FX Weekly Strategy: December 18th-22nd

BoJ meeting the main focus

No immediate policy change seen but signal of Q1 tightening could extend JPY recovery

GBP upside scope is modest given current policy expectations

CAD looks a little extended

CHF/JPY is clearly overvalued

Strategy for the week ahead

BoJ meeting the main focus

No immediate policy change seen but signal of Q1 tightening could extend JPY recovery

GBP upside scope is modest given current policy expectations

CAD looks a little extended

CHF/JPY is clearly overvalued

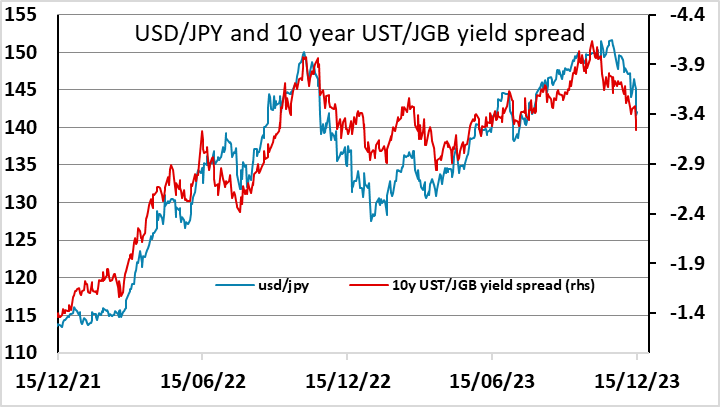

The BoJ meeting on Tuesday will be the most watched event of the coming week. We see the BOJ trying to muddle through on monetary policy by raising the BOJ policy rate gradually in 2024/25 and formally abandoning yield curve control (YCC). However, with ultra-low rates having been in place since 1996, plus the associated build up in Japan household/ corporate and government to low financing rates, the BOJ will be concerned about too much of an interest rate shock. It could be that the BOJ plan is for a 0.50-0.75% policy rate. The BOJ hopes of sustaining 2% inflation will likely not be met and inflation will likely relapse to below 1.5%, which could curtail such a BOJ plan being realized.

Given this background, it is unlikely we will see any change of policy at this BoJ meeting. However, the recent speech from Ueda made it clear that he anticipates an exit from ultra-easy monetary policy in 2024, so it would make sense if the BoJ formalised this with a change in forward guidance at this week’s meeting. They may not be specific, but we would expect them to suggest a change in policy in Q1. This should be enough to extend the recent JPY gains, which have been driven by lower yields in the US and Europe rather than higher yields in Japan. Indeed, JGB yields have fallen with US yields in the last week, having tested the 1% reference ceiling in the period after the last BoJ meeting. We would see risks to the JPY’s upside, but if there is no change in policy or forward guidance we will likely see some initial JPY weakness after the meeting, with scope for a bounce of a figure or more. Even so, such a move would likely be short lived, as current yields fully justify the decline in USD/JPY seen in the last week, and we would not expect any decline in JGB yields in response to a neutral meeting. If we do see a signal of a Q1 rate hike, expect to see USD/JPY test 140.

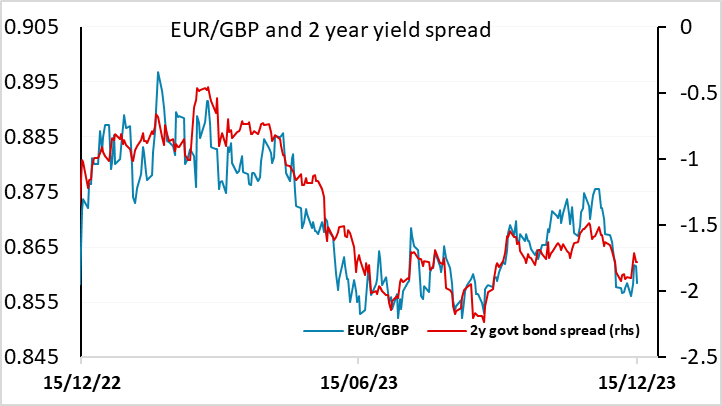

Elsewhere, UK CPI will be a focus, particularly in view of the relatively strong PMIs from the UK last week. GBP benefited from this, and the strength lent the hawkish BoE stance at last week’s meeting some credibility, particularly relative to the ECB. While we see the underlying trends as still being weak, our forecasts are marginally above market consensus, so there may still be limited scope for GBP gains against the EUR. But while the BoE may well cut rates less next year than the ECB, this is already well priced into the market, and from here there isn’t much scope for any further widening of spreads in GBP’S favour. So while EUR/GBP could dip as low as 0.8550, stronger than expected CPI will be required to make progress even as far as that.

