ECB Review: Council Sticks to its Optimistic Guns

As nearly all expected the ECB kept policy on hold for a second successive meeting, making it clearer that policy has peaked. The decision was unanimous and the statement largely repeated that seen in October, most notably which rates are at levels that, maintained for a sufficiently long duration, will make a substantial contribution to getting inflation back to target. This clear attempt to rebuff to market thinking that rates will be cut clearly from next year was reinforced by the ECB’s revised economic forecasts (Figure 1) that see headline inflation stabilizing just under 2% into 2026 but with the core still a notch above target. But the extent to which markets are pricing in rate cuts may have driven the ECB into the surprise move to end PEPP reinvestments early. This we think is misplaced as have been some of the extensive rate hikes and balance sheet reductions that have cramped bank lending. As a result we continue to think that the ECB is too optimistic on the economy and that already slumping inflation (Figure 2) will fall faster and further than it thinks, in turn creating both scope and rational for rate cuts staring in Q2 next year and which will continue in to 2025.

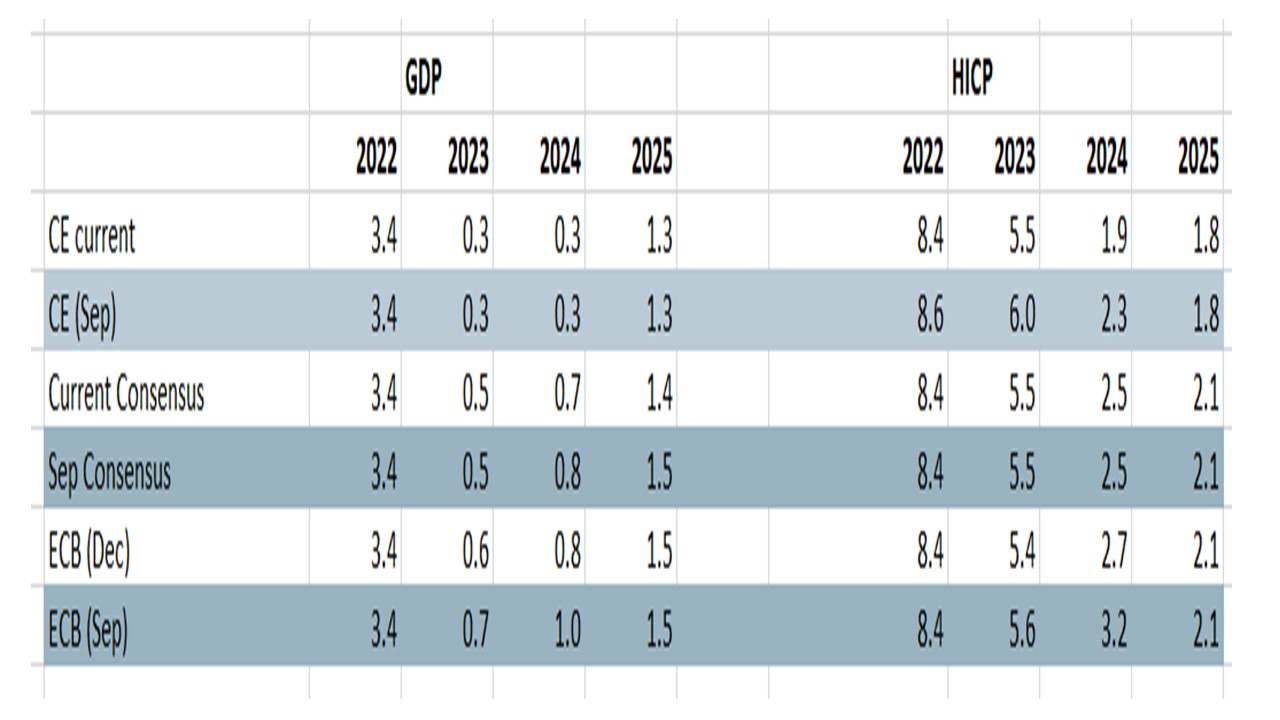

Figure 1: ECB Still Too Optimistic on Growth

PEPP Talk and Walk

In a somewhat surprise move, at least in terms of timing, the ECB announced its intends to stop some reinvestments of the € 1.7 tn pandemic emergency purchase programme (PEPP) portfolio during the second half of next year, by € 7.5 bn per month on average and then discontinue entirely at the end of 2024. Some € 180 bn of such reinvestments are due in 2024 so that some € 45 bn less will now be reinvested. This is not large and will have little impact on the excess liquidity issue which is worrying some on the ECB. Perhaps more notable, in underscoring that official interest rates are the primary tool for setting the monetary policy, the ECB is trying to play down the significance of this explicit further tightening in unconventional policy, ie effectively stepping up its QT and balance sheet reduction plans.

But we continue to argue that the balance sheet reduction has caused (or at least accentuated) banking sector fragilities, most notably in terms of an unprecedented drop in bank deposits that is acting to reduce bank’s appetite and willingness to lend, with obvious adverse consequences for the real economy. This makes us think that this PEPP move is misplaced, as it is hardly a data-dependent decision and also reduces a flexibility to address market fragmentation. Moreover, the rational looks flimsy, particularly if it was triggered by Council hawks worried that falling inflation may remove any rationale for such a move if they waited any longer. NB: it is unusual that this policy move was not flagged in advance as Lagarde said in October that such matter had not even been discussed!

