USD, JPY, GBP, CHF flows: JPY remains cheap, USD, CHF and GBP expensive

The market is focused on which way risk sentiment will turn, but there is value in the FX market either way

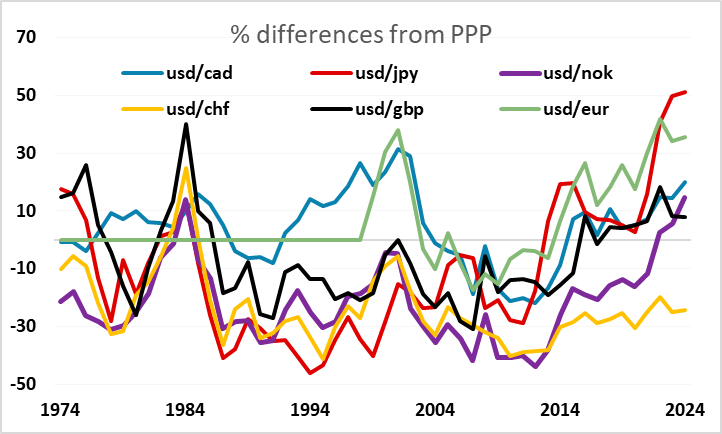

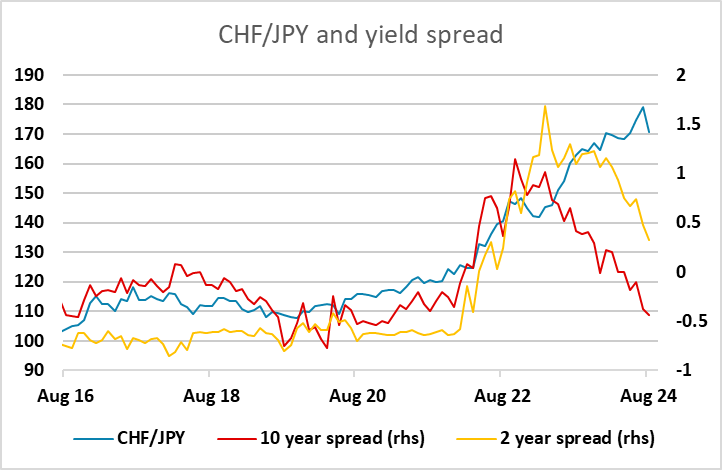

It’s looking like a quiet Thursday in which the markets continue to take stock of recent moves and try to decide whether the recent risk decline was a short-lived correction or the start of a bigger reversal. For the FX market, there are similar questions, but the answers are complicated by a different valuation background. For the JPY, it is 100% clear that the JPY is still very cheap, and even if we do see some risk recovery trigger some short term JPY weakness, the downside for the JPY remains very limited. However, the same is not true for the CHF, which remains expensive, albeit nothing like as expensive as the JPY is cheap. The upside for the CHF is therefore quite limited, even if risk sentiment declines, with the SNB helping to restrict the CHF upside just as the BoJ is restricting the JPY downside. We will also soon see a full reversal of the spread between CHF and JPY rates along the curve, underpinning the case for CHF/JPY losses.

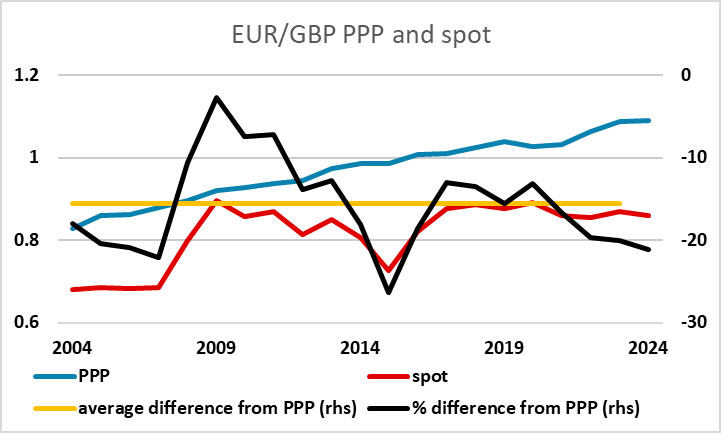

For the higher yielders, the downside ought to be quite limited against the USD as all are still trading on the cheap side. Among the higher yielders, GBP looks the most expensive relative to fundamentals, being the least undervalued against the USD relative to PPP despite a seriously underperforming economy post-pandemic (and post-Brexit vote). Relatively high UK yields are providing short term support for GBP, but it looks hard to justify current levels against the scandis – notably the NOK – or the AUD in the longer run, with these economies significantly outperforming the UK. Even EUR/GBP looks cheap both relative to longer term valuation metrics and relative to current yield spreads, and with CFTC data showing extended speculative net long GBP positions, the risks should remain on the downside.