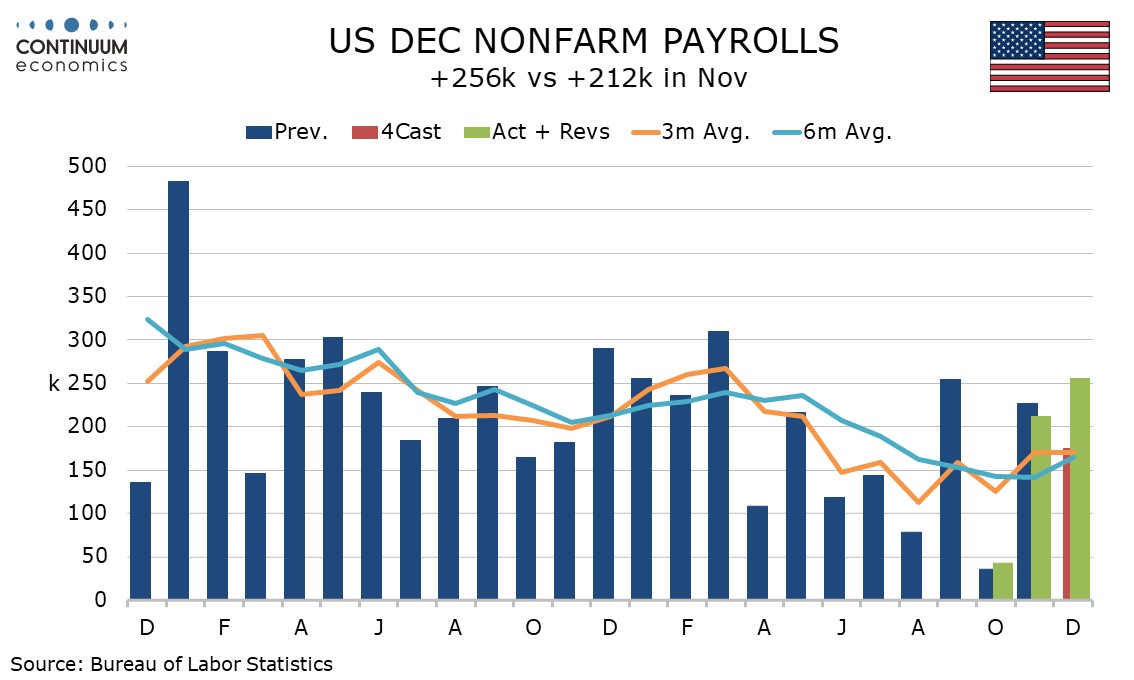

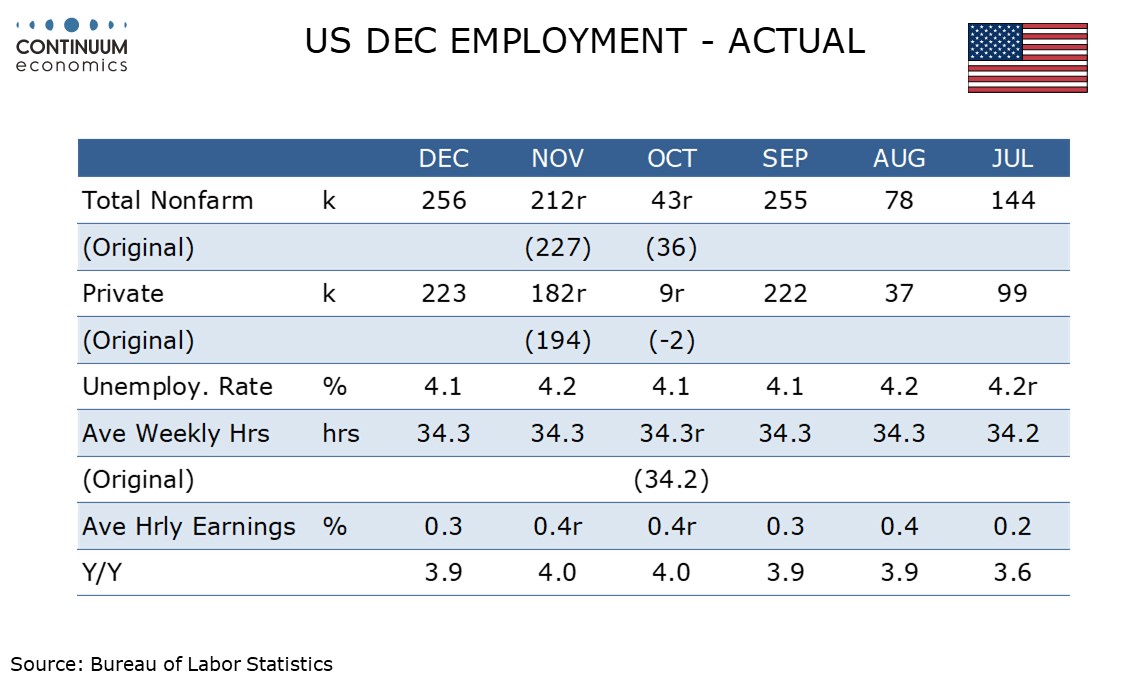

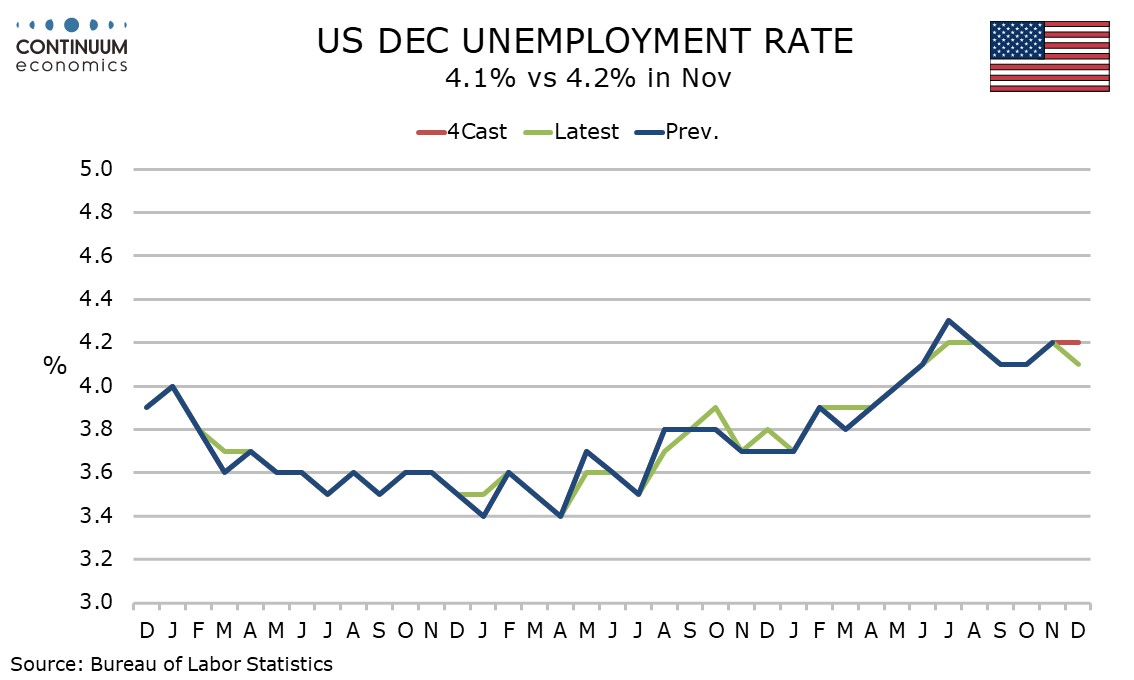

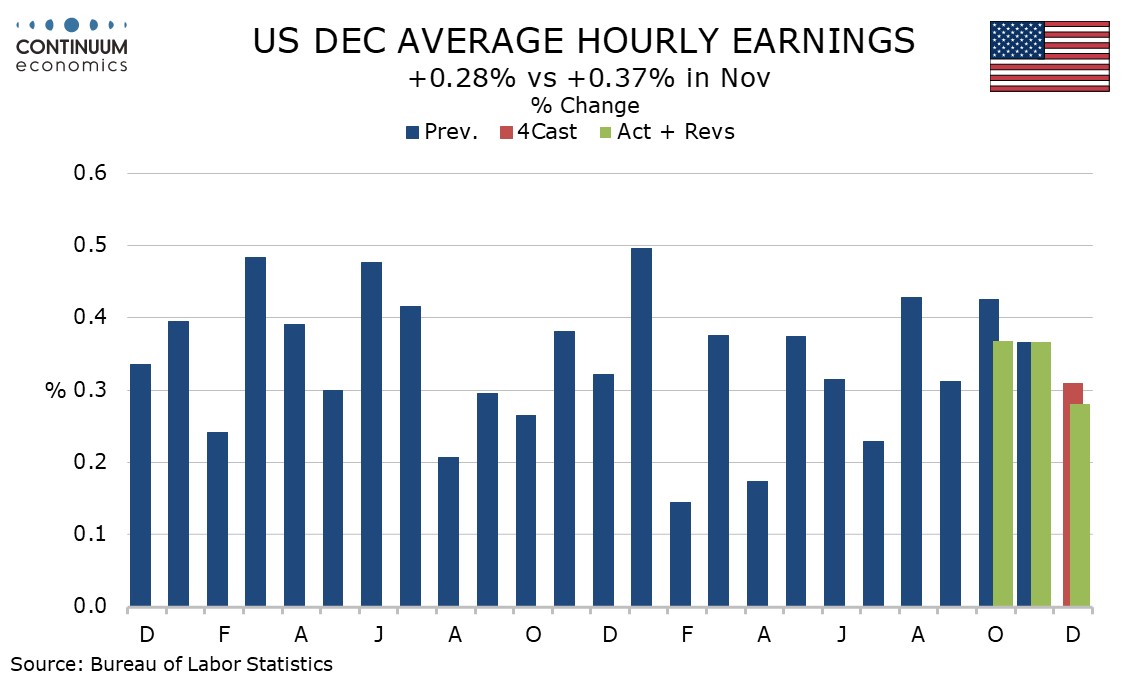

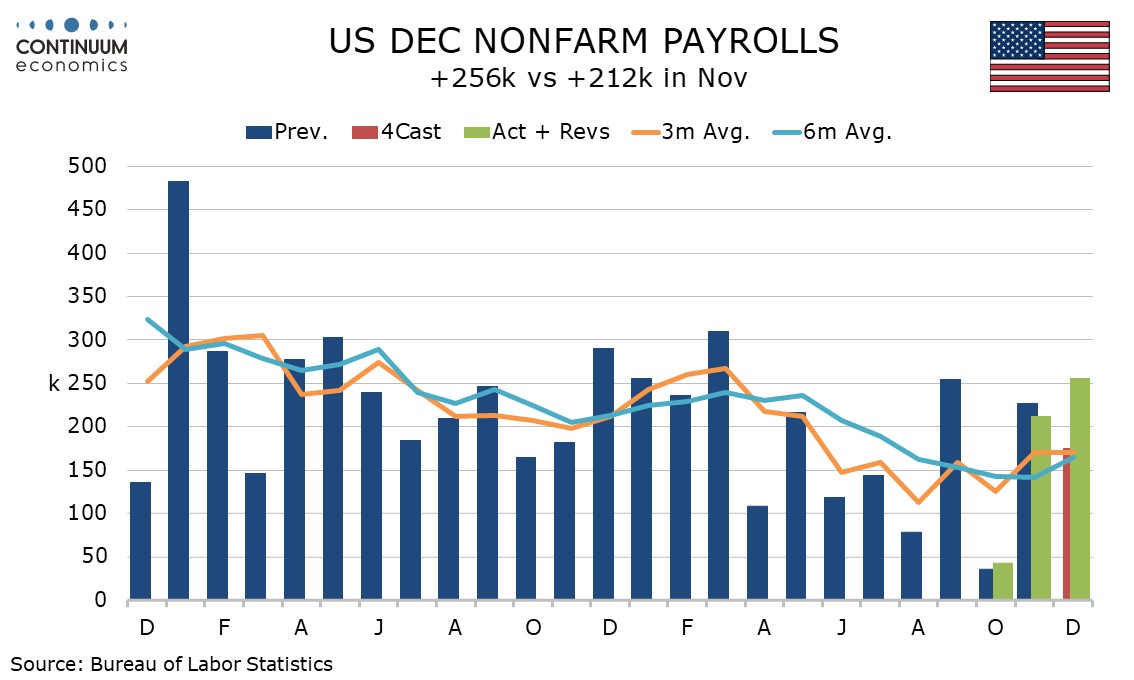

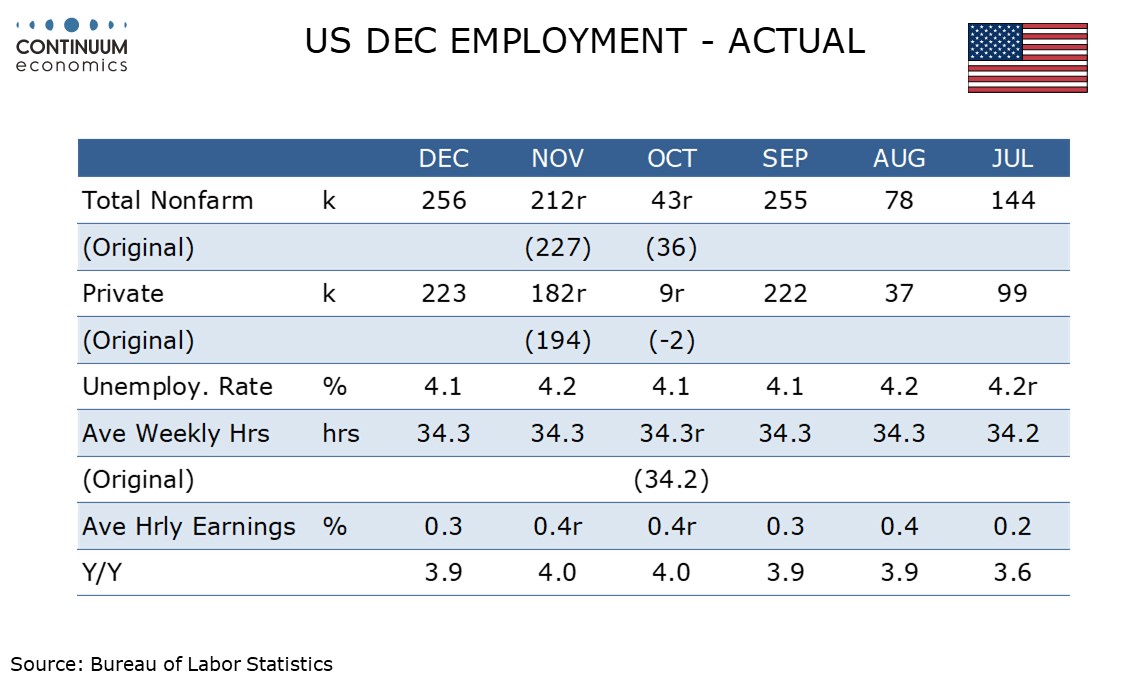

December’s non-farm payroll with a 256k increase, 223k in the private sector, is significantly higher than expected and suggests the economy has significant momentum entering 2025, adding to an already strong case for a Fed pause in January. The unemployment rate slipped to 4.1% from 4.2% but a 0.3% rise in average hourly earnings suggests only modest inflationary pressure.

Back month revisions were marginal totaling a negative 8k. Job growth was led by services with goods down by 8k with manufacturing down by 13k. This may be related to concerns over impending tariffs won Canada and Mexico given tightly linked supply chains.

Services continue to be led by heath care and social assistance at 69.5k but leisure and hospitality at 43k and retail at 43.4k are both strong and suggest a confident consumer, though the retail gain is a bounce from a 29.2k decline in November.

Services continue to be led by heath care and social assistance at 69.5k but leisure and hospitality at 43k and retail at 43.4k are both strong and suggest a confident consumer, though the retail gain is a bounce from a 29.2k decline in November.

That payrolls increased by more than November’s 212k is quite impressive given that November was seen as inflated by a rebound from a 43k October rise that was restrained by hurricanes and a strike at Boeing. The 3-month averages of 170k overall and 138k in the private sector are however unchanged from November. The post-hurricane rebound may not have been finished in November.

