Turkiye Inflation Preview: CPI is Expected to Cool Down in July

Bottom line: After easing to 71.6% annually and 1.6% monthly in June, down from 75.5% in May, we expect consumer price index (CPI) to cool further down to 64-67% y/y in July. We predict favourable base effects, tightened monetary and fiscal policies, additional macro prudential measures, and relative Turkish lira (TRY) stability will help relieving the pressure on the inflation, despite recent hikes in taxes, 38% surge in electricity and natural gas prices and 25% hike in minimum monthly pension. Our forecast for the annual average inflation is 58.8% and 35.3% in 2024 and 2025, respectively, and we think the road to bringing inflation back down to single-digit levels will be very bumpy, and the inflation getting there before 2027 remains very unlikely.

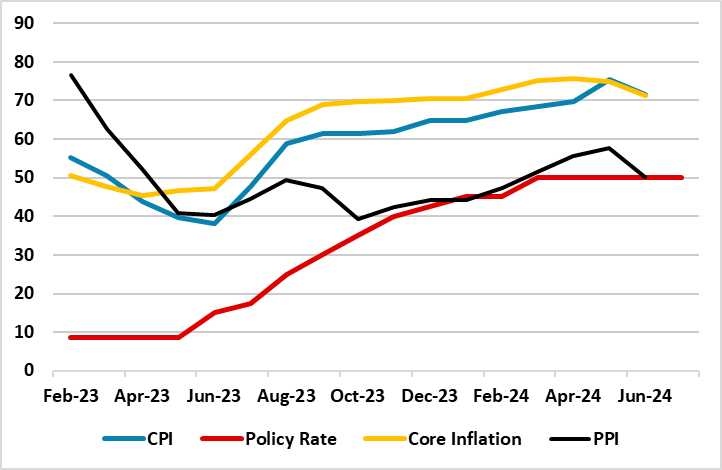

Figure 1: CPI, PPI, Core Inflation (YoY, % Change) and Policy Rate (%), February 2023 – July 2024

Source: Continuum Economics

Turkiye’s CPI eased to 71.6% annually in June, down from 75.5% in May, partly supported by the ease in energy and food prices in June. We envisage CPI to cool further down to 64-67% y/y in July thanks to favourable base effects, tightened monetary and fiscal policies, additional macro prudential measures, relative TRY stability, and the falling trend will likely continue in August and September. (Note: Inflation figures for July will be announced on August 5).

Remaining hopeful, vice president Cevdet Yılmaz stated on July 31 that “We expect inflation to record around 60% thanks to base effects and the positive impact of our disinflation program. We foresee the rate to stand at 50%s in August, and 40%s in September. The disinflation process will continue this year.”

Despite inflation is expected to cool off in Q3, there remains upside risks due to recent hikes in taxes along with 38% surge in electricity and natural gas prices, and 25% hike in minimum monthly pension in July. Despite Minister of Labor Vedat Isikhan emphasized in June that there will not be an interim increase in the minimum monthly payments in July citing policy tightening and savings plans meant to curb soaring inflation, Turkish Grand National Assembly (TBMM) approved a legislative proposal late July and increased the lowest pension to 12,500 TRY (USD 379) from 10,000 TRY. The same package of regulations raised the fee for the Turkish citizens traveling abroad must pay from 150 TRY to 500 TRY, and the multinational companies are set to be subject to 15% minimum corporate tax with the new law.

Despite Central Bank of Republic of Turkiye (CBRT) increased its year-end inflation forecast to 38% from 36% on May 9, cumulative inflation in H1 already reached 24.7% after June reading. CBRT’s forecast for end-2025 remains at 14%, while inflation is seen falling to 9% by the end of 2026, which we think would be hard to reach as monthly rises will persist. Our forecast for the annual average inflation is 58.8% and 35.3% in 2024 and 2025, respectively.

As CPI softened in June ignited by favourable base effects and relative TRY stability underpinning the inflation relief, we foresee that favourable base effects will continue to dominate the inflation outlook in Q3, but the extent of the decline will be determined by administrative price adjustments. In spite of aggressive monetary tightening, we still think the road to bringing inflation back down to single-digit levels will be very bumpy, and the inflation getting there before 2027 remains very unlikely.