U.S. November CPI - Some strong components but acceptably subdued overall

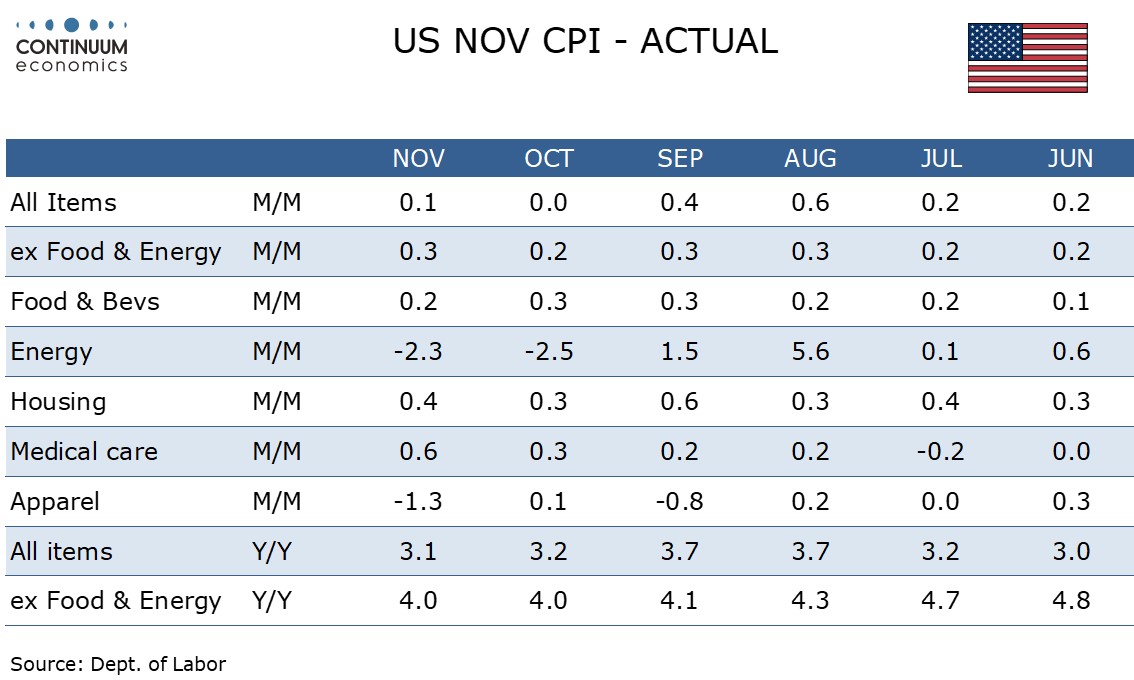

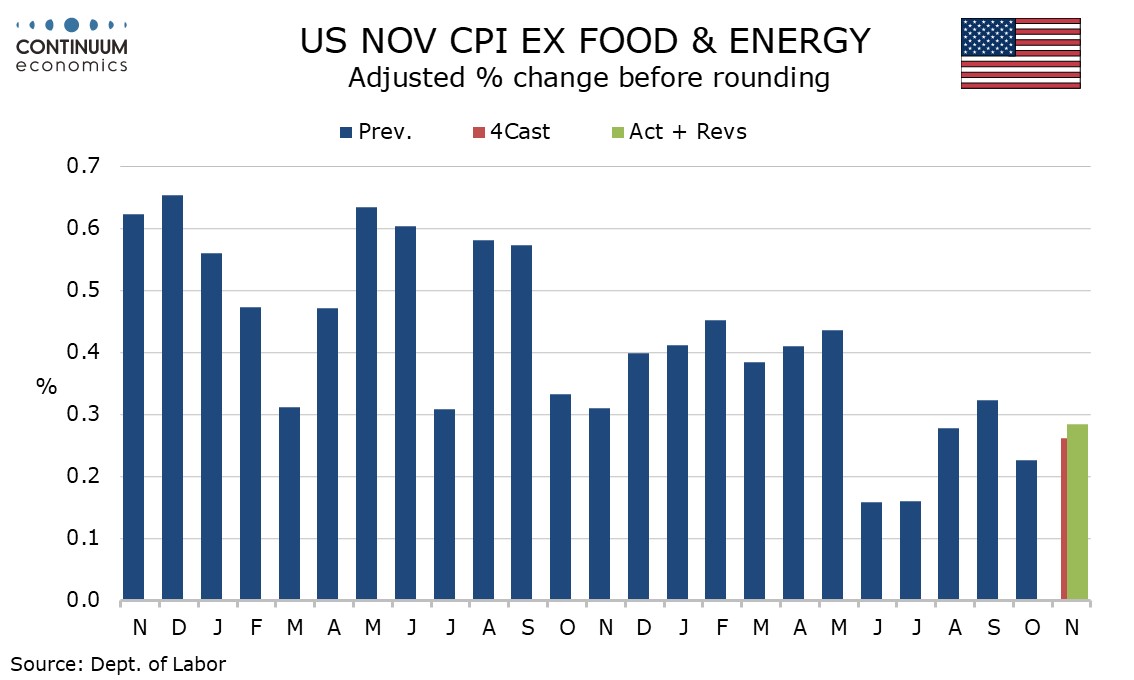

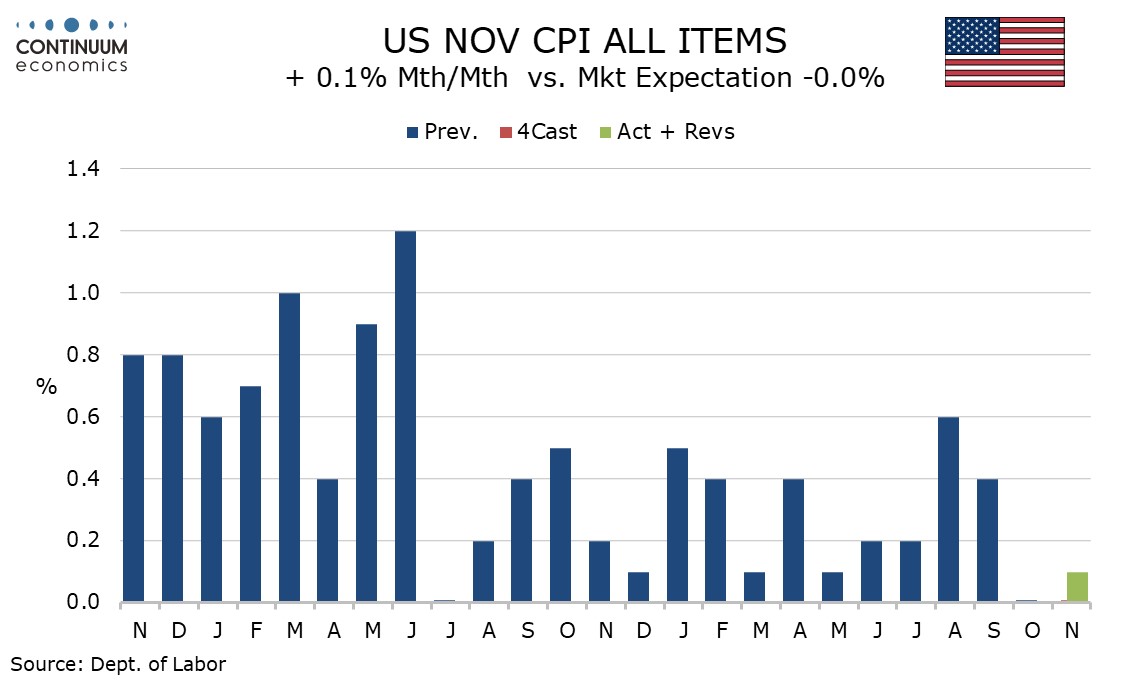

