Mexico CPI Review: Unpleasant but It might be Transitory

The CPI release for January by INEGI aligns with expectations, showing a 0.9% rise (m/m). This brings the Y/Y CPI to 4.9%, marking a third consecutive month of increase. Concerns may arise, but much of the rise stems from non-core items, possibly indicating transitory inflation. Banxico's strategy faces challenges amid potential permanent shocks and increased government spending.

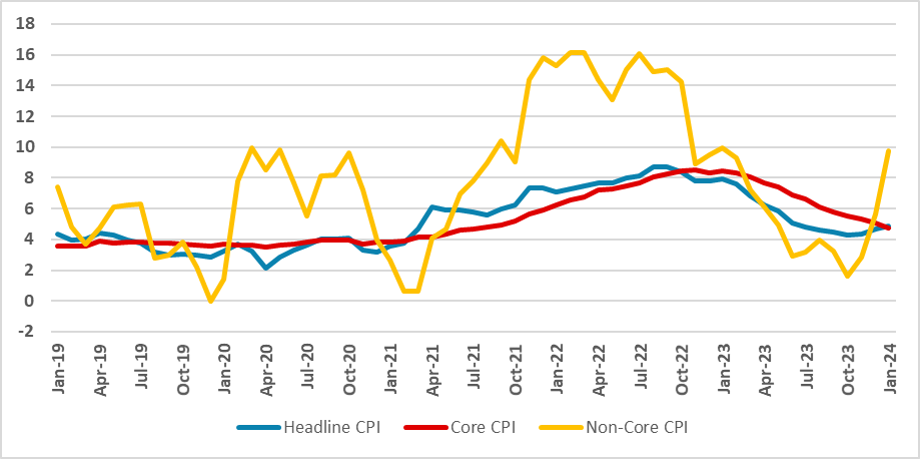

Figure 1: Mexico’s CPI

Source: INEGIThe Mexico National Statistics Institute (INEGI) has released the CPI number for January. The numbers were in line with market expectations rising 0.9% (m/m) in January. Therefore, the Y/Y CPI has risen to 4.9% from 4.7%. Now, the Y/Y CPI has rise for the third consecutive month and it might just raise some concern for this trend. However, most of the rise was located on non-core item which could indicate that this rise is transitory.

Source: INEGIThe Mexico National Statistics Institute (INEGI) has released the CPI number for January. The numbers were in line with market expectations rising 0.9% (m/m) in January. Therefore, the Y/Y CPI has risen to 4.9% from 4.7%. Now, the Y/Y CPI has rise for the third consecutive month and it might just raise some concern for this trend. However, most of the rise was located on non-core item which could indicate that this rise is transitory.

Core CPI has risen 0.4 (m/m) during the month, with both, services and goods, rising by the same amount; 0.4% (m/m). However, the y/y index fell to 4.4 from 4.9 indicating a better situation. Non-core CPI rose 2.3% (m/m) in the month, influenced by the price of food (+4.2% m/m) and energy price (0.5% m/m). In the food, it is possible that prices are responding to seasonal factors and they will soon cool down, while in energy the index was mainly influenced by adjustments on fuel and electricity which is likely not to repeat.

However, this CPI numbers worries in some way the Banxico strategy. There have been numerous cases in which transitory inflationary shocks translates into more permanent shocks and in a situation which like Mexico, where government will increase spendings during this electoral years and the labour market is hot, and the output gap is positive, Banxico will need to be cautious. With the rise of the CPI it is now very unlikely that Banxico will cut the policy rate before March. Additionally, conditions for the cut will only appear even this transitory movement on inflation is really transitory meaning February and March CPI show a cooling down of the inflation numbers.