U.S. January CPI - A clear disappointment

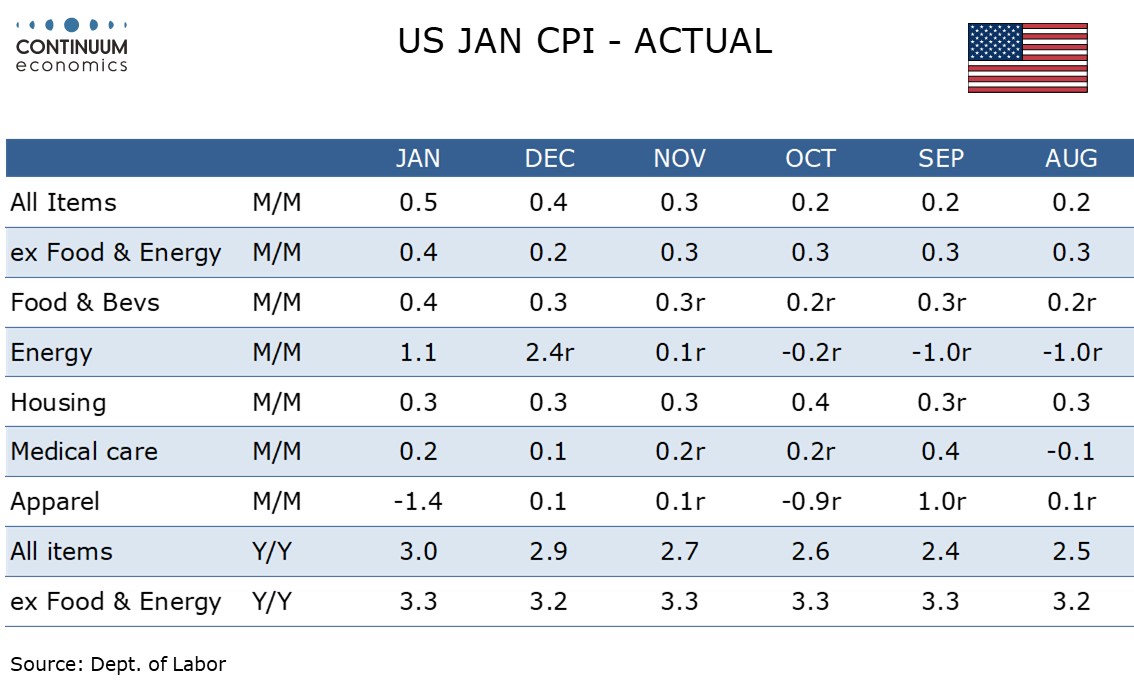

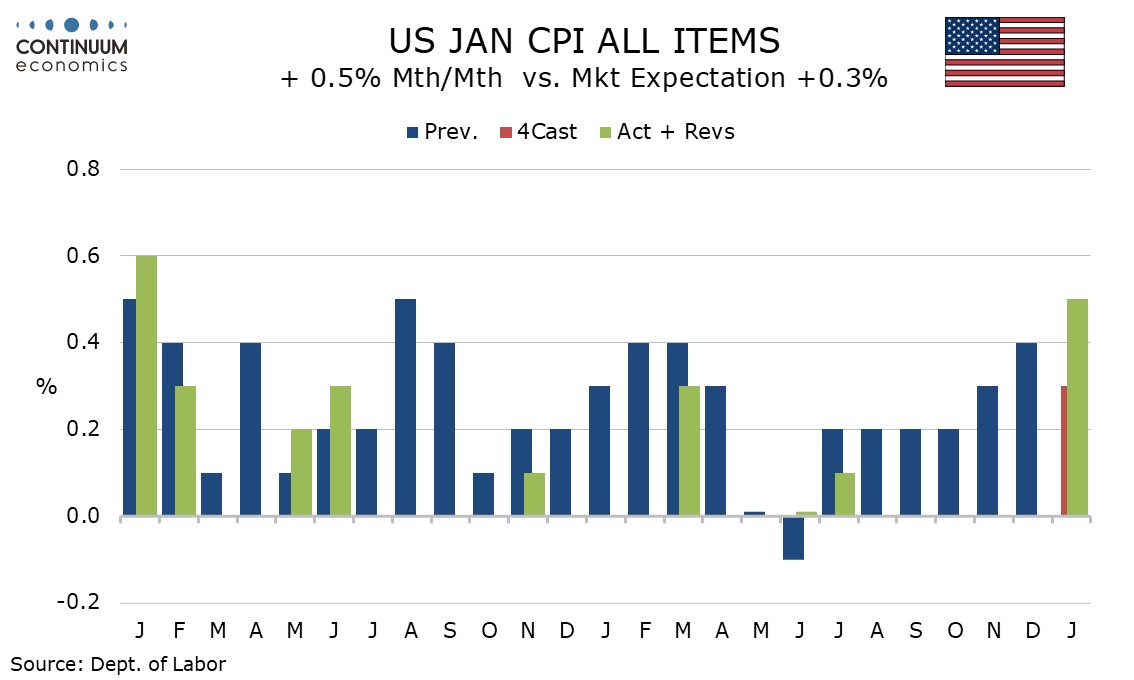

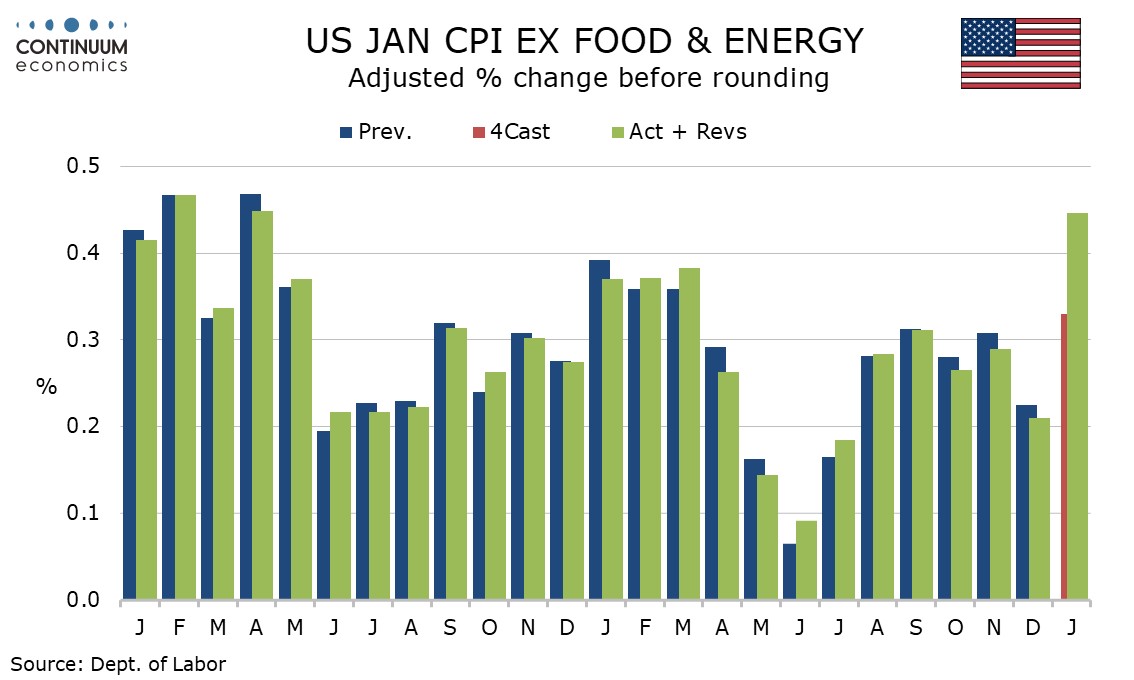

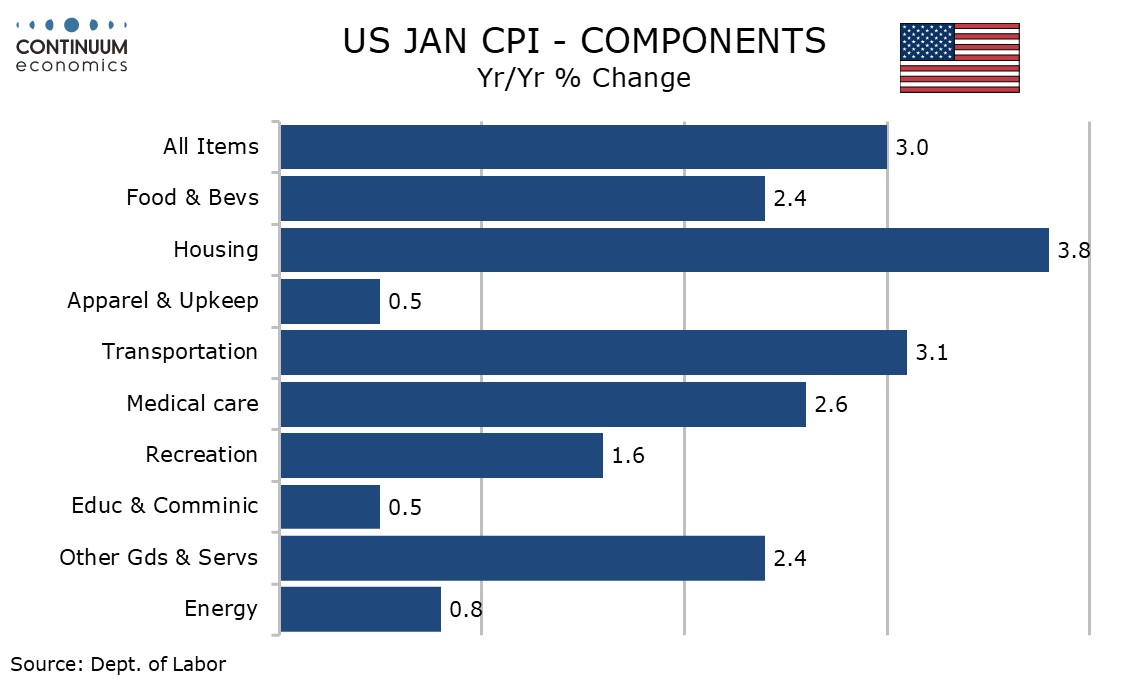