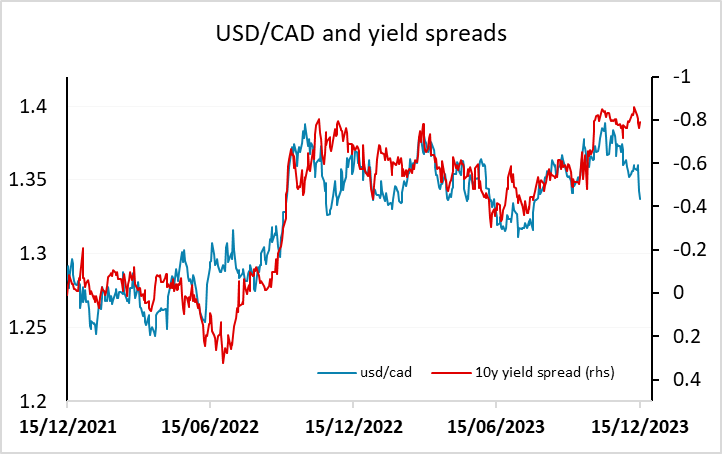

While there isn’t a great deal of note due in the US, Canadian CPI will also be a focus. We see downside risks for the CAD which has outperformed yield spreads in recent weeks against the USD. Another dip in CPI should maintain the expectation of easier BoC policy in line with the Fed next year, and we could see USD/CAD rebound towards 1.35.

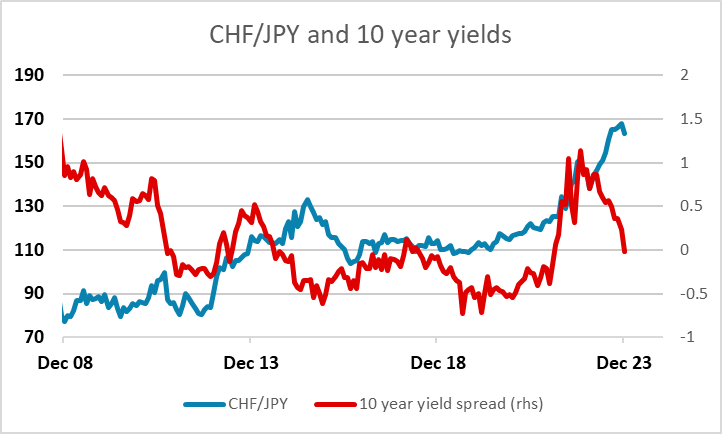

The EUR continues to vulnerable on the crosses against the scandis, which both made some ground last week, notably the NOK after the Norges Bank rate hike. However, the CHF is probably even more vulnerable. The SNB turned clearly dovish at last week’s meeting, and also indicated that it was winding down its selling of FX reserves, removing one of the supportive factors for the CHF. We still see the CHF as most obviously vulnerable against the JPY, with JGB 10 year yields now above Swiss yields, and CHF/JPY 30% higher in the last couple of years, but there may be scope for more general CHF losses. Having said this, in real terms the CHF has been quite steady in recent years, as Swiss inflation has been below inflation elsewhere (Japan excluded), so from a value perspective the scope for CHF losses is clearly greatest against the JPY.

Data and events for the week ahead

USA

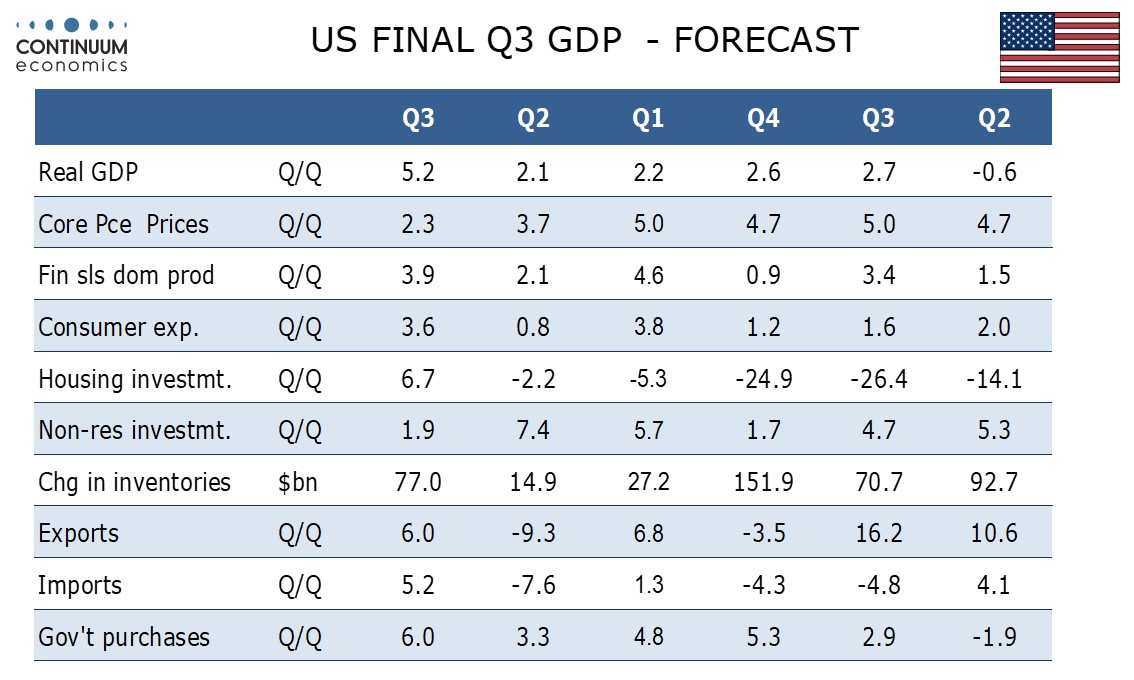

Monday sees December’s NAHB homebuilders’ survey. On Tuesday we expect November housing starts to fall by 3.1% 1330k to while permits fall by 2.5% to 1460k. Fed’s Bostic is also due to speak. On Wednesday we expect a Q3 current account deficit of $196bn, down from $212.1bn in Q2, and a 0.8% fall in November existing home sales to 3.76m. December consumer confidence is also due. Thursday sees weekly jobless claims, December’s Philly Fed manufacturing survey and final Q3 GDP data, which we expect to be unrevised at 5.2%. November’s leading indicator follows.

