Deceleration Continues: Turkiye's GDP Growth Hits 2.1% YoY in Q3

Bottom Line: Turkish Statistical Institute (TUIK) announced on November 29 that Turkish economy expanded by 2.1% YoY in Q3 driven by higher contribution from net exports. As we expected, the pace of the GDP growth decelerated in Q3, when compared to Q1 and Q2, as demand ebbed - especially in the services sector- due to lagged impacts of aggressive monetary tightening by the Central Bank of Turkiye (CBRT) coupled with tighter fiscal stance and weaker credit growth aiming to cool off galloping inflation. We feel tight monetary and income policies will continue to suppress domestic demand, and bring 2024 and 2025 growth to 3.3% and 2.9% YoY, respectively.

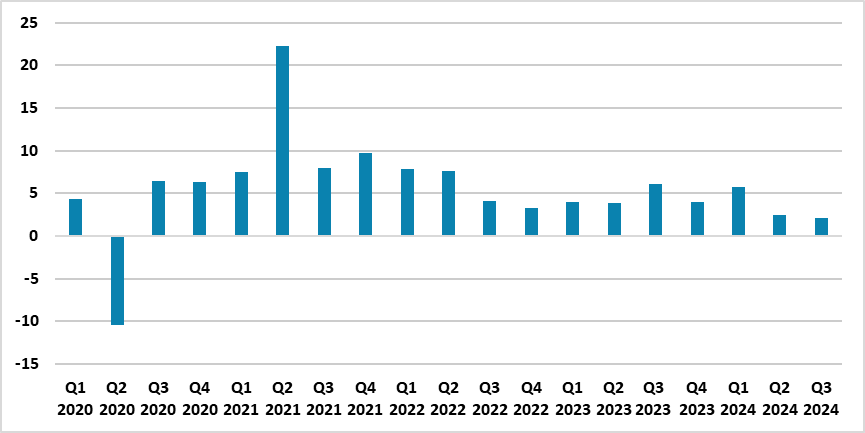

Figure 1: GDP (%, YoY), Q1 2020 – Q3 2024

Source: Continuum Economics

Turkish economy expanded by 2.1% YoY in Q3, after growing by a strong 5.7% in Q1 and 2.5% in Q2. GDP adjusted for seasonality and calendar effects dipped by 0.2% in Q3, down from an expansion of 0.1% during the previous period, confirming the onset of a technical recession. Services-related activity pulled overall GDP lower in Q3, while construction and financial services remained elevated on an annual basis, TUIK data revealed. Net exports continued to support the headline growth while private consumption has remained sluggish with a 3.1% YoY rise. Investment appetite weakened from 9% YoY in Q1 to 0.8% YoY in Q2, turning negative with -0.8% YoY growth in Q3.

Speaking about Q3 growth rate, Treasury and Finance minister Mehmet Simsek said on November 29 that growth during the disinflation process is following a moderate and balanced course, as predicted. Simsek added that economic activity would bounce back in the second half of next year.

After CBRT lifted the benchmark one-week repo rate from 45% to 50% on March 21, and held it steady for the eighth consecutive month as of November 21 to contain the price pressures, we envisage the pace of the GDP growth will continue to decelerate in Q4 due to monetary tightening, contractionary fiscal actions and additional macro prudential policies.

Taking into account that the inflation deceleration slowed down in September and October blurring the policy outlook, we expect cautious and hawkish CBRT to start cutting rates in Q1 2025 due to higher-than-forecast inflation prints, -if inflation allows in Q4 2024 and Q1 2025-. We feel anti-inflation measures mentioned above will likely continue to dent growth considering tight monetary and income policies suppressing domestic demand and bringing 2024 and 2025 growth to 3.3% and 2.9% YoY, respectively.