USD flows: USD up on employment data

USD gains as payrolls come in slightly above consensus

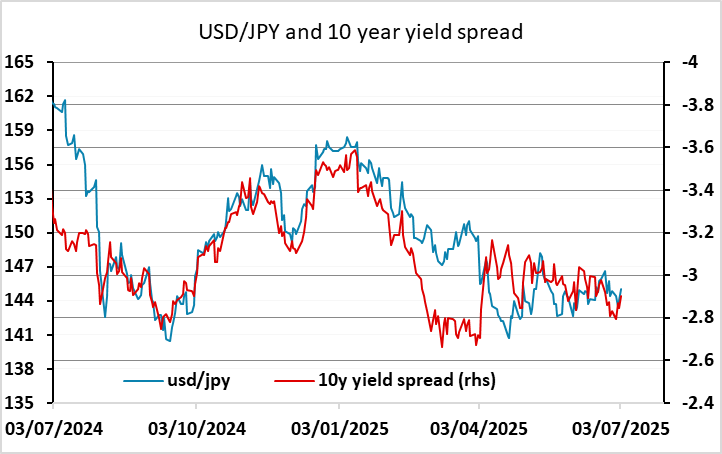

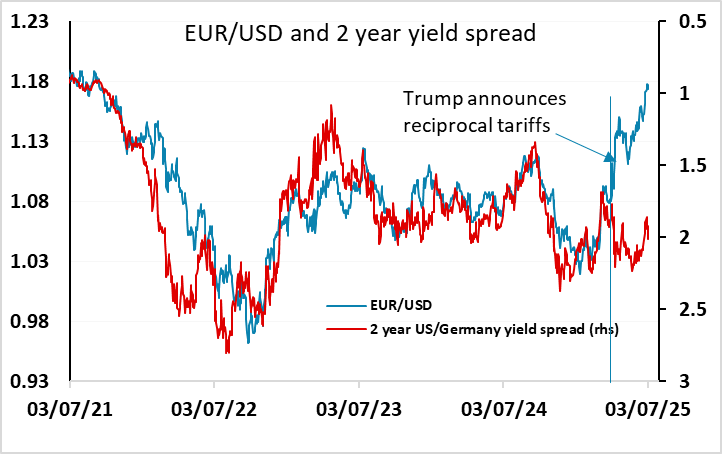

The US employment numbers are better than expected, with non-farm payrolls up 27k m ore than expected at 147k in June and the April and May numbers both revised slightly higher. The unemployment rate was also lower than expected at 4.1%. Slightly offsetting the stronger employment numbers were weaker than expected average earnings growth at 0.2% and lower weekly hours at 34.2. But the USD has benefited from the data, rising across the board with USD/JPY the biggest mover, rising more than a big figure. US yields are higher, but only by 5bps in the 10 year area, and spreads are up less than that as yields elsewhere are also higher. The data is, in reality, not dramatically away from expectations, so we doubt it will make a lot of difference to Fed thinking. A July rate cut was already unlikely, and the market has now all but ruled it out, but September is still priced as an 80% chance. The initial decline in the JPY on the crosses is pressing key levels in EUR/JPY above 170. We doubt these will break convincingly today, so would not look for an extension of the initial move in either USD/JPY or EUR/JPY. Positioning in EUR/USD and USD/CHF is likely more extended than in USD/JPY, so there may be more potential for the USD to recover versus European currencies.