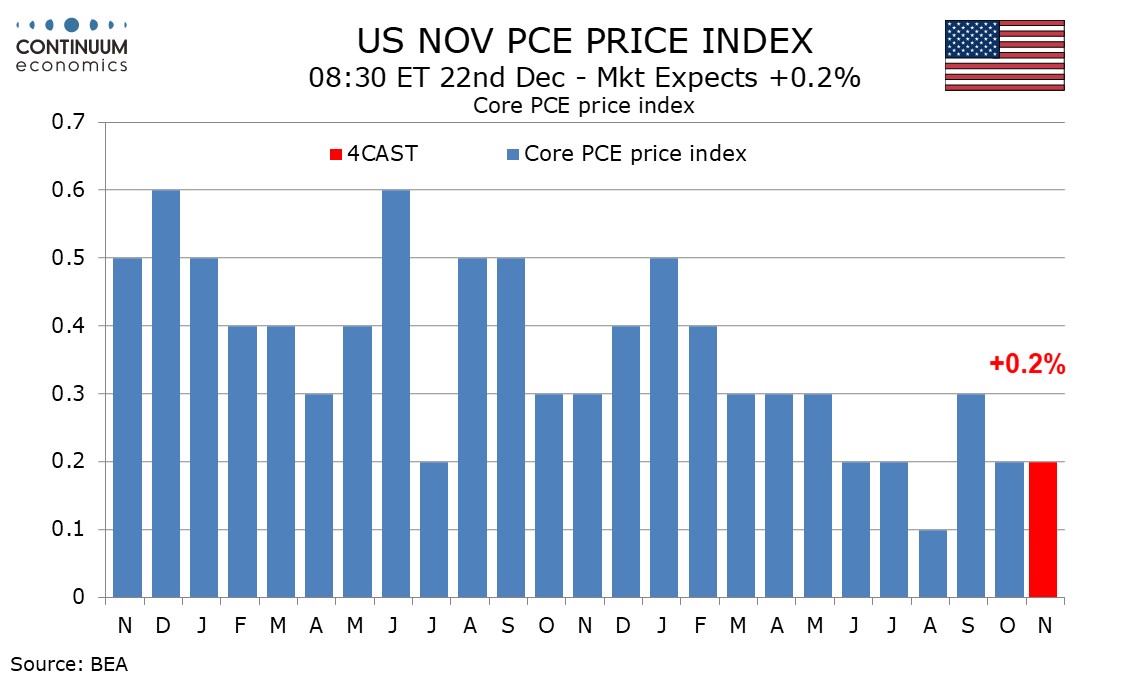

The most significant release of the week may be Friday’s core PCE price index for November, which we expect to rise by 0.2%, softer than a 0.3% core CPI. We expect gains of 0.4% in personal income and 0.5% in personal spending. At the same time we expect November durable goods orders to rise by 0.6% with a 0.3% increase ex transport. Later we expect November new home sales to fall by 4.3% to 650k. Final December Michigan CSI data is also due. The preliminary report saw a significant increase.

