BOE: August Expected But Could be June and Not Enough Discounted

The market is not discounting enough BOE easing in the next 6-18 months during which we see a cumulative 175-200bps of cuts. The BOE is swinging from a reactive to proactive policy stance and will take account of the prospects of further wage and service inflation slowing. UK fiscal tightening will also be a headwind to UK growth and need some BOE easing to partially counterbalance.

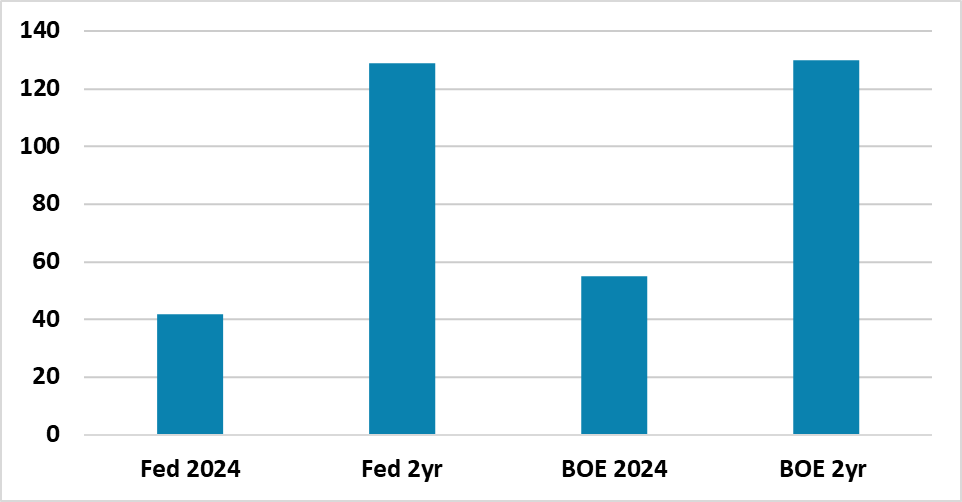

Figure 1: Rate Cuts Discounted End 2024 and In 2 years Time (%)

Source: Bloomberg/Continuum Economics

The money market is discounting the first BOE cut at the August 1 meeting, when a new set of forecasts is released by the BOE. A 50% chance of a cut is currently discounted at the June 20 meeting, as the market believes that UK wage and service inflation needs to improve before the majority of the MPC will vote for a cut. In this regard, two sets of CPI data are due before that June meeting, the first of which arrives in the next day (here). Regardless, BOE Broadbent and Bailey have sounded in recent weeks that they could back a cut, while BOE Pill has been more cautious but still open to a cut – hawk BOE Greene is also admitting that persistent inflation pressures have eased. We feel it will be close in June, but on balance we look for a 25bps cut from the BOE.

More importantly, we feel that not enough is discounted on BOE rate cut prospects in the next 6-18 months even the IMF in updated forecasts out today suggest room for up to three moves by year-end and highlights risks of delayed easing (here). A 2nd cut is only discounted at the December 19 meeting and in 12 months only 75bp of cumulative cuts are discounted. We would make a couple of points. Firstly, the UK labor market is slowing with falling employment and less vacancies, which will translate into lower wage inflation in the coming quarters. Secondly, the UK is undertaking fiscal tightening and further tightening measures are due to kick in 2025 irrespective of the election result – Labour the likely winners of the election are committed to the current fiscal rules and higher tax take. The IMF estimate the cyclically adjusted budget deficit being reduced from 3.9% of GDP in 2024 to 2.9% in 2025. Thirdly, policy is switching from being reactive to proactive, which means that MPC members are looking more at forward looking forecast and waiting less for lower wage and service inflation to actually arrive. Finally, service inflation has traditionally been higher than goods inflation and so the majority of MPC members just need to be happy that the degree of slowing in the future is enough to be consistent with a 2% inflation target.

We look for a further 25bps of cuts in Q3 and 25-50bps in Q4, as the BOE seeks to boost the economy from the doldrums. Excitement over some PMI readings has been less evident in a broad array of forward looking indicators, while those same PMI numbers highlight an increasing squeeze on company margins. In 2025, we see the BOE continuing to reduce the degree of restriction. The fiscal policy headwinds will remain in place and the BOE needs to keep reducing rates to offset the adverse lagged effects of restrictive policy. We see a further 100bps of cuts by end 2025. Our view of 175-200bps contrast with much less currently being discounted in the money market and as the first cut arrives the market will swing to discounting more. End 2025, we would still be at a 3.25-3.50% BOE rate versus a neutral rate around 2.50%.

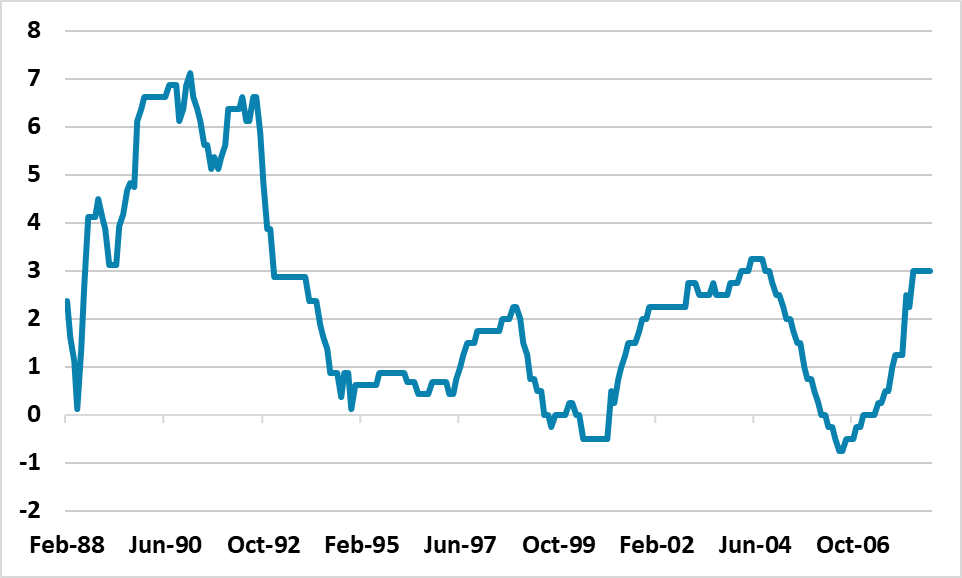

The Fed stance is also not a constraint on the BOE. BOE Bailey made this point clearly and encouraged the market to discount more rate cuts in the coming quarters, as UK fundamentals would be the key driver. Additionally, looking at the 1988-2008 period (Figure 2), the BOE has acted differently from the Fed and has also changed policy more than the Fed (e.g. 1998-99 BOE easing by 250bps).

Figure 2: BOE Policy Rate-U.S. Fed Funds (%)

Source: Datastream/Continuum Economics