That payrolls increased by more than November’s 212k is quite impressive given that November was seen as inflated by a rebound from a 43k October rise that was restrained by hurricanes and a strike at Boeing. The 3-month averages of 170k overall and 138k in the private sector are however unchanged from November. The post-hurricane rebound may not have been finished in November.

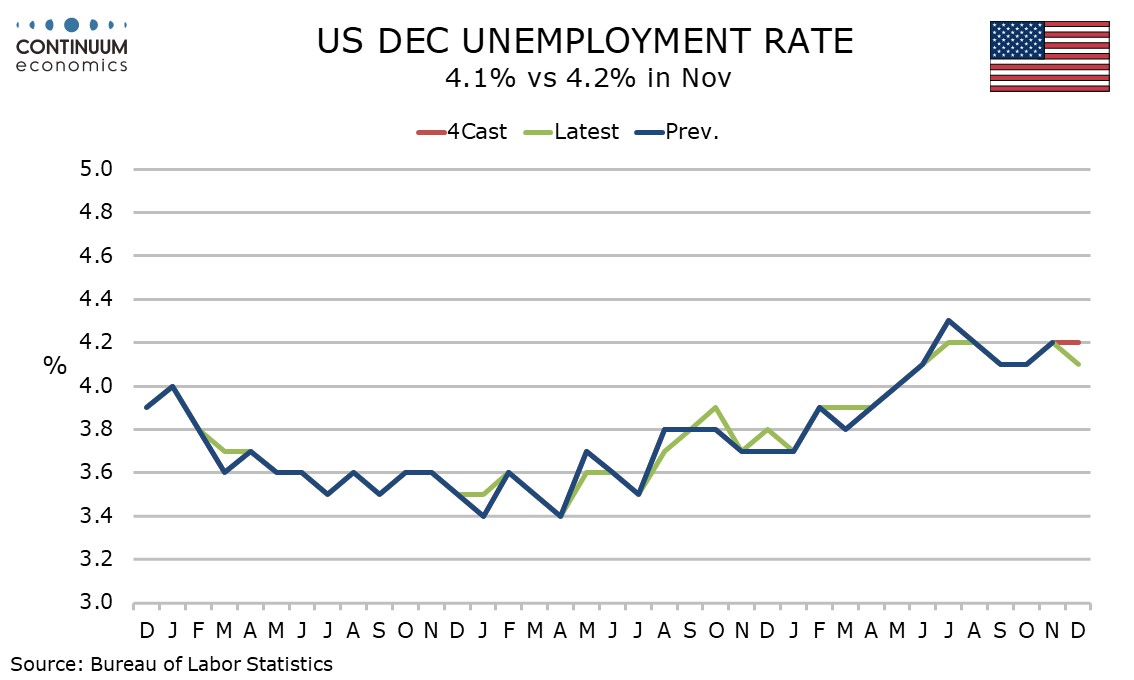

The household survey which calculates the unemployment rate showed employment very strong indeed with a rise of 478k, allowing unemployment to fall despite a strong 234k rise in the labor force. This offsets some of past underperformance of payrolls by the household survey’s employment estimate. The unemployment rate saw annual historical revisions, but they were minimal.

The household survey which calculates the unemployment rate showed employment very strong indeed with a rise of 478k, allowing unemployment to fall despite a strong 234k rise in the labor force. This offsets some of past underperformance of payrolls by the household survey’s employment estimate. The unemployment rate saw annual historical revisions, but they were minimal.

