U.S. September Employment - A strong month and downside risk to October has fallen too

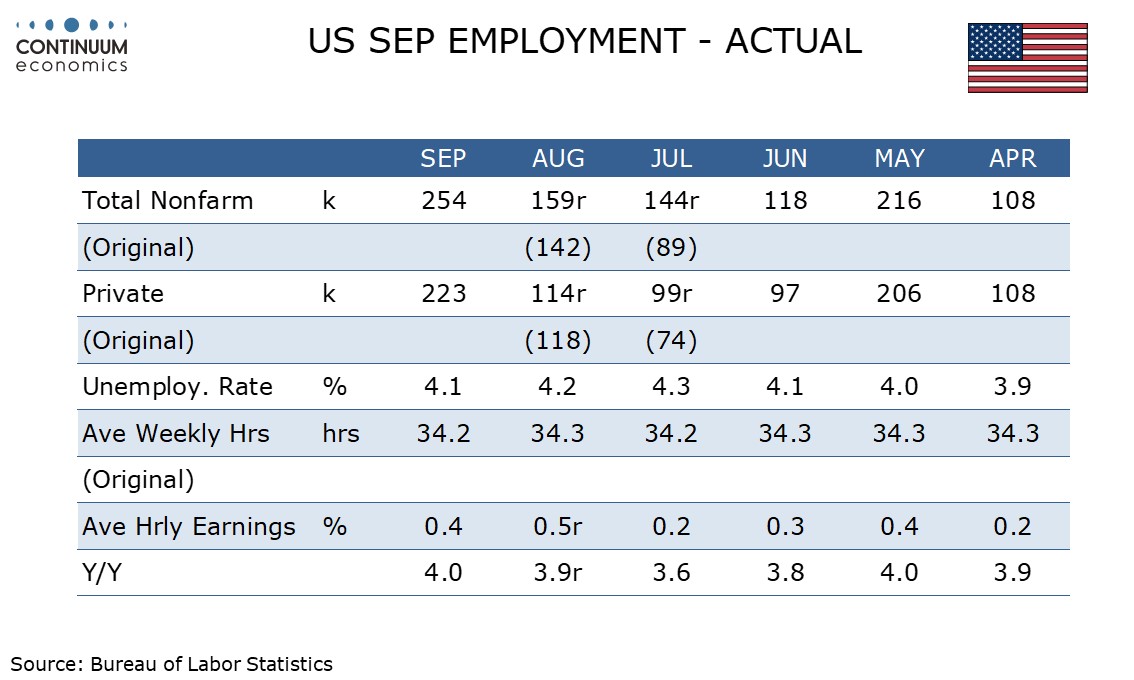

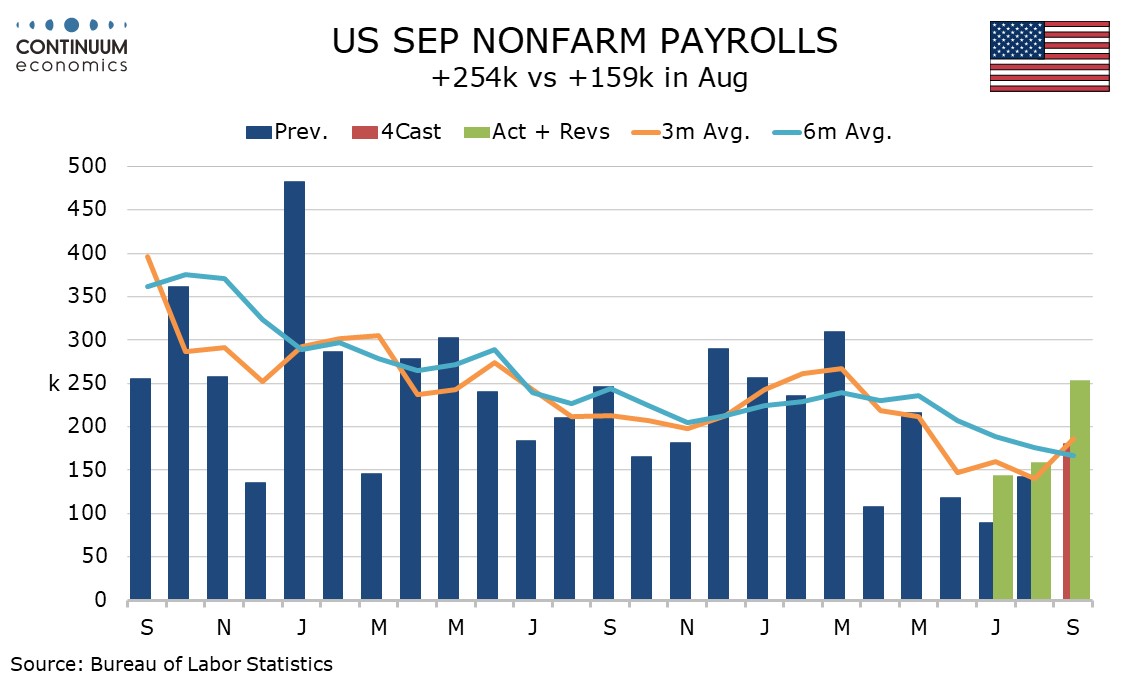

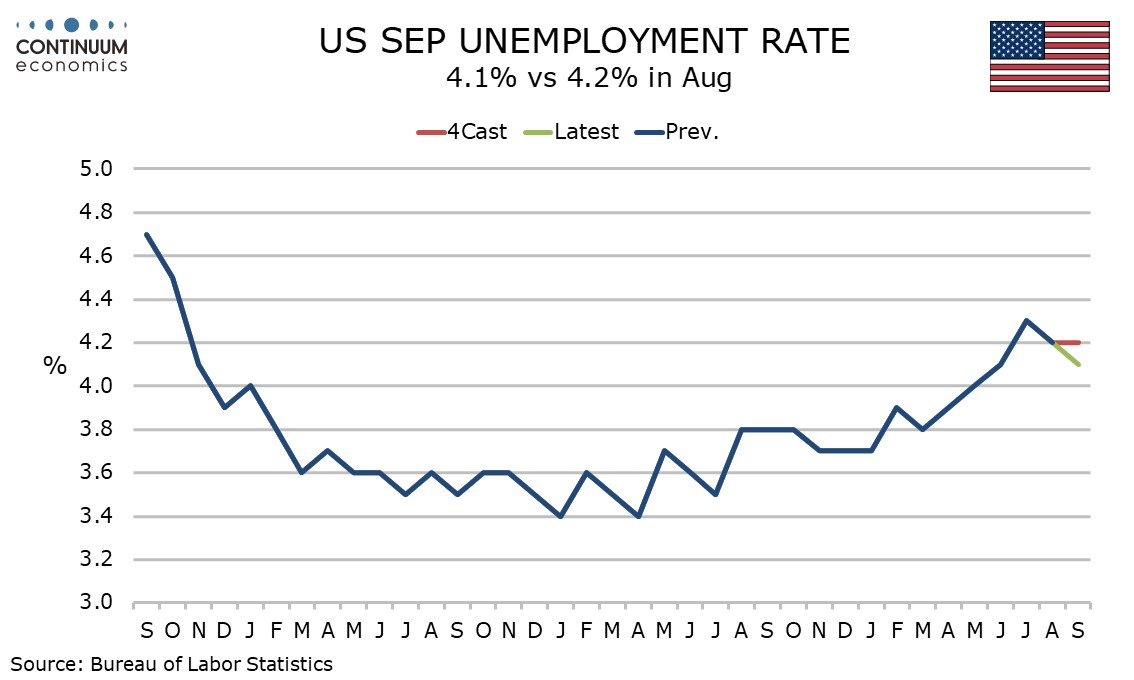

September’s non-farm payroll is well above consensus with a rise of 254k. Unusually net back revisions are positive at 72k, if largely in government. Unemployment unexpectedly fell to 4.1% from 4.2% and average hourly earnings were above trend at 0.4% again with upward back revisions. This is clearly a strong report, even with a dip in the workweek to 34.2 from 34.3 hours.

