U.S. January Employment - Trend still strong despite a weather-restrained January

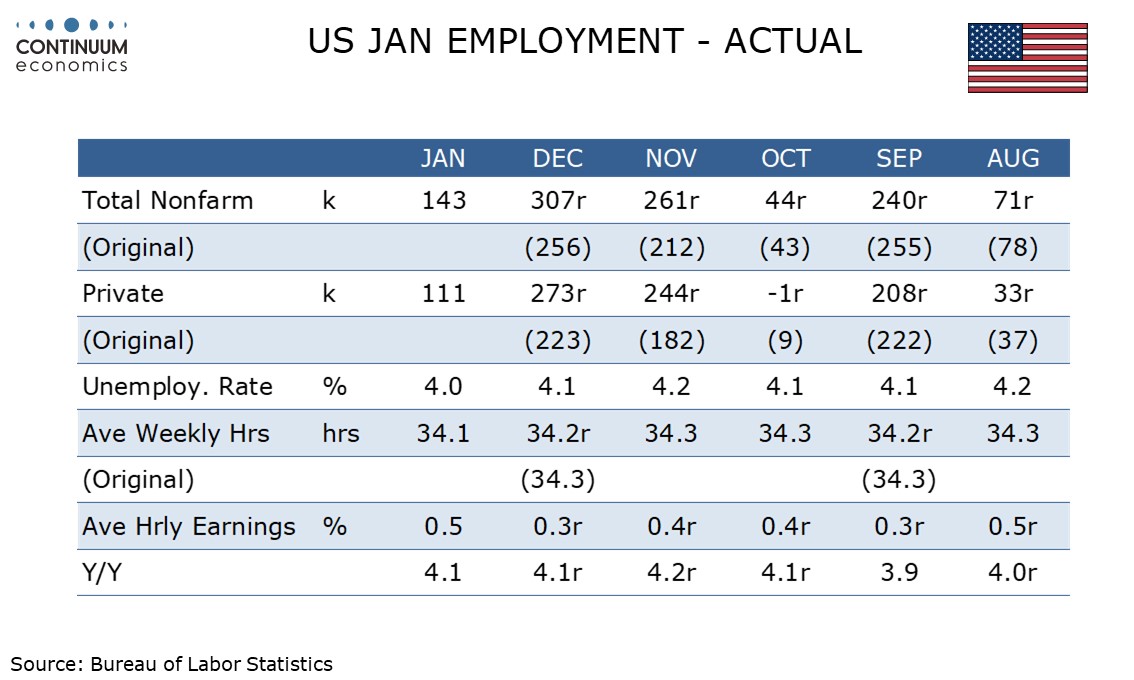

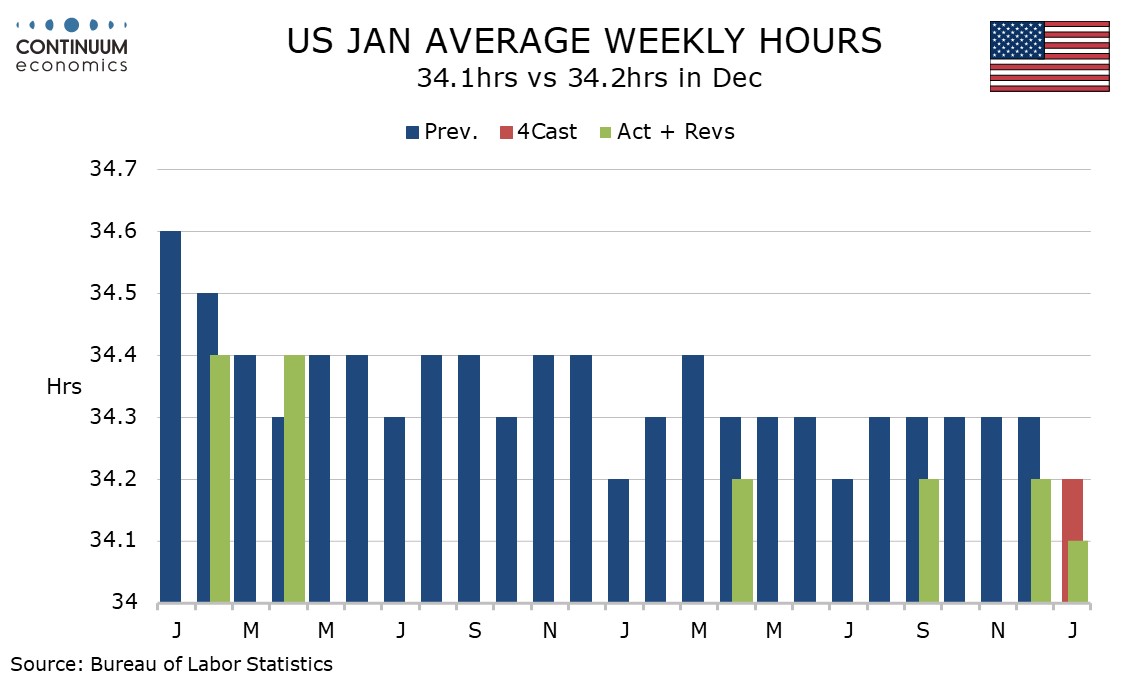

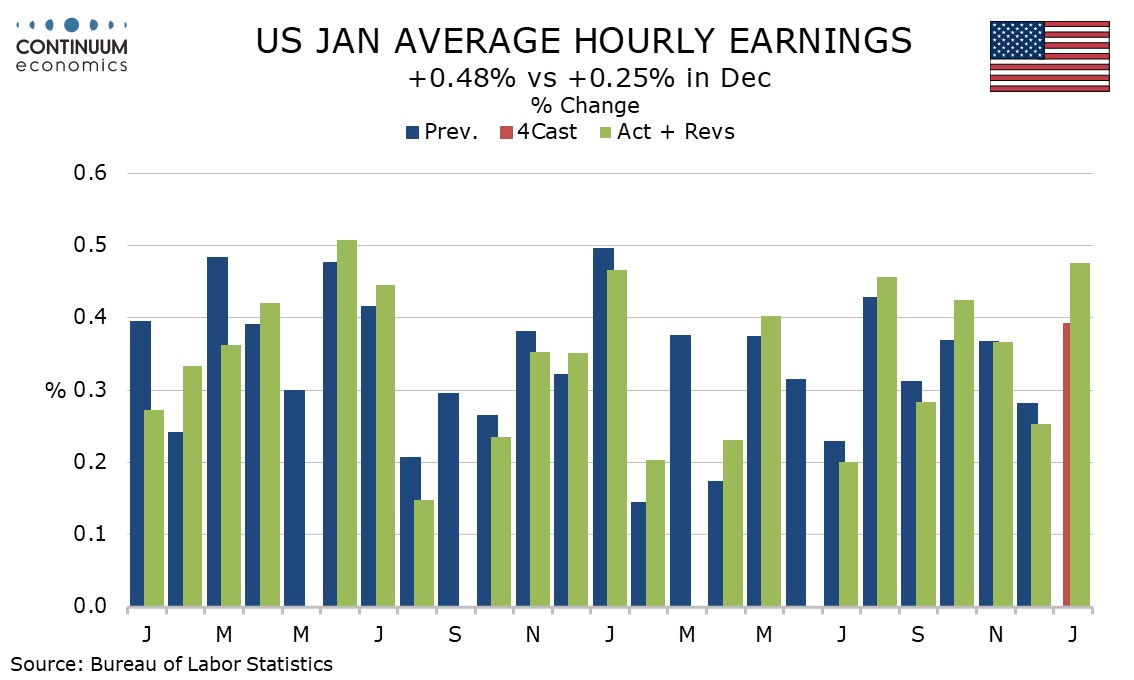

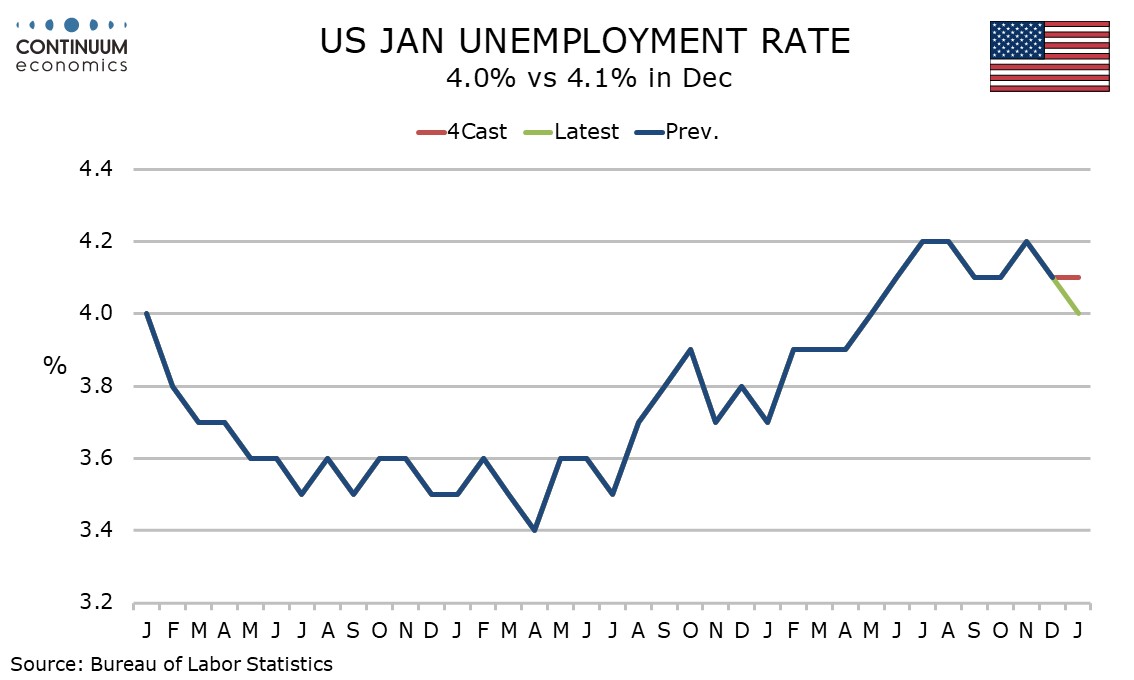

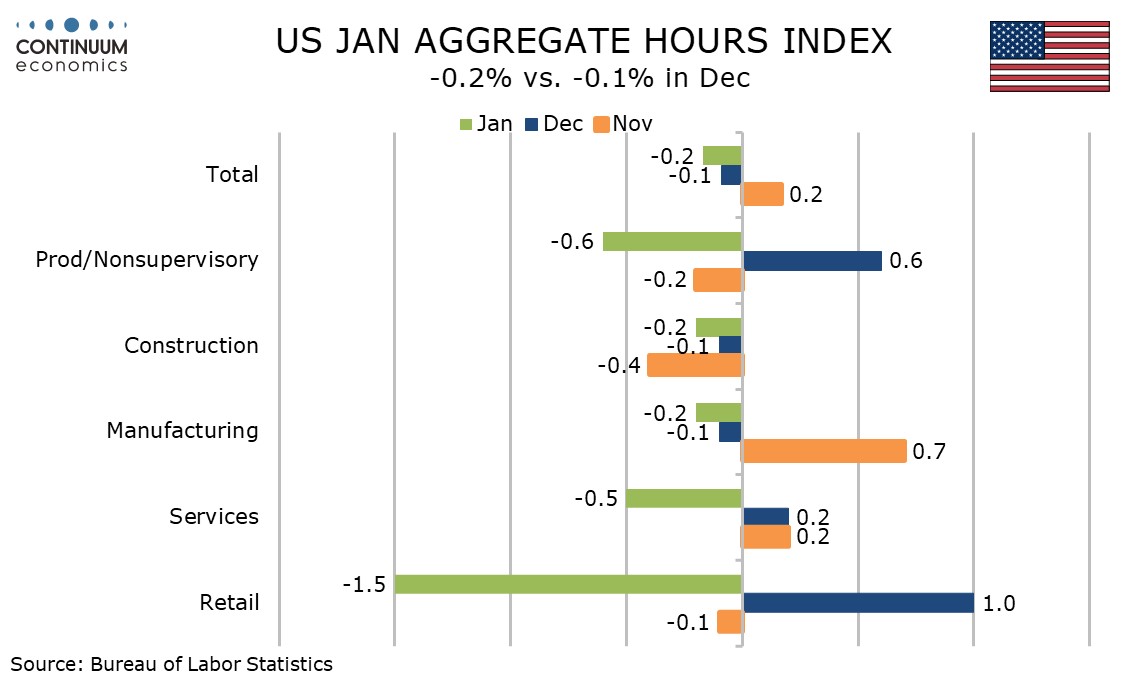

January’s non-farm payroll with a 143k increase is on the low side of expectations, though we suspect January data was restrained by bad weather. A dip in the workweek is also probably weather-induced and may be behind an above trend 0.5% rise in earnings per hour. Unemployment slipped to 4.0% from 4.1%, with weather restraining the labor force more than employment.

December and November gains were was revised higher leaving the 3-month average firm at 237k. December’s level was revised lower by 610k but 2024 revisions were generally modest outside a 137k downward revision to January meaning that the bulk of the negative historical revisions came further back. Trend did lose momentum in mid-2024 with the three months to August all seeing revised gains of less than 100k but momentum has subsequently revived.

