High Inflation Continues to Dominate Russian Economy: 9.1% YoY in August

Bottom Line: According to Russian Federal Statistics Service data released on September 11, inflation stayed at 9.1% YoY in August after July, the highest reading since February 2023, due to adverse base effects, strong military spending, high domestic demand, tight labor market, continued expansion of retail and corporate lending, and recent surges in food and services prices. The reading is well above Central Bank of Russia’s (CBR) medium term target of 4%. We expect a moderate slowdown in inflation in September, but CPI will continue to stay a lot higher than CBR expectations.

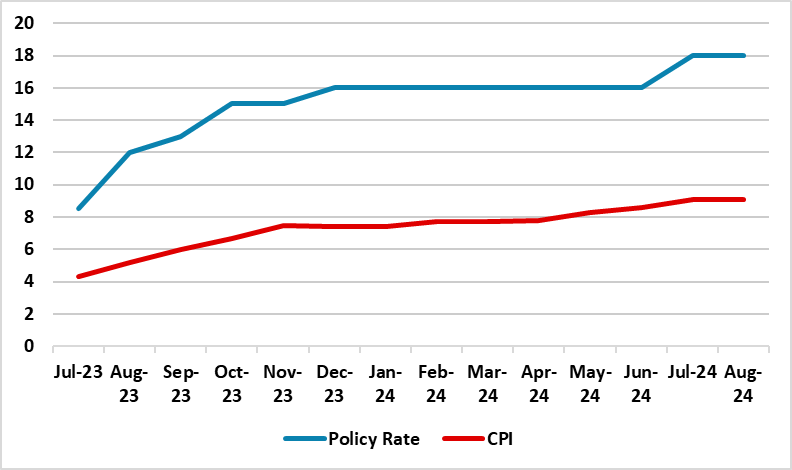

Figure 1: CPI (YoY, % Change) and Policy Rate (%), July 2023 – August 2024

Source: Continuum Economics

According to Rosstat figures, the inflation rate continued to stay high at 9.1% YoY in August after July. MoM price growth fastened to 0.2% in August from 1.1% in July driven by the food and services prices, which rose by 9.7% and 11.7% in annual terms, respectively. Prices of nonfood goods went up by 6.1% YoY. We think the inflationary pressures remained strong basically due high military spending, strong fiscal policy, demand-cost pressures stemming from high demand, and tight labor market.

August’s 9.1% YoY inflation remained far above the CBR’s 2024 forecast range of 6.5–7.0%, and CBR’s medium term target of 4%. The reading is higher than Economy Ministry expectations of annual inflation ending the year at 7.3%.

Taking into account that CBR decided to lift the policy rate by 200 bps to 18% on July 26 MPC meeting citing that inflation remaining far above the CBR’s targets, we think it will not be surprising to see the CBR to hike key rate to 19% at the next policy rate meeting on September 13 basically to cool off overheated economy given inflationary risks and its hawkish forward guidance.

Of course, CBR can also decide to hold the policy rate stable at 18% particularly considering the lagged impacts of the aggressive monetary tightening are still feeding through. If no changes, we feel CBR could consider hiking the rate in Q4 due to increase in cost of borrowing, hike in inflation, sanctions, buoyant domestic demand, and surge in public spending. (Note: CBR will likely start considering cutting rates in Q1 2025 if inflation starts cooling off, RUB stabilizes and inflation expectations would converge to CBR’s forecasts).

Overheated economy shows that cooling off inflation will not be straightforward as it is likely that the inflation would remain higher than CBR’s expectations in 2024. We envisage annual average inflation to record 7.9% in 2024 partly due to adverse base effects coupled with surges in food and services prices. We expect a moderate slowdown in inflation in September but it will continue to stay high as CPI is projected to slow down after Q4 as tight monetary policy will start alleviating bank lending and private consumption. Despite this, we feel the risks to the outlook remain upside as the fiscal policy is making a big contribution to domestic demand coupled with continued military spending due to ongoing war in Ukraine, and costly operations in Kursk oblast against Ukraine’s surprising cross border incursion.