U.S. August Employment - A little stronger than downwardly revised June and July

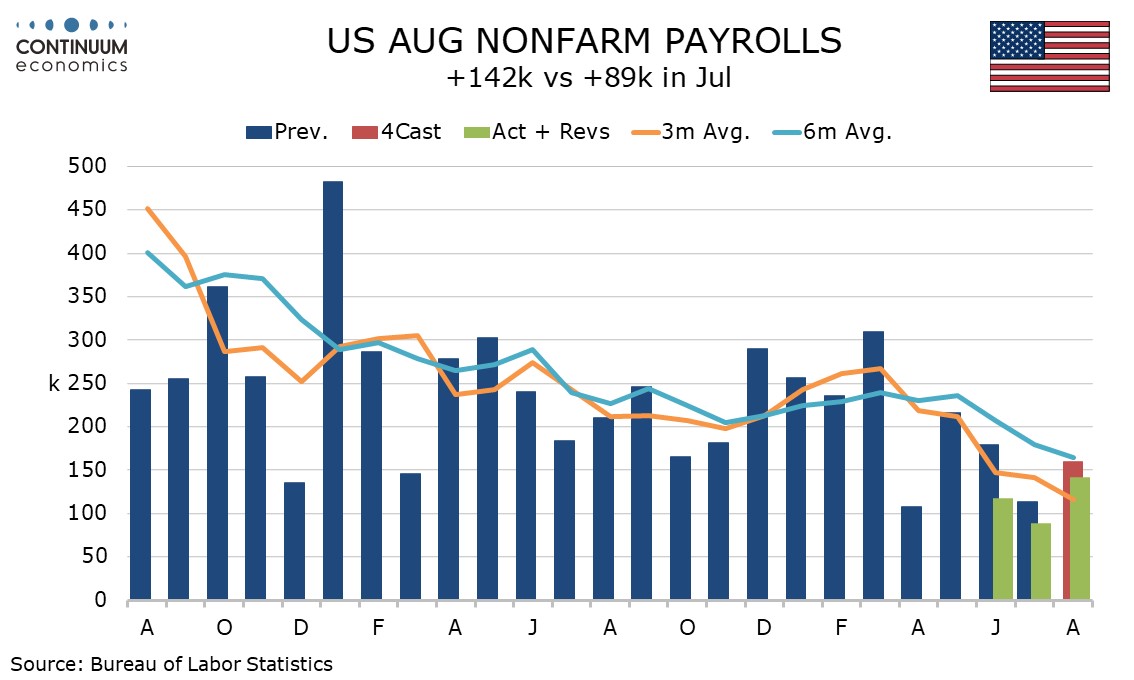

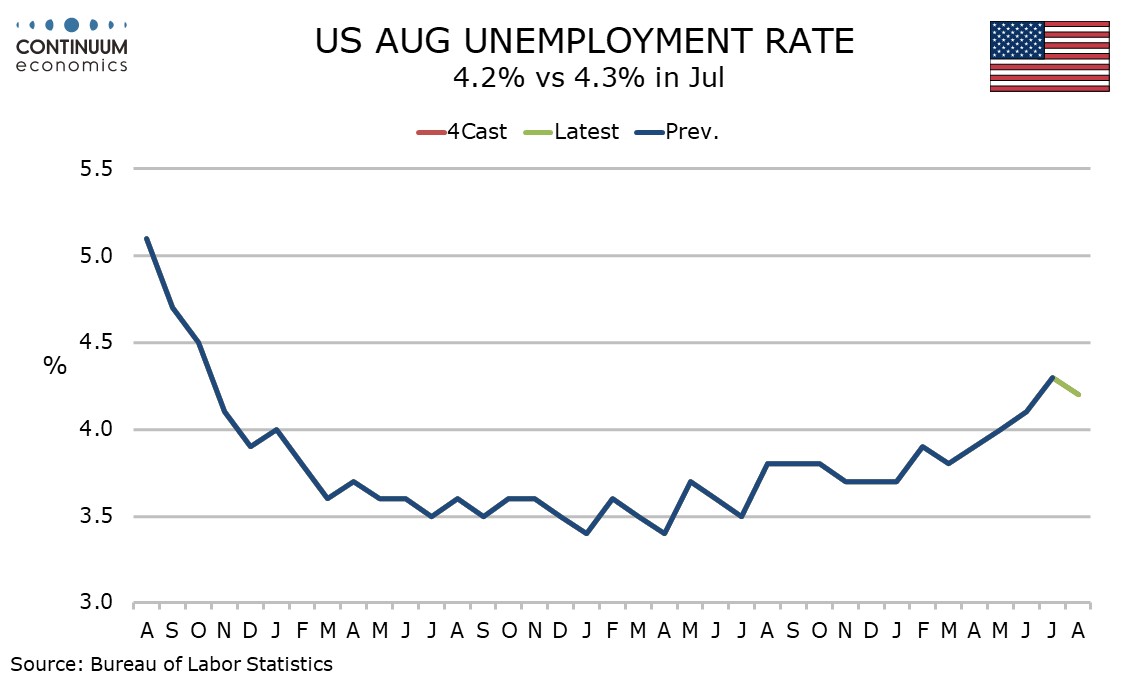

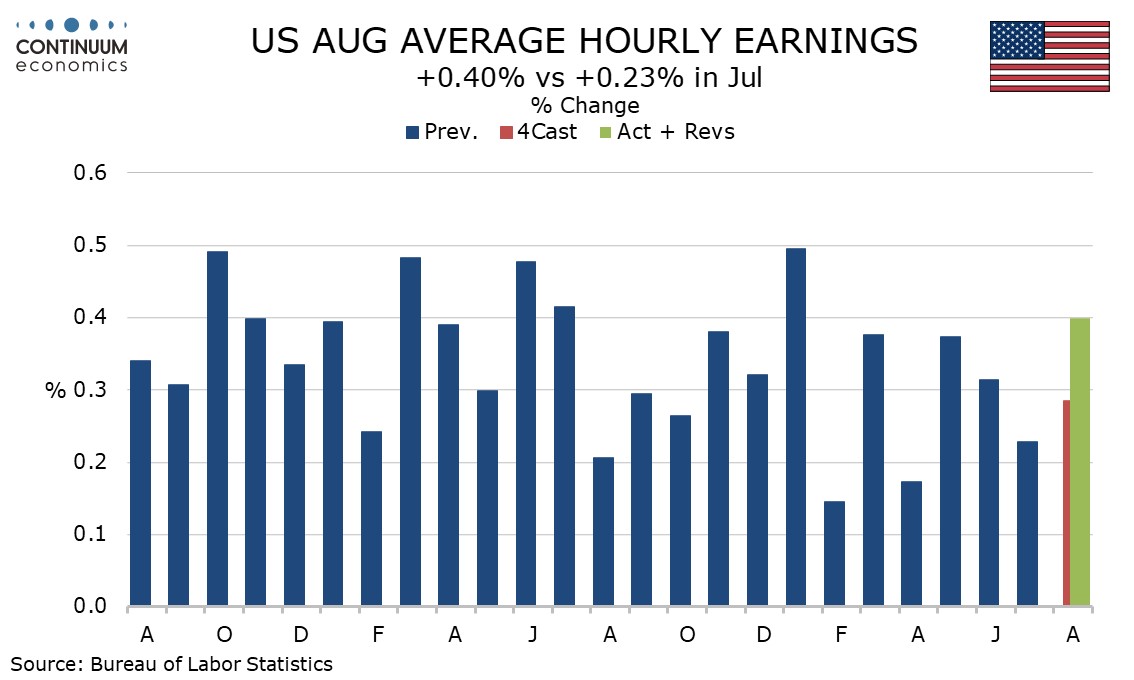

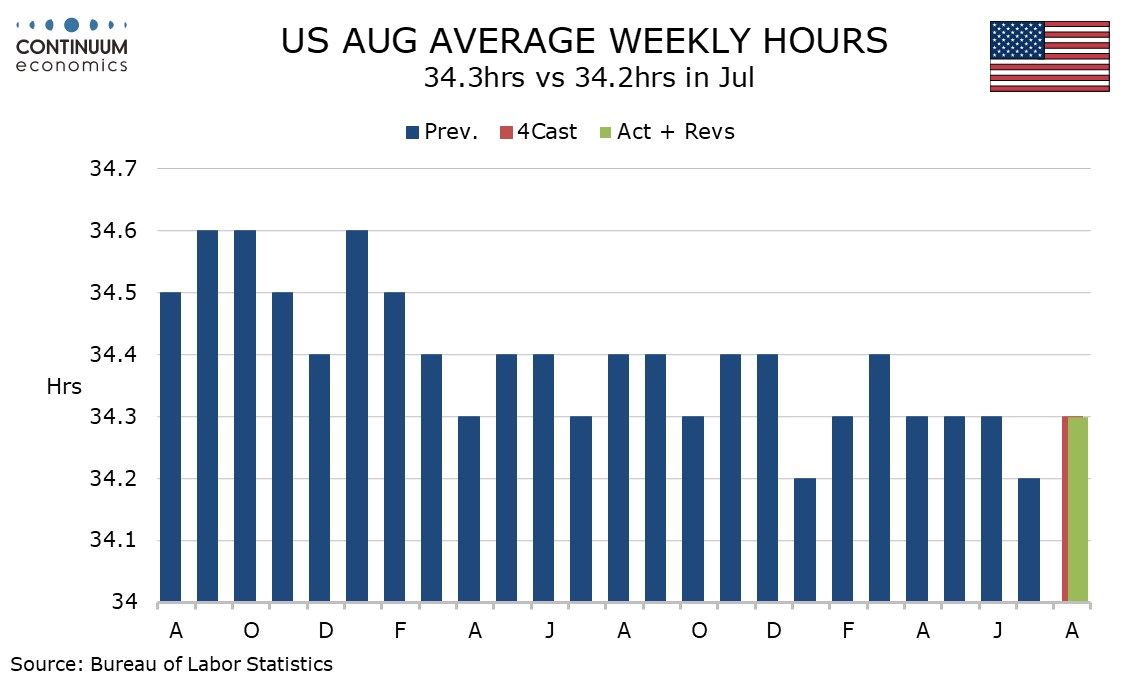

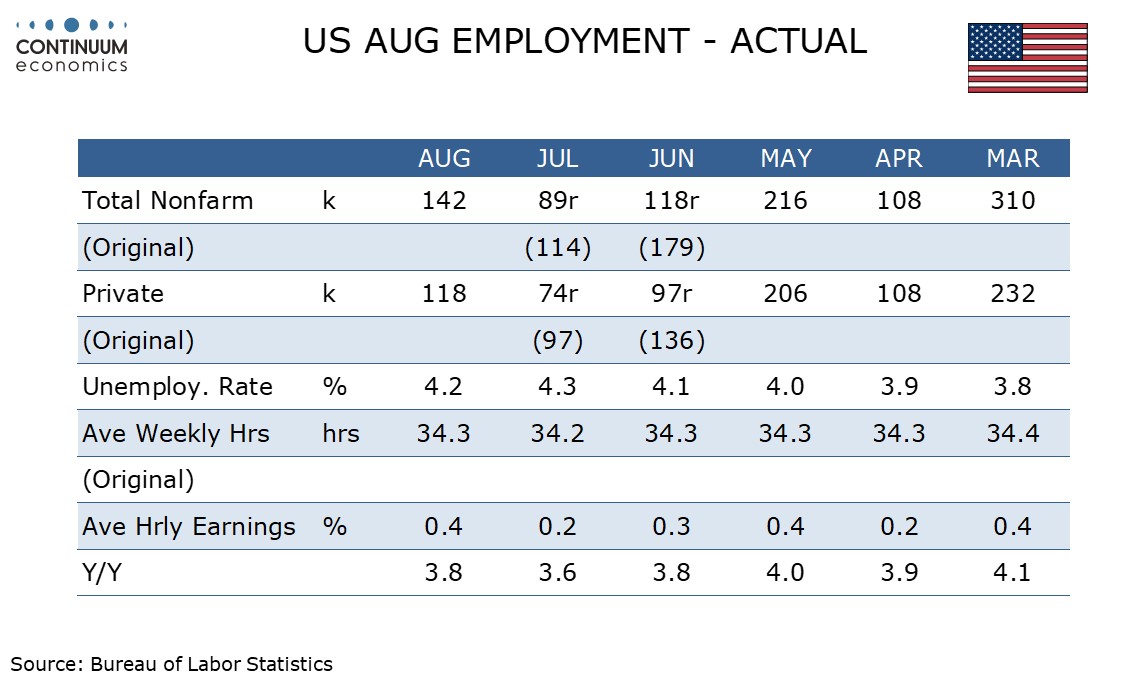

August’s non-farm payroll is a little weaker than expected with a 142k rise overall, 118k in the private sector, with significant negative back month revisions in the preceding two months totaling 86k. However the data is stronger than July’s, not only in the payroll, but also a correction lower in unemployment to 4.2% from 4.3%, a reversal of July’s dip in the workweek and an above trend 0.4% rise in average hourly earnings to follow July’s below trend 0.2%. This suggests a 25bps FOMC easing in September rather than 50bps.

