FOMC holds rates but dots and statement more dovish

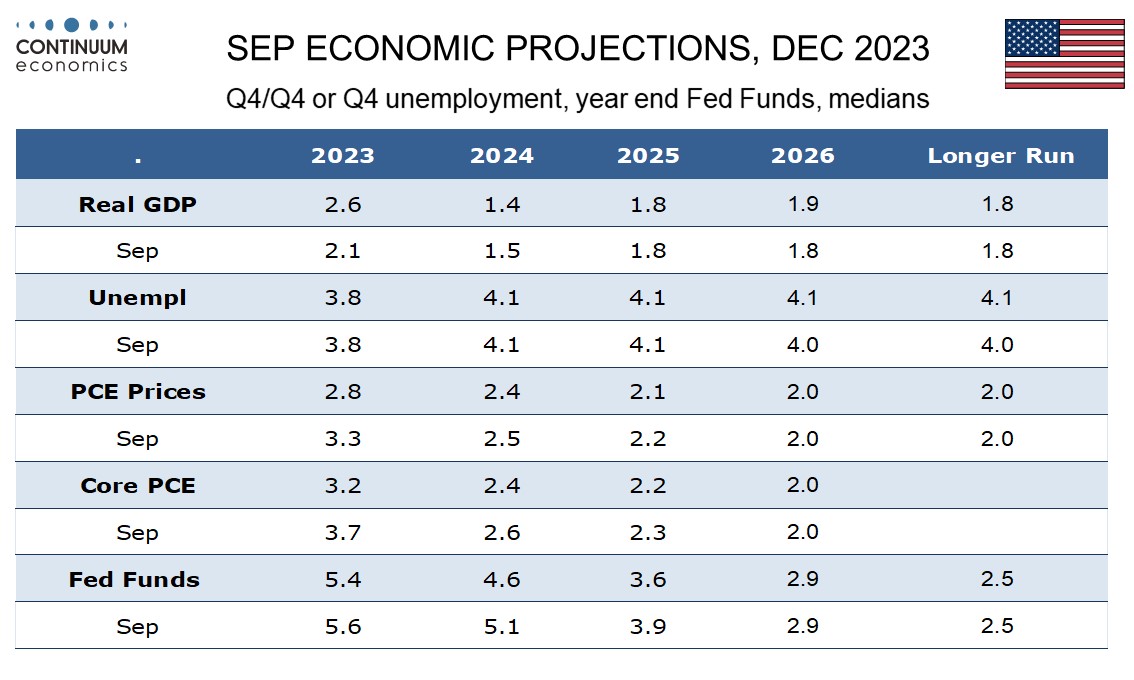

The FOMC has left rates unchanged at 5.25-5.50% as expected though made some dovish adjustments to the statement and to the dots. The FOMC no longer expects further tightening while the dots see 75bps of easing in 2024 rather than 50, which with the end 2023 rate 25bps lower than seen in December means the 2024 view has been adjusted down by 75bps.

Looking at the 2024 dots six are on the median of 4.625%, with eight above and five below. Economic forecasts show GDP for 2023 revised higher and inflation revised lower, reflecting recent data, but GDP and unemployment views for 2024-2026 are almost unchanged and inflation forecasts for those years have seen only modest downgrades, with the median forecasts still not seeing the 2.0% core PCE price target being reached until 2026. The dots actually see a slightly slower pace of easing in 2025 and 2026 than September, though the end 2025 level is 25bps lower than seen in September given the adjustments to 2023 and 2024.

The main change in the statement is that they now reference any additional firming that may be appropriate, the addition of the word any suggesting additional firming is no longer expected, though it is still seen as possible while easing is unlikely to be debated at a near term meeting. The statement also suggests that recent indicators suggest that growth has slowed from its strong Q3 pace, a notable shift given that we have only limited data for Q4 at this point. They also add that inflation has eased over the past year, that clearly evident in the data, while continuing to describe it as elevated. Despite the statement being less hawkish, there were no dissenting votes.