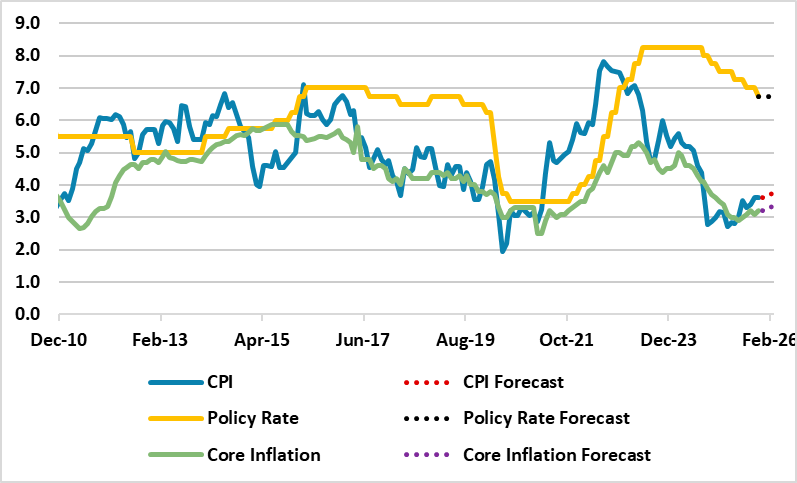

South Africa Inflation Preview: Inflation is Expected to Hover Around 3.5% y/y in December

Bottom Line: After inflation decreased to 3.5% YoY in November, we foresee inflation will stand around 3.5% y/y in December supported by suspended power cuts (loadshedding), stronger Rand (ZAR), and decrease in inflation expectations. Lower international food prices and slightly elevated fuel costs will likely be the major determinants for the December inflation figures, which will be announced by Stats SA on January 21.

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2010 – April 2026

Source: Continuum Economics

After cooling off to 3.5% moderately in November, we envisage the inflation in December will hover around 3.5% due to suspended load-shedding, relatively strong ZAR and fall in inflation expectations. Lower international food prices and slightly elevated fuel costs will likely be the major determinants for the December inflation figures, which will be announced on January 21.

On the power cuts front, South Africa’s national electricity utility company Eskom announced on January 2 that South Africa has now experienced 231 consecutive days without an interrupted supply, with only 26 hours of loadshedding recorded in April and May. Despite few load shedding in H2 2025, some energy analysts think blackouts are still a threat and further power disruptions are likely while continued investment build out of energy infrastructure remain the key.

This is still a significant development for South African economy as the suspension helped businesses and households to relieve facing increasing costs from using alternative sources such as diesel backup generators, contributing at lower inflation figures. December inflation outlook has also been supported by a stronger ZAR, which hovered around 16.6-17.1 against the USD.

Additionally, there has been a recent fall in the inflation expectations as well. The Bureau for Economic Research’s (BER) latest survey for the SARB in December showed that in Q4 2025 (the first survey after the inflation target changed to 3%), the two- and five-year inflation expectations on average, fell to a record low of 3.7% (from 4.2% before). Next-year expectations were also down by a significant margin (0.4% pts) to 3.8%. Household inflation expectations resumed its downward trend, after a brief pause in Q3; one-year expectations were observed at 5.3% (5.5% previously).

Despite positive developments, we think risks to the inflationary outlook remain strong such as increase in utility costs and climate-related agricultural disruptions. The usual increase in sin taxes in the budget and hikes in wages and salaries will likely pressurize CPI in Q1.

We think cautious and data-dependent SARB will likely try to bring inflation down to new 3% anchor and assess the impact of earlier cuts early 2026. We foresee average inflation will hit 3.8% and 3.5% in 2026 and 2027, respectively, supported moderately by long lagged impacts of previous tightening, and a relatively stable ZAR. We believe the key for the inflation trajectory will be the global developments, tariffs, government’s determination to address the electricity shortages, logistical constraints and financing needs – though we forecast a decline in oil prices, which will help on the margin.