U.S. April Retail Sales, Weekly Initial Claims - Only limited signs of slowing

April retail sales and weekly initial claims are in line with expectations, and consistent with a moderate slowing in the economy, but with no recessionary signals. It is however too early for the full impact of tariffs to be seen, particularly with the impact of tariffs on prices so far limited.

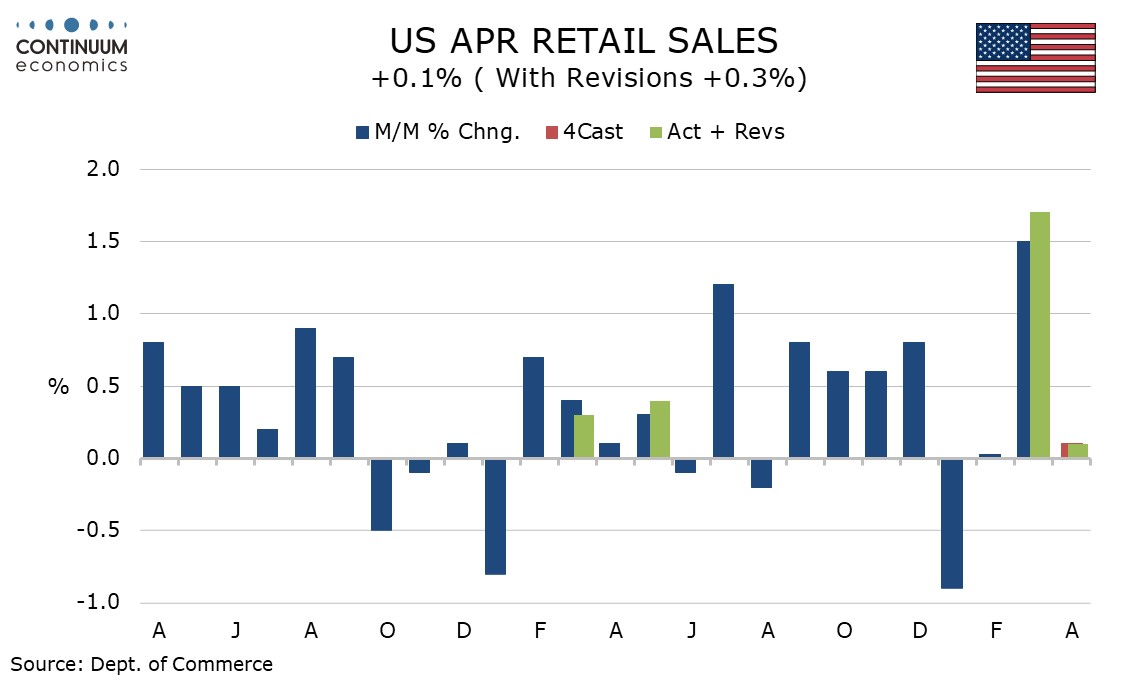

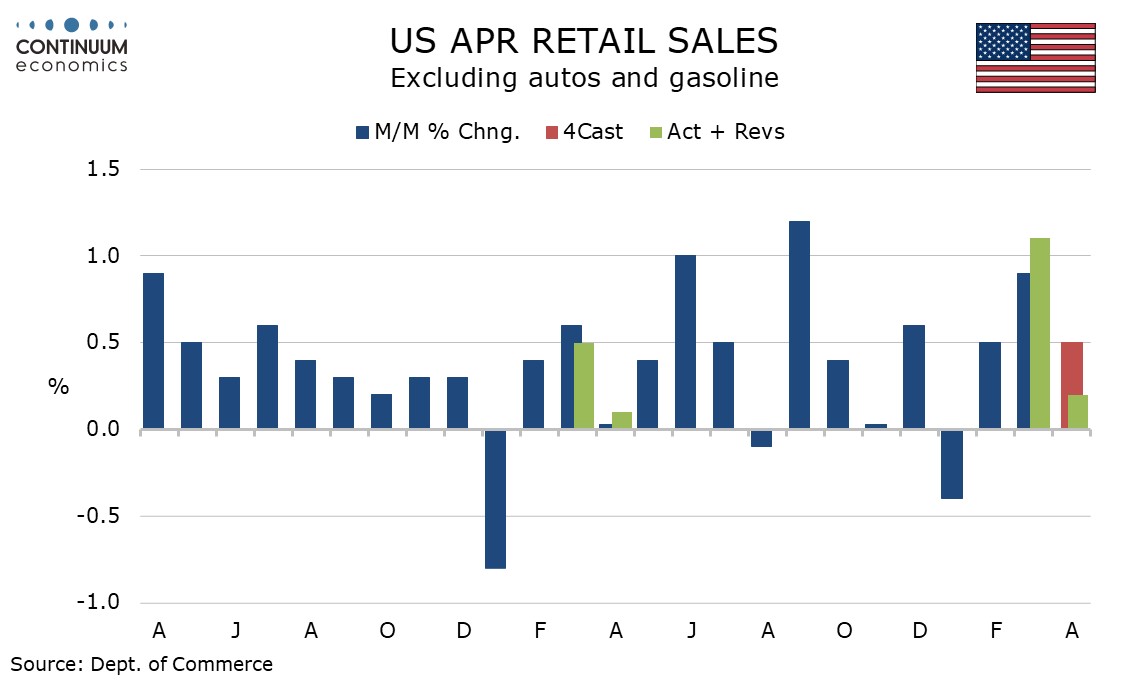

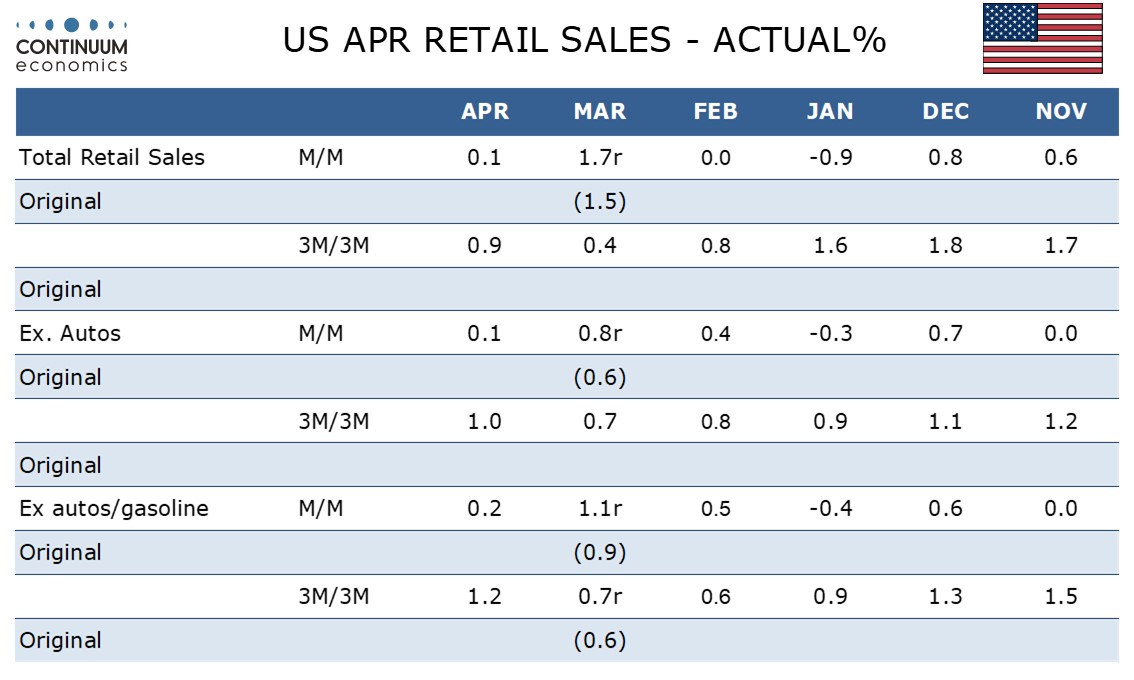

Retail sales with gains of 0.1% overall and ex autos, and 0.2% ex autos and gas, were close to consensus, a pause after a strong March which was revised higher to a 1.7% roe from 1.5%. with March ex auto data at 0.8% and ex auto and gasoline at 1.1% also both revised up by 0.2%.

