France Downgrade: Warning for the U.S./UK?

French politics makes it difficult for President Macron to improve the underlying budget deficit and government debt after the S&P downgrade to AA-. The National Rally could also do well in this week’s European parliamentary elections and put further pressure on Macron. Meanwhile, though rating agencies assessment differ by country, the U.S. persistent cyclical adjusted government deficit and debt leave the U.S. at risk of downgrade into 2025.

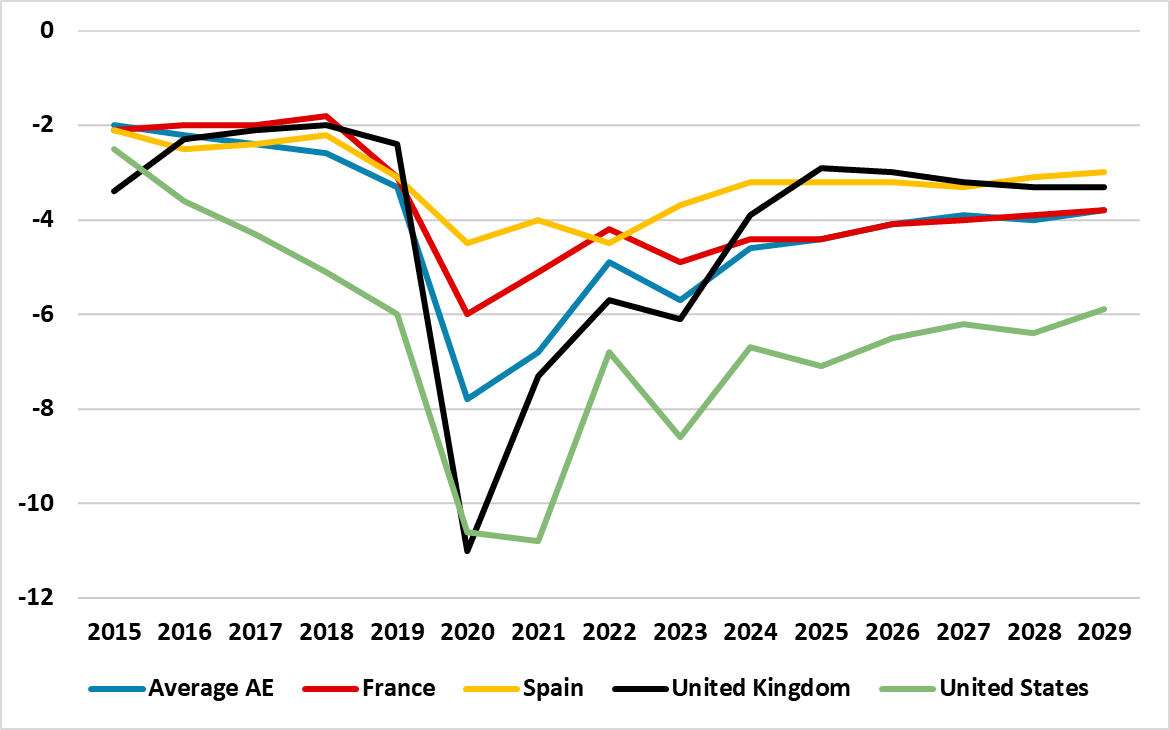

Figure 1: Government Cyclically Adjusted Deficit to GDP (%)

Source: IMF

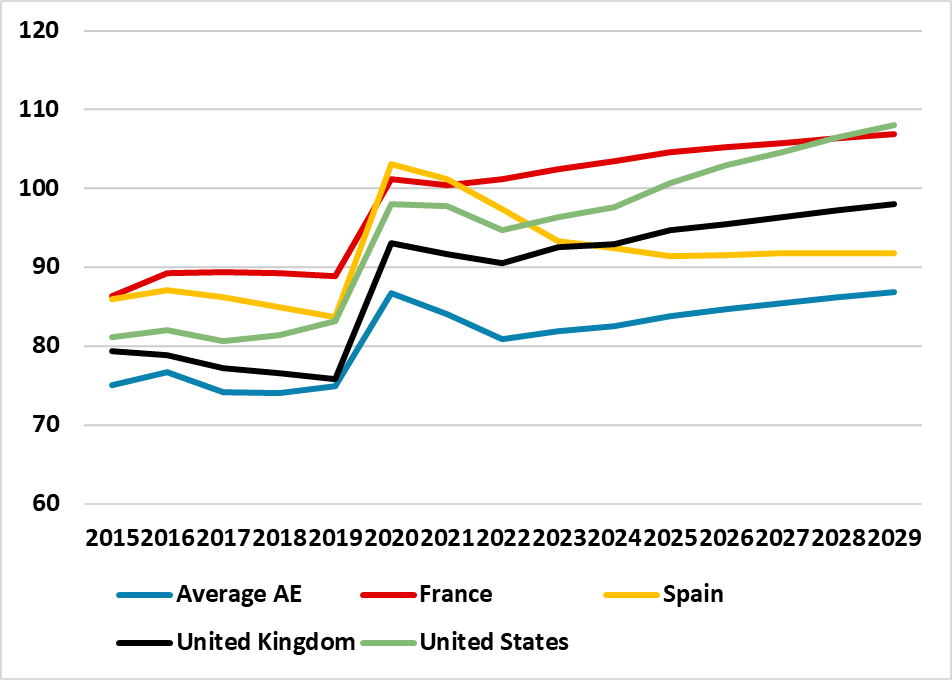

France’s downgrade to AA- by S&P is not a big surprise, given the persistent structural budget deficit (Figure 1); rising government debt/GDP ratio (Figure 2) and lack of political consensus for budget deficit cuts and huge budget overshoot in 2023. These were all cited alongside, minority status in parliament for Macron party that requires other parties support – though on fiscal measures the French constitution allows some leeway. This downgrade is a political disappointment in France, but has not caused much market reaction (though household and corporate debt is also a problem (here)). President Macron will also see a disappointing European parliamentary election (June 6-9) result this week, with far right Marine Le Pen National Rally expected to do well. If the National Rally does very well it will raise the political temperature in France and make progress on the fiscal front very difficult.

Does France ratings downgrade provide lessons for other countries? It is not a direct read, as the rating agencies assessments take account of institutional differences and in the U.S. case the reserve status of the USD. However, S&P have the U.S. two ratings higher than France and one higher than the UK, while Moody have the U.S. two ratings higher than France and three higher than the UK. Moody have the U.S. on negative and post-election we see a real risk of a U.S. downgrade under either of the two main presidential candidates (here).

Using the IMF projections, the UK is shrinking the cyclically adjusted deficit the quickest (Figure 1), as the Truss government crisis produced a U-turn to fiscal tightening. The UK general election is widely expected to see a Labour government with a healthy majority given opinion polls in the first week of the campaign. The manifesto with fiscal costings are due in a couple of weeks, but the pre-election and campaign promises so far suggests that a Labour government would largely stick to the Conservative spending restraints with targeted measures funded by modest tax increases (via freezing tax allowances) and roll off of the 2022 utility subsidies – we shall return with a fuller article nearer the election. Provided that a fiscally cautious and moderate Labor government is elected, then the rating agencies will likely be happy with the UK current ratings.

Figure 2: Government Debt to GDP excluding Financial Assets (%)

Source: IMF