Short-End Gilts To Discount More Easing?

2yr Gilt yields will likely start declining further after the 1 BOE rate cut (we expect Aug 1), both as BOE communications guide to further cuts in the medium-term and as incoming wage and service inflation provides more comfort to reduce the scale of restrictive policy. We see 2yr Gilt yields at 3.65% end 2024 and 3.2% end 2025.

The UK debt market is discounting a gradual pace of BOE easing over the next 12-24 months to a terminal policy rate of 3.5-3.75%. Will these expectations change when the BOE starts cutting?

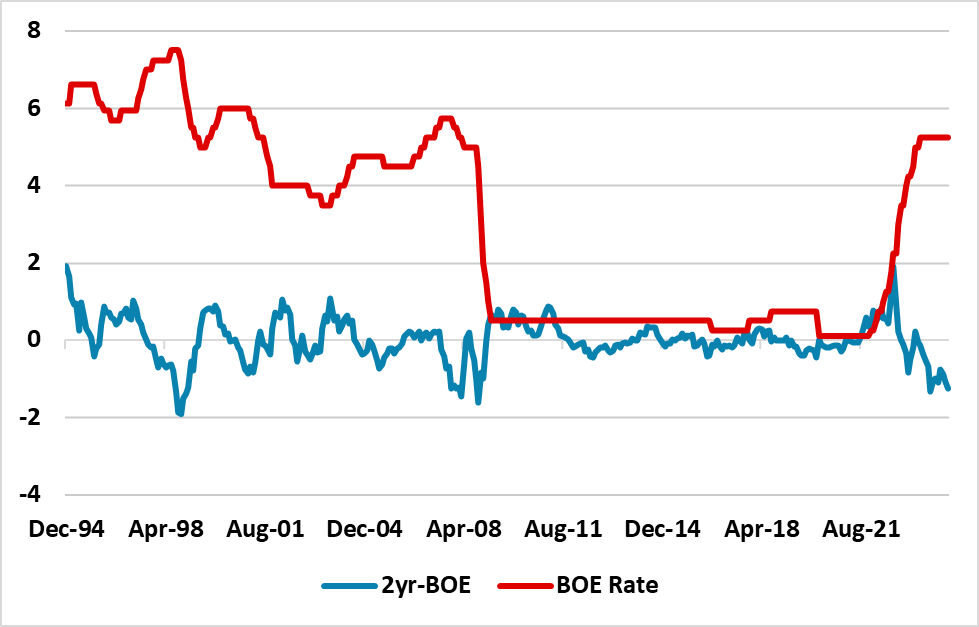

Figure 1: UK 2yr-BOE Policy Rate (%)

Source Datastream/Continuum Economics

2yr Gilts are currently close to a 125bps discount versus the BOE policy rate at 5.25%, but what will happen when the BOE starts its easing cycle – on balance we look for 25bps cut in August but the market is more biased towards September. A number of points are worth making.

· Oct 98 and Feb 01 easing cycles. 2yr yields were at 190bps discount to the BOE policy rate prior to the Oct 98 easing cycle and 2yr yields fell consistently after the 1 cut – with the BOE moving quickly to cut by 175bps in five months. The financial tensions surrounding the LTCM rescue was an additional reason for the BOE to reduce restrictive policy. Feb 01 had a smaller discount of 85bps for 2yr yields versus BOE policy rate and 2yr yields were volatile in the following months as the market felt that easing could be restricted to a mini 75bps of cuts. However, as the BOE eased by a cumulative 175bps over ten months, 2yr yields then declined from the summer of 2001. It is also worth stressing that historical comparisons are complicated by ongoing QT, which we believe to be partially restrictive. Though the BOE will likely slow QT late 24/early 25, they will still likely want to carry on multi year.

· BOE Forward guidance. The current guidance from the BOE governor is that the BOE expects to gradually ease through a series of rate cuts. Central bankers in easing cycles do not want to give guarantees, but keep on adding to confidence of further rate cuts as the process unfolds. This will likely be the way that BOE easing guidance develops through the remainder of 2024 and 2025 after the 1 rate cut. Watch the centrists not the hawks. More importantly, the May Monetary Policy Report (MPR) using market expectations of a 4.00% BOE bank rate in 2 years produced a 1.9% CPI inflation forecast Q2 2026 and 1.6% Q3 2027 (using 3yr market implied policy rate at the time of 3.7%). While this is not a BOE commitment, it does provide some guidance on the multi-year input into BOE thinking on the policy trajectory e.g. should this be the minimum the BOE eases. We see a similar message being delivered in the looming August MPR!

