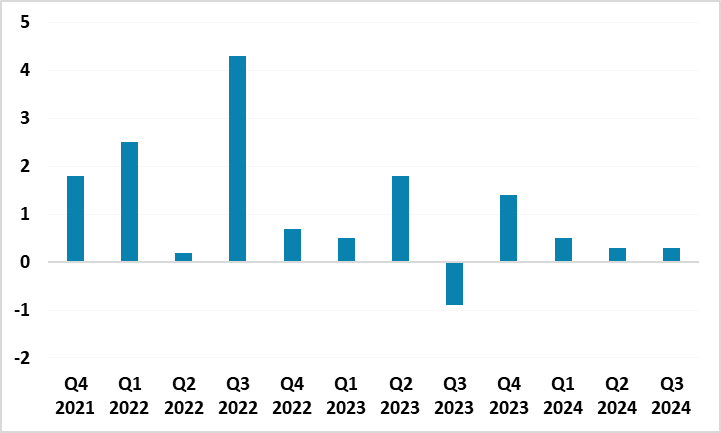

South Africa’s Economy Expanded by a Moderate 0.3% in Q3

Bottom line: South African economy grew lower than expectations by a moderate 0.3% YoY in Q3 2024 driven by a 28.8% QoQ decline in the agricultural sector due to drought reducing output of key crops like corn, soybeans, and wheat. According to Department of Statistics of South Africa’s (Stats SA) announcement on December 3, there was a decline in imports, exports and government consumption on the expenditure (demand) side. Despite Q3 print, we continue to foresee a stronger Q4 recovery, supported by improved consumer sentiment, lower inflation, interest rate cuts, and growing momentum in structural reforms, which will likely extend to 2025.

Figure 1: GDP Growth Rate (%, YoY), Q4 2021 – Q3 2024

Source: Continuum Economics

South African economy grew by a moderate 0.3% YoY in Q3, which was less than expectations. According to SA, the agriculture industry was the main drag on growth on the production (supply) side of the economy, with transport, trade and government services also contributing to the slowdown. On the expenditure (demand) side, there was a decline in imports, exports and government consumption.

Despite lower-than expected surge in growth, the construction sector recorded its second straight rise, growing by 1.1% – its largest increase in two years. Additionally, finance was the largest positive contributor, pushed higher by banking, insurance, real estate and other business services.

The electricity, gas & water supply industry expanded for a second straight quarter, driven higher by a rise in electricity generation and consumption taking into account that power cuts (loadshedding) remains suspended for more than eight months. Eskom emphasized on November 29 that loadshedding has been suspended for 247 consecutive days, due to bettering planned maintenance, investments in generation recovery, and reduction in unplanned outage. In its outlook, Eskom highlighted that loadshedding will be a thing of the past by March 2025, and announced a detailed likely scenario of a loadshedding-free outlook.

One major driver behind the Q3 reading was 28.8% QoQ decline in the agricultural sector due to drought reducing output. Stats SA mentioned that “The industry experienced a rough quarter since drought plagued the production of field crops such as maize, soya beans, wheat and sunflower. Adverse weather conditions also hindered the production of subtropical fruits, deciduous fruits and vegetables in parts of the country.”

Despite Q3 print, we continue to foresee a stronger Q4 recovery, supported by improved consumer sentiment, lower inflation, interest rate cuts, and growing momentum in structural reforms, which will likely extend to 2025. We think the growth outlook is positive as mining, manufacturing and construction all grew in Q3.

There are some downside risks that can negatively impact the growth in the upcoming quarters, which largely relate to the uncertain external environment and possible failures in the continuation of structural reforms on enhancing infrastructure investments. Uncertainty about the U.S. economy in 2025 and slowing China demand could cause problems over the growth outlook in 2025, while the return of power cuts could also darken the trajectory.