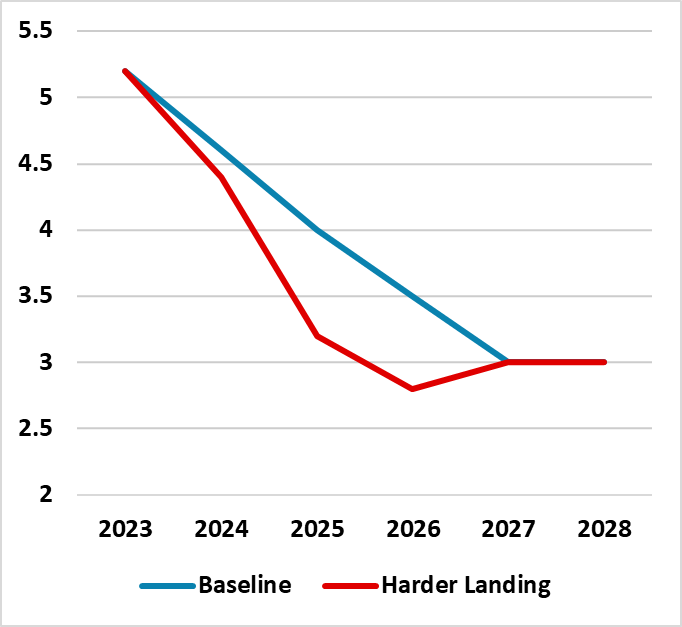

China Harder Landing Scenario

We see a 30% probability of a harder landing in China GDP growth in 2025, which we most likely be in the 3-4% region but could persist into 2026 (Figure 1). A large than projected slowdown in consumption would be a key concern, alongside persistently moderate negative deductions from residential investment. Negative inflation would only worsen this situation, while China authorities appear reluctant to go beyond targeted extra policy support towards aggressive action.

Figure 1: Baseline and Downside Scenario GDP Growth (%)

Source Continuum Economics (our baseline is driven by population aging and slowing productivity)

Our baseline view for China GDP trajectory remains 4.6% for 2024 and 4.0% for 2025 (here), as we see public sector investment; exports and high tech manufacturing helping the economy. Nevertheless, growth is unbalanced with an ongoing multi-year drag from residential construction investment, plus slowing consumption. We have a 30% probability of a harder landing in 2025, due to the following issues

· Residential investment bigger drag. The poor sentiment in the housing sector could get worse, as developers struggle with unsold homes; falling house prices and shaky finances. This could cause 2 round effects in steel, cement; wider construction employment and local government finances that are dependent on land sale taxes. We have recently outlined these issues in more detail (here), which could mean that instead of our baseline that construction negative GDP contribution getting more modest that it stays at 1.0-1.5% of GDP. Government policies would stop it getting worse than that.

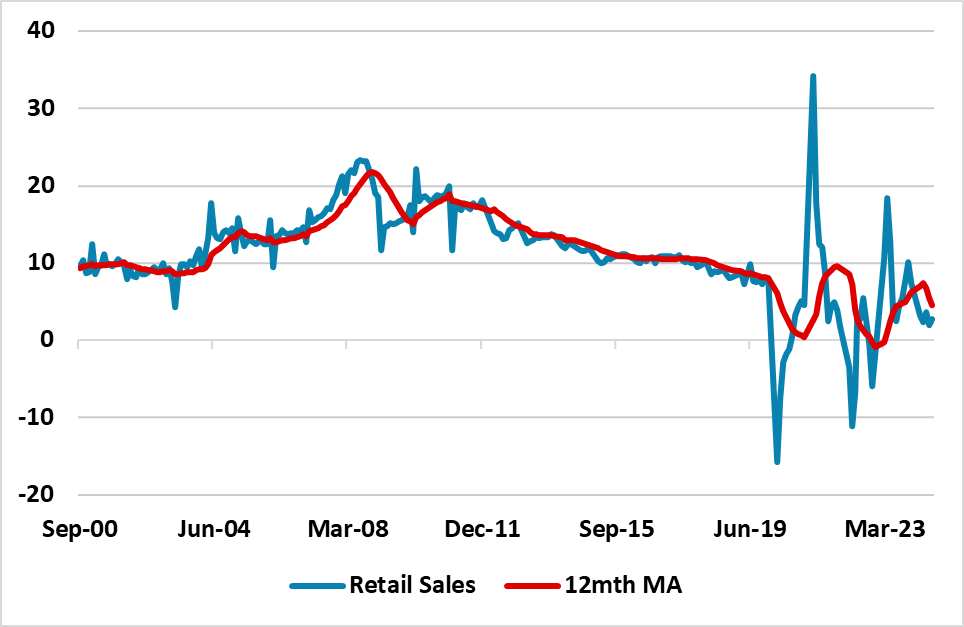

· Consumer slowdown. We are uncertain about consumption, which is weaker than the GDP trajectory (here). Post Covid pent up demand is fading, but weakness in auto sales/appliances/furniture remain. China households are reluctant to make big ticket purchases and this is also now impacting sales of luxury items that have for so long been a status symbol in China. Adverse wealth effects from housing is having an impact but the magnitude is uncertain. Slowing employment and wage growth is also hurting consumption, but the impact is also uncertain. Though China’s households already hold large savings balance, this is for long term precautionary savings for health/unemployment and retirement. The impact of these issues could be great than we have penciled in our baseline forecasts.

Figure 2: China Retail Sales Trend (%)

Source Datastream/Continuum Economics

· Deflation. Inflation in China is being hurt by an excess of domestic production over consumption, which has prompted a push to exports at lower prices. This has already prompted some western tariffs by the U.S./EZ. If Kamala Harris wins the U.S. presidential election then it could get a bit worse, but if Donald Trump wins it could cause a trade war with China and hurt export prospects. If ultra-low inflation become small negative inflation, it is not really deflation but would still impact real GDP growth by delaying consumption and investment decisions – the IMF estimate that a 1% reduction in core China CPI would knock 0.5% off annual GDP growth (here).

· Targeted Government Policy. Government stimulus in 2023 and 2024 has been targeted, partially as the GDP trajectory has been close to government objectives. However, China’s policymakers are also concerned that aggressive stimulation is difficult with the total government/corporate and households/GDP ratio already exceeding U.S./EZ and risks a Japan style bust if debt/GDP is pushed up aggressively. Additionally, the government wants to transition away from construction, but has focused on high tech and renewable production. However, significant cyclical or structural support for households is not seen as a priority by the authorities. China authorities will face a crossroads in 2025, as the recent IMF article IV report had China’s officials forecasting medium-term growth at 5-6% -- well above private sector forecasts for 2025-28. If China really wants to achieve these growth numbers then aggressive policy stimulus would be required.

Overall, this suggests a 30% probability of a harder landing 2025/26, most likely in the 3-4% region. Anything worse and China policymakers could swing towards aggressive policy action. We do not really see this alternative economic harder landing being amplified by a financial crisis. Though sections of China rural and mid-tier banking system are weak, policymakers are already forcing mergers and takeovers and have lots of experience in proactive policy in rescue the banking system in the bailout of large banks 1997-04. Additionally, China financial system can be directed by the authorities as a lot of creditors are sensitive to official desires, as was seen with loan extensions during the COVID crisis.