U.S. Fiscal Problems: 2025 More Than 2024

Current real yields in the U.S. government bond market already large reflect the large government deficit trajectory. Even so, H1 2025 could see some extra fiscal tensions that add 30-40bps to 10yr U.S. Treasury yields as the post president election environment will either see a reelected Joe Biden challenged by Republicans over the debt ceiling or a president Trump pushing for his tax cuts to be made permanent.

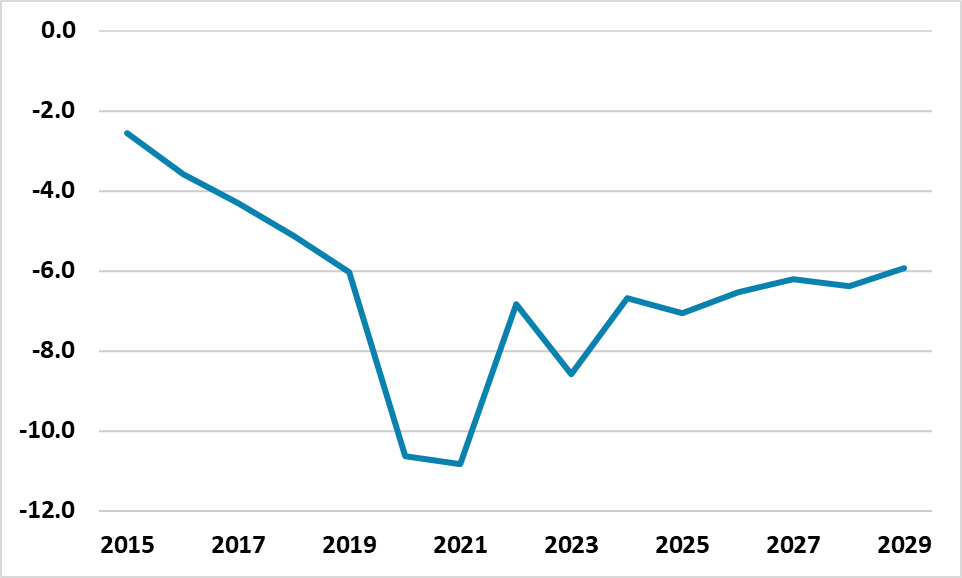

Figure 1: U.S. General Government Deficit to GDP (%)

Source: IMF

The U.S. continues to run a large and persistent budget deficit, with President Biden IRA act adding to the size of the deficit in 2024 and beyond (Figure 1). Despite the scale of the budget deficit we do not expect much further fiscal pressure in 2024 for a number of reasons.

· U.S. Real Yields already high post GFC. The Fed tightening and associated rise in nominal yields across the curve has left real yields high versus the post GFC experience, with 10yr breakeven inflation currently at 2.35%. The fiscal and supply situation is already largely in the price, given the swing from negative real yields in recent years.

· Investor interest. Domestic investors have helped absorb net issuance and Fed QT flows, as the fear of higher yields has been strategically replaced by a sense that U.S. inflation is moving back towards target and the Fed will reduce restriction at some stage – notwithstanding the tactical rise in yields this year as the market discounts less Fed easing. High starting yields in nominal and real terms, plus cheapness versus U.S. equities, means that U.S. investors are allocating more towards U.S. Treasuries and corporate bonds. Foreign investors’ U.S. Treasury holdings have crept higher in the last 12 months, as China disinvestment has been more than counterbalanced by others attracted by U.S. yields or alternatively still accumulating FX reserves and parking them in U.S. Treasuries.