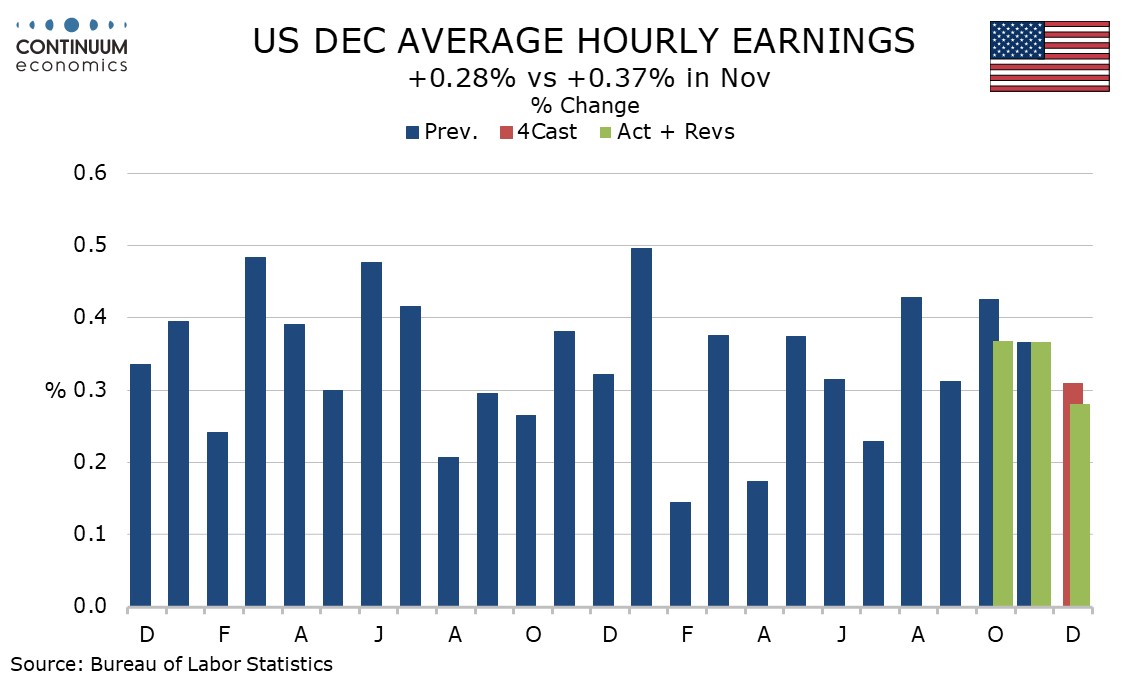

Average hourly earnings rose by a 5-month low of 0.28% before rounding after two straight gains of 0.37%, allowing yr/yr growth to slip back to September’s 3.9% pace after two months at 4.0%. The strong labor market does not appear to be a significant source of inflationary risk, a view shared at the Fed.

Average hourly earnings rose by a 5-month low of 0.28% before rounding after two straight gains of 0.37%, allowing yr/yr growth to slip back to September’s 3.9% pace after two months at 4.0%. The strong labor market does not appear to be a significant source of inflationary risk, a view shared at the Fed.