The strong data corresponds with falling initial claims in September. Downside risks for October have been significantly reduced with the East Coast ports strike that had threatened significant supply disruptions being called off yesterday. A strike at Boeing, which started too late to be captured in this report, however persists.

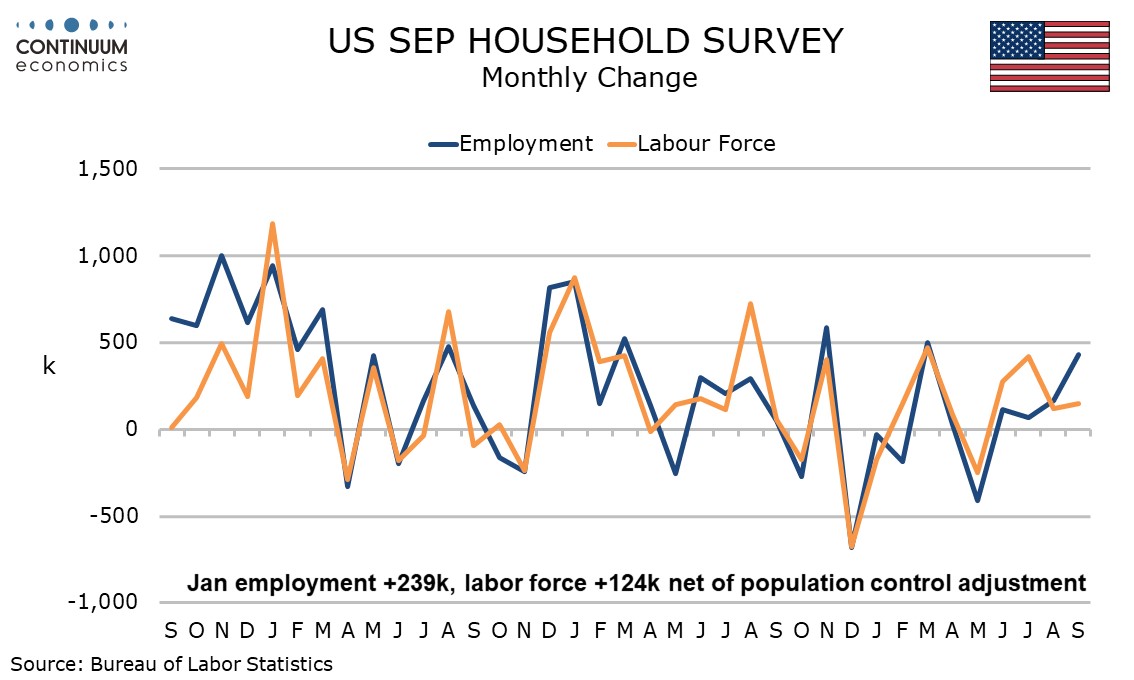

The fall in the unemployment rate was caused by a 430k increase in the household survey’s estimate for employment, unusually outperforming the payroll. The labor force rose by 150k, in line with trend.

Goods employment with a 21k rise was in line with trend with manufacturing still slightly negative at -7k and construction still positive, rising by 25k. Services accelerated to a 202k increase, with most of the gains coming from a 72k rise in health care and social assistance and a 78k rise in leisure and hospitality. Retail was healthy at 16k and a 17k rise in professional and business is an improvement from recent trend, despite a 14k fall in temporary help, one of few areas of weakness.

Government remains firm, rising by 31k. Government explains most of the upward back revisions, with the net upward revision to private payrolls being modest at 21k, all of that coming in July. The upward revision to overall payrolls in August was modest, by 17k by 159k but July was revised up to 144k from 89k.

