BoE Review: Table Mountain Still, But Descending Q2 2024

BOE has maintain the message that policy needs to remain sufficiently restrictive, though clearly six members are unlikely to agree with the remaining three hawks for a further hike. Data since the November report has made most more comfortable and we see the BOE become less hawkish in H1 2024, with the first cut most likely being delivered in Q2 2024. Sufficiently restrictive does not mean no rate cuts and the BOE will likely see downside surprises to its inflation forecast.

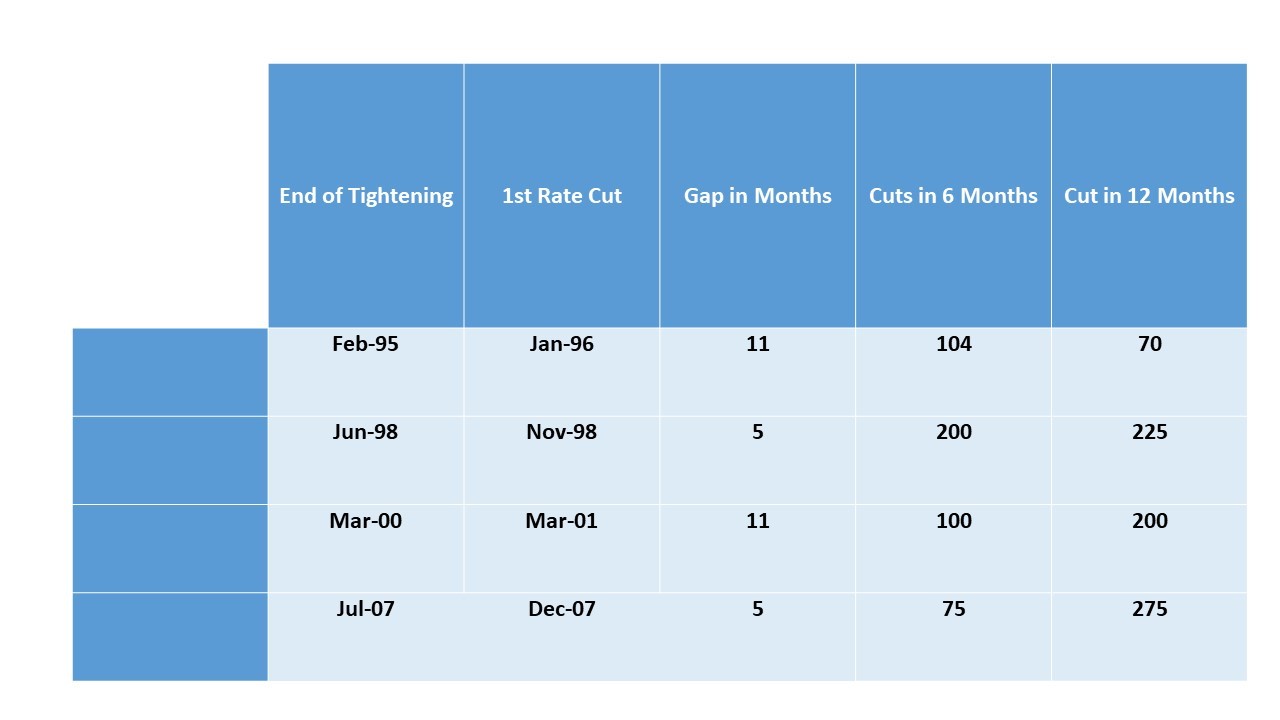

Figure 1: Previous BOE Easing Cycles

Source: BOE/Continuum Economics

BOE communications from the December MPC statement maintain the broad thrust that the committee foresee that policy will need to be sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term. Combined with three people voting for a 25bps hike, this will likely see BOE officials continuing to damp early interest rate expectations (little real prospect exists of a rate hike as the other six members appear to accept that rates have peaked). However, this is backward looking communications to ensure that the rate hikes that the BOE has taken bite and forward guidance is lacking.

