South Africa’s Economy Expanded by a Moderate 0.1% in Q4

Bottom line: As we correctly predicted, South African economy grew by 0.6% YoY in 2023, and by a moderate 0.1% QoQ in Q4. According to Department of Statistics of South Africa’s (Stats SA) announcement on March 5, the supply side of the economy was largely fuelled by the manufacturing, transportation and mining sectors, which saw recoveries partly due to slight reduction in power cuts (loadshedding) in the last quarter of the year, while a 0.2% uptick in household spending in Q4 was the key driver on the demand side.

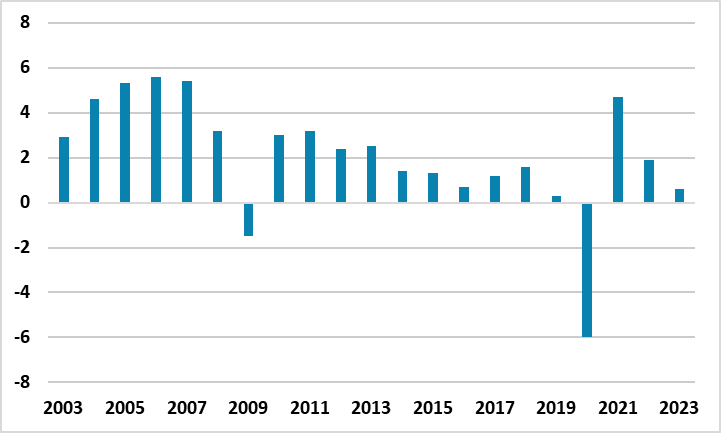

Figure 1: Annual GDP Growth Rate (%), 2003 - 2023

Source: Continuum Economics

South African economy expanded by a 0.1% QoQ in Q4, bringing YoY growth to 0.6% in 2023. GDP growth in 2023 was the worst growth number since 2009 excluding the pandemic years of 2019 and 2020.

One driver behind the uptick in supply side of the economy in Q4 was stronger mining and manufacturing industries, which saw recoveries. According to the released quarterly figures, six of the ten industries recorded expansion in Q4 2023, with transport, storage and communication, which boosted by 2.9%, experiencing the strongest expansion. Obviously, the recovery was partly ignited by the slight fall in loadshedding in Q4 as the Stats SA mentioned that “The country experienced fewer days of load shedding in the fourth quarter (63 days) compared with the third quarter (91 days), with the rise in electricity production and consumption reflecting positively in the GDP numbers.” On the demand front, the household spending slightly surged by 0.2% in Q4 after shrinking by 0.2% in Q3.

Despite South African load shedding issue partly easing in Q4 and in the beginning of Q1 (as Eskom managed to supply three days of full electricity in the first week of 2024), it is worth mentioning that the falling trend of the scheduled electricity blackouts came to an end in mid-January after power cuts rose up to Stage 3 and Stage 4 due to numerous factors such as shutdown of generating units, the need to continue to do planned maintenance, and excessive demand. (Note: The country faced the most severe nationwide power cuts in months mid-February, as Eskom implemented Stage 5 and Stage 6 outages, which can put a pressure on Q1 2024 growth figures).

On the other side of the coin, agriculture, forestry & fishing activities shrank by 9.7% in Q4 on the back of weaker production figures for field crops, horticulture products and animal products. (Note: Agriculture recorded its first annual contraction last year since 2019, contracting by a 12.2%).

In January, the South African Reserve Bank’s (SARB) GDP growth forecast remained unchanged for 2024 and 2025 at 1.2% and 1.3%, respectively. Treasury also announced in February that it expects the economy to expand by 1.3% in 2024 and 1.6% in 2025. We assess the economy will grow by 1.2% in 2024, particularly if the country will be able address the electricity shortages, logistical constraints, and financing needs. We foresee investment in machinery and equipment for energy production to remain strong, and less severe loadshedding and long-term electricity production in the medium term.

We also think there are downside risks to the growth, which remains restrained due to high interest rates as households continue struggling with finding spare funds in an environment of high interest rates, and businesses facing with a tough domestic environment including high lending rates and high costs of doing business. This situation will be helped somewhat after SARB would start cutting the policy rate, and lending rates would start likely coming down in H2 of 2024. In addition to this, we think inefficiencies at Eskom and Transnet continue to pose risks to the growth trajectories.

This was the last major GDP figures announced before May 29 elections and this will likely be used by the opposition parties to attack ANC which is currently averaging below the 50% threshold according to the most of the polls.