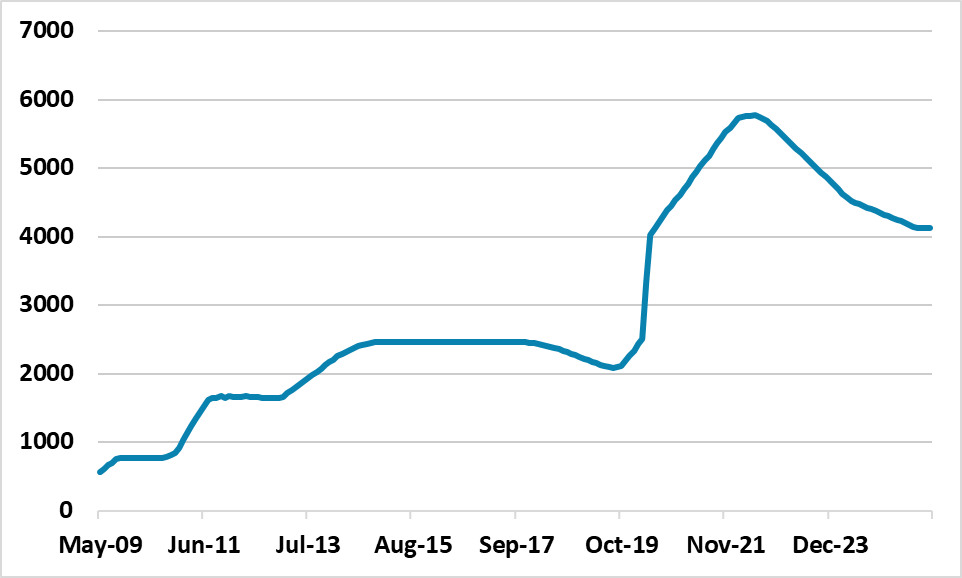

· Less Fed QT. The Fed decision to reduce the cap for U.S. Treasury rundown from $60bln pm to $25bln pm will mean that the supply question become largely a function of net issuance. This should become even more evident in 2025 when cumulative Fed easing and liquidity considerations will likely see QT for U.S. Treasuries stopping (Figure 2) – though we would see QT MBS going on in the background.

Figure 2: Fed Holdings of U.S. Treasuries Projected Out to 2025

Source: Datastream/Continuum Economics

However, the U.S. fiscal worries can reappear in H1 2025 in a number of scenarios.

· If President Biden is reelected, then Republicans will likely cause political problems over raising the debt ceiling. This would be moderate tensions with the Republicans controlling the Senate and the Democrats the House (our central scenario), but would be more difficult and prolonged if the Republicans controlled the House. Rating agencies are unlikely to be happy with this or the lack of willpower to reduce deficits via increased taxes or reduce expenditure growth.

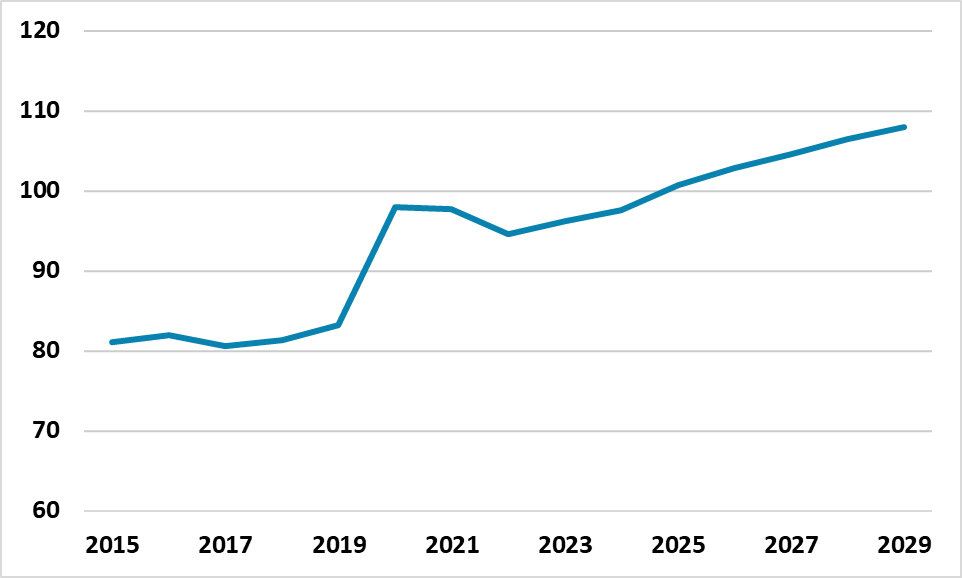

· If Donald Trump is elected president, then he would likely push for his tax cuts to be made permanent and not expire. He would likely cut some IRA support and other expenditure, but the overall result would likely be expansionary for the budget deficit. The U.S. government debt/GDP trajectory net of financial assets is already set to climb through the remainder of the decade (Figure 3). Rating agencies would be more worried if the existing rule of law were changed in the U.S., with the Trump camp reported to be considering replacing top civil servants with political appointees and reducing the Fed’s independence. Rating agencies would view this dimly if it is too aggressive and risk multiple agencies downgrading the U.S. in H1 2025.

Figure 3: Net U.S. General Government Debt to GDP (%)

Source: IMF

However, context is required, as the likely increase in U.S. 10yr yields would only be around 30-40bps. The government deficit and debt only really comes to bite more noticeably when the actual interest payments to GDP start climbing noticeably. This takes time given the outstanding stock of U.S. Treasuries with low coupons from the post GFC era. However, into the 2 half of the 2020’s it could become an issue depending on where the terminal policy rate is in the next Fed easing cycle; how much 10yr U.S. Treasury yields come down and the U.S. Treasury’s issuance biases.