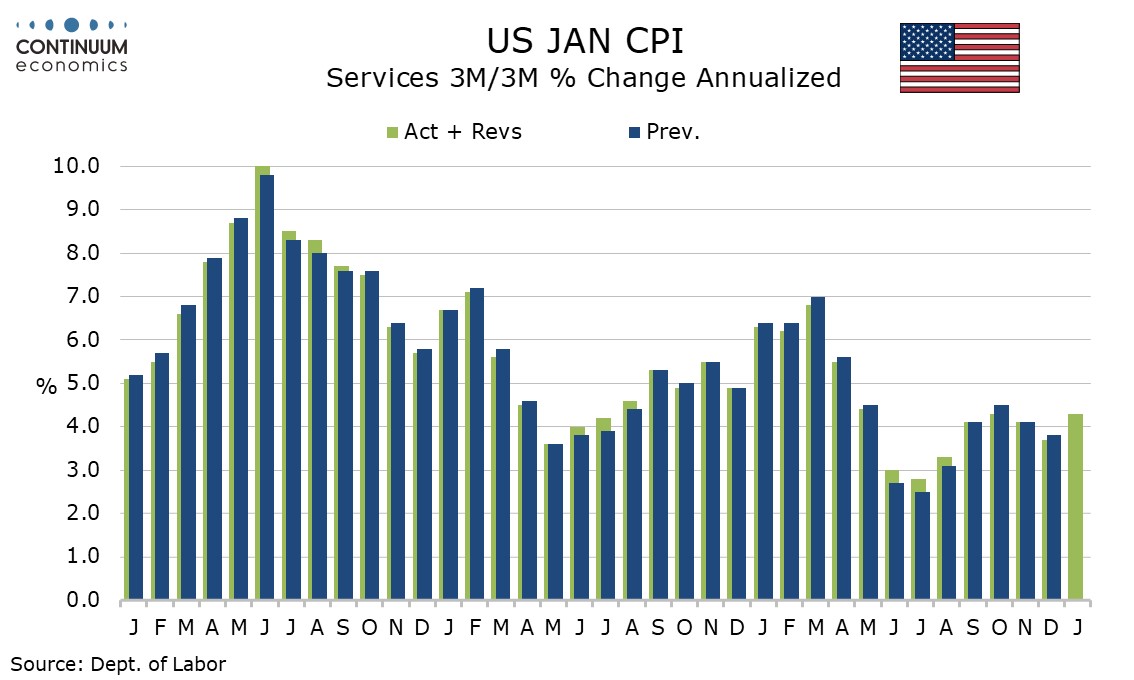

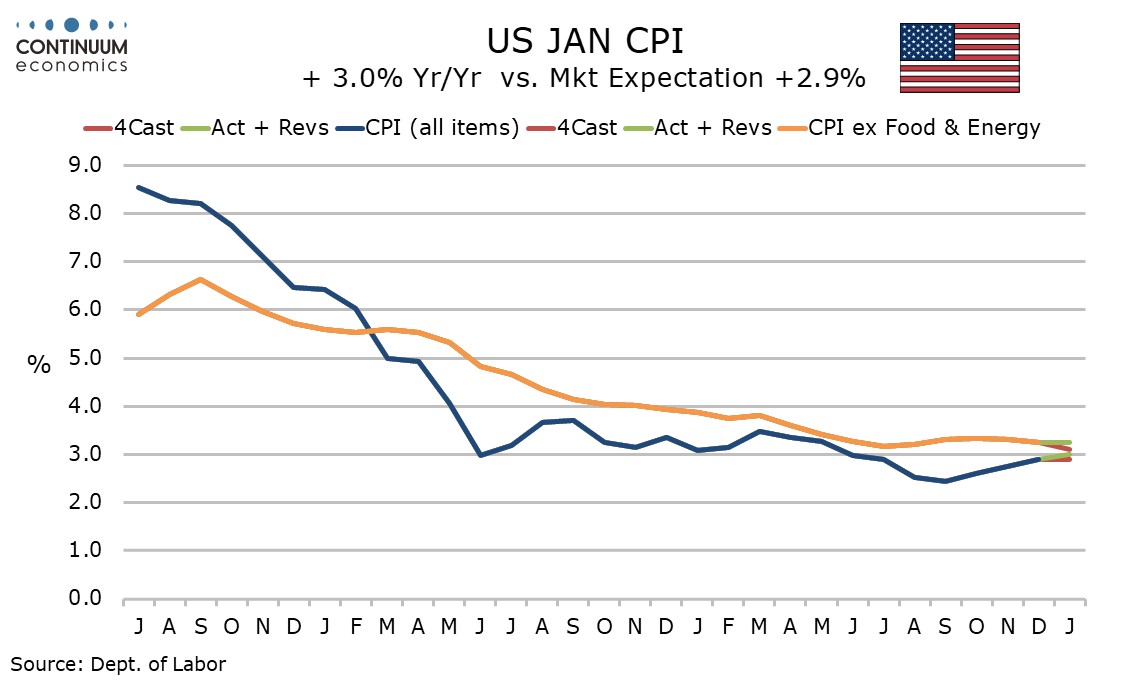

January CPI is a clear disappointment rising by 0.5% overall and 0.4% ex food and energy (0.446% before rounding). While there is a problem of residual seasonality