Canada

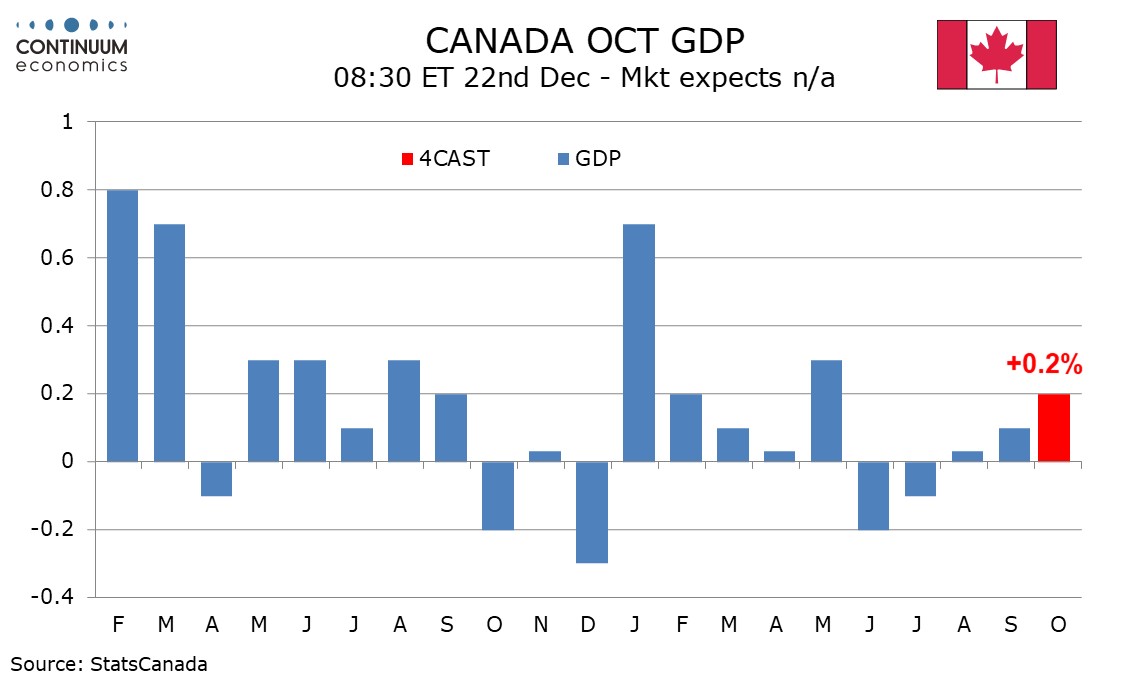

Canada’s most significant release will be November CPI on Tuesday, where we expect a fall to 2.8% yr/yr from 3.1% with the BoC’s core rates also likely to soften. Minutes from the December 6 BoC meeting are due on Wednesday. Thursday sees October retail sales, for which a preliminary estimate for a 0.8% increase was made with September’s report. On Friday we expect a 0.2% increase in October GDP, in line with a preliminary estimate made with September data.

UK

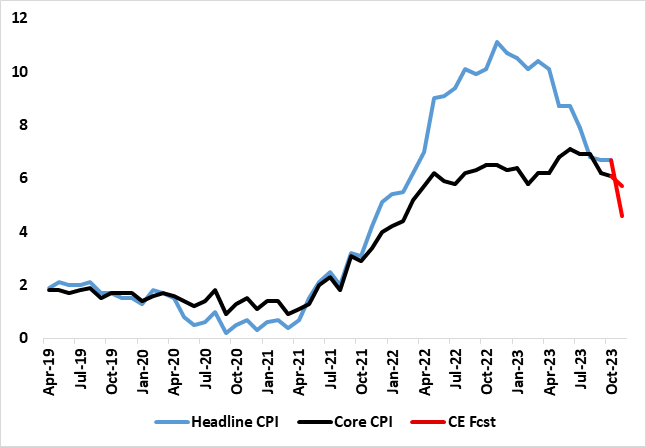

Datawise, the week is dominated by CPI figures on Wednesday. UK headline and core inflation have been on a clear downward trajectory in the last few months the former having peaked above 10% in February and the latter at 7.1% In May. We think this trend will continue in November even after the very favourable October fell to a 24-month low of 4.6% but where the core slid lower by a further 0.4 ppt to 5.7%, a 19-month low (Figure 1). We see both sliding a little to 4.6% and 5.6%, meaning that would be some 0.2 ppt below BoE projections unveiled last month

Further Fall in in Headline and Core Inflation Beckons

Source: ONS, Continuum Economics

Public borrowing numbers (Thu) will perhaps suggest signs of an undershoot of the OBR budget deficit target. Retail sales (Fri) may show a small bounce of around 0.3% m/m while no revisions are seen to the Q3 GDP data. Q3 current account numbers may show a small fall in the deficit from the previous quarter’s 3.7% of GDP underlying figure.

Otherwise, the BoE appear with Dep Gov Broadbent (Mon) and Dep Gov Breeden (Tue).

Eurozone

Survey data dominate the week. In France, INSEE business survey data (Thu) may continue to highlight fragility but German Ifo figures (Mon) may edge higher for a third successive month, albeit still very much in contraction territory. Otherwise, there will be keen interest on comments from ECB Chief Economist Lane, speaking with some colleagues at an ECB conference on fiscal matters

Rest of Western Europe

There are key events in Sweden, with the focus on the Economic Tendency Survey (Thu) alongside Riksbank Governor Thedéen speaking on Wednesday about the economic situation and current monetary policy.

Japan

The most important meeting before Christmas holiday would be the BoJ meeting. Market participants have mixed expectation, ranging from no change, to change in forward guidance and change in monetary policy. We believe right now would be a good time for the BoJ to change their forward guidance and signalling they will exit negative rates in Q1 2024. It would be a surprise to see BoJ acting immediately in the December meeting as such would suggest they are much more hawkish than their rhetoric and data. Else, we have trade data on Tuesday and National CPI on Thursday with the later capturing more eyeballs. After BoJ exiting ultra-loose monetary policy, very likely their pace to move forward would be depending on inflation dynamics, where we see further moderation in headline CPI to continue in coming months.

Australia

We have the fiscal outlook on early Monday and RBA meeting minutes on Monday. Both is interesting to look into but expect little surprises.

NZ

We will have the Business PMI on early Monday, Trade Balance and business outlook on Monday. After the surprising contraction of GDP, trade data would be an area of spotlight to assess the dynamic of future NZ economic growth.