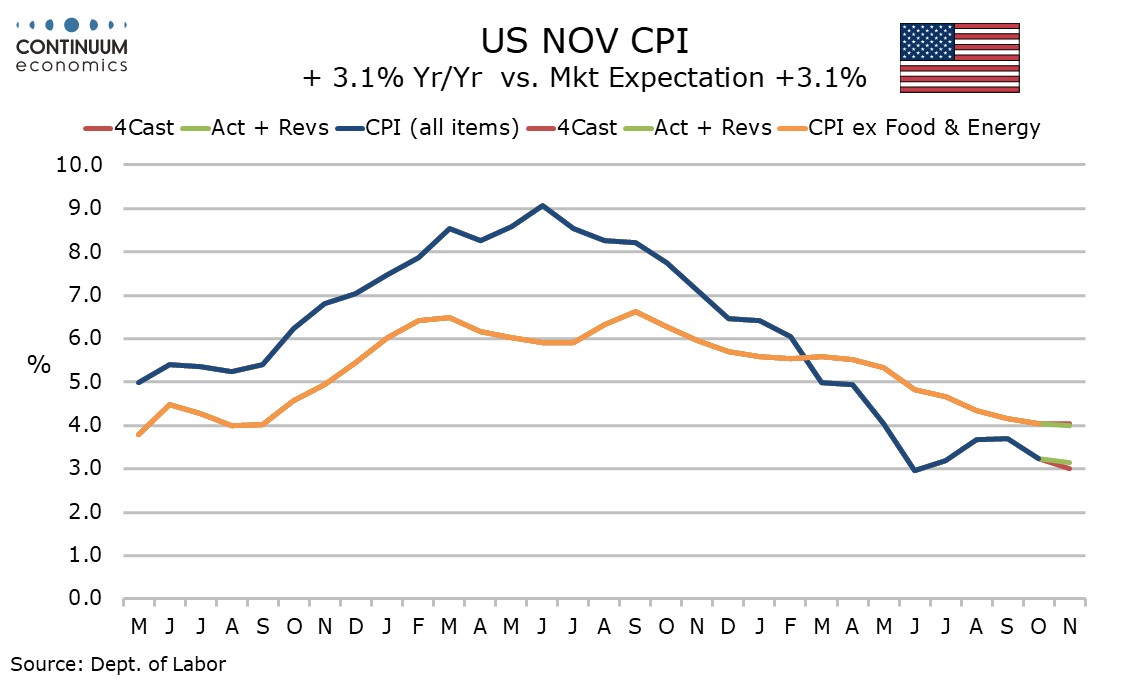

November’s CPI saw a 0.1% increase, slightly stronger than expected as a rise in energy services partially offset a fall in gasoline, but the core rate ex food and energy with a 0.3% increase was in line with expectations, and being slightly below 0.3% (0.285%) before rounding, leaves recent progress on inflation largely intact.

