Eurozone: Consumers - Still Missing?

Revised national account data confirmed the upside surprise in the preliminary data with EZ GDP rising 0.3% q/q. The question is whether this emergence from the modest H2 2023 recession is the start of more sustained momentum. We think not, mainly due to what are still weak consumer fundamentals, something that the ECB is very much wary about. Indeed, it is notable that despite the apparent Q1 upside surprise, the updated growth projections from the European Commission show no upgrade to the 0.8% 2024 GDP picture and even a notch downgrade to the now-1.4% 2025 outlook. This is largely due to slightly softer growth profile in H2 this year despite a downward revision to the inflation outlook where a rate of 2.1% is now envisaged for 2025! There are no details with this revised GDP update, but rather than genuine added momentum, we suspect it will more reflect special factors such as swings in Irish data, working day effects and soft imports, and where subsequent updates will confirm a still soft consumer picture as part of a EZ backdrop that is increasingly diverging geographically. If so, this would tally with clear consumer worries still evident within the ECB, one factor that persuaded a few Council members to vote for a rate cut at the April meeting.

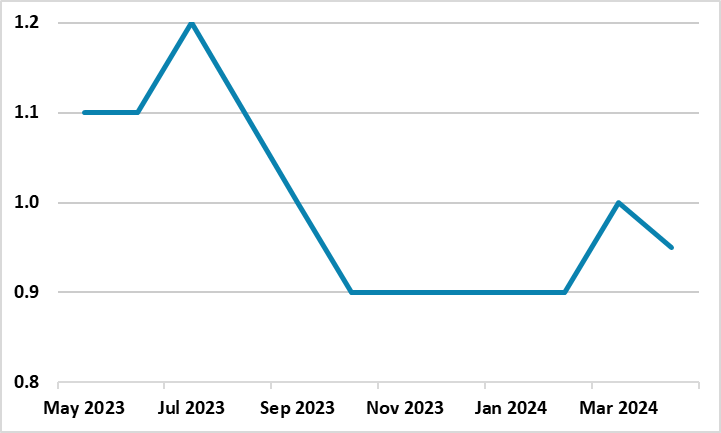

Figure 1: Consumer Spending Projection Still on the Wane?

Source: Bloomberg

Divergent Eurozone

It is clearer that amid the fall-out from the Ukraine War, the EZ growth landscape is far from uniform with divergences across both countries and sectors. Less energy-intensive sectors were growing faster than energy-intensive ones, which could be seen as pointing to structural rather than cyclical weakness while proximity to the war is also weighing on economic performance – this possibly explaining the Spanish and Irish strength in Q1 GDP. There are no details with this revised Q1 GDP update, but we suspect the apparent resilience will more reflect special factors such as swings in Irish data, working day effects and soft imports, and where subsequent updates will confirm a still EZ backdrop.

Indeed, this is backed up by empirical work by the likes of the ECB which have been using nowcasting tools which indicated quarter-on-quarter real GDP growth last quarter was weak. Moreover, the Council (most notably in the April meeting account) still seem to regard that achieving the profile of the baseline projection (0.6% GDP growth this year and 1.5% next) remained quite a challenge and that any observed upward movements in incoming data should therefore not be equated with a materialisation of upside risks to the baseline projections.

Indeed, there are few, if any, signs of a recovery in private consumption, which is expected by the ECB to be the growth engine for that baseline in 2024 and 2025. Indeed, consensus consumer spending projections are still largely on the wane (Figure 1) This may reflect a series of factors, notwithstanding the possible support from the fall in overall HICP inflation.

Consumer Risks Persist

For instance, still very weak consumer credit and an increase in rejected bank loan applications could suggest fragile household balance sheets or greater risk aversion by banks. If so, this would suggest risks of a more persistent weakness in consumption. This risk may be amplified given signs of some cooling of labour demand, most particularly visible in decreasing job vacancies. This raises concerns that the labour market support to the EZ economy had reached its limit where labour supply which has already increased substantially and where firms may have (more) limited buffers left for hoarding labour. A turn of the cycle in the labour market could thus imply greater labour shedding and reduced hirings while the clear evidence of recent labor hoarding would suggest much more limited upside r=surprises for fresh employment gains.

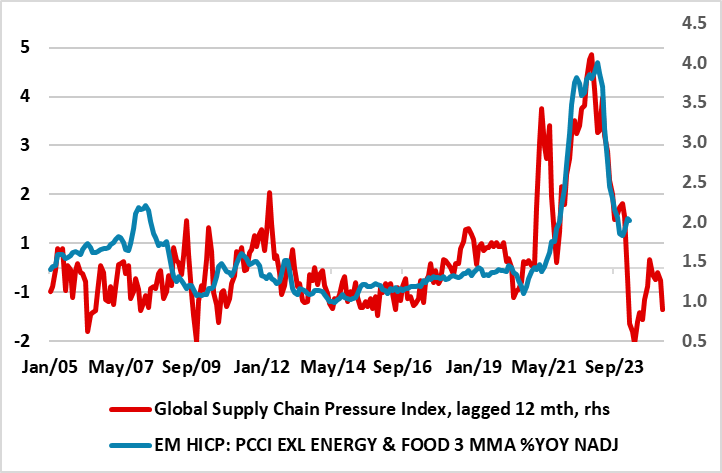

Figure 2: EZ Inflation Drop Driven by Supply

Source: NY Fed, ECB - PCCI is Persistent and Common Component of Inflation

All of which makes up think that the apparent GDP resilience will affect ECB thinking materially. Indeed, it seems clear(er) that the ECB (justifiably) regards inflation developments in the United States and the EZ to be different in nature, with those in the United States being driven more strongly by demand factors and those in the euro area more by supply factors and where the latter still seem to be easing even more clearly of late (Figure 2).