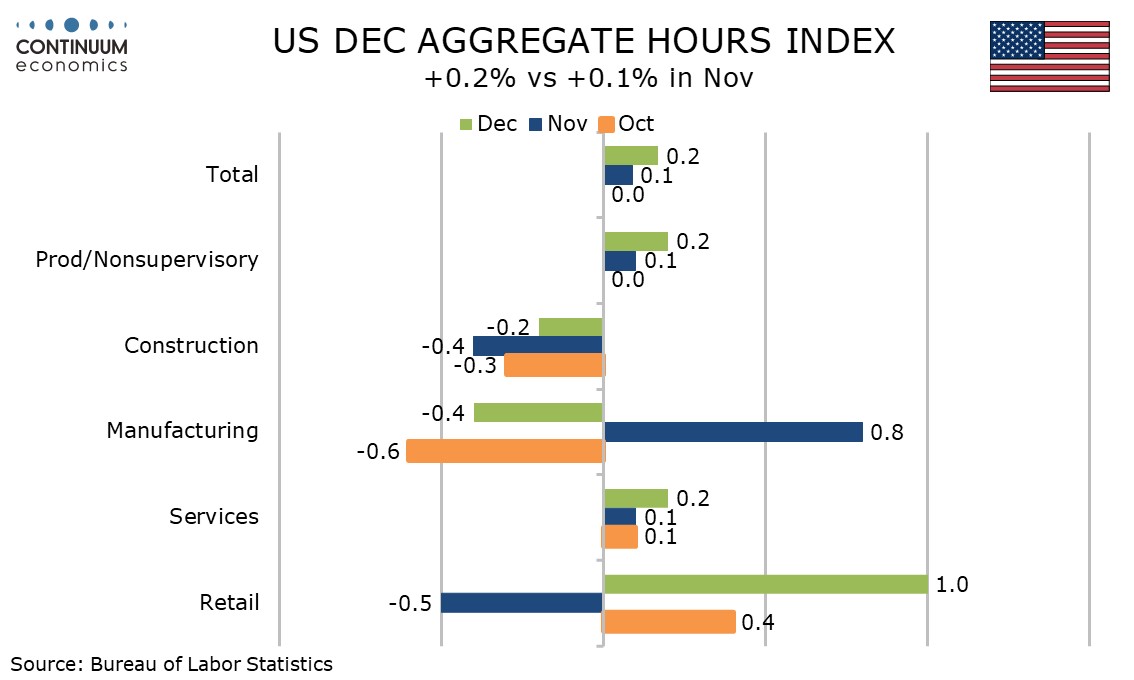

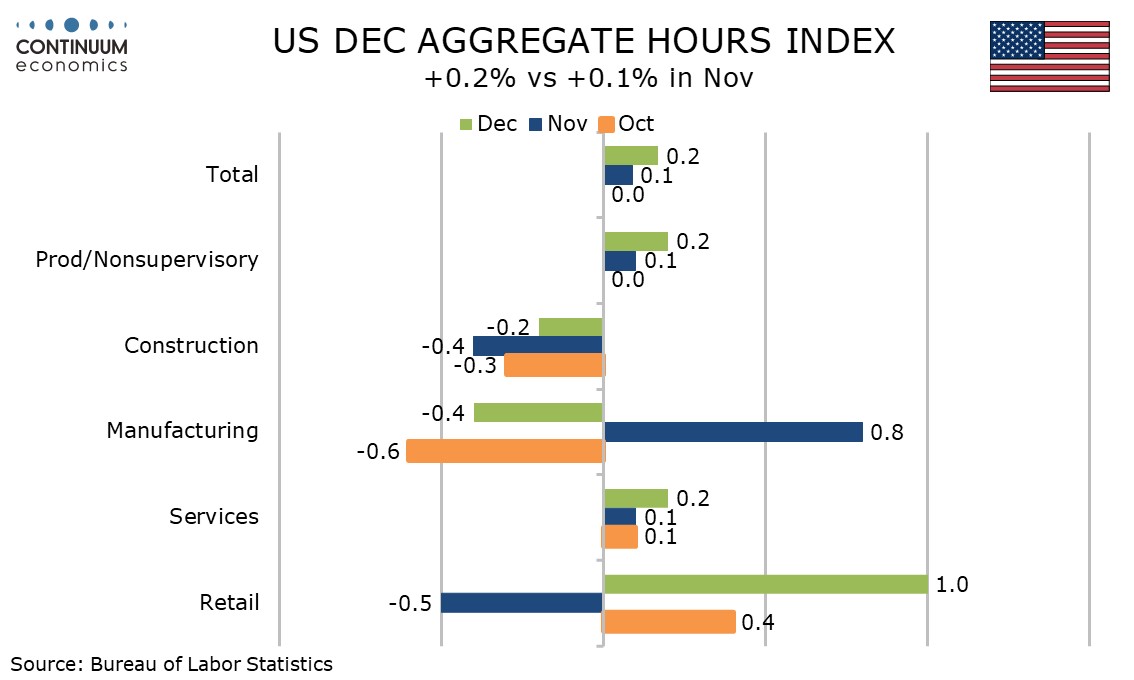

The workweek saw a fifth straight month at 34.3 hours, leaving aggregate hours worked up 1.4% annualized in Q4, consistent with a healthy GDP increase if productivity remains positive. The monthly detail for aggregate hours looks similar to the payrolls, with manufacturing and construction slipping but services positive and retail particularly so.

The workweek saw a fifth straight month at 34.3 hours, leaving aggregate hours worked up 1.4% annualized in Q4, consistent with a healthy GDP increase if productivity remains positive. The monthly detail for aggregate hours looks similar to the payrolls, with manufacturing and construction slipping but services positive and retail particularly so.