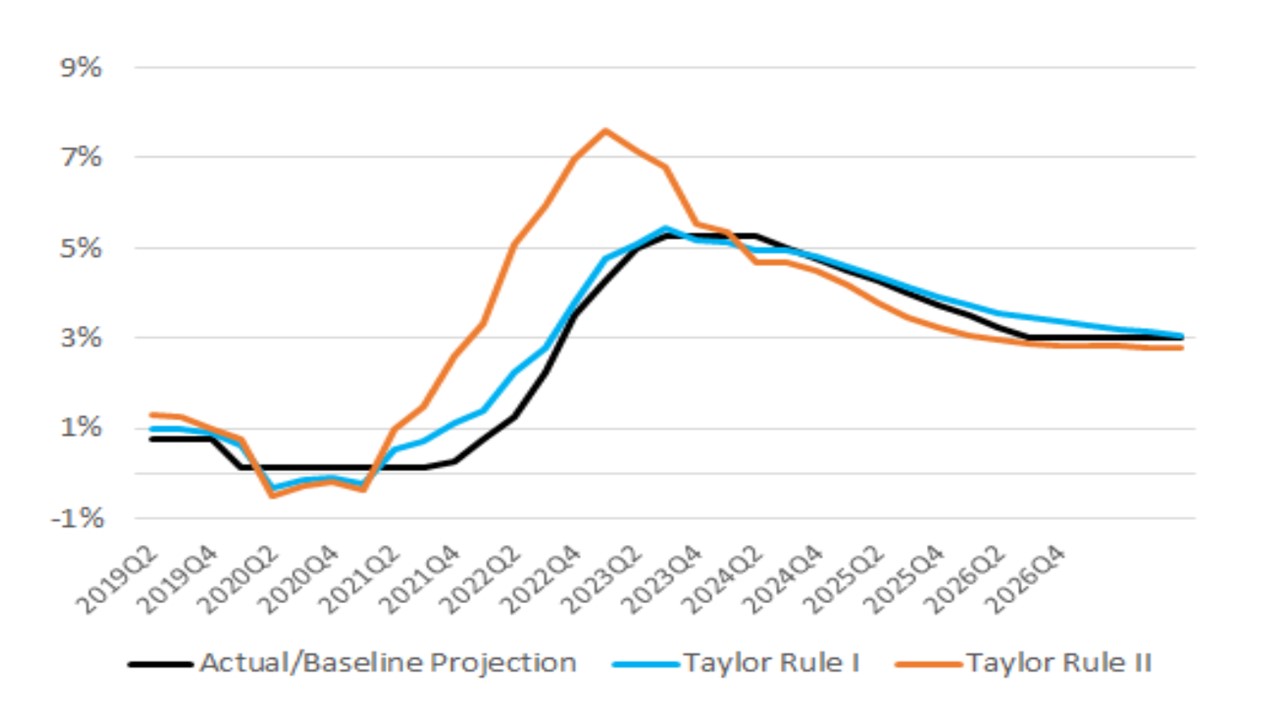

· Terminal policy rate 3% or below? Money markets are discounting between 3.50-3.75% policy rate in three years, which is a higher terminal policy rate than say the IMF – Figure 2 for three model simulations that all end at 3%. The scale of policy easing will be a function of the UK economic trajectory and also CPI/wage and services inflation. Labour’s first budget in October should maintain the existing fiscal tightening by the multi-year freezing of allowances (here), while UK growth is being restrained by weak trade post Brexit. Meanwhile, wage and service inflation are coming down, with the HMRC wage measure (here) likely to prove comforting to the BOE. As wage and service price inflation comes down still further, we see the BOE becoming more comfortable in reducing the scale of restrictive policy. We see the BOE policy rate at 3.50% end 2026 and 2.50% end 2026. The overall BOE view on neutral policy rate is not clear, but Fed economists have estimated between 2-3% (here) and one BOE hawk potentially higher or lower (here). Overall, the market will likely shift to discount a 3% BOE policy rate and then the incoming data will determine how much further it goes beyond that. However, even discounting a 3% terminal policy rate is more than currently discounted, especially as a very slow pace of easing is discounted H2 2025-H1 2026.

Figure 2: IMF Estimates of BOE Rate Path (%)

Source IMF select issues 2024 (here)