Russia’s Growth Continues to Lose Steam

Bottom Line: According to a recent announcement by the Ministry of Economic Development, Russia's GDP expanded by a moderate 0.4% YoY in August, meeting the same pace in the previous month, driven by manufacturing, retail trade and agriculture activities. According to the announcement, the growth in the first eight months hit 1.0% YoY. We think Central Bank of Russia’s (CBR) previous aggressive monetary tightening coupled with sanctions, supply side constraints and price pressures remain restrictive while strong military spending, higher wages and fiscal stimulus pumping up the economy. It is worth noting that Ministry of Economic Development recenty revised the forecast of GDP growth in 2025 from 2.5% to 1% and from 2.4% to 1.3% in 2026 following subdued growth data so far in 2025. We envisage growth to hit 1.3% YoY in 2025.

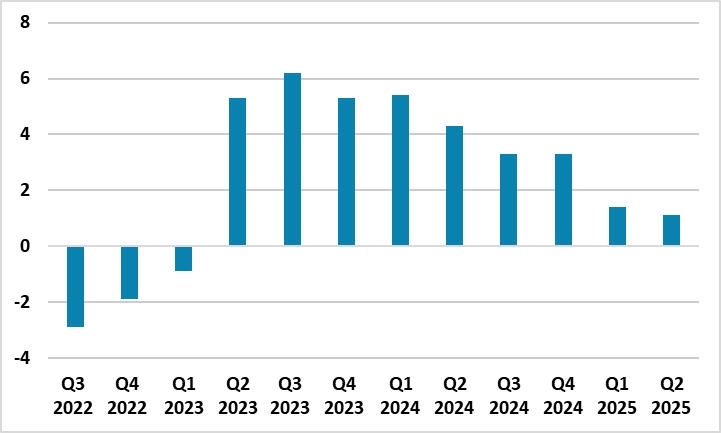

Figure 1: GDP Growth (%, Annual), Q3 2022– Q2 2025

Source: Rosstat

After expanding by 1.1% in Q2 2025, Russian economy grew by a moderate 0.4% YoY in August, signaling the economic slowdown continues despite strong military spending, higher wages and fiscal stimulus. The growth in August was fueled by manufacturing, retail trade and agriculture activities. (Note: Manufacturing output increased by 2.4% in August (+ 1.5% in July), agriculture output surged by 6.1% (-0.4% in July), and retail trade output edged up by 2.8% in August (+2.0% in July)). According to Ministry of Economic Development, the growth in the first eight months hit 1.0% YoY. The relative softening of growth figures demonstrates previous monetary tightening, sanctions, supply side constraints and price pressures remain restrictive.

Speaking about the GDP trajectory, economy minister Reshetnikov highlighted on October 1 that "It is clear that the situation is challenging now. Certainly, the cool down period in the economy will continue for some time but it will end sooner or later." Reshetnikov added that domestic demand, primarily consumer demand, driven by growth in real wages, will remain the primary growth driver for the upcoming three years.

It is worth noting that the Ministry of Economic Development recently revised the forecast of GDP growth in 2025 from 2.5% to 1% and from 2.4% to 1.3% in 2026 following subdued growth data in 2025. Prime minister Mikhail Mishustin said late September that Russia’s economic growth is expected at 1.3% in 2026. We also envisage growth to hit 1.3% and 1.4% in 2025 and 2026, respectively.

Taking into account that CBR continues its easing cycle, the current discussion is centered around whether the recent sharp fall in GDP growth demonstrates that Russia economy is entering a recession or merely cooling. Challenging recession claims, President Putin noted on September 18 that Russia is still far from entering a recession, as indicated by the labor market situation. "I believe that we are still far from a recession, and the labor market reflects this," Putin said.

We think sanctions, supply side constraints and higher price pressures remain restrictive in Russia. Capacity utilization in Russia reached its maximum in years, and labor force deficit is unlikely to change in the short term. Despite problems, the easing cycle by CBR could slowly reignite growth but this will take time. We continue to feel all will depend on how Ukraine war will go. A peace deal in Ukraine would be key to ease some pressure on inflation and alleviate demand-supply imbalances in Russia despite sealing a full-scale peace deal in Ukraine is still very unlikely in 2025.