Highlights from the last week

Fed Hold Rates and Tilts Dovish

U.S. November CPI Shows strong components

BoE Table Mountain Still But Descending Q2 2024

ECB Council Sticks to its Optimistic Guns

UK GDP Resilience Dissipates

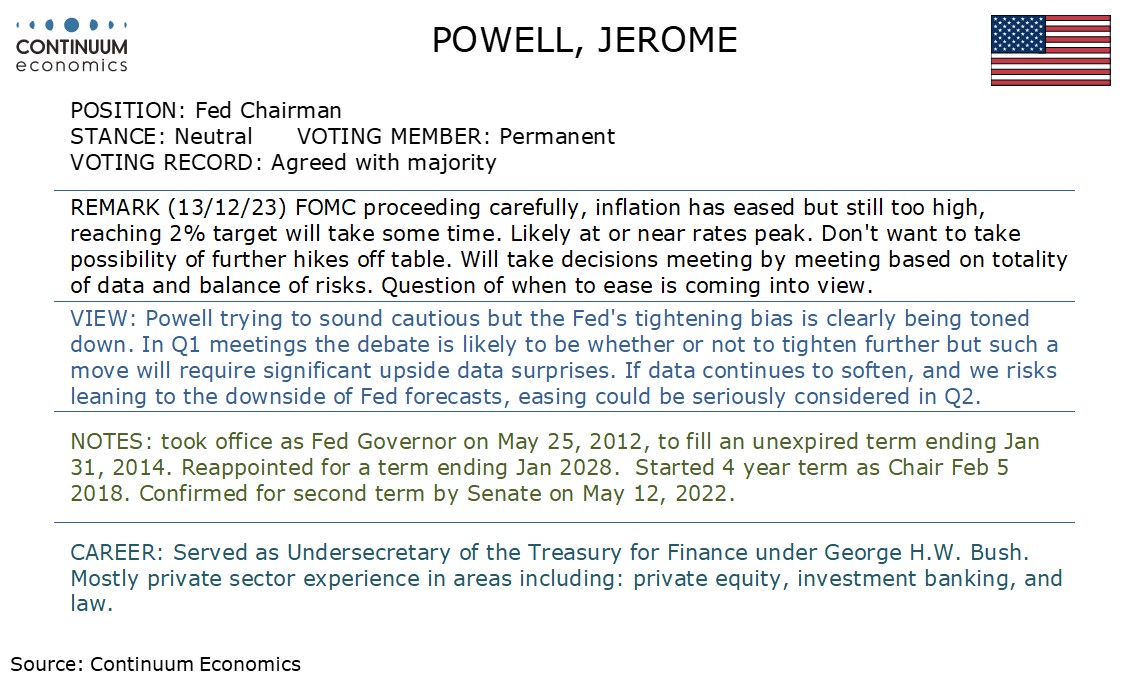

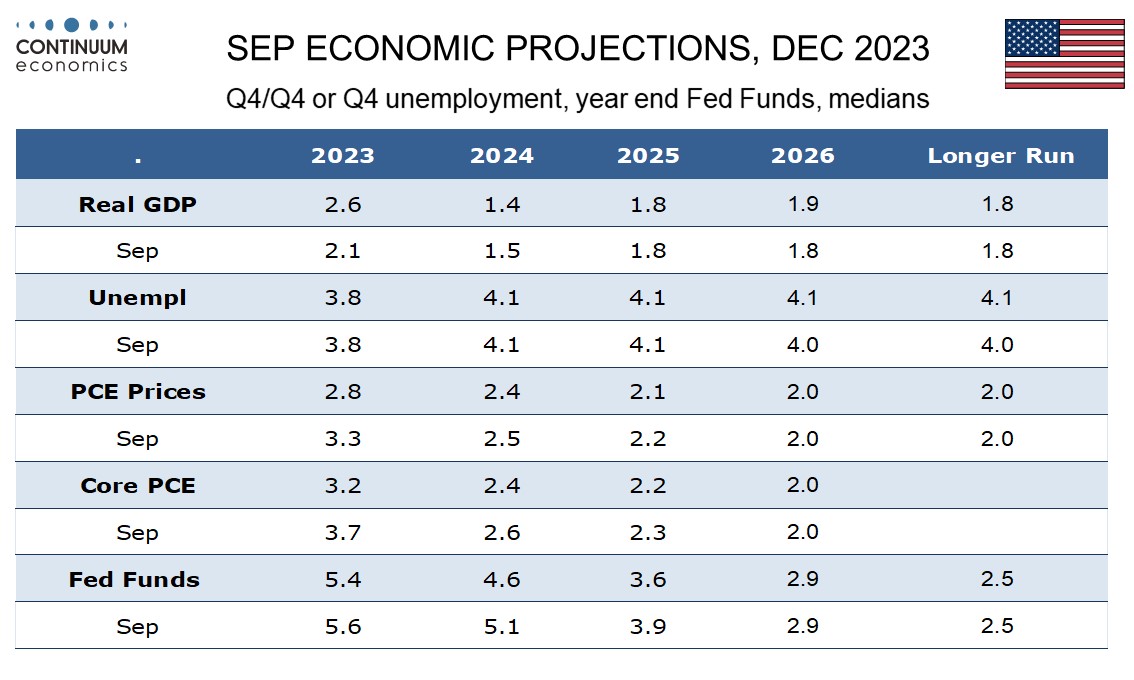

The FOMC has left rates unchanged at 5.25-5.50% as expected though made some dovish adjustments to the statement and to the dots. The FOMC no longer expects further tightening while the dots see 75bps of easing in 2024 rather than 50, which with the end 2023 rate 25bps lower than seen in December means the 2024 view has been adjusted down by 75bps. Looking at the 2024 dots six are on the median of 4.625%, with eight above and five below. Economic forecasts show GDP for 2023 revised higher and inflation revised lower, reflecting recent data, but GDP and unemployment views for 2024-2026 are almost unchanged and inflation forecasts for those years have seen only modest downgrades, with the median forecasts still not seeing the 2.0% core PCE price target being reached until 2026. The dots actually see a slightly slower pace of easing in 2025 and 2026 than September, though the end 2025 level is 25bps lower than seen in September given the adjustments to 2023 and 2024.

