Mexico CPI Review: Slight Uptick in December

The INEGI's recent release of Mexico's December CPI data, surpassing expectations, led to a 0.7% month-on-month increase. Year-on-year, the index rose to 4.6%. Notable surges in non-core Agriculture CPI and a slight uptick in core CPI were observed. Despite exceeding historical averages, the inflation rise is attributed to holiday season effects. In 2024, with tight monetary policy, a gradual inflation deceleration is expected, reaching a 4.2% year-on-year average. Banxico now has room for rate cuts, with a 50% chance of implementation in February, yet caution will prevail.

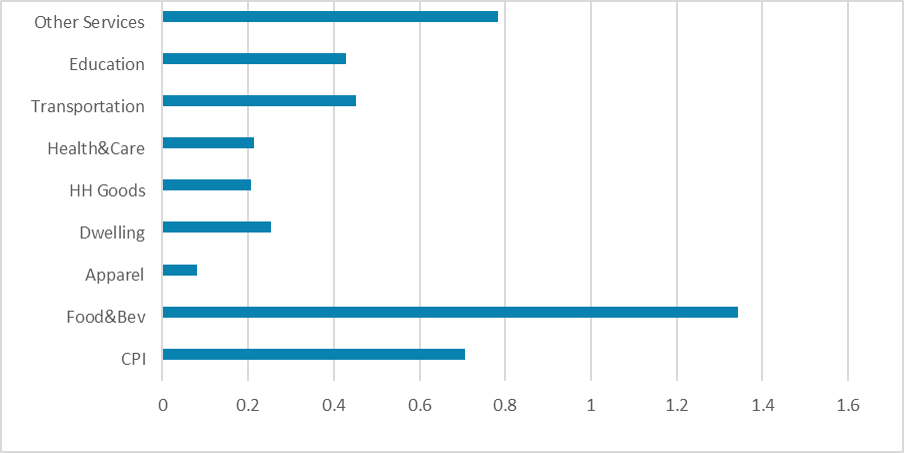

Figure 1: Mexico CPI by Groups (%, m/m)

Source: INEGI

The National Institute of Statistics and Geography of Mexico (INEGI) has recently released the Consumer Price Index (CPI) data for December. The figures have exceeded expectations, surprising market participants. While a Citibamex survey anticipated a 0.6% increase in the index, the actual data revealed a 0.7% (month-on-month) rise. Consequently, the year-on-year index increased to 4.6% in December from 4.3% in November. The notable surge was observed in the non-core Agriculture CPI, which experienced a 1.5% increase during the month. Additionally, core CPI rose by 0.4% (month-on-month), with services CPI seeing a 0.6% (month-on-month) increase.

Analyzing specific groups, all categories displayed positive inflation in December. The Food and Beverage sector, growing by 1.4%, was influenced by the increased prices of certain vegetables. Onions prices rose by 55%, while tomatoes saw a 33% increase. Transportation costs were impacted by higher airfare ticket prices, and other services were affected by changes in tourism services. Despite the CPI exceeding its historical December average of 0.6%, it is reasonable to attribute most of the uptick to the seasonal effects of end-of-year holidays, causing no significant concern.

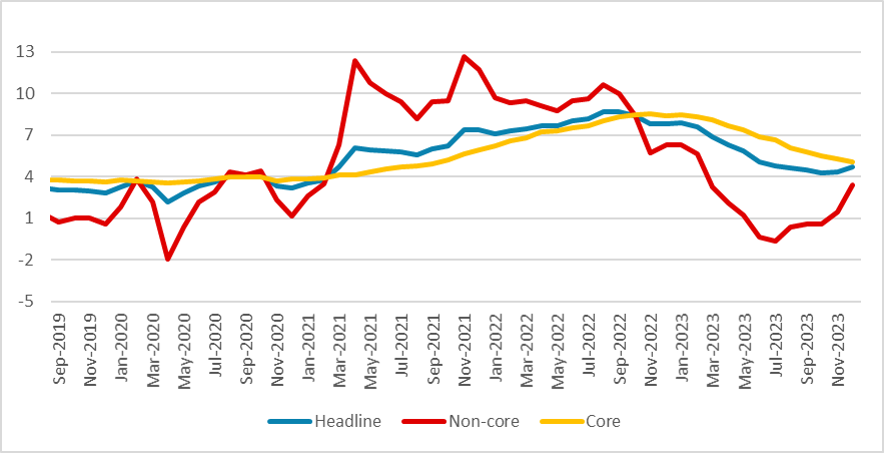

Figure 2: Mexico CPI by Groups (%, Y/Y)

Source: INEGI

Examining the Core CPI, there has been marginal improvement as the index continued to decrease in December to 5.1% (year-on-year). The gap between core CPI and headline CPI narrowed in December, reaching its lowest point in over 15 months. What can we anticipate for inflation in 2024? With monetary policy expected to remain tight, inflation is projected to decelerate throughout the year, albeit at a slower pace than observed in 2023. Some inertia is expected to prevent CPI from converging to the Banxico target of 3.0%. The forecast for Mexico CPI closing in 2024 is 4.2% (year-on-year average).

However, due to a significant drop in inflation, Banxico now has room to consider rate cuts. Nevertheless, caution will be emphasized in Banxico's communications. There is a 50% probability that Banxico might implement a cut during their February meeting. Despite this, monetary policy will remain contractionary throughout the year, with lagged effects continuing to pose a headwind.