FX Daily Strategy: APAC, July 4th

Quiet day likely on US holiday

German orders unlikely to be of significant interest

USD recovery on employment report looks to be sufficient

JPY weakness still looks overdone

GBP to remain weak

Quiet day likely on US holiday

German orders unlikely to be of significant interest

USD recovery on employment report looks to be sufficient

JPY weakness still looks overdone

GBP to remain weak

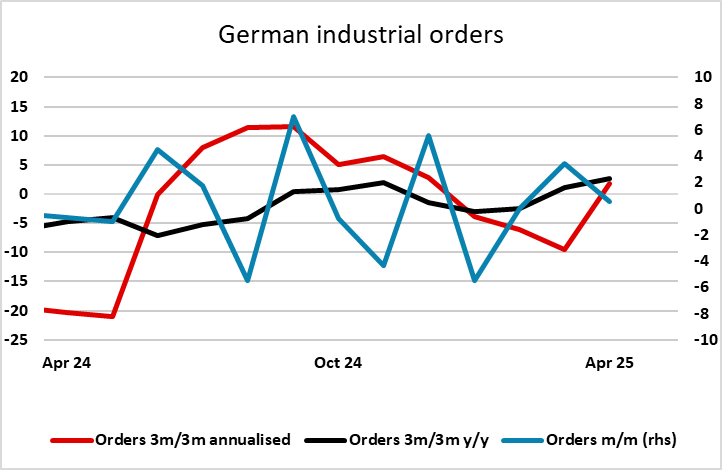

Friday is likely to be a quiet day for the markets with the US on holiday and very little of note on the Asian or European calendars. The German manufacturing orders data might attract a little interest, but the numbers can be volatile and the trend is fairly flat, so even a number well away from expectations probably won’t lead to any firm conclusions.

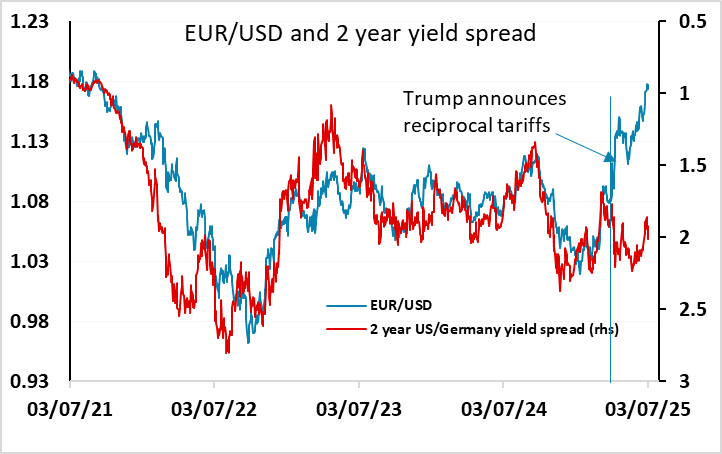

In the FX market, the USD gained on the back of the stronger headline employment data, but the underlying numbers weren’t particularly strong, with private payrolls, average earnings and the average workweek all below expectations, and only the unemployment rate really much better than expected. There was probably some desire to square some short USD positions ahead of the US holiday that helped the USD recovery, but we doubt we will see much followthrough on Friday.

