UK GDP Review: GDP Resilience Dissipates

Coming in lower than expected, and probably hindered by poor weather and a recovery in imports, GDP fell by 0.3% m/m in the October data, a result that meant that the surprise rise of the previous month was more than reversed. Regardless, the data prior to these latest numbers was very much indicative of further resilience, not chiming with the recession risks flagged by some business survey data and more recent and still weak retail sales reading. But as we thought, the October data (Figure 2) paves the way for an overall 0.2% q/q drop this quarter, a contrast to the small rise that the BoE has been looking for, albeit with it likely that the Monetary Policy Report due for an update at tomorrow’s MPC decision may show a downgrade. Thus the UK may be in formal recession given that this may be the second successive q/q GDP drop this quarter. Regardless, this data arrives the day before the next BoE policy decision but is unlikely to have any impact on what looks to be a highly likely stable verdict.

Clearly, this picture is being framed by BoE policy alongside the damage to spending power from high inflation, this explaining the very weak underlying picture in which the downside risks we underscore are also being flagged by consumer trends.

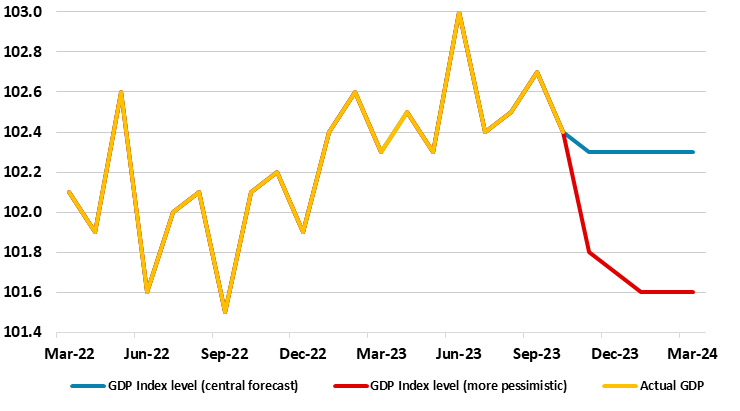

Figure 1: UK GDP Slides Afresh and With Downside Risks?

Source: ONS, CE

Downside Risks Still Clear?

The UK economy has apparently been showing some resilience, at least in headline terms, this assertion accentuated by recent upward revisions actually dating back to the midst of the pandemic. This continued into Q3 even though there was a fall in business investment, household spending and government consumption, albeit offset by an increase in the volume of international trade flows. As a result, domestic demand fell afresh in q/q terms.

Admittedly, unusually warm weather helped boost services in September and this may have been unwound into Q4. But warm weather continued into October, albeit against very wet conditions too. This may have weighed on utility and construction output and to a degree that may reverse in the rest of Q4. But elsewhere the weak housing market will have an impact via the fall in transactions while we already know retail spending may continue to be weak.

As a result while the recent revisions and Q3 numbers now mean that GDP may grow this year by up to 0.5%, the outlook for 2024 remains gloomy and we have halved our projection to just 0.1%, similar to BoE thinking, ie slightly lower than consensus numbers. This scenario may seem to be in conflict with GDP data that has seemingly shown some degree of resilience in the last few quarters. But this masks commonly overlooked details that show domestic demand having fallen afresh. There are supportive factors: not least the marked drop in wholesale energy prices which will filter through in another bout this month and where the fiscal situation is going to be little more supportive than previously envisaged. But businesses are losing much of the energy support cushion and this will be even more the case in 2024. However, the main concern is clearly the impact of the more sizeable tightening in monetary policy that is already causing tighter financial conditions that will increasingly bite the economy through the credit channel, this very much highlighted by unprecedented declines occurring in both the level of bank credit and bank deposits. This fragile outlook is very much led by the consumer, the most exposed to likely outright damage from the housing market. In perspective, this will involve consumer spending falling modestly in 2023 and slipping a little further in 2024.

As for details, services output fell by 0.2% in October, driven by a fall in information and communication, and was the main contributor to the fall in growth in GDP; this follows growth of 0.2% in September 2023. Production output fell by 0.8% in October 2023, driven by widespread declines in manufacturing, after showing no growth in September 2023. The construction sector fell by 0.5% in October 2023 after growth of 0.4% in September 2023.