Monsoon Boost or Policy Shift? RBI Faces Critical Decision

The calls for a rate cut are rising in the Indian market, but this is unlikely to impact the RBI's upcoming decision. The RBI will retain its stance of withdrawal of accomodation and maintain benchmark rate of 6.5% in its August meeting, staying on the path of inflation target. Concerns around high borrowing costs are rising, which could change the RBI's stance. This is only expected in Q3 though. Changes to inflation forecast for Q2-FY25 and Q3-FY25 are expected in this meeting.

For the Monetary Policy Committee (MPC) meeting this week, the key development since its last assembly in June is not the Federal Reserve Chair's signal towards interest rate cuts, but rather the substantial rainfall that India has witnessed recently. Governor Shaktikanta Das, who has previously dismissed the notion of aligning India’s monetary policy with the developed world, might be poised to alter his stance in the upcoming decision, despite previously withholding any guidance.

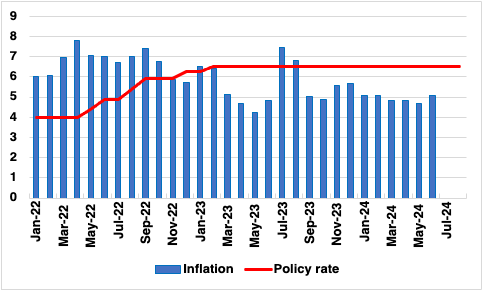

Figure 1: India Benchmark Policy Rate and CPI (%)

Das is firmly committed to bringing inflation down to the statutory target of 4% in a sustainable manner. With the policy interest rate standing at 6.5% and the stance being "withdrawal of accommodation," India's inflation dynamics differ markedly from those in advanced economies. In India, inflation is predominantly driven by food prices, reflecting the significant share of household income spent on food. Consequently, agricultural output and food prices are heavily dependent on seasonal monsoon rains, which have recently been favourable. According to the weather department, the southwest monsoon arrived six days ahead of schedule, and cumulative rainfall for June and July was 2% above the long-term average. This has bolstered kharif crop sowing, which has reached 905 lakh hectares—82% of the full-season target and 3% higher than the previous year. This positive agricultural outlook should mitigate the risk of sudden spikes in food prices, although some volatility in items like tomatoes and onions remains possible. However, this may not suffice for the Reserve Bank of India (RBI) to shift its forward guidance significantly. Tt is noteworthy that the recent La Nina conditions have resulted in excessive rainfall across different parts of the country, impacting agriculture and economic activity. Landslides in multiple parts of the country will hinder both supply chains and economic activity, and drive up food prices in the near term.

The RBI’s inflation forecast for the year remains at 4.5% yr/yr, with Q2 FY25 (July-September) expected to be at 3.8% and an uptick anticipated in the subsequent quarters. In our view, this projection leaves little room for downward revision based purely on food prices, especially given rising costs in service sectors, such as telecom tariffs. Further, we expect the RBI to raise its inflation forecast for Q2 given the above mentioned factors.

The real interest rate, which previously contributed to financial distortions and a currency crisis in 2013, suggests the MPC should also weigh its growth mandate. There are increasing signs of the market now getting dissatisfied with persistently high interest rates. Although the RBI 7.2% yr/yr forecast for FY25 is robust, the administration, under scrutiny for unemployment issues, may seek to achieve a higher growth rate through more accommodative monetary policy. The external members of the MPC, tasked with preventing state influence on monetary policy, have been vocal in their advocacy for easing. External members JR Varma and Ashima Goyal have diverged from the majority of the MPC, calling for a rate cut. They argue that the current real policy rate of approximately 2% (based on projected inflation) is excessively high. A recent RBI research paper posits that the neutral real rate should be between 1.4% and 1.9%, an increase from the post-Covid range of 0.8% to 1%. Varma maintains that such a high real policy rate is unnecessary for guiding inflation towards its target. Ashima Goyal echoes this sentiment, suggesting that failing to adjust real rates in response to easing inflation could prove costly. In the minutes of the last MPC meeting, she warned that inaction might distort economic variables and exacerbate shocks rather than smooth them. Furthermore, the Finance Minister, Nirmala Sitharam is scheduled to hold a meeting with the RBI Board next week. RBI's decision this week will be a key aspect of discussion during the meeting.

If the RBI opts for a status quo on rates and stance, policymakers might face significant challenges in justifying their decision. However, given the heightened geopolitical tensions globally and in India's neighbourhood, the volatility in food prices, owing to the monsoon will keep RBI cautious yet again. A change in stance is only likely in Q4 with assurance of favourable harvest outcomes. What is likely though is that the RBI may shift its stance to neutral in Q3, given the change in global monetary policy and Q3 being a more intense economic activity season in India.