ECB Preview (Apr 11): Still the Focus on Words Not Deeds – For Now!

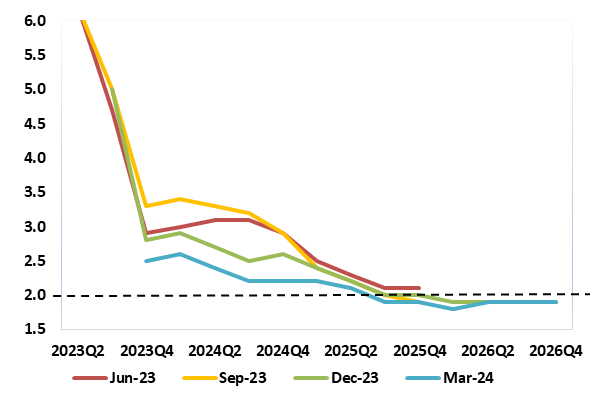

As has been the case for several times now, the ECB meeting verdict due next Thursday (Apr 11) will be notable not for what the Council does but rather what is said just as at the March meeting whose minutes were released today. A fifth successive stable policy decision is very much expected, albeit with some possible formal dissents from a minority in favor of actual cuts at this juncture. Even without such vocal opposition, the path to a rate cut at the June 6 Council meeting will be made clearer, albeit with the ECB reluctant to pan out any particular path beyond then, insistent it is, and will remain, ‘data dependent’ most notably on labor costs data due in the interim. But given existing projections now showing inflation below target by next year (Figure 1), the bar is higher for such data to forestall a 25 bp in June and the ECB may underscore a willingness to ease ahead of the Fed. But if the ECB remains focused on such quarterly labor costs updates then subsequent rate cuts may only arrive in September and December, hence our long-standing view that the ECB may cut only some 75 bp this year. However, by year-end more durable evidence of labour costs easing should convince the ECB to continue easing and we see 100 bp further easing through 2025!

Figure 1: ECB Sees Inflation Below Target and Durably

Source: ECB, last four forecast vintages

Near-Term Policy Issues

It is ever-clearer that it is the labour market (and particularly labour costs) which are the dominant theme for the ECB is assessing the policy backdrop and outlook – some consideration of profit margins is also be made. But the ECB is very aware of a still very weak credit and bank deposit backdrop. This was accepted at the March Council meeting where the account noted (and chiming with one of our long-standing themes) that a reduced supply of liquidity was also contributing to monetary tightening, owing to ongoing and prospective reductions in the asset purchase program and PEPP portfolios, as well as maturing targeted longer-term refinancing operations.

Moreover, back in March, some Council concerns were expressed that financial stability risks were emerging, given signs of financial distress among low income households. The risks facing some non-financial firms and the risks from the commercial real estate sector were also highlighted. Against this background, banks’ non-performing and underperforming loans were increasing, which could make it tougher for non-financial corporates to access bank credit. With this in mind, the ECB will be looking at its next Bank Lending Survey (due Apr 9) with perhaps greater interest!

