South Africa’s Inflation Softened to 5.2% in April, the Lowest Reading in Four Months

Bottom Line: According to the inflation figures announced by Department of Statistics of South Africa (Stats SA) on May 22, the inflation eased to 5.2% YoY in April down from 5.3% in March due to less severe power cuts (load shedding), a firmer South African rand (ZAR) coupled with lower food and non-alcoholic beverages (NAB) prices. Despite the fall in April, inflation remained some way off from the 4.5% midpoint of target band of 3% - 6%. Taking into account that SARB has repeatedly noted that it will not start a cutting cycle until inflation is under control, we foresee sticky inflation figures could cause SARB to delay the rate cuts to Q4 or Q1 2025, and this could be further delayed if a coalition with an uncertain fiscal and load shedding policy will be formed following the presidential election on May 29.

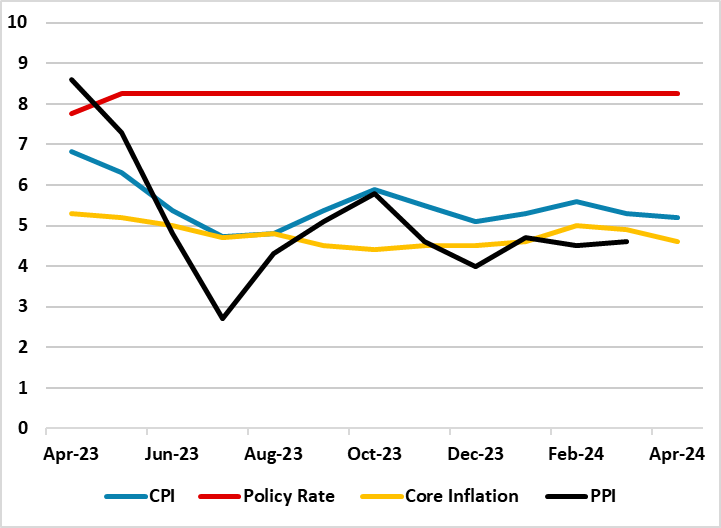

Figure 1: Policy Rate (%), CPI, PPI and Core Inflation (YoY, % Change), April 2023 – April 2024

Source: Continuum Economics

South Africa’s inflation fell to 5.2% YoY in April due to softening prices for food & NAB (4.7% YoY versus 5.1% YoY in March), alcoholic beverages & tobacco (4.3% YoY versus 4.5% YoY in March), and miscellaneous goods & services (7.2% YoY versus 8.5% YoY in March). Food inflation was modest in April as drought conditions related to El Nino weather pattern was rather mild in April. Annual core inflation stood at 4.6% after April’s 4.9%, falling from an eight-month high of 5.0% in February in annual terms. On a monthly basis, inflation was at 0.3% in April softer than the 0.8% rise a month before.

On the other side of the coin, inflation in April was driven by higher prices of transportation and restaurants & hotels. The annual price growths in transportation (5.7% YoY versus 5.3% YoY in March) and restaurants & hotels (7.5% YoY versus 5.7% YoY in March) were remarkable in April.

There was some good news from the load shedding front in April supporting the inflation softening process. After Stages 2 and 3 load shedding was implemented broadly in March with the available generation capacity was largely sustained, Eskom announced on May 17 that that load shedding remains suspended for 51 consecutive days, reflecting an improvement in its generation fleet. This period of stability is the longest since the stretch from December 5, 2021, to February 2, 2022.

On the currency front, ZAR strengthened by 1.6% against the US Dollar in April. ZAR continued to demonstrate strength by revaluing 3.1% against the Dollar in May, and hit 18.05 on May 21 which marked the strongest level since August.

Despite inflation falling slightly in April, we think risks to the inflationary outlook remain strong. According to the Monetary Policy Review Report released by SARB late April, the risk of higher inflation still remains, and the return of inflation to the midpoint of the target band (4.5%) is only expected in the last quarter of 2025. The report emphasized that the slower pace of disinflation reflects a range of issues, including normalising services components, housing prices and elevated inflation expectations while administered prices continue to exert substantial upward pressure on headline inflation.

Taking into account that SARB Governor Kganyago repeatedly stressed that SARB will wait for inflation to slow to the midpoint of target range before policy is adjusted, we expect SARB will likely keep the rates unchanged at 8.25% on the next MPC meeting on May 30, just after the elections. We envisage the first rate cut could happen either Q4 or Q1 2025, which could be further delayed if a coalition with an uncertain fiscal and load shedding policy will be formed after the presidential election on May 29.