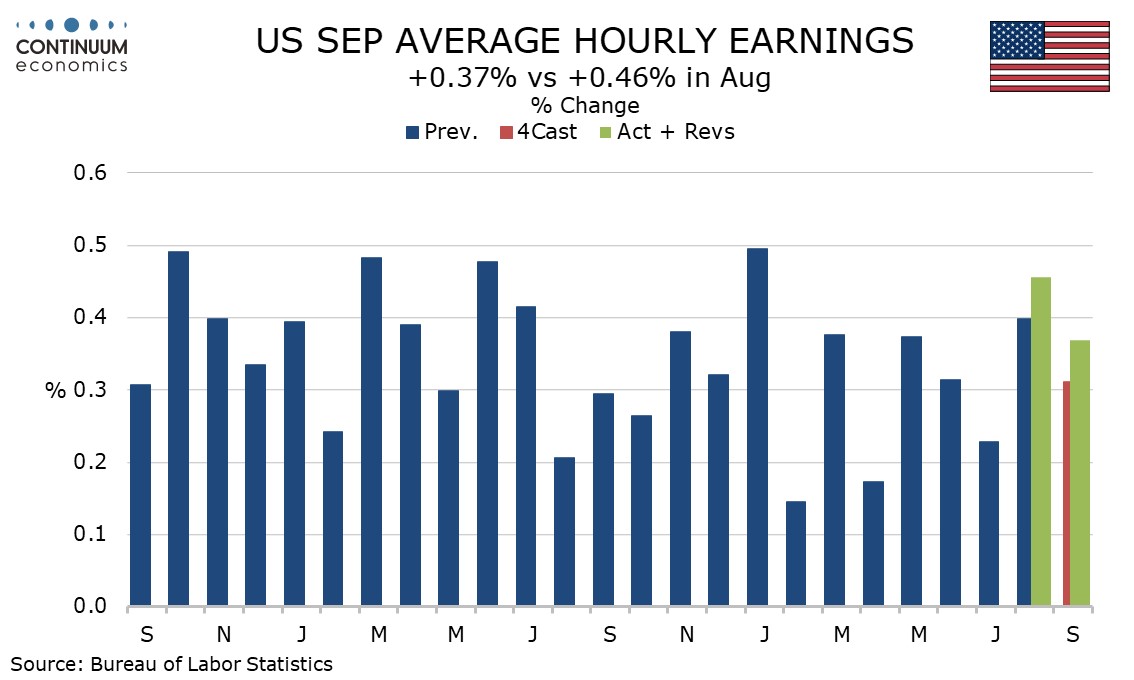

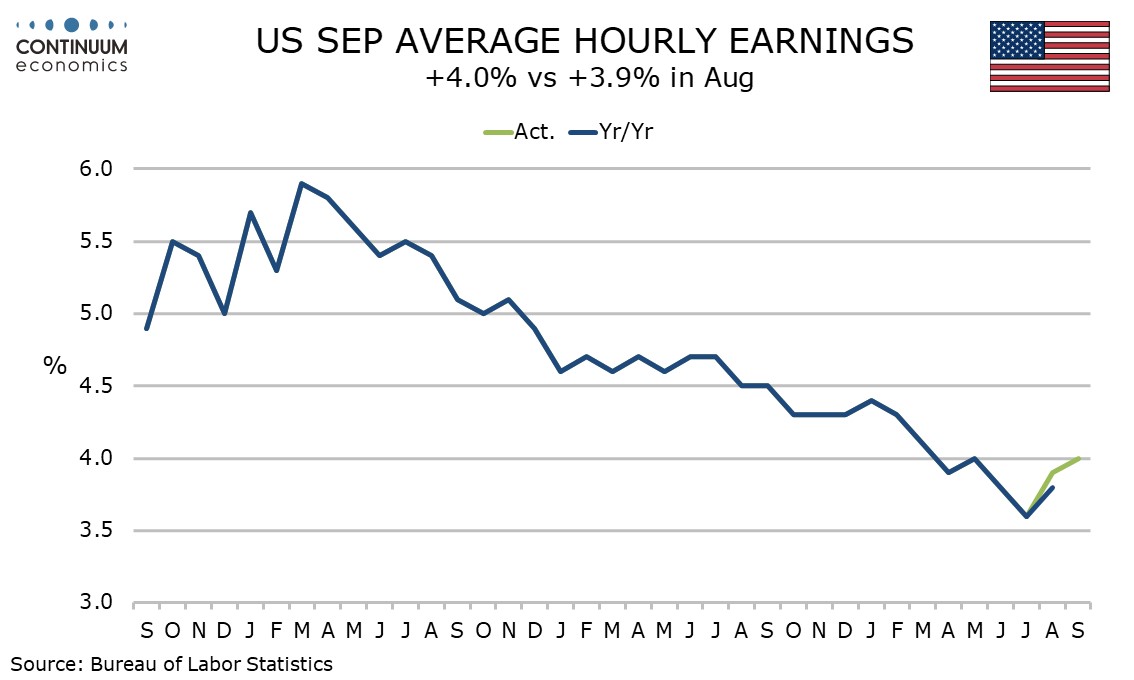

Average hourly earnings rose by 0.37% before rounding with August revised to 0.46% from 0.40%. Yr/yr growth, after falling to 3.6% in July, its lowest since May 2021, now stands at 4.0%, with August revised up to 3.9% from 3.8%. This looks a little high to be consistent with 2.0% inflation.

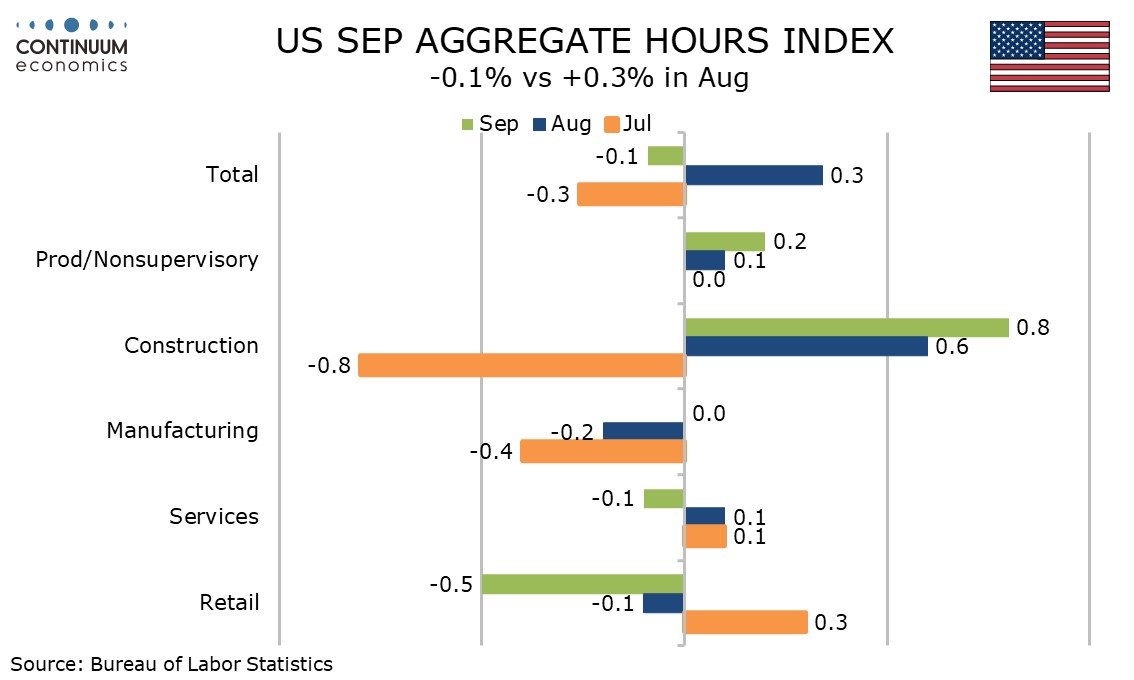

The one weak spot in the report is a fall in the workweek to 34.2 from 34.3 hours, this a little harder to blame on weather than similarly weak numbers in January and July. Aggregate hours worked fell by 0.1% in September and rose by only 0.2% annualized in Q3, which raises some questions on a suggestion by Fed’s Powell that Q3 GDP would be similar to Q2’s 3.0% increase.

Aggregate hours detail shows construction firm with a 0.8% increase, manufacturing unchanged and services generally soft, with the exception of a 0.9% rise in leisure and hospitality, where employment growth accelerated.While the hours worked data raises a few questions, generally the data suggests the economy has momentum entering Q4. If inflation data remains soft another Fed easing is still likely in November, but it looks increasingly likely to be a 25bps move, particularly given that the ending of the ports dispute has diminished what had previously looked like significant downside risks to October.