Turkiye's GDP Growth Decelerates in Q2 with 2.5% YoY

Bottom Line: Turkish Statistical Institute (TUIK) announced on September 2 that Turkish economy expanded by 2.5% YoY in Q2, after growing by a strong 5.7% in Q1 driven by the buoyant demand and government spending. As we expected, the pace of the GDP growth decelerated in Q2 while we envisage the deceleration will be more apparent in H2 2024 due to lagged impacts of aggressive monetary tightening by the Central Bank of Turkiye (CBRT) coupled with tighter fiscal stance and weaker credit growth aiming to cool off galloping inflation. We foresee the Turkish economy to grow by 3.3% YoY in 2024.

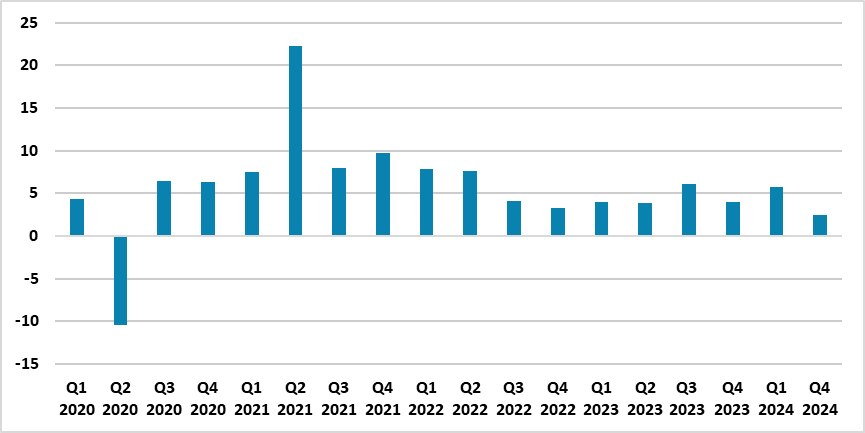

Figure 1: GDP (%, YoY), Q1 2020 – Q2 2024

Source: Continuum Economics

Turkish economy expanded by 2.5% YoY in Q2, after growing by a strong 5.7% in Q1. GDP adjusted for seasonality and calendar effects grew by 0.1% in Q2, down from an expansion of 1.4% during the previous period. When the activities which constitute GDP are analyzed, the value added increased by 7.4% YoY in other service activities, 6.5% in construction, 3.7% in real estate activities and agriculture, 3.4% in information and communication activities, respectively. Industry sector decreased by 1.8% YoY in Q2.

The growth was partly stimulated by strong service exports as Turkiye ranked first among G20 countries in service export growth for Q2, according to a statement from the Ministry of Trade on August 31 highlighting that service exports grew by 9.5% in H1 compared to the same period last year reaching $47.2 billion, resulting in an average trade surplus of around 50% in service trade.

The Treasury and Finance minister Mehmet Simsek has said the economy is moving toward more balanced and sustainable growth as the government has pledged to cool galloping inflation, change the composition of economic growth and attain sustainable levels.

After CBRT lifted the benchmark one-week repo rate from 45% to 50% on March 21 and held it steady in Q2 to establish the disinflation course as soon as possible and to control the deterioration in pricing behavior, we feel the pace of the GDP growth will further decelerate in H2 2024 due to contractionary fiscal actions targeting to slow down demand and lending coupled with additional macro prudential policies. (Note: CBRT announced on August 29 that the ratio for maintaining TRY required reserves in blocked accounts has been increased by 5 points aiming to change to the reserve requirement practice in order to support the monetary transmission mechanism).

Reporting on the expected GDP growth, the International Monetary Fund (IMF) recently notified that following the transformation in economic policies in Turkiye since mid-2023, which reduced crisis risks and increased confidence, both GDP growth and inflation are predicted to shrink this year and next. According to IMF’s statement, tight monetary and income policies will suppress domestic demand and bring 2024 growth to approximately 3.4%. Similarly, Reuters recently announced that GDP growth in 2024 is expected to be 3.35%, based on the median estimate in a recent Reuters poll as the predictions ranged from 3% to 3.5%.

We think that the government will lower GDP growth predictions for 2024 and 2025 as part of the medium-term economic program (MTP) which will be released in September setting key macroeconomic indicators for the 2025-2027 period. It is worth mentioning that the government will continue to focus on bringing down the inflation and likely revise growth predictions down, despite we don’t envisage a sharp slowdown. Taking these into account, we are of the view that the Turkish economy to grow by 3.3% in 2024 as tight monetary policies and fiscal measures will continue to slow domestic demand through the end of the year.