The main change in the statement is that they now reference any additional firming that may be appropriate, the addition of the word any suggesting additional firming is no longer expected, though it is still seen as possible while easing is unlikely to be debated at a near term meeting. The statement also suggests that recent indicators suggest that growth has slowed from its strong Q3 pace, a notable shift given that we have only limited data for Q4 at this point. They also add that inflation has eased over the past year, that clearly evident in the data, while continuing to describe it as elevated. Despite the statement being less hawkish, there were no dissenting votes.

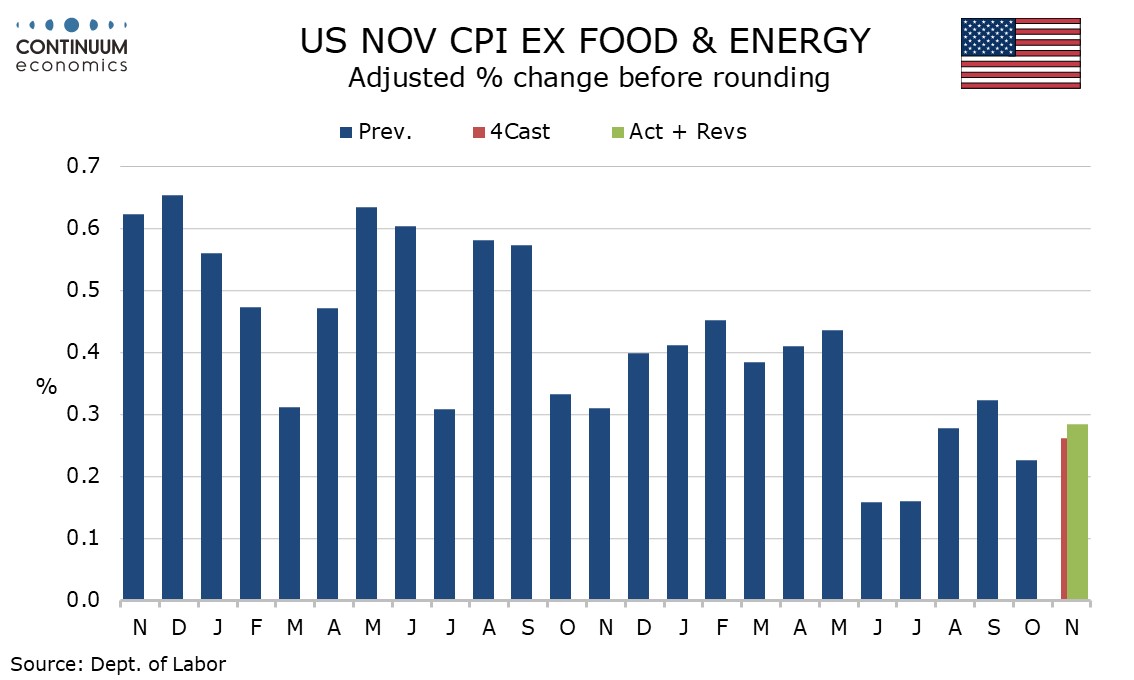

November’s CPI saw a 0.1% increase, slightly stronger than expected as a rise in energy services partially offset a fall in gasoline, but the core rate ex food and energy with a 0.3% increase was in line with expectations, and being slightly below 0.3% (0.285%) before rounding, leaves recent progress on inflation largely intact. While there was an unexpected rise in used autos of 1.6%, adding 0.05% to core CPI, commodities ex food and energy remained weak, falling by 0.3%, a 1.3% fall in apparel largely offsetting the bounce in used autos.

Services less energy rose by 0.5% after a 0.3% increase in October with a 0.6% rise in medical care services the most notable area of strength. This was a sector that was seen as a source of upside risk in October as new methodology was introduced. While October’s data was subdued enough to provide relief November’s medical care data suggests that the new methodology is boosting the data, and this could persist in the months ahead. If medical care, which was consistently weak in the first nine months of the year, is picking up, it could be a barrier to further progress on core CPI, but we expect core PCE prices will show less of an acceleration in medical care, and if so the data is probably not going to be a game changer for the Fed. Shelter was also stronger in November than October, with owner’s equivalent rent rising by 0.5%, stronger than October’s 0.4% but slower than September’s 0.6%. This sector remains stronger than the Fed would like. Yr/yr core CPI at 4.0% is unchanged from October’s outcome which was the slowest since September 2021. Overall CPI fell to 3.1% yr/yr from 3.2%, still above June’s low of 3.0%.

