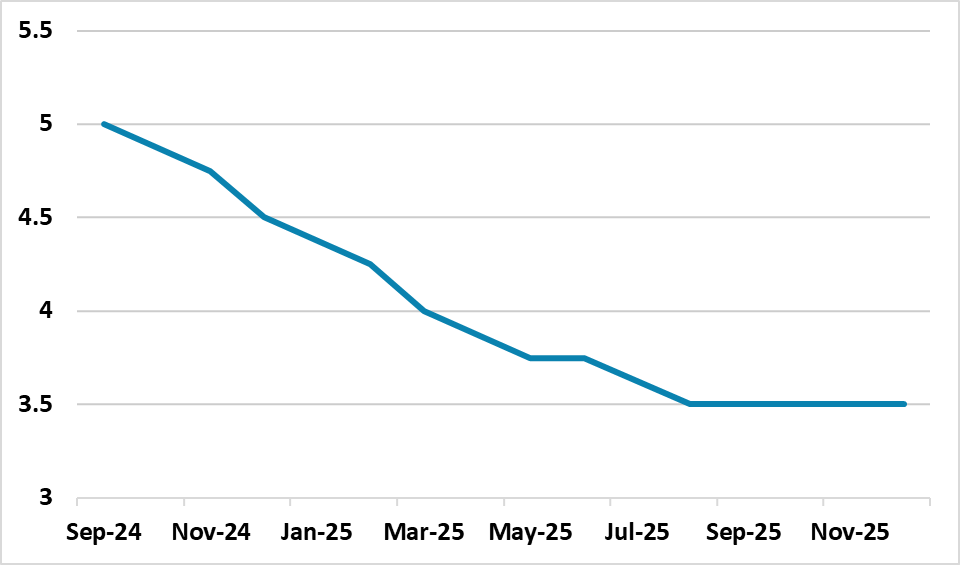

BOE Rate Cuts to 3.50% Then Stop?

UK wage inflation and CPI services will likely be less persistent than the BOE hawks worry about, which will likely see less resistance to UK rate cuts. This gives us confidence of quarterly rate cuts at the next five BOE monetary policy reports, plus one additional cut in December 2024 or March 2025 – we lean towards December. Thus we see the policy rate at 3.50% for end 2025. This is still a restrictive policy stance and scope exists for the policy rate to come down to 3.0% or potentially below in 2026.

Figure 1: Fully Priced BOE Rate Cuts (%)

Source Bloomberg/Continuum Economics

Money markets are discounting the next 25bps cut at the November meeting followed by December, February, March, May and August 2025 (Figure 1). Once it reaches 3.50% in August 25, a prolonged pause is then expected, though one final cut to 3.25% is in the 2yr money market curve. The median for economists is a 3.75% BOE bank rate end 2025. The rationale for the slower BOE easing compared to the Fed or the BOE is that the MPC is split on the timing and scale of easing. This is driven by a perception that UK wage inflation is on a higher trajectory than the U.S. or EZ and so is CPI services. This then risks UK CPI inflation rotating back above 2% once weak goods price inflation washes out of the numbers.

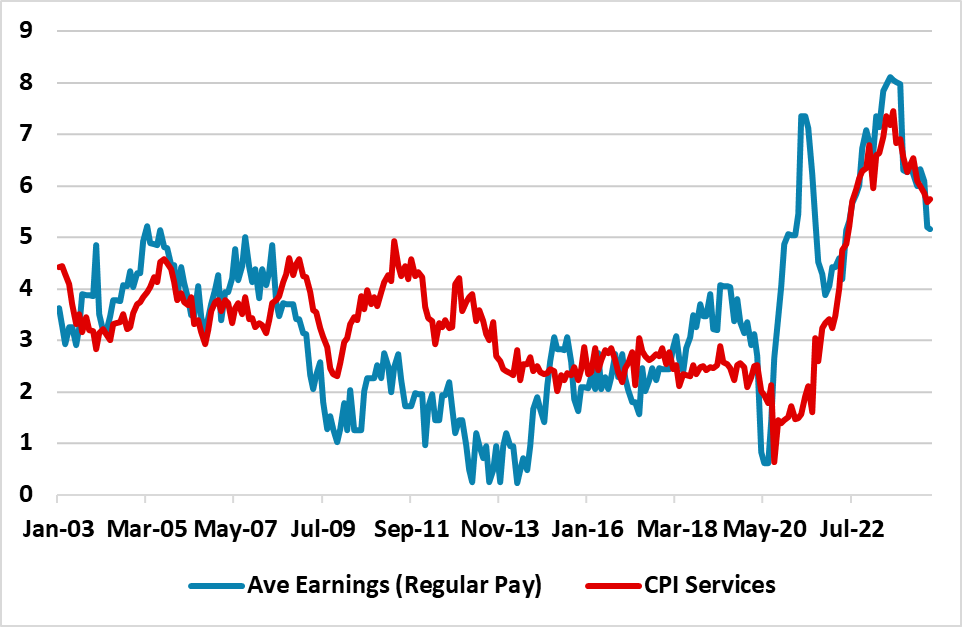

Figure 2: UK Average Earnings and CPI Services (%)

Source Datastream/Continuum Economics

A number of points are worth making

· Average Earnings trend slowing. The latest average earnings data shows that the wage inflation trend continues to slow. This is not a surprise given that the more comprehensive HMRC data on pay growth shows a clear slowing trend. One of the reasons for the slower pay growth is the softness in the private sector labor market, which is highlighted in the HMRC employment numbers (here). We still feel that average earnings growth will slow further.

· Profit and fiscal squeeze on CPI services. While a slow trend in wage inflation will help to bring wage inflation down, sluggish consumption will likely also squeeze profits. Low to middle income households are still suffering from the cost of living crisis in the last few years. Meanwhile, high income households are expected to be squeezed by the October 30 budget, which is getting a lot of time in the UK media. All households of course still have to cope with the freeze to income tax allowances. Overall, the fiscal squeeze should ensure that CPI services slows.

· MPC reset. The 5-4 vote for the 25bps cut in August is not an indication that the MPC will have a sizeable minority fighting every move. The MPC is quite pragmatic and views can change with the data. A September cut is unlikely, but possible given the data (here). If the average earnings and CPI services pan out in line with our forecasts, then this could open up a December cut rather than March – we look for 25bps cuts in November 2024/February/May/August 2025. We are also looking for more sluggish GDP in H2 (here). We also look for a November 2025 cut of 25bps to 3.50%. The August monetary policy report also had an undershoot of the CPI inflation target using 3.50% implied policy rate by 2027, but a deliberate upwards skew of 0.3% due to uncertainty over wage and CPI services (here). If this uncertainty become less then the BOE could remove the skew and the BOE consensus can become more comfortable in delivering 3.50% BOE Bank rate by November 2025. This is still a restrictive policy stance and scope exists for the policy rate to come down to 3.0% or potentially below in 2026. This is not currently discounted in the money market structure and 2yr, but could be if the wage and CPI services picture turns out in line with our forecasts.