices of 3.1% in Q4 of 2025 and Q1 and Q2 of 2026, before a slowing to 2.6% in Q4 2026. We expect core PCE prices to average 2.9% in both 2025 and 2026, while CPI rises to 3.0% in 2026 from 2.8% in 2025, though we see CPI at 2.8% yr/yr in Q4 2026, down from 3.2% in Q4 2025.

Tariffs are providing the government with revenue, which is likely to see budget deficits edging slightly below 6.0% of GDP in 2026 rather than rising to 7.0% of GDP as would have been the case without tariffs under the “Big Beautiful Bill”. That bill will provide support to consumers from tax cuts and most of its spending cuts will be delayed until after the 2026 midterm elections. That tariff revenues look set to be substantial means the eventual pass through to consumer prices will also be, even if it takes time to fully arrive.

Fed policy and political risk

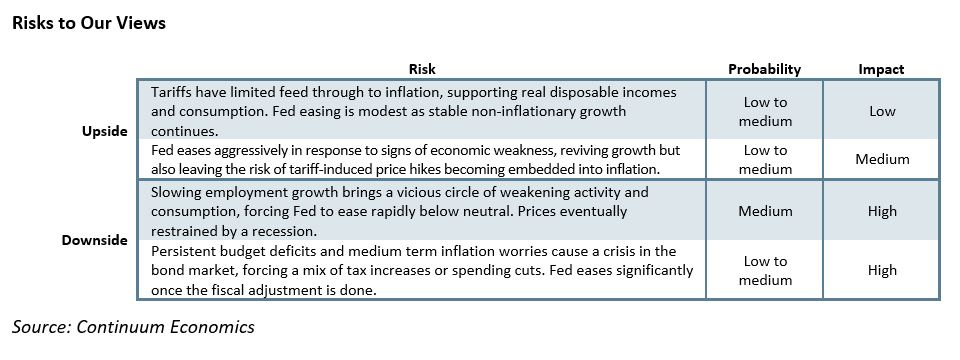

The Fed is weighing upside risks to inflation and downside risks to employment, in an increasingly politically changed environment. Slowing in the labor market has seen easing start, and the pace of future moves will be data-dependent. Should non-farm payrolls turn significantly negative and unemployment rises quickly above 4.5%, the Fed could move aggressively below the neutral 3.0%. However under our soft landing view, in which payroll growth is near flat and unemployment gains limited, the Fed is likely to move gradually, particularly if inflation is lifted by tariffs, as the neutral rate gets closer. The latest Fed dots suggest two more 25bps moves this year, in October and December, but if inflation remains firm with payrolls near neutral a pause may be seen in Q1 2026. We expect two moves in 2026, in Q2 and Q3, once inflation moves off its highs. That would take the Fed Funds target range to 3.0-3.25%, close to where the Fed currently sees neutral. This may be a little lower than appropriate if the Fed fails to return inflation to the 2.0% target.

Jerome Powell’s term as Fed Chairman, though not as Governor, ends in May 2026 and Trump is certain to replace him with someone more dovish. If Trump selects a Fed insider, with Governor Christopher Waller the most likely choice, we doubt easing as rapid as Trump would wish would be seen in the absence of recession. However should Trump select a less known figure, and that individual is confirmed by the Senate, markets would be right to worry. Still, it will be difficult for Trump to achieve a FOMC voting line up in which the majority follow the President’s wishes rather than their own assessment of what appropriate monetary policy will be. Policy slightly more dovish than appropriate is our expectation. A complete loss of Fed credibility is not.

Midterm elections in November 2026 look likely to see Democrats regaining control of the House, which will require only a small swing and the election is likely to be seen as a referendum on the Trump administration. However it is unlikely the Democrats will be able take control of the Senate unless the economy falls into recession. The economic consequences of the elections will be moderate, with the Trump economic agenda already in place, and unlikely to be dramatically altered before the elections of 2028 even if Republicans maintain control of Congress in 2026. The elections will however be significant in many other aspects of policy, some of which, notably immigration, would have indirect economic implications. Recession is a significant risk, we estimate at 30%, if weakness in employment leads to a sharp consumer pullback, generating the start of a vicious circle of declining consumption and employment. However, the Fed has the ability to respond to an emerging recession, and it appears likely that the Fed will do at least as much as it needs to keep any recession brief and moderate, potentially cutting the Fed Funds target to 2.0-2.5%. The risk of the Fed doing too much, and sustaining both economic growth and above target inflation is also a significant risk even if the Fed is able to largely sustain its independence.