bringing strength in Q1 data, that yr/yr rates accelerated, overall to 3.0% from 2.9%, and ex food and energy to 3.3% from 3.2%, will be particularly disappointing for the Fed. Inflation clearly remains too high, with progress appearing to stall.

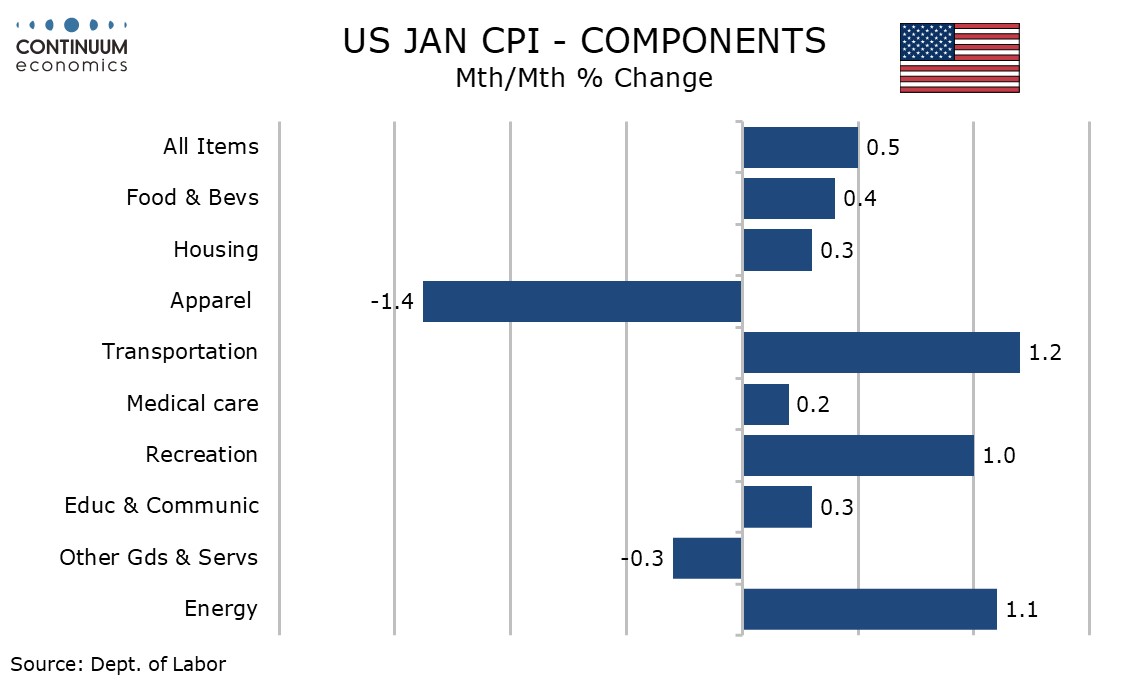

Energy increased by 1.1% led by a 1.8% rise in gasoline. Food rose by 0.4% with eggs surging by a massive 15.2% on the month. Explaining around half of the rise in food.