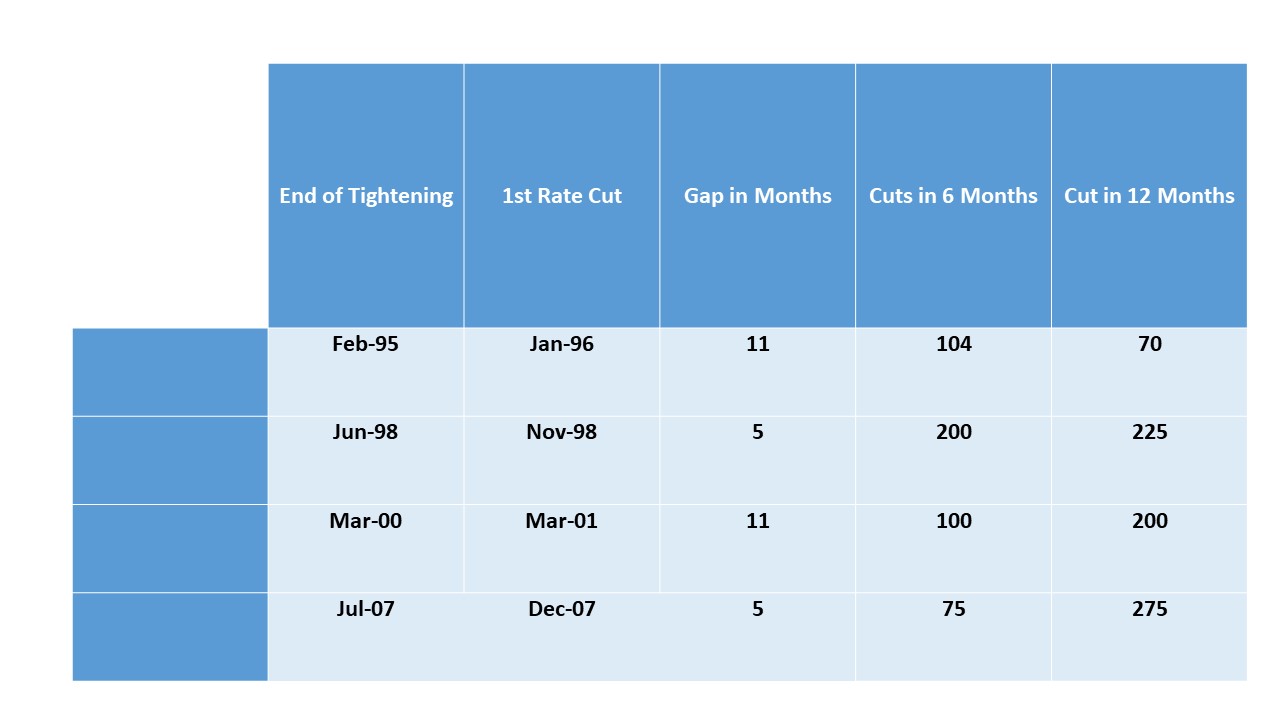

Figure: Previous BOE Easing Cycles

BOE has maintain the message that policy needs to remain sufficiently restrictive, though clearly six members are unlikely to agree with the remaining three hawks for a further hike. Data since the November report has made most more comfortable and we see the BOE become less hawkish in H1 2024, with the first cut most likely being delivered in Q2 2024. Sufficiently restrictive does not mean no rate cuts and the BOE will likely see downside surprises to its inflation forecast.

BOE communications from the December MPC statement maintain the broad thrust that the committee foresee that policy will need to be sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term. Combined with three people voting for a 25bps hike, this will likely see BOE officials continuing to damp early interest rate expectations (little real prospect exists of a rate hike as the other six members appear to accept that rates have peaked). However, this is backward looking communications to ensure that the rate hikes that the BOE has taken bite and forward guidance is lacking.

What can be said from the BOE December assessment is that they are becoming more comfortable than the November projections. The 0.3% Oct GDP decline, the fall in average weekly earnings to 7.3% in the three months to October were noted (Figure 2); the downside surprises on inflation in other DM economies, plus energy prices coming in lower than assumed in November. However, the six members that voted for no change felt it was too early to conclude that services price inflation and pay growth were on a firmly downward path – though one member sounds somewhat move dovish. The only counterbalance is the material drop in bond yields since the November report, which has already prompted mortgages rate cuts by major UK banks. Meanwhile, the November UK autumn statement was seen boosting demand by up to 0.25% but also supply and the net impact was likely small on the output gap. The BOE is probably in wait and see mood ahead of the February monetary policy report when a proper reassessment occurs.

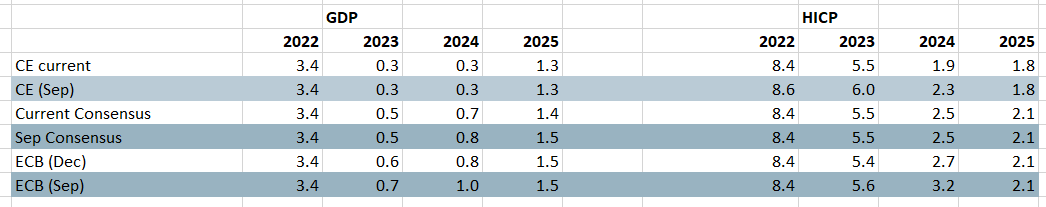

Figure: ECB Still Too Optimistic on Growth

Source: Bloomberg, ECB, CE

As nearly all expected the ECB kept policy on hold for a second successive meeting, making it clearer that policy has peaked. The decision was unanimous and the statement largely repeated that seen in October, most notably which rates are at levels that, maintained for a sufficiently long duration, will make a substantial contribution to getting inflation back to target. This clear attempt to rebuff to market thinking that rates will be cut clearly from next year was reinforced by the ECB’s revised economic forecasts (Figure 1) that see headline inflation stabilizing just under 2% into 2026 but with the core still a notch above target. But the extent to which markets are pricing in rate cuts may have driven the ECB into the surprise move to end PEPP reinvestments early. This we think is misplaced as have been some of the extensive rate hikes and balance sheet reductions that have cramped bank lending. As a result we continue to think that the ECB is too optimistic on the economy and that already slumping inflation (Figure 2) will fall faster and further than it thinks, in turn creating both scope and rational for rate cuts staring in Q2 next year and which will continue in to 2025.

In a somewhat surprise move, at least in terms of timing, the ECB announced its intends to stop some reinvestments of the € 1.7 tn pandemic emergency purchase programme (PEPP) portfolio during the second half of next year, by € 7.5 bn per month on average and then discontinue entirely at the end of 2024. Some € 180 bn of such reinvestments are due in 2024 so that some € 45 bn less will now be reinvested. This is not large and will have little impact on the excess liquidity issue which is worrying some on the ECB. Perhaps more notable, in underscoring that official interest rates are the primary tool for setting the monetary policy, the ECB is trying to play down the significance of this explicit further tightening in unconventional policy, ie effectively stepping up its QT and balance sheet reduction plans.

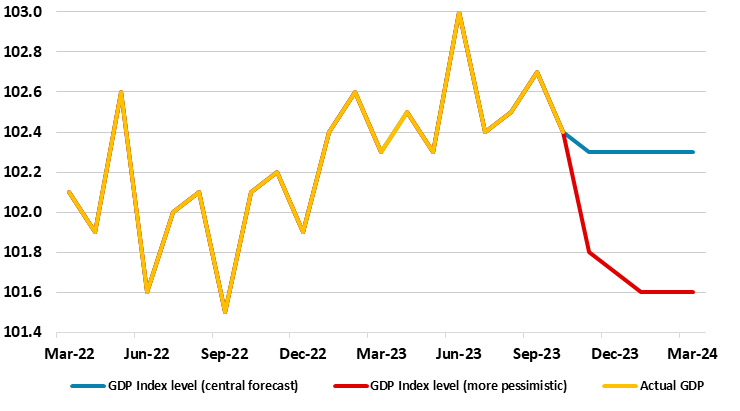

Figure: UK GDP Slides Afresh and With Downside Risks?

Source: ONS, CE

Coming in lower than expected, and probably hindered by poor weather and a recovery in imports, GDP fell by 0.3% m/m in the October data, a result that meant that the surprise rise of the previous month was more than reversed. Regardless, the data prior to these latest numbers was very much indicative of further resilience, not chiming with the recession risks flagged by some business survey data and more recent and still weak retail sales reading. But as we thought, the October data (Figure 2) paves the way for an overall 0.2% q/q drop this quarter, a contrast to the small rise that the BoE has been looking for, albeit with it likely that the Monetary Policy Report due for an update at tomorrow’s MPC decision may show a downgrade. Thus the UK may be in formal recession given that this may be the second successive q/q GDP drop this quarter. Regardless, this data arrives the day before the next BoE policy decision but is unlikely to have any impact on what looks to be a highly likely stable verdict.

The UK economy has apparently been showing some resilience, at least in headline terms, this assertion accentuated by recent upward revisions actually dating back to the midst of the pandemic. This continued into Q3 even though there was a fall in business investment, household spending and government consumption, albeit offset by an increase in the volume of international trade flows. As a result, domestic demand fell afresh in q/q terms. Admittedly, unusually warm weather helped boost services in September and this may have been unwound into Q4. But warm weather continued into October, albeit against very wet conditions too. This may have weighed on utility and construction output and to a degree that may reverse in the rest of Q4. But elsewhere the weak housing market will have an impact via the fall in transactions while we already know retail spending may continue to be weak.

As a result while the recent revisions and Q3 numbers now mean that GDP may grow this year by up to 0.5%, the outlook for 2024 remains gloomy and we have halved our projection to just 0.1%, similar to BoE thinking, ie slightly lower than consensus numbers. This scenario may seem to be in conflict with GDP data that has seemingly shown some degree of resilience in the last few quarters. But this masks commonly overlooked details that show domestic demand having fallen afresh. There are supportive factors: not least the marked drop in wholesale energy prices which will filter through in another bout this month and where the fiscal situation is going to be little more supportive than previously envisaged. But businesses are losing much of the energy support cushion and this will be even more the case in 2024. However, the main concern is clearly the impact of the more sizeable tightening in monetary policy that is already causing tighter financial conditions that will increasingly bite the economy through the credit channel, this very much highlighted by unprecedented declines occurring in both the level of bank credit and bank deposits. This fragile outlook is very much led by the consumer, the most exposed to likely outright damage from the housing market. In perspective, this will involve consumer spending falling modestly in 2023 and slipping a little further in 2024.