SA Inflation Slightly Rose to 2.9% YoY in November, Still Leaving Room for a Rate Cut in January

Bottom Line: Despite inflation eased to more than a 4-year low in October with 2.8% YoY, it slightly increased to 2.9% YoY in November. Taking into account that the inflation remains below the South African Reserve Bank’s (SARB) target range of 3% and 6%, we think November print backs rate cut bets during the next MPC meeting. We foresee SARB will cut key rate by 25 bps to 7.50% on January 30.

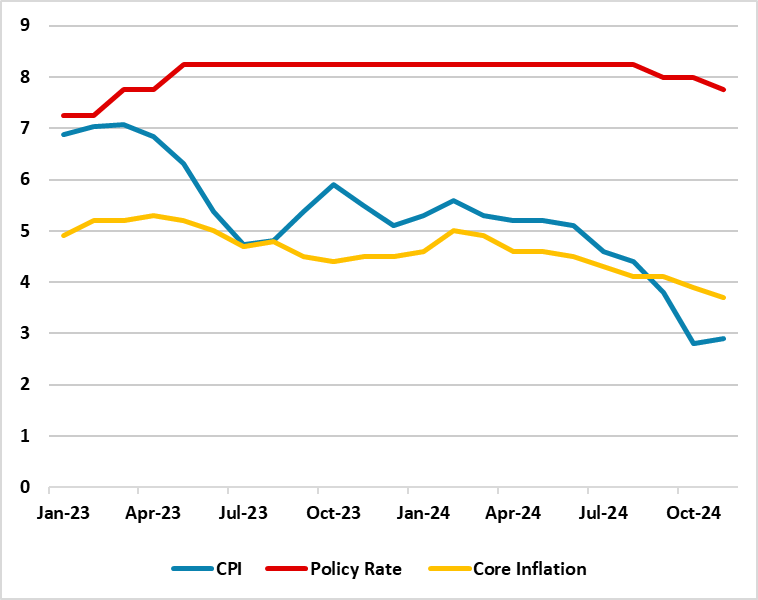

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – November 2024

Source: Continuum Economics

South Africa’s inflation slightly increased to 2.9% YoY in November after hitting 2.8% YoY in October. According to StatSA, annual inflation for food & non-alcoholic beverages (NAB) witnessed another sharp decline in November, slowing to 2.3% from 3.6% in October. Fuel prices increased by 0.9% MoM in November, taking the annual rate to -13.6% from -19.1% in October. The price index for the restaurants & hotels category rose by 5.9% in the 12 months to November, with increases recorded for both restaurants (+5.1%) and hotels (+7.5%).

On a MoM basis, inflation was at 0.0% in November, compared to -0.1% in October. Annual core inflation eased to 3.7% in November from 3.9% in October.

The inflation print continued to be supported by the suspended power cuts (loadshedding). South Africa’s national electricity utility company, Eskom announced on December 6 that load shedding remained suspended for 254 consecutive days since March 26, reflecting an improvement in the reliability and stability of the power generations coupled with new investments.

Despite slight rise, we think November print backs rate cut bets during the next MPC meeting scheduled next month since the inflation remains below the central banks's target range of 3% and 6%. We foresee SARB will cut key rate by 25 bps to 7.50% on January 30.

Speaking on this topic, SARB governor Kganyago signaled this week that officials will proceed carefully on interest-rate adjustments, given the unpredictable outlook for the global economy. “In an environment of uncertainty, it is very important for the central bank to move with caution and not add to the noise that you have in the data,” Kganyago said. “We should not be creating uncertainty by making moves that we would later regret.”

In this respect, we feel it will be important for SARB to monitor unpredictable outlook for the global economy, trade tariffs, and oil price movements early 2025, as they could significantly impact inflation forecasts. Uncertainty about the U.S. economy under new Trump administration and slowing China demand could cause reconditeness for South African economy in the medium term. Taking into account that Eskom is planning to apply tariff hikes over the next two years 2025/2026: 36.15% and 2026/2027: 11.81%., we think this could also lift CPI over expectations, which will be significant to follow for SARB.