How Long is “Sufficiently Long”

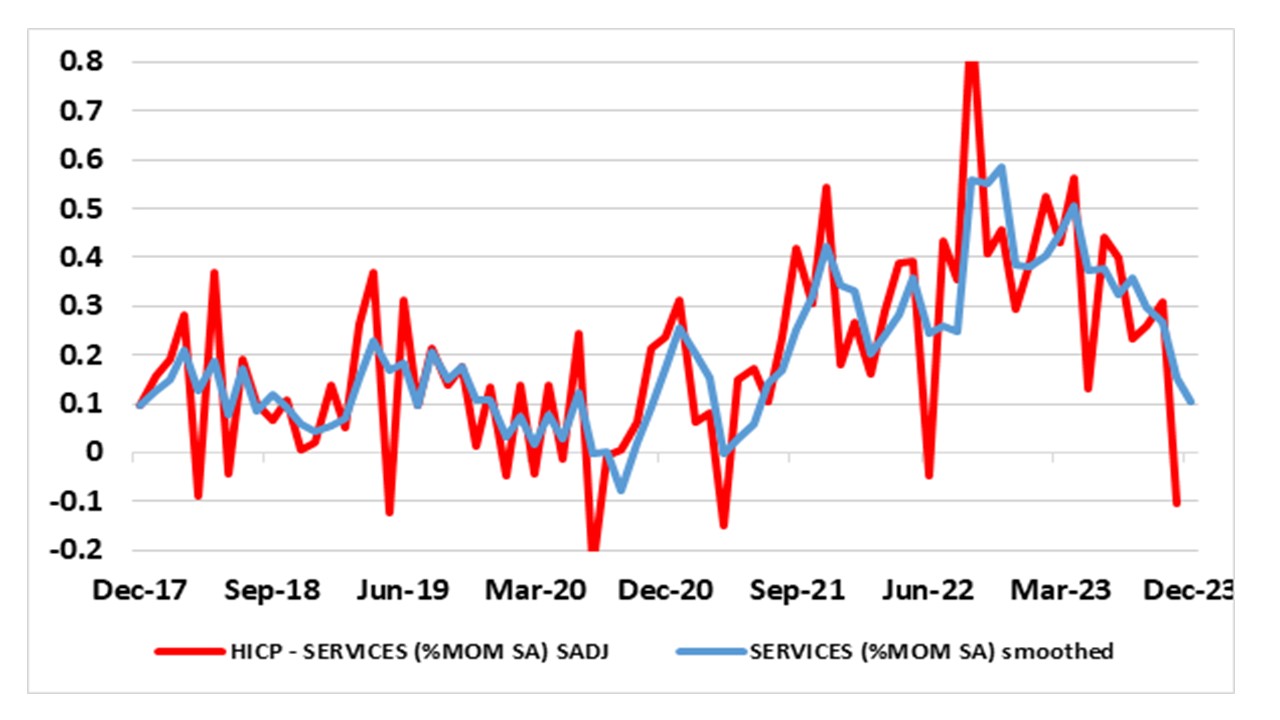

This widely expected stable policy decision still leaves official rates at the highest in ECB history and encompassing a cumulative hike of 450 bp, also unprecedented and taking a toll on both demand and most measures of underlying inflation. Indeed, the ECB now accepts that underlying inflation has fallen and has made a marked and almost unprecedented reduction to its 2024 inflation outlook as a result of recent downside surprises. But it is clear that the ECB has inflation reservations. One is that it thinks domestic (and particularly services) inflation is proving resilient. But this is because it focuses on y/y numbers and places little importance on the seasonally adjusted numbers it produces itself. These show a very different picture with slumping service price inflation (Figure 2).

Regardless, these inflation worries make it unsurprising that President Lagarde again used the press conference to underline policy is now ‘holding’ and underline no early easing. However, this could be very much in conflict with the suggestion that if the Council really does have a predisposition that it will be data dependent, then how much more downside surprises will be need to make the ECB at least implicitly accept it has not only hiked extensively but also excessively. Indeed, given current ECB thinking which states that ‘we consider that rates are at levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to our target’, the question is actually how long is “sufficiently long” and what will persuade the ECB that such a period of time has been reached.

ECB Too Optimistic on Growth

It could be argued that such a point has already been reached given that existing ECB projections envisage inflation below target by Q4 2025 and then through 2026. But the ECB needs more persuasion. We think this will be forthcoming for an apparently ‘data dependent’ Council. Indeed, we think that ever-worsening real economy prospects will materialize, causing a further slide in core inflation and thus force the ECB to revisit its over-optimistic economic outlook – we see 75 bp of cumulative easing in 2024, an unchanged view from three months ago and this easing cycle to continue into 2025 with a further 100 bp drop in rates.

Figure 2: Services Inflation Slowing Sharply

Source: ECB, smooth equates to 3-mth mov avg