This supports views that while trend is slowing, with the 3-month average at 116k versus 211kin May, July’s data was depressed by bad weather, notably Hurricane Beryl but also some exceptionally hot weather in the Midwest. August’s gain is actually a 3-month high, with July revised to 89k from 114k and June revised to 118k from 179k. In the private sector both June at 74k and June at 97k saw gains below 100k.

In August’s payroll breakdown construction remains firm at 34k but manufacturing was weak at -24k. Private services rise by 108k, mostly in health at 44k (that a slowing from recent trend) and leisure and hospitality at 46k, which like construction may have been supported by improved weather.

The household survey which calculates the unemployment rate was fairly consistent with the payroll which it usually underperforms, with employment up by 168k, marginally exceeding a 120k rise in the labor force. This saw unemployment rounded down to 4.2% rather than rounded up to 4.3% as was the case in July. This is the first fall since March, though trend is rising.

The average hourly earnings gain was 0.40% even before rounding, and a seven month high, leaving the two month average consistent with a 3.8% yr/yr pace that was up from 3.6% in July. Wage growth which was above 4% through most of 2023 and above 5% through most of 2022 has clearly slowed, but is still a little stronger than the pre-pandemic trend that was only marginally above 3.0%.

A rebound in the workweek to 34.3 hours from 34.2 in July is probably weather-assisted, returning it to where it was in each month of Q2. Aggregate hours worked rose by 0.3% after a 0.3% July decline with the rebound strongest in construction.

The data is consistent with an economy that has lost some momentum but does not appear to be at risk of recession, while inflationary risks, while reduced, have not been eliminated. This suggests the FOMC is likely to ease by 25bps in September with the case for a more aggressive move not looking convincing from this data.