Commodities less food and energy rose by 0.3% with most components seeing moderate gains, though used autos with a 2.2% rise were particularly firm and apparel with a 1.4% decline looking erratically soft.

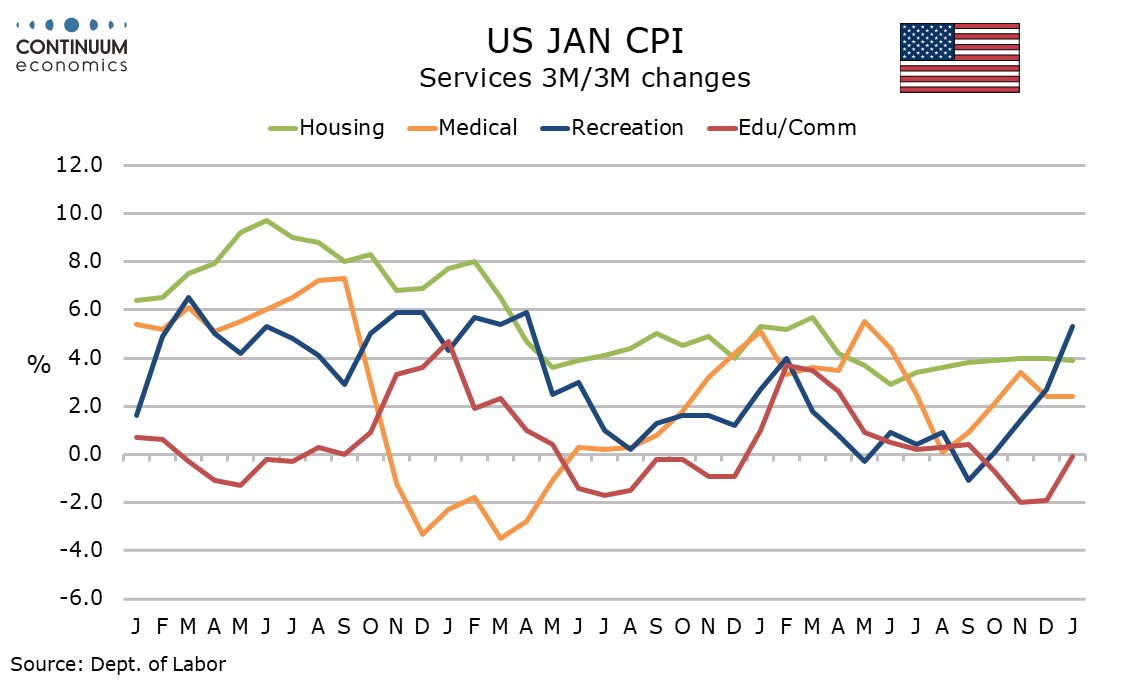

Services less energy rose by 0.5%. Owners’ equivalent rent was in line with recent trend at 0.3% sustaining a rennet slowing though shelter rise by 0.4% lifted by a 1.4% increase in the volatile lodging away from home sector.

Strength was most pronounced in transportation services, with motor vehicle insurance at 2.0% the most significant gainer, though air fares at 1.2% were also quite firm as were the less heavily weighed motor vehicle fees and parking.

Recreation services at 1.4% were also strong with cable TV, video discs, pet services and sporting events all seeing strong gains.

The rise is broad enough to suggest inflation is still a concern and will keep near term Fed easing off the agenda. Tariffs could add to upside risk in coming months, though by how much is unclear.

Yr/yr gains of 3.0% overall is the strongest since June but the 3.3% rise ex food and energy simply returns the pace to that seen September, October and November after a dip to 3.2% in December. Still, there has been little progress in core CPI since June with every month since then being either 3.2% or 3.3% yr/yr.

There were hopes that the strong Q1 2024 dropping out would see yr/yr growth slip. There are still strong February and March 2024 data due to drop out but we cannot be confident of a slowing, particularly if further import tariffs are imposed.