India CPI Review: India's Inflation Edges Up to 3.65% in August, Staying Below RBI Target

Bottom line: India’s August rose to 3.6% yr/yr, rising marginally from 3.53% y/y in July, reflecting higher food prices. Anticipate increased inflation over Q4, as festive demand drives up prices and the high base effects drop out of the equation.

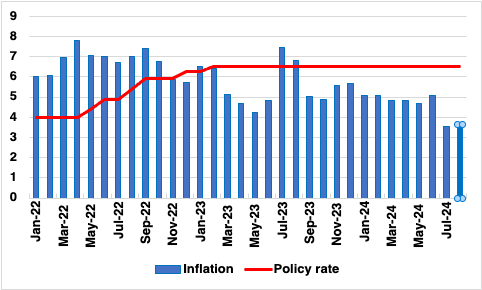

Figure 1: India Consumer Price Inflation and Policy Rate (%)

Source: MOSPI, Reserve Bank of India, Continuum Economics

India's retail inflation inched up to 3.65% yr/yr in August from 3.6% yr/yr in July, according to data released by the Ministry of Statistics and Programme Implementation. While the figure remains well within the Reserve Bank of India’s (RBI) medium-term target of 4%, it slightly exceeded our expectations. The rise in inflation was driven largely by an uptick in food prices. Food inflation, which rose to 5.66% yr/yr in August from 5.42% yr/yr in July, was propelled by a sharp increase in vegetable prices, which surged by 10.71%, compared to 6.83% the previous month. Pulses inflation, although still high at 13.6%, moderated from July’s 14.77%. Meanwhile, prices for fuel and light continued to contract, recording a decline of 5.31%.

Rural inflation came in at 4.16% yr/yr, while urban inflation was slightly lower at 3.14% yr/yr, reflecting differing pressures across the country. The data also showed a stable outlook for housing inflation at 2.66%, while clothing and footwear costs rose marginally to 2.72%.

The August Consumer Price Index (CPI) figure marks the second-lowest inflation reading in five years, despite increased food prices. India's retail inflation rose marginally by 0.1% month-on-month in August, signaling a measured price increase despite continued pressures in the food basket. However, inflation is expected to rise in the coming quarters, driven by festive demand and the fading impact of last year’s high base.

Given the volatility in inflation trends, the Reserve Bank of India (RBI) is likely to maintain its current policy rate for the time being, even as the U.S. Federal Reserve may cut rates this month. We anticipate that the RBI will begin trimming rates by the end of 2024, as inflationary pressures moderate and global conditions evolve.