The Labor Dept noted that wildfires in California and severe weather in much of the country was seen in the reference week but had no discernable impact on the data. Still, we fell that some of the January slowdown was weather-impacted.

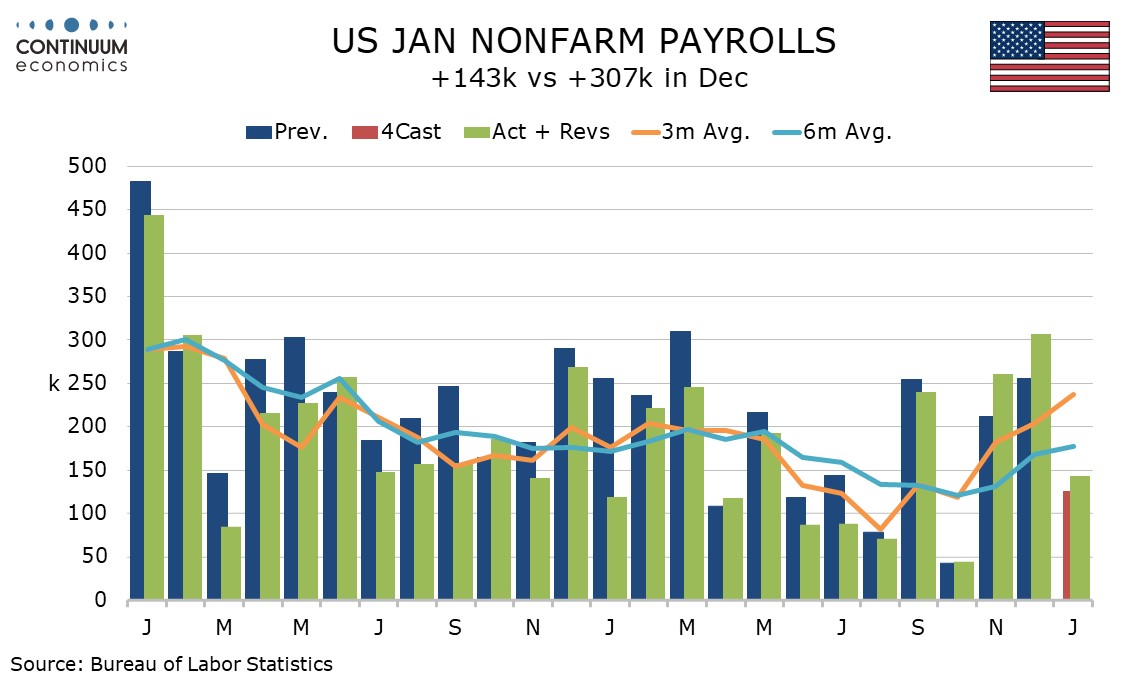

A workweek of 34.1 hours is the lowest since March 2020 at the height of the pandemic, though is not a dramatic fall from December which was revised to 34.2 from 34.3.