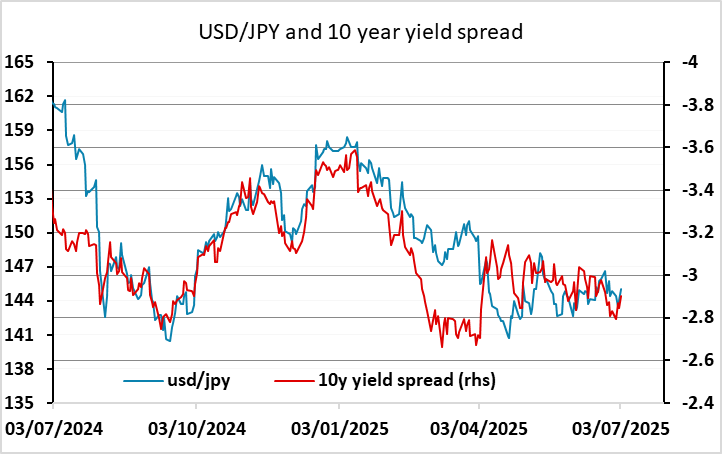

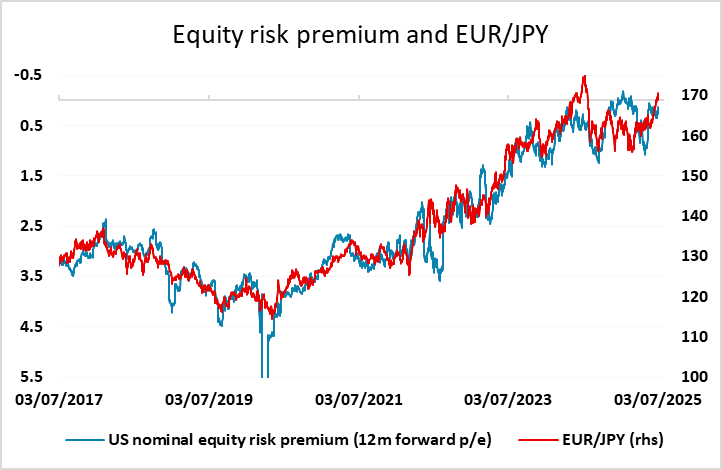

JPY weakness was once again a notable feature of the market, with EUR/JPY hitting another new 1 year high and CHF/JPY another all time high. These moves reflect continued strength in the equity market and continued declines in implied equity risk premia which tend to be correlated with JPY weakness, particularly on the crosses. But EUR/JPY has now hit a big retracement level above 170 and should at least pause here, since it is already moving ahead of the decline in risk premia and is in its sixth consecutive week of gains. JPY weakness may also relate to concerns about the potential high tariff to be imposed on Japan, with no trade deal with the US looking likely, but July 9th also represents a deadline for a US-EU deal that also seems unlikely to happen, so increased tariffs on the EU may also be imminent.

The main argument against further JPY weakness is that it is hard to justify further declines in (or even current levels of) equity risk premia in a slowing US economy which facing some impact from tariff increases and is close to full employment and which consequently is unlikely to deliver the well above trend earnings growth that is priced into the market. The fact that the USD is suffering from foreign investors diversifying away from the US and a general loss of confidence related to uncertainty around tariffs and fiscal policy makes it all the harder to justify record highs in equity markets. Momentum remains hard to oppose, but we would look for at least a pause in JPY weakness.

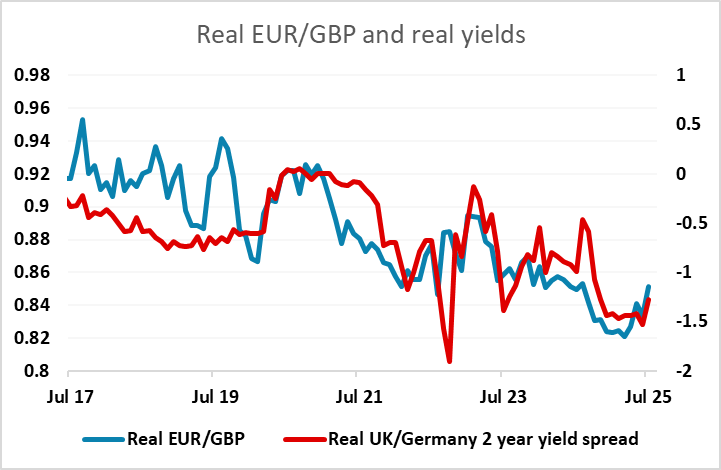

Otherwise, GBP has recovered some of its losses as Starmer has supported his Chancellor Reeves, but remains lower than it was before the government failed to put through its planned spending cuts. The failure to cut spending remains a significant problem for the government, as the books will now have to be balanced by more growth negative policies involving either lower investment spending and/or higher taxes, so we would expect GBP to remain under some pressure, with a more dovish BoE stance likely to emerge in the coming weeks.