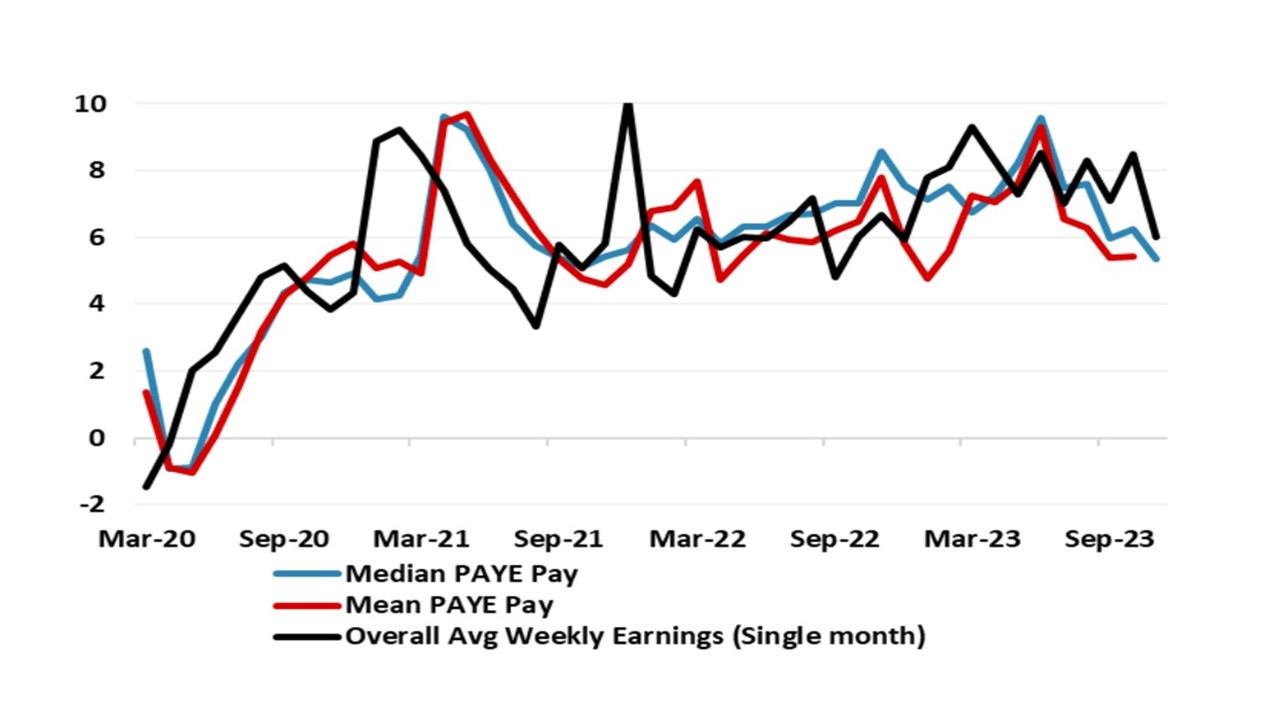

What can be said from the BOE December assessment is that they are becoming more comfortable than the November projections. The 0.3% Oct GDP decline, the fall in average weekly earnings to 7.3% in the three months to October were noted (Figure 2); the downside surprises on inflation in other DM economies, plus energy prices coming in lower than assumed in November. However, the six members that voted for no change felt it was too early to conclude that services price inflation and pay growth were on a firmly downward path – though one member sounds somewhat move dovish. The only counterbalance is the material drop in bond yields since the November report, which has already prompted mortgages rate cuts by major UK banks. Meanwhile, the November UK autumn statement was seen boosting demand by up to 0.25% but also supply and the net impact was likely small on the output gap. The BOE is probably in wait and see mood ahead of the February monetary policy report when a proper reassessment occurs.

We see downside risks on the economy and for inflation and this could come through by the February report. By May these downside should be clear and we feel that this will prompt the BOE to cut rates by 25bps in Q2 2024. We would argue that with falling inflation that real rates are edging higher. Furthermore, sufficiently restrictive policy can be achieve with rate cuts to achieve the inflation target sustainably, especially if downside surprises are seen relative to the BOE growth forecasts. We look for a total of 100bps of cuts in 2024.

Figure 2: Wage Developments

Source: BOE/Continuum Economics