Turkiye Inflation Preview: CPI will Continue to Decelerate in September

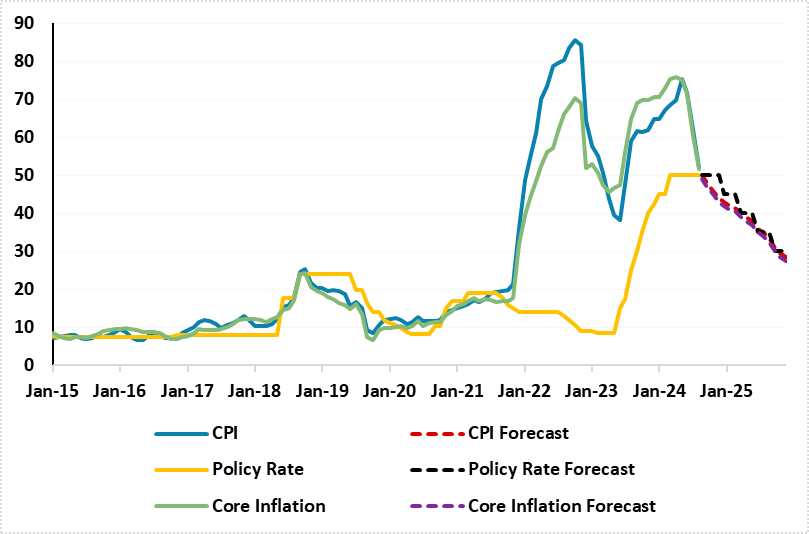

Bottom line: After easing to 51.9% y/y in August from 61.8% y/y in July due to favorable base effects, the lagged impacts of the tightening cycle, relative slowdown in credit growth, and tighter fiscal stance, we expect the falling trend will continue in September supported by moderate slowdown in domestic demand. We foresee CPI will decelerate to around 48% in September.

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – December 2025

Source: Continuum Economics

After easing to 51.9% y/y in August supported by the lagged impacts of the tightening cycle, relative slowdown in credit growth, and tighter fiscal stance, we expect the falling trend will continue in September supported by moderate slowdown in domestic demand and relative TRY stability, we think inflation will cool off to around 48% in September. (Note: TRY lost 5% of its value against the U.S. dollar between June and August.)

Remaining hopeful, Treasury and Finance Minister Mehmet Simsek acknowledged on September 25 that inflation is still high but reiterated expectations it would see a significant decline by 2025, as tighter monetary policy begins to show its delayed effects and fiscal and income policies will become more supportive. Simsek added that inflation is expected to fall to between 40%-42% this year, before dropping below 20% next year.

Despite CBRT predicts inflation will to fall to 38% and 14% at end-2024 and end-2025, respectively, and the government sees end 2024 inflation of 41.5% in the updated medium-term program (MTP), we foresee end-year inflation will likely hit around 43% higher than CBRT’s year-end inflation target as our forecast for the annual average inflation remain higher than government targets at 58.8%, and 35.3% in 2024 and 2025, respectively. We anticipate high inflation expectations, stickiness in services inflation, deteriorated pricing behavior, and geopolitical risks will keep inflation pressures alive.

On the key rate front, we expect cautious and hawkish CBRT to delay cutting rates for the rest of 2024 and until there is a sustained decline in the underlying trend of monthly inflation is observed, given CBRT governor Karahan repeatedly stressed that CBRT would do whatever it takes to avoid any lasting deterioration in inflation as it maintains a tight monetary policy stance. We feel the first rate cut will happen in Q1 2025 given residual inflationary risks. Our end year key rate prediction is 50.0% for 2024, and 30.0% for 2025 as we believe 500bps cuts in every quarter in 2025.

As CPI softened in Q3 ignited by favourable base effects, lagged impacts of aggressive tightening and relative TRY stability underpinning the inflation relief, we envisage that inflation will continue decelerate in Q4, but the extent of the decline will be determined by administrative price adjustments, TRY volatility and tax adjustments. In spite of strong monetary tightening, we still think the road to bringing inflation back down to single-digit levels will be very bumpy, and the inflation getting there before 2027 remains unlikely.