UK GDP Review: Friday the 13th Weakness Confirmed?

The latest GDP data add to questions about the UK’s economy’s apparent solidity, if not strength, as seen in sizeable q/q gains in the first two quarters of the year of 0.7% and 0.5% respectively. As we envisaged, October saw a second successive m/m drop of 0.1%, well below expectations, this adding to what have now been only two positive outcomes in the last seven months of data in which the economy has ‘grown’ a cumulative 0.1%. This all the more notable as it suggests a weaker trend that dates back prior to the election of the new government let alone its October Budget and its mixed policy measures. Although most evident in a further drop in manufacturing, construction weakness re-emerged while services stagnated again. This raises the important policy question as to whether any such weakness suggests that the support from services to the economy seen of late, thereby offsetting manufacturing weakness, is faltering.

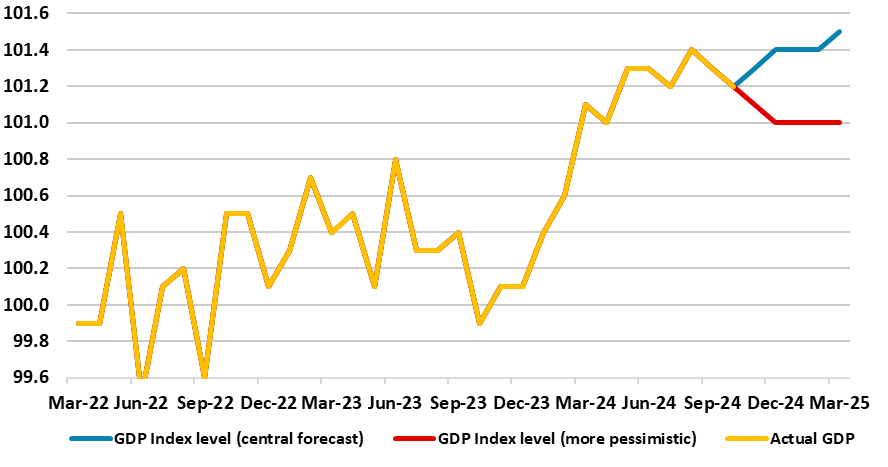

Figure 1: Momentum Ebbing – Amid Downside Risks?

Source: ONS

Certainly business surveys suggest that may be the case, this putting more emphasis on the PMI update due on Monday. But the data suggest that even with an assumed recovery in the two remaining months of the current quarter, Q4 |GDP may not have growth and with a risk that t may have fallen afresh (Figure 1). This is an important consideration for the likes of the BoE which has projected a more upbeat 0.2% GDP rise for the current quarter.

To suggest that the unexpected GDP drop in September and now October was a result of pre-Budget apprehension is wide of the mark; after all, GDP stopped growing between March and when the new government took office in July. As for the latest details, m/m real GDP is estimated to have fallen by 0.1% in October, largely because of a decline in production output; this follows a fall of 0.1% in September 2024. Admittedly, GDP is still estimated to have grown by 0.1% in the three months to October 2024, compared with the three months to July 2024, with growth in the services and construction sectors in this period. But in m/m terms, services output showed no growth in October 2024 after also showing no growth in September 2024, while production output fell by 0.6% in October 2024, because of falls in manufacturing, and mining and quarrying output, following a fall of 0.5% in September 2024; production output fell by 0.3% in the three months to October 2024. Notably, construction output fell afresh by 0.4% in October 2024, and where a recovery in utility production helped temper the weakness elsewhere

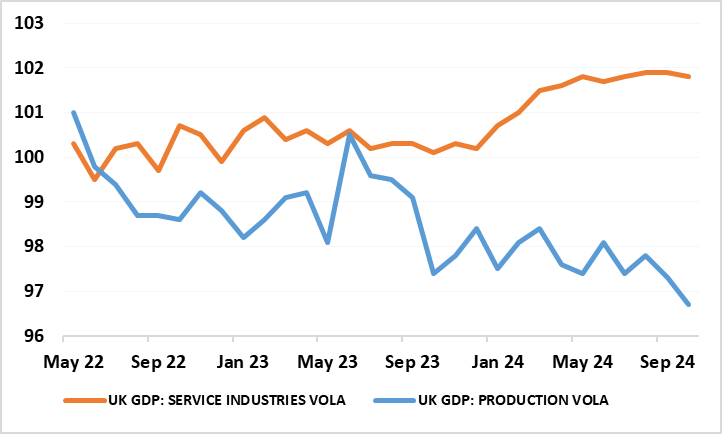

Regardless, the monthly real economy data may be becoming an increasingly important factor in shaping BoE policy ahead, especially if more weakness occurs. There was a clear boost from real estate given a sizeable jump in house sale, but with something of an imponderable being the public sector which had been clearly boosting activity in H1, but may now be flattening out, if not reversing, at least outside of education. Such weakness has been flagged both by a series of m/m drops in payrolls during the month and by business surveys. They suggest deeper weakness in manufacturing (something echoed by industry data on vehicle production), but a slowing in services, this being important given the manner in which services have propped up the whole economy of late (Figure 2)

Figure 2: Are Services Ebbing Too?

Source: ONS

As suggested above, the lack of growth in late Q3 has created a soft base effect for Q4 growth which we now see being flat in q/q terms, thereby 0.2 ppt below the BoE estimate and maybe even weaker without an assumed recovery in the Nov/Dec GDP numbers. This backdrop may cause some consternation at this month’s MPC meeting, with a verdict due on Dec 19, albeit with it likely that clear majority still votes for stable policy but where dissent may be fermenting. Regardless, and as suggested above, this weaker immediate GDP backdrop is something that chimes more with labor market and public borrowing data and where HMRC payrolls paint a much softer backdrop and possible outlook that also had conflicted very much with PMI survey numbers, at least until recently. However, while the BoE may still look to a clear recovery into 2025, any further signs that Budget apprehension and what may now be damaged business and consumer confidence from actual fiscal measures may warrant a reassessment, especially given what looks to be a weak(er) economic picture in the neighbouring Eurozone.