ECB: June Rate Cuts Too Trigger More Rate Cut Expectations for 2024/25

However much the Council will resist fueling discussion of possible easing path, confirmation of a 1 cut normally increases speculation over further easing in subsequent quarters and we see 25bps in June followed by 25bps in September and December. The market could discount some more easing over the next 2 years, but the major change will be to bring forward rate expectations to discount around a quarterly pace into H1 2025.

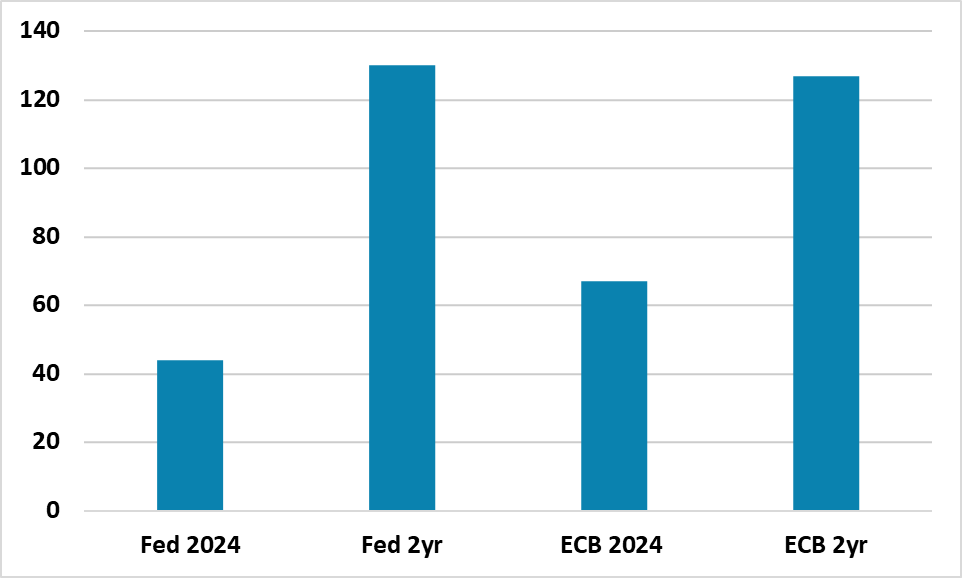

Figure 1: Rate Cuts Discounted End 2024 and In 2 years Time (%)

Source: Bloomberg/Continuum Economics

Source: Bloomberg/Continuum Economics

While the Fed is currently on hold, expectations are widespread that the ECB will cut the deposit rate by 25bps at the June 6 meeting. What will happen to ECB rate cut expectations for the remainder of 2024 and the next 2 years after the June meeting (Figure 1)?

A 25bps cut from the ECB, will like bring forward expectations of further reductions. Confirmation of a 1 cut normally increases speculation over further easing in the coming quarters. A subsequent ECB easing is only discounted for the October meeting, whereas we are forecasting a September move and then again in December. These are conditional on the inflation trajectory in the EZ remaining under control and the economic recovery not gaining too much momentum. We feel that this will be the case and we see headline inflation just below 2% in H2 2024, while also noting that the EU commission survey suggests less of a pick-up than the PMI figures. The labor market is also slacking with slowing employment growth and lower hours worked (here), which should ensure a soft trend to wage settlements.

For 2025 and 2026 ECB rate cut expectations, the market is already discounting a move to a 2.50% terminal policy rate. While we feel that the ECB will eventually ease more, it could be difficult for the market to swing too much towards a 2% rate expectation for the terminal rate in early summer. The ECB’s forward guidance will be very weak, as the Council does not want to signal guidance due to internal differences and President Lagarde opaque communications. The market could discount some more easing over the next 2 years, but the major change will be to bring forward rate expectations to discount around a quarterly pace into H1 2025.

Could more Fed rate cut expectations encourage more ECB expectations? We feel this is unlikely in the coming months. Firstly, the market has drawn a distinction between the Fed and ECB looking at 2024 expectations (Figure 1). Secondly, the June 12 FOMC meeting will likely not materially shift current expectations of 2024 rate cuts. We do think that the economy softening, but this would have to be surprisingly weak in the next few weeks to radically change the Fed stance. The dot plot will likely shift from 3 to 2 rate cuts for 2024 – the market could discount a little more the Fed as the summer progresses.