View:

July 04, 2025

Asia Open - Overnight Highlights

July 4, 2025 12:00 AM UTC

EMERGING ASIA

EM currencies are trading individually against the greenback as the USD performs its up and down on stronger than expected NFP and subsequent positive risk mood. The largest winners are TWD 0.65%, followed by INR 0.46%, IDR 0.27%, PHP 0.24% and MYR 0.11%; while the biggest losers are KR

July 03, 2025

Preview: Due July 18 - U.S. June Housing Starts and Permits - Starts to correct higher, permits to continue falling

July 3, 2025 6:07 PM UTC

We expect June housing starts to rise by 3.5% to 1300k in a correction from a 9.8% May decline, but we expect permits to fall by 1.0% to 1380k, in what would be a third straight fall.

U.S. June ISM Services - Hit from tariffs shows signs of fading

July 3, 2025 2:25 PM UTC

June’s ISM services index of 50.8 from 49.9 has rebounded above neutral after falling to 49.9 in May but is still quite subdued. Detail shows bounces from weakness in May in business activity and new orders but slippage in employment and delivery times restrained the composite.

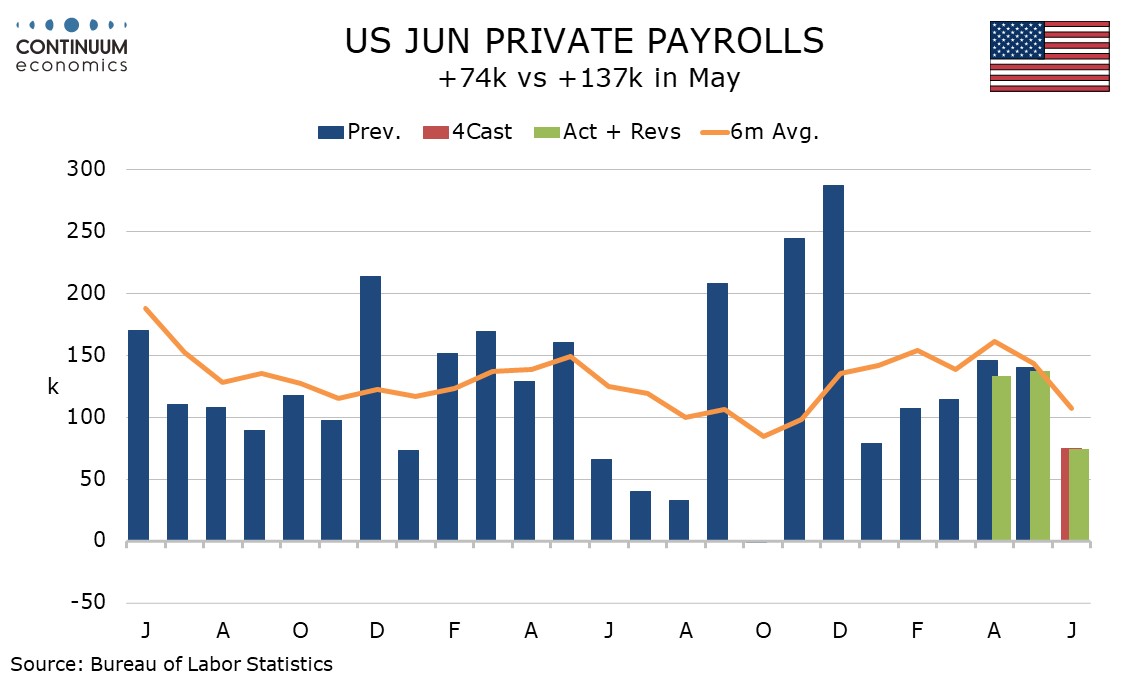

U.S. June Employment - Some signs of slowing activity, but lower unemployment suggests no urgency for Fed easing

July 3, 2025 1:09 PM UTC

June’s non-farm payroll is surprisingly strong overall with a rise of 147k, with 16k in net upward revisions, but private payrolls at 75k are weaker than expected, with 16k in net negative revisions. Unemployment unexpectedly fell to 4.1% from 4.2%, but average hourly earnings are weaker than expe

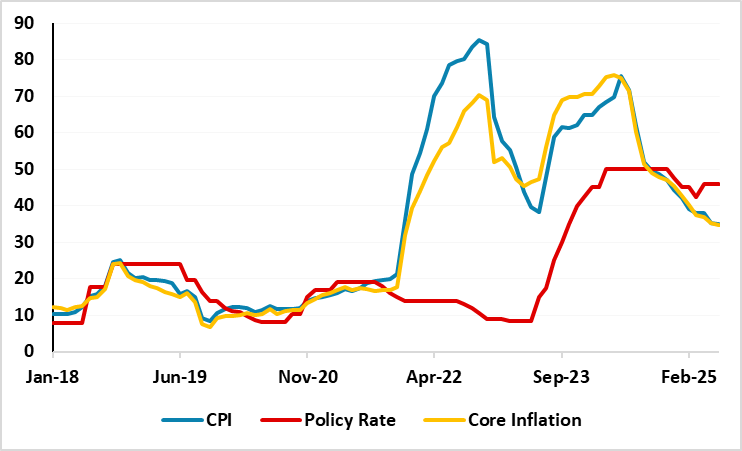

Turkiye’s Inflation Slightly Eased to 35.1% YoY in June

July 3, 2025 1:00 PM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced on July 3 that the inflation softened to 35.1% y/y in June from 35.4% y/y in May driven by lagged impacts of previous monetary tightening, tighter fiscal measures and suppressed wages. Despite moderate fall, inflationary risks remain tilte

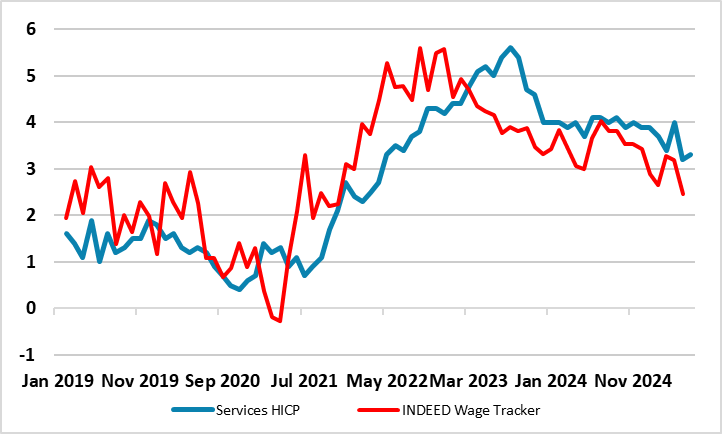

June ECB Council Meeting Account Review: Divides Continue if Not Widen

July 3, 2025 12:24 PM UTC

The account of the June 3-5 Council meeting just about left the door open for a move at the July 24 policy verdict given the array of news (probably negative particularly regarding tariffs but also bank lending) due beforehand. But the account adds to the impression we has initially that a pause