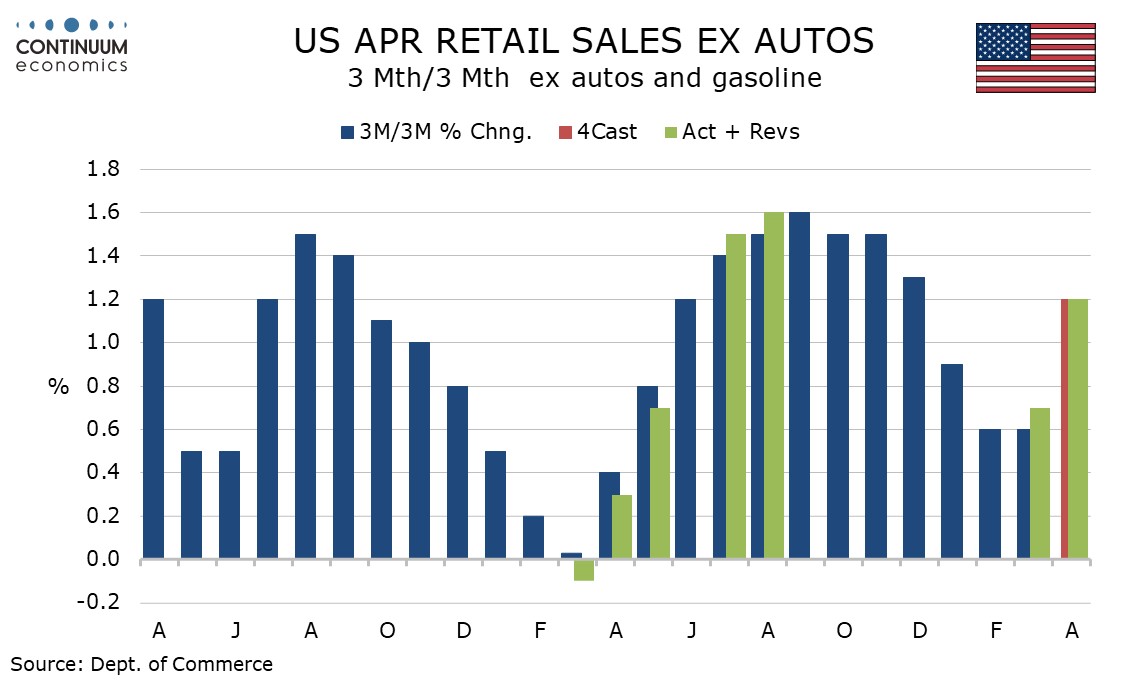

The March strength was inflated by a rebound from weather-depressed data in January, leaving Q1 data as a whole still quite subdued. April’s 3 month/3 month gains of 0.9% overall, 1.0% ex auto and 1.2% ex autos and gasoline are flattered by the weak January dropping out.

The ex auto and ex auto and gasoline 3 month/3 month data looks similar to that of December, but the overall pace is down from Q4 strength. Still, consumer spending still seems to have momentum, even if April data is quite subdued.

Auto sales at -0.1% showed a smaller decline from a strong March that industry data had implied. Data elsewhere was mixed with durables generally firmer but non-durables mostly softer, though eating and drinking places were surprisingly strong with a rise of 1.2%, even after a very strong 3.0% rise in March.