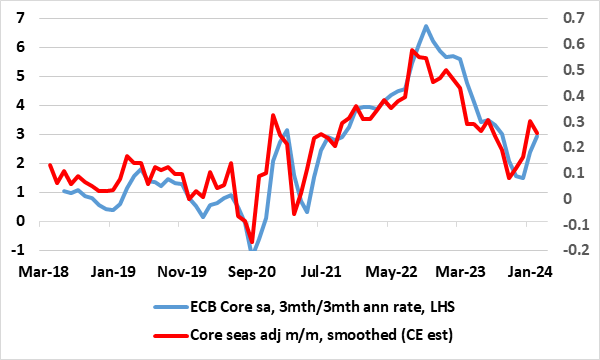

While HICP inflation continues to subside amid an economy backdrop which is flat despite some better business surveys, the labor market is still suggesting an easing in labour costs growth. This is particularly in regard to Q4 compensation per employee and to a degree that has surprised the ECB to the downside. Thus should filter through into what has been recent service sector inflation resilience, albeit the latter possibly accentuated by fiscal matters (see below). This may be a factor in the ECB hawks remaining vocal, albeit not too loudly or persuasively, but where there may be some highlighting that various underlying price gauges have stopped falling and may even have risen afresh (Figure 2). Moreover, as the March minutes highlighted, with the differential between Italian and German ten-year government bond yields at its smallest in two years, this meant an effective lack of sovereign spread strains. This may sustain some hawkish priorities despite this largely a result of the weakness in Germany, and where worries about France and Italy fiscally cannot be ruled out. Otherwise, a small and recent rise back in market measures of inflation expectations is unlikely to be considered worrisome, but will be related to what does seem to be economic resilience in the U.S.

Policy Outlook

As was evident in the March 6-7 Council meeting, the ECB seems very reluctant to discuss openly a possible rate cut path. But regardless, the very fact that ECB forecasts now point to headline inflation below target before and then through 2026 and the core rate at target on the basis of market rate pricing of future official rates down to 2.4% next year and through 2026, very much implies a tacit ECB Council endorsement of that rate profile. With this in mind, perhaps the main risk is that interest rates cuts may be larger and/or faster than we have assumed as the monetary policy transmission mechanism proves even more powerful than we have estimated and fiscal policy prove more restrictive.

Re-emerging Fiscal Issues?

Indeed, it will be interesting to see the extent to which fiscal issues are highlighted as the outlook does seem to have changed somewhat more that was assumed in the March minutes. Very clearly, the EZ headline budget gap is going to narrow this year as energy price support measures are withdrawn, this likely to mean a tighter cyclically adjusted primary balance this year and maybe a little more in 2025. But the headline budget gap may be higher than the likes of the ECB have assumed, not least given the marked upward revisions to 2023 fiscal gaps being admitted by several countries – those from just Italy and France result in a collective budget gap of over half the 3.2% ECB estimate. As a result, further government spending reductions are being considered and implemented, these likely to act as a drag on overall EZ growth into 2025 over and beyond the reversal of energy support measures and where some revenue enhancements may also occur, the later adding to apparent price pressures. Thus with headline budget gaps that may stay around or above 3% of GDP this year and next , the fall in the EZ government debt ratio to 88.3% of GDP last year may now reverse. This maybe more of an issue as the Economic and Financial Affairs Council has agreed on new regulations concerning the EU’s fiscal rules, mean that member states with excessive deficit or debt ratios envisage a more ambitious budgetary objective necessitating a structural deficit ratio of no more than 1.5% over the medium term, mainly though spending reductions.

Over and beyond the inflation repercussions, it is notable that amid the mild EZ recession, the zero growth of the last year would have been clearly negative were it not for government spending. This is important as it not only highlights the weakness in final private demand but the likely slowing on the government side explains one of the downside risks for GDP growth we seen into 2024 (and even 2025). This downside risk is very much applicable to the ECB projections where its slightly above consensus GDP forecast for this year (0.6%) is based around government expenditure providing half that momentum! It is these such risks that have persuaded some high-profile Council members to call for rate cuts sooner rather than later. Indeed, BoF President Francois Villeroy de Galhau, in what may be seen as pressure for a cut as soon as next Thursday, recently stressed that ‘the time has come to take out an insurance’.

Figure 2: Eurozone Core Disinflation: Stalling, Slowing or Reversing?

Source, CE, ECB, all based on seasonally adjusted monthly data

This is not likely to carry the Council, which stressed that the new information available in time for the April meeting would be much more limited, making it harder to be sufficiently confident about the sustainability of the disinflation process by then.

Regardless, we concur with the ECB that a good portion of recent disinflation is supply driven but, note with policy hikes still biting, the impact of weak demand will only accentuate this. This is implicitly accepted by the ECB who said last month that ‘a significant part of policy transmission remained in the pipeline, as the coming quarters would see the impact of past policy tightening continuing to be transmitted to bank funding conditions, broader financing conditions, credit volumes and the real economy’. It was also noted that there would be some tightening in financing conditions in 2024 stemming from the contraction of its balance sheet