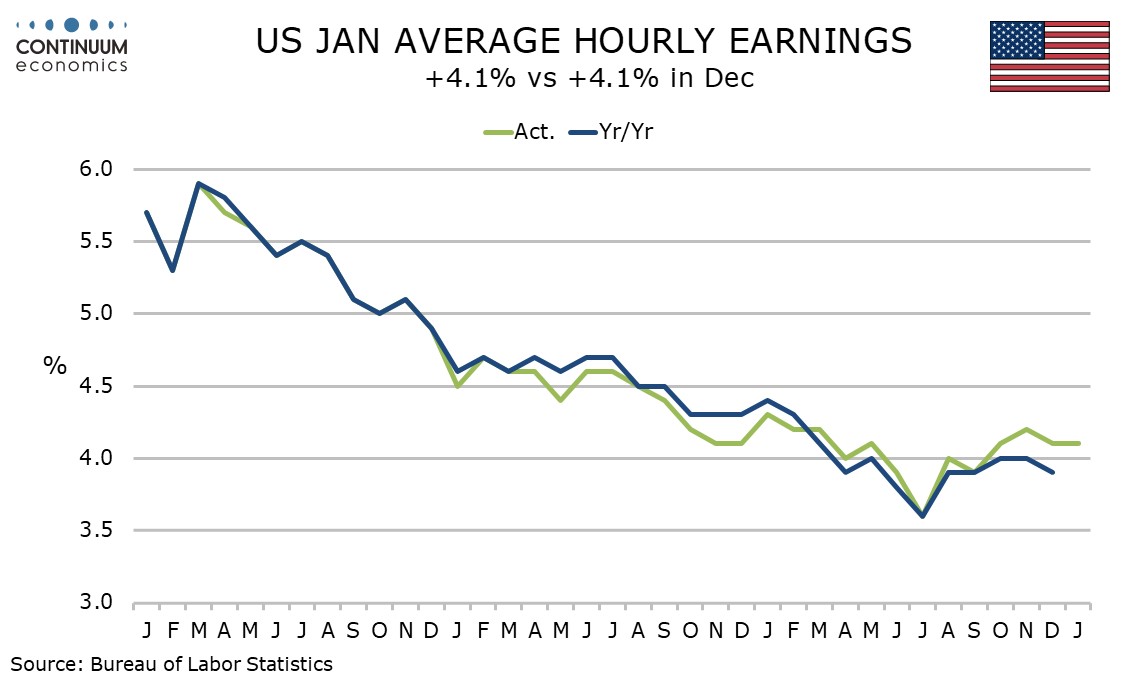

A lower workweek may be behind an above trend 0.5% increase in average hourly earnings, though December’s yr/yr growth was revised up to 4.1% from 3.9%, with January stable at 4.1%, so wage growth is looking quite firm.

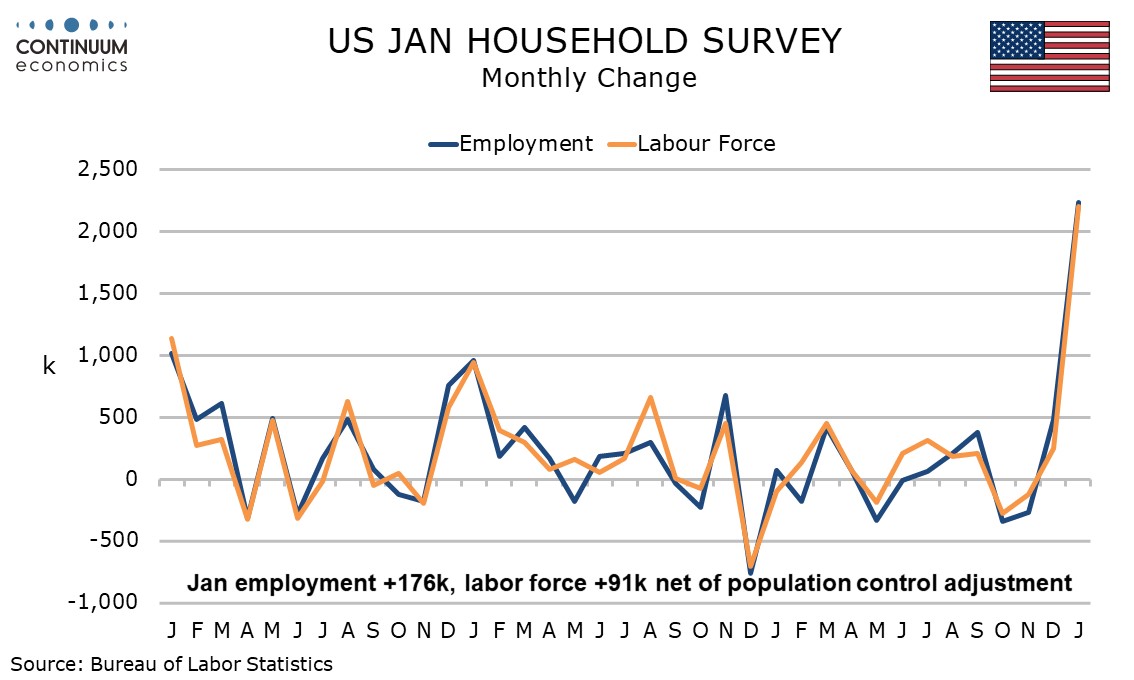

The unemployment rate saw its historical revisions with December’s data (and they were minimal). January’s household survey detail showed a 176k rise in employment and a smaller 91k rise in the labor force after removing an annual population control adjustment.

The population control adjustment was however large, with employment 3047k above the published December level and the labor force up by 2197k. This removes the prior situation of the household survey underperforming trend in non-farm payrolls.

Within the non-farm payroll breakdown there were few major breaks from trend. Gains of 3k in manufacturing and 4k in construction were weak, government maintained trend with a 30k rise while private sector services added 111k jobs.

Health care and social assistance continues to lead private sector services but at 66k was below trend. Retail was quite firm at 34k though the retail workweek fell sharply. Temporary help was weak at -12k. Other components generally saw small gains.