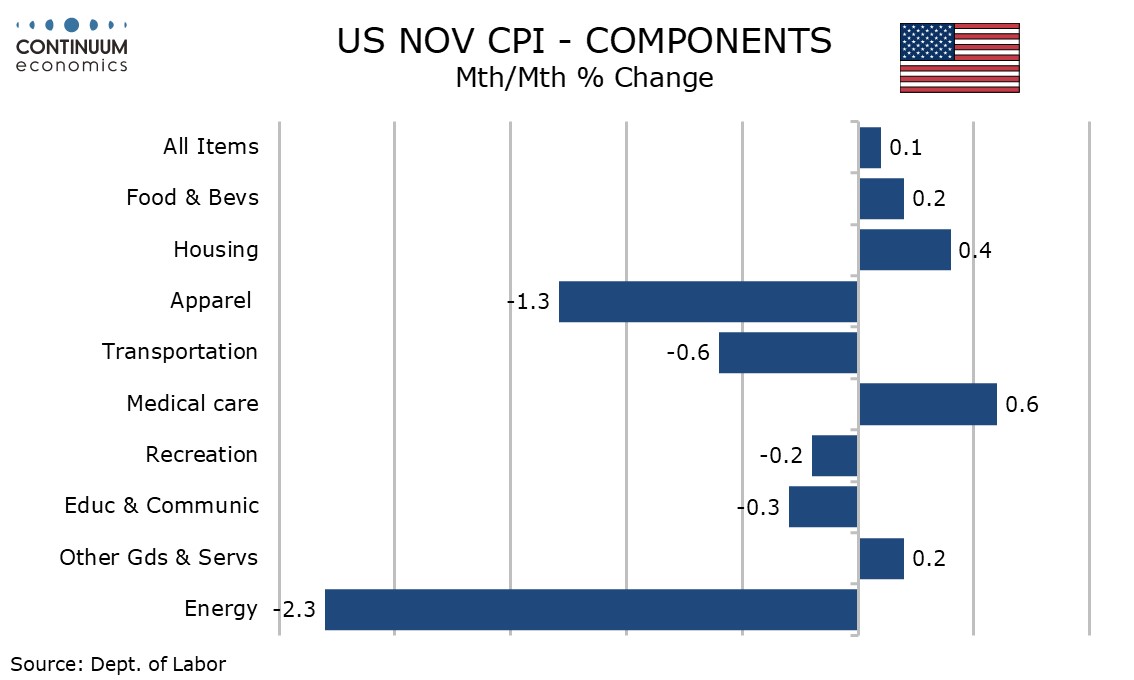

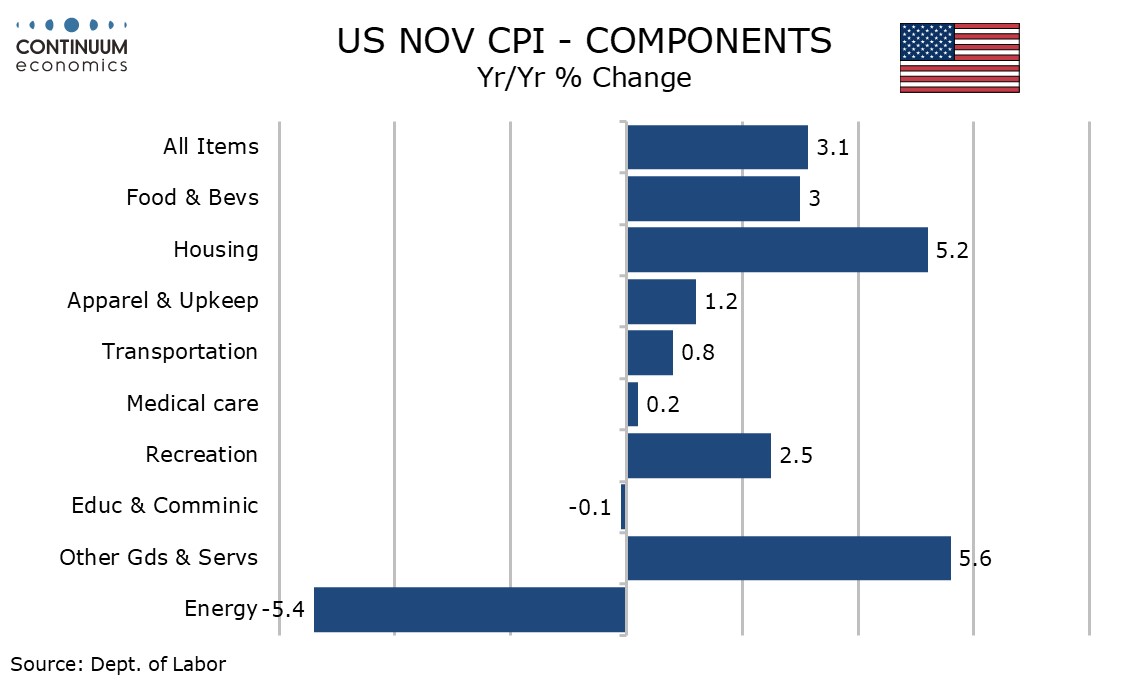

While there was an unexpected rise in used autos of 1.6%, adding 0.05% to core CPI, commodities ex food and energy remained weak, falling by 0.3%, a 1.3% fall in apparel largely offsetting the bounce in used autos.

Services less energy rose by 0.5% after a 0.3% increase in October with a 0.6% rise in medical care services the most notable area of strength. This was a sector that was seen as a source of upside risk in October as new methodology was introduced. While October’s data was subdued enough to provide relief November’s medical care data suggests that the new methodology is boosting the data, and this could persist in the months ahead.

If medical care, which was consistently weak in the first nine months of the year, is picking up, it could be a barrier to further progress on core CPI, but we expect core PCE prices will show less of an acceleration in medical care, and if so the data is probably not going to be a game changer for the Fed.

Shelter was also stronger in November than October, with owner’s equivalent rent rising by 0.5%, stronger than October’s 0.4% but slower than September’s 0.6%. This sector remains stronger than the Fed would like.

Yr/yr core CPI at 4.0% is unchanged from October’s outcome which was the slowest since September 2021. Overall CPI fell to 3.1% yr/yr from 3.2%, still above June’s low of 3.0%.