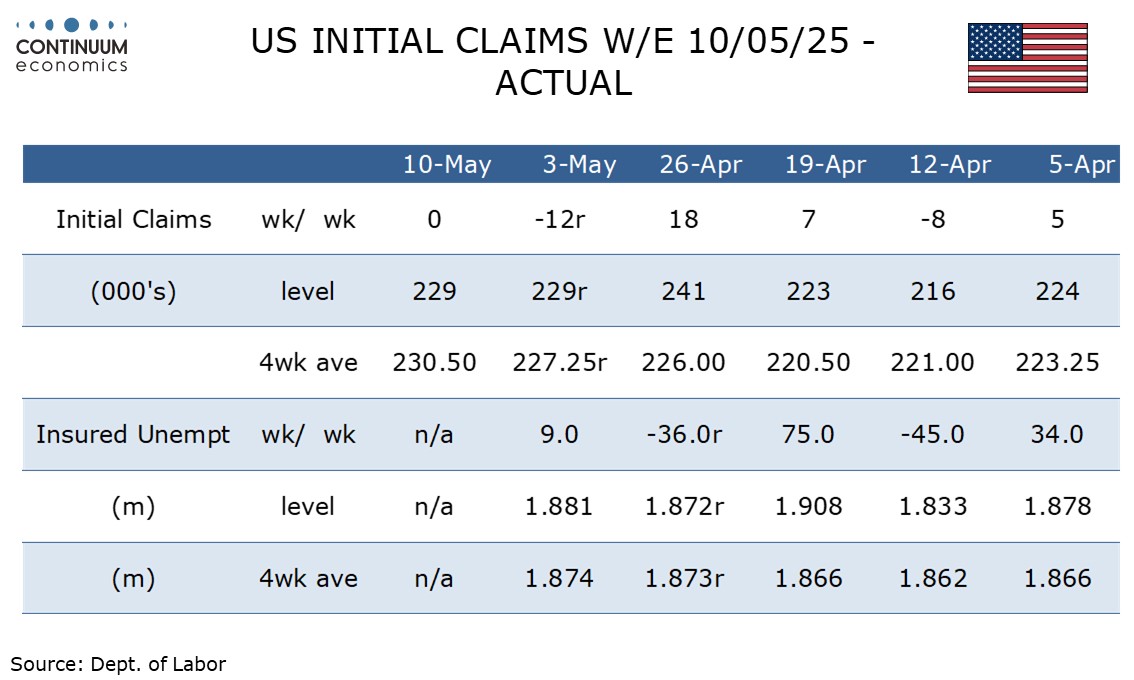

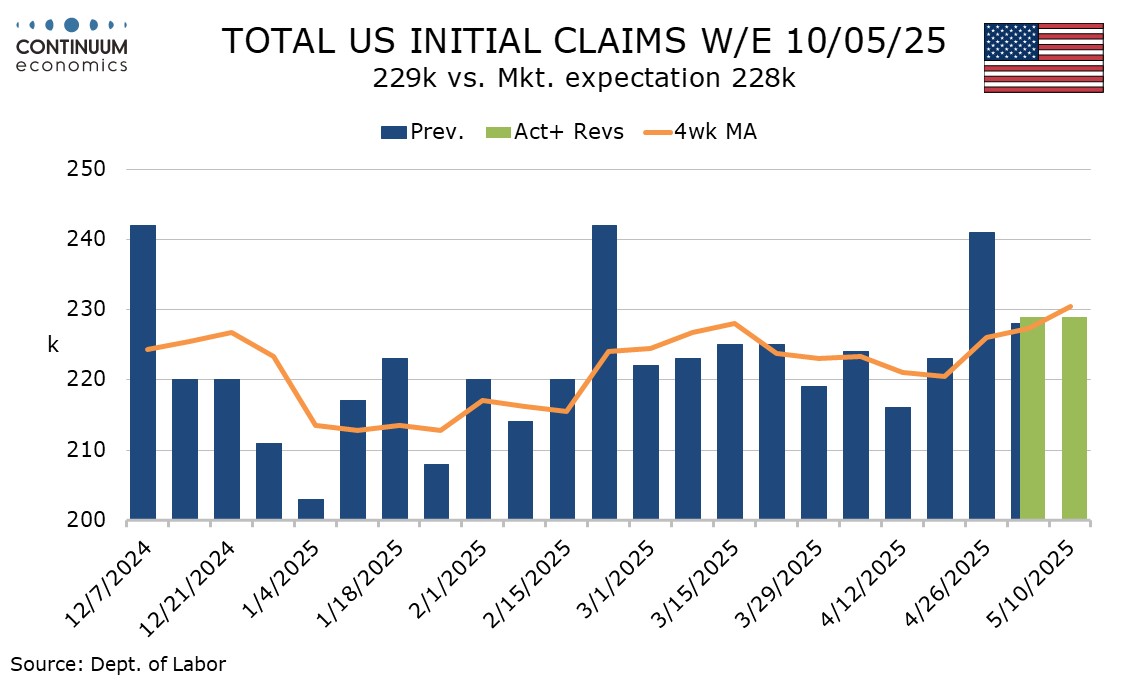

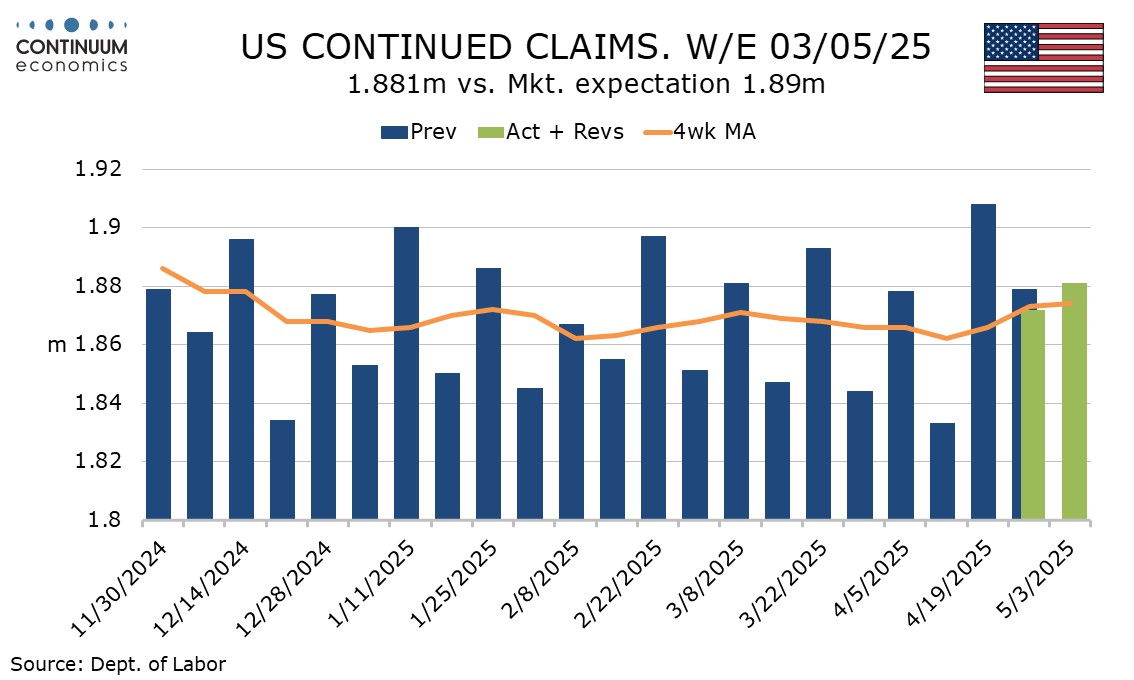

Initial claims were unchanged at 229k with last week revised marginally from 228k, while the continued claims rise of 9k to 1.881m was modest after a 36k decline in the preceding week.

4-week averages have started to move higher in both series, though the initial claims 4-week average is inflated by a high figure two weeks ago that came largely because of Easter issues in New York education.

The levels of the last two weeks have no obvious distortions and are a little higher than where trend was in March and April but the slowdown in the labor market that is implied is marginal.