India GDP Review: A Sobering Start to FY25

India’s GDP growth slowed to 6.7% yr/yr in Q1 FY25, falling short of expectations, as reduced public spending during the election period weighed on economic activity. Strong private consumption and investment provided some support, but a decline in manufacturing growth and weak external trade dampened overall momentum. Looking ahead, easing inflation, improved farm output, and a rebound in government spending are expected to drive growth in the coming quarters.

India’s economy expanded by 6.7% yr/yr in Q1 FY25, marking the slowest pace in five quarters (since Q4 FY23) and a significant deceleration from the 7.8% rate observed in the previous quarter, according to provisional data released by the National Statistical Office. The latest figure fell short of our expectations as well as the Reserve Bank of India’s (RBI) forecast of 7.2% growth, underlining the challenges facing Asia’s third-largest economy.

The slowdown was primarily driven by a contraction in public spending, which emerged as the biggest drag on growth during the quarter. A reduction in government capital expenditure, particularly during the general elections held from April 19 to June 1, was a key factor weighing on economic activity. In addition, external trade made a negative net contribution as exports dipped while imports remained elevated, further dampening growth prospects.

Private Consumption and Investment Provide Some Relief

Despite the overall deceleration, the Indian economy found some support from robust private consumption and investment. Household spending surged to a seven-quarter high of 7.4% yr/yr, driven by a recovery in discretionary spending amid easing inflation. Private investment also remained resilient, bolstered by an uptick in real estate activity and increased infrastructure development by the private sector, even as government expenditure faltered.

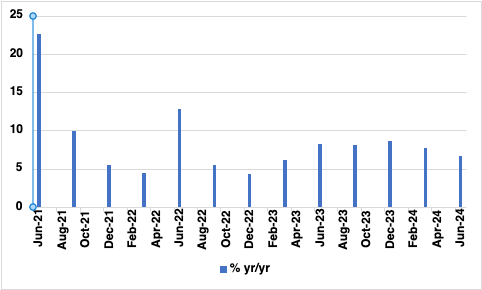

Figure 1: India GDP Growth (% change yr/yr)

Public Spending Slump Dampens Growth Prospects

The contraction in government final consumption expenditure, which fell by 0.24% yr/yr, underscores the cautious fiscal stance adopted during the election period. Public spending on infrastructure, typically a significant growth driver, was notably subdued, reflecting the impact of election-related constraints on government activity. A revival of public capex will be critical to restoring economic momentum in the coming quarters. Additionally, with the Reserve Bank of India (RBI) unlikely to cut rates before Q4 2024, the private investment growth will be limited in the coming quarters. The longer the rate pause by the RBI the more likely that the economic growth will continue to trend down.

Sectoral Performance: Mixed Signals from Manufacturing and Services

A sectoral breakdown reveals a mixed picture. The agricultural sector grew by just 2.0% yr/yr in Q1 FY25, down from 3.7% in the same period a year ago, as adverse weather conditions, including erratic monsoons and heatwaves, took a toll on crop yields. Meanwhile, the manufacturing sector, which had shown resilience in previous quarters, posted a four-quarter low growth rate of 7%, hindered by sluggish industrial output and corporate profitability challenges. Gross Value Added (GVA), a key measure that excludes indirect taxes and subsidies, rose by 6.8% yr/yr in Q1 FY25, accelerating from 6.3% in the previous quarter. Growth was broad-based across sectors, with agriculture, mining, construction, and most service sub-segments showing improvement.

On a more positive note, the construction sector continued to demonstrate robust growth, expanding by 10.5% yr/yr, driven by labour-intensive projects and increased real estate activity. Similarly, sectors like electricity, gas, and water supply grew by 10.4% yr.yr, reflecting heightened infrastructure development.

Outlook: Cautious Optimism with Lingering Risks

Looking ahead, economists maintain a cautiously optimistic outlook for the remainder of the fiscal year. Private consumption is expected to remain a key growth driver, supported by easing inflation, potential interest rate cuts, and improved farm output from a favourable monsoon season. Government spending is also likely to regain momentum, driven by a higher outlay for infrastructure development in the current fiscal year.

However, risks to the growth outlook remain. A slowdown in manufacturing, coupled with a cautious fiscal approach by the government, could weigh on overall economic performance. Additionally, global uncertainties, including geopolitical tensions and volatile commodity prices, pose external risks that could revive inflationary pressures and disrupt capital flows.

The RBI maintains its forecast for India’s GDP growth at 7.2% for FY25, positioning the country as one of the fastest-growing major economies globally. However, meeting this target will require careful navigation of both domestic and international challenges. Sustained growth in private consumption, a rebound in government spending, and continued structural reforms will be crucial to keeping India’s economic momentum on track.

Table 1: India Growth Statistics

| Growth | Q1 FY24 | Q2 FY24 | Q3 FY24 | Q4 FY24 | Q1 FY25 |

| GDP | 8.20% | 8.10% | 8.60% | 7.80% | 6.70% |

| Private final consumption expenditure | 0.20% | 2.60% | 4.00% | 4.00% | 7.40% |

| Govt final consumption expenditure | -0.10% | 14.00% | -1.80% | 0.90% | -0.20% |

| Gross fixed capital formation | 8.50% | 11.60% | 10.20% | 6.50% | 7.50% |

| Change in stocks | 1.20% | 4.90% | 54.10% | 5.00% | 5.60% |

| Valuables | -21.00% | -30.90% | 65.70% | 72.80% | -11.40% |

| Exports | -6.60% | 2.50% | 5.70% | 8.10% | 8.70% |

| Imports | 15.20% | 2.30% | 3.40% | 8.30% | 4.40% |

| GVA | 8.30% | 7.70% | 6.80% | 6.30% | 6.80% |

| Agriculture, forestry & fishing | 3.70% | 1.70% | 0.40% | 0.60% | 2.00% |

| Mining and quarring | 7.00% | 11.10% | 7.50% | 4.30% | 7.20% |

| Manufacturing | 5.00% | 14.30% | 11.50% | 8.90% | 7.00% |

| Electricity, gas, water supply & other utility | 3.20% | 10.50% | 9.00% | 7.70% | 10.40% |

| Construction | 8.60% | 13.60% | 9.60% | 8.70% | 10.50% |

| Trade, hotels, transport, and communication services | 9.70% | 4.50% | 7.00% | 5.10% | 5.70% |

| Financial, real estate & professional services | 12.60% | 6.20% | 7.00% | 7.60% | 7.10% |

| Public administration, defense & other services | 8.30% | 7.70